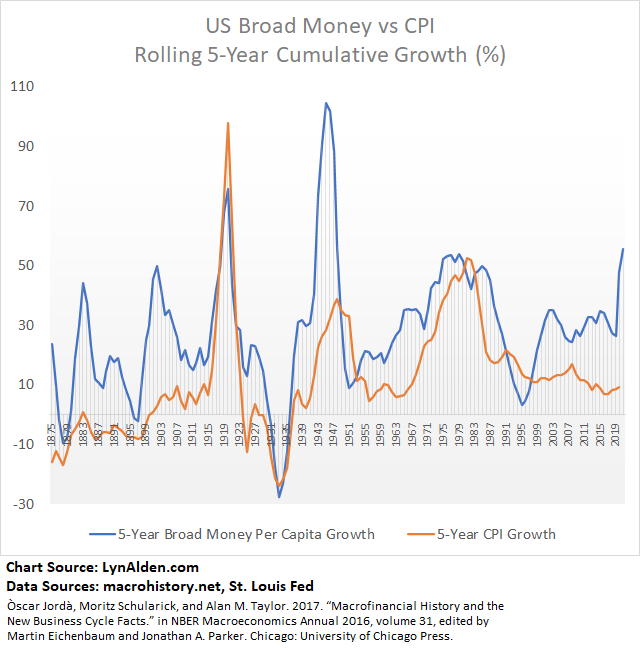

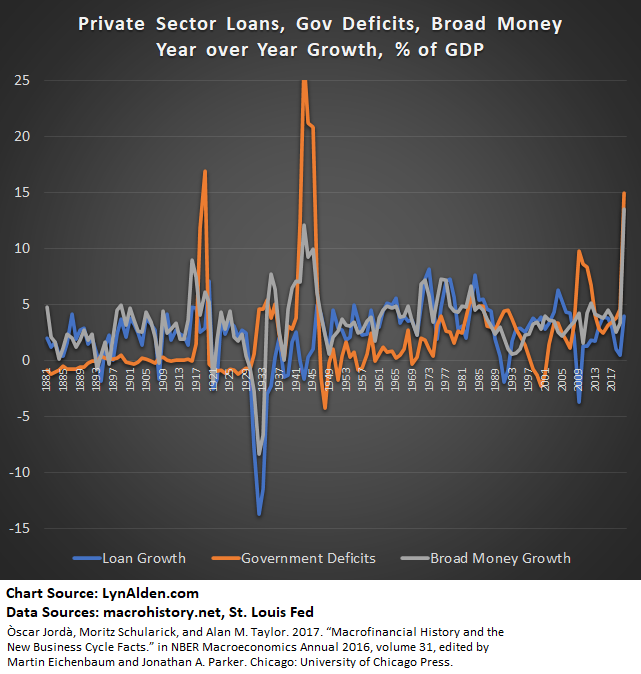

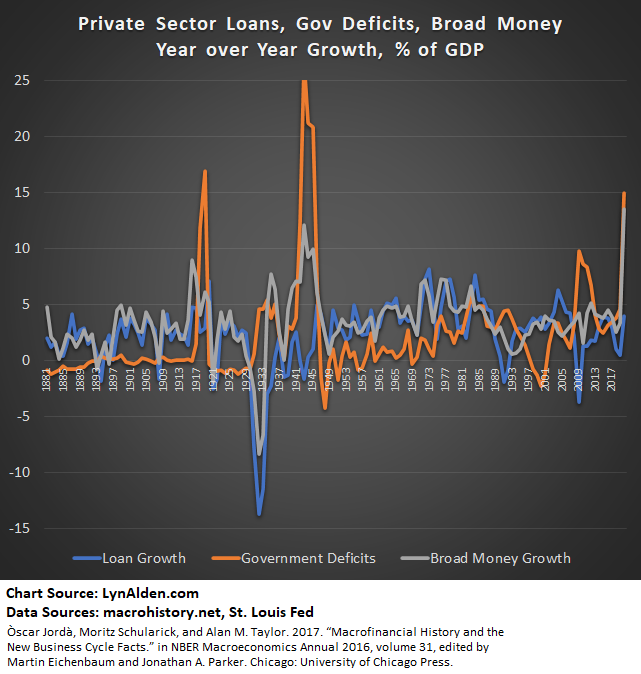

Broad money growth generally occurs in one of two ways: either banks lend and create deposits (and thus increase the money multiplier, M2/MB) or when bank lending seizes up, governments run large deficits and go around the bank lending channel.

A thread.

A thread.

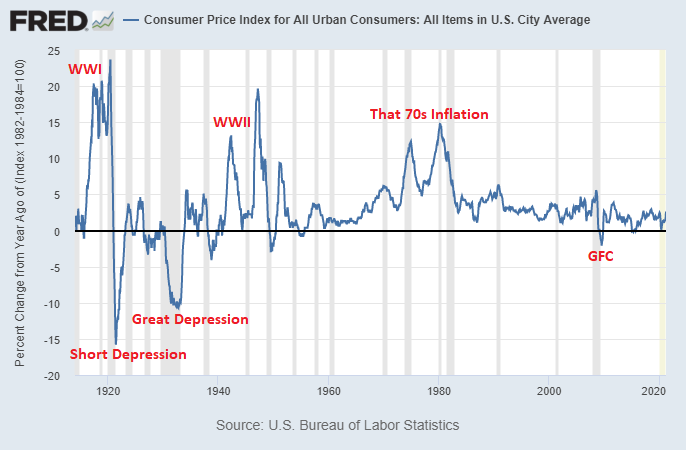

Looking at 140 years of data, we see periods where loan growth fueled broad money growth (late 1800s, 1920s, 1950s, etc), periods where fiscal deficits fueled broad money growth (1940s), and periods like the 1970s/1980s where both lending and deficits fueled broad money growth.

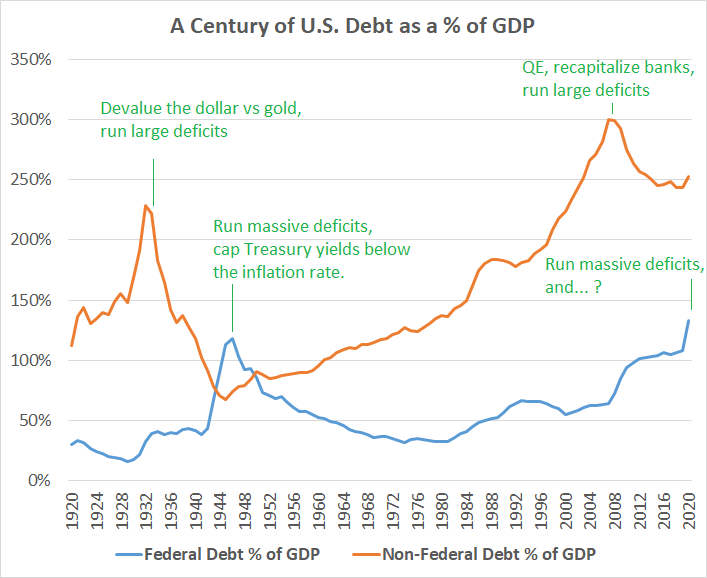

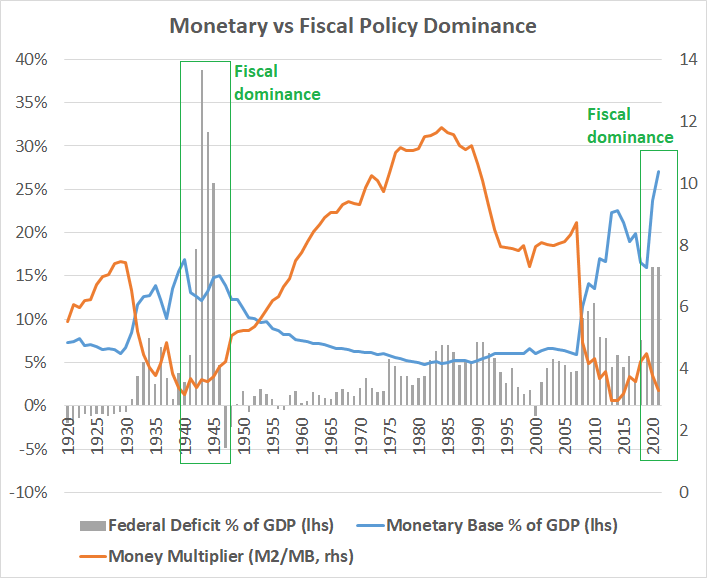

The 1940s are interesting because they are most analogous to the 2020s. After a large private debt bubble partial deleveraging (1930s and 2010s), a period of economic stagnation and external catalyst eventually resulted in a massive fiscal response (1940s and 2020s).

If we look at the money multiplier, M2/MB, along with fiscal deficits, we see further similarities between the 1930s/2010s (eras of rates hitting zero, monetary base expansion, private debt bubble peak), and 1940s/2020s (eras of fiscal dominance).

lynalden.com/fiscal-and-mon…

lynalden.com/fiscal-and-mon…

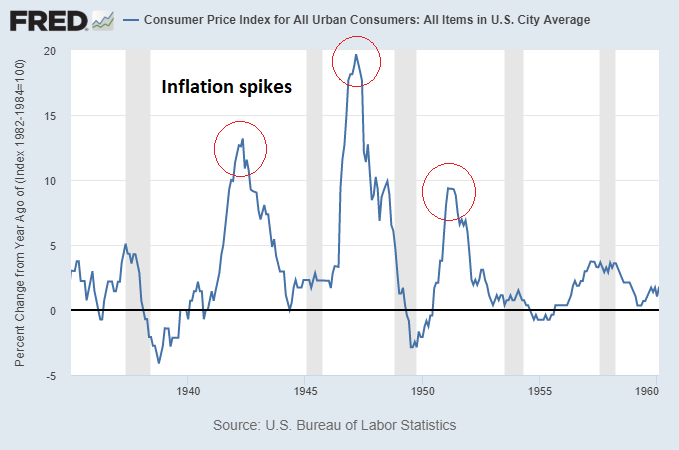

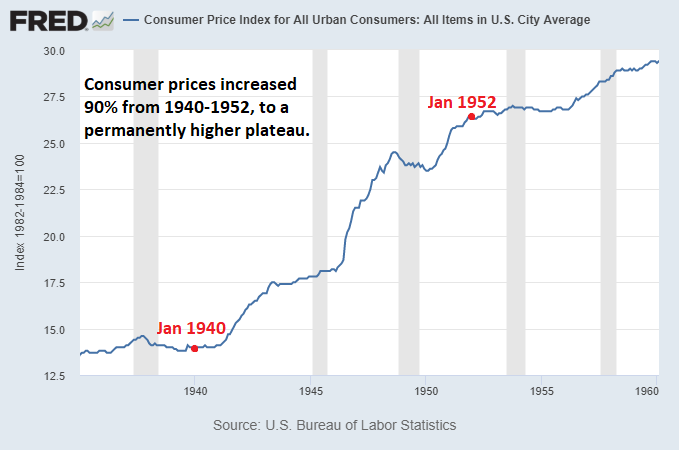

During the 1940s, inflation was transitory in rate-of-change terms, but after each spike in inflation, prices reached a new permanent plateau and went up from there. Cash and bondholders permanently lost purchasing power in three transitory/stepwise movements.

Temporary supply shortages serve as catalysts for those rapid rate-of-change inflation spikes, but then prices remain structurally higher because more money is permanently in the system. It's not *just* the supply shortage, in other words.

When debt is high and the economy is sluggish, banks don’t lend much. The 1940s broad money growth, nominal GDP growth, and inflation were fueled almost entirely by fiscal deficit spending. It wasn’t until the late 1940s, after notable inflation, that bank lending kicked back in.

In other words, bank lending is not a prerequisite for either broad money growth or price inflation over a multi-year period.

Periods of fiscal dominance can override that usual relationship.

Periods of fiscal dominance can override that usual relationship.

• • •

Missing some Tweet in this thread? You can try to

force a refresh