1/💩ton

Ok... kids are asleep, I've finished reading the bill, so buckle up!

It's "Go time!"

We're gonna break down HR 2954, better known as "Securing a Strong Retirement Act of 2021."

( And even better known as SECURE Act 2.0!)

Here's the bill text:

waysandmeans.house.gov/sites/democrat…

Ok... kids are asleep, I've finished reading the bill, so buckle up!

It's "Go time!"

We're gonna break down HR 2954, better known as "Securing a Strong Retirement Act of 2021."

( And even better known as SECURE Act 2.0!)

Here's the bill text:

waysandmeans.house.gov/sites/democrat…

2/

As always, I want to start with some high-level thoughts...

This one clocked in at 146 pages. While that pales in comparison to recent legislative endeavors (cough, cough... looking at you CAA

As always, I want to start with some high-level thoughts...

This one clocked in at 146 pages. While that pales in comparison to recent legislative endeavors (cough, cough... looking at you CAA

https://twitter.com/CPAPlanner/status/1341111472269746180?s=20) its worth a reminder that this is 100% retirement stuff!

3/

So, there's actually a TON to digest here for planners.🙌

Certainly more than we got from CAA. Maybe even more, in total, than we got from the original SECURE Act (though no one provision will have the impact that the 'death' of the 'stretch' had).😯

Now, do I think this...

So, there's actually a TON to digest here for planners.🙌

Certainly more than we got from CAA. Maybe even more, in total, than we got from the original SECURE Act (though no one provision will have the impact that the 'death' of the 'stretch' had).😯

Now, do I think this...

4/

...this is going to pass?

Yep.

And while I'd be surprised if there weren't SOME changes, I'd be more surprised if it died altogether.

Has STRONG bipartisan support (politicians ♥ talking about how they saved your retirement).

I'd say 90% it gets passed in similar form.

...this is going to pass?

Yep.

And while I'd be surprised if there weren't SOME changes, I'd be more surprised if it died altogether.

Has STRONG bipartisan support (politicians ♥ talking about how they saved your retirement).

I'd say 90% it gets passed in similar form.

5/

Let's get down to biz here and talk about what the bill says.

Fair warning, I'm going to be going completely out of order, focusing on why I think are the bigger-news items first.

Let's begin with RMDs, b/c they basically impact all non-Roth IRA retirement acct owners...

Let's get down to biz here and talk about what the bill says.

Fair warning, I'm going to be going completely out of order, focusing on why I think are the bigger-news items first.

Let's begin with RMDs, b/c they basically impact all non-Roth IRA retirement acct owners...

6/

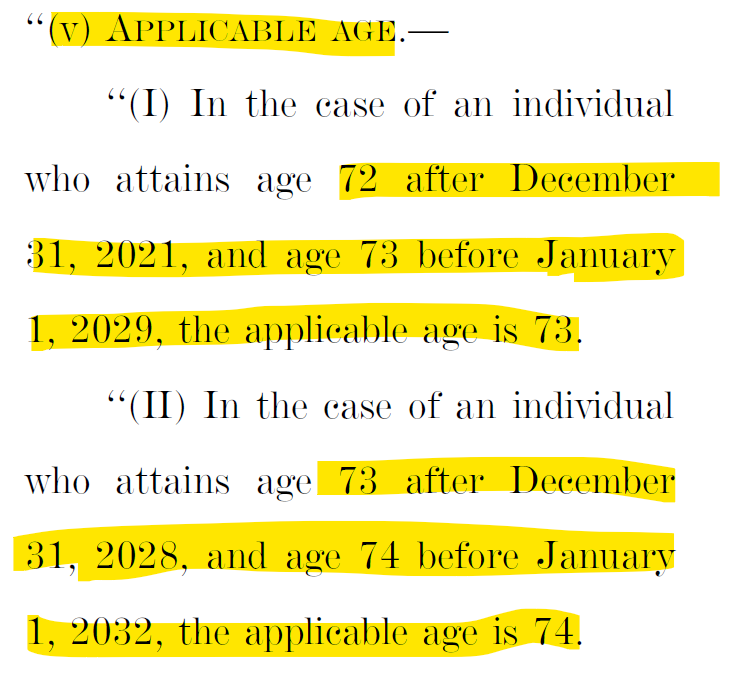

RMDs GRADUALLY get pushed back from 72 (current) to 75.

Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...

RMDs would start at:

73 if you turn 72 from 2022-2027

74 if you turn 72 in 2028-2039

75 if you turn 72 in 2030 or later

F.M.L.🤕

RMDs GRADUALLY get pushed back from 72 (current) to 75.

Yep. Instead of just making it 75 and having it be simple, Congress be Congressing...

RMDs would start at:

73 if you turn 72 from 2022-2027

74 if you turn 72 in 2028-2039

75 if you turn 72 in 2030 or later

F.M.L.🤕

7/

Gonna jump here and go to Section 312, b/c I think it's sneaky important.

Right now, taxpayers generally have NO STATUTE OF LIMITATIONS for IRA penalties. So, theoretically, you miss an RMD today, and the IRS can come back in 20 years and assess the penalty, interest, etc...

Gonna jump here and go to Section 312, b/c I think it's sneaky important.

Right now, taxpayers generally have NO STATUTE OF LIMITATIONS for IRA penalties. So, theoretically, you miss an RMD today, and the IRS can come back in 20 years and assess the penalty, interest, etc...

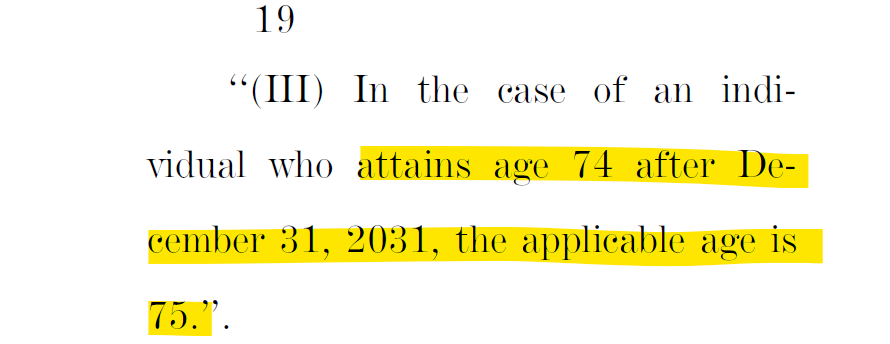

8/

W/out boring you to death, the reason is b/c those penalties get reported on Form 5329. IRS and the Tax Court have previously agreed Form 5329 is its own RETURN (see casetext.com/case/paschall-…).

So, no file Form (return) 5329 = no start of clock for statute of limitations...

W/out boring you to death, the reason is b/c those penalties get reported on Form 5329. IRS and the Tax Court have previously agreed Form 5329 is its own RETURN (see casetext.com/case/paschall-…).

So, no file Form (return) 5329 = no start of clock for statute of limitations...

9/

No one just randomly files Form 5329, so unless you knew you had a penalty and filed, you were basically leaving yourself open to IRS scrutiny forever.

This would solve that by saying if you filed your income tax return (Form 1040), THAT starts the clock.

It even goes so...

No one just randomly files Form 5329, so unless you knew you had a penalty and filed, you were basically leaving yourself open to IRS scrutiny forever.

This would solve that by saying if you filed your income tax return (Form 1040), THAT starts the clock.

It even goes so...

10/

...far as to say that if you didn't file a return b/c you didn't have to, the statute of limitations starts when you otherwise would have filed your return (if you needed to).

Pretty taxpayer-friendly, and frankly, maybe my favorite thing in the whole bill.

Moving on...

...far as to say that if you didn't file a return b/c you didn't have to, the statute of limitations starts when you otherwise would have filed your return (if you needed to).

Pretty taxpayer-friendly, and frankly, maybe my favorite thing in the whole bill.

Moving on...

11/

Let's talk about catch-up contributions, shall we?

Section 106 would FINALLY index IRA catch-up contributions for inflation.

Presently, the IRA contribution, plan salary deferral, plan catch-up contribution, and plan overall limits are ALL indexed for inflation.

But...

Let's talk about catch-up contributions, shall we?

Section 106 would FINALLY index IRA catch-up contributions for inflation.

Presently, the IRA contribution, plan salary deferral, plan catch-up contribution, and plan overall limits are ALL indexed for inflation.

But...

12/

...not the IRA catch-up contribution limit. It has to be increased by legislation, and that's only happened one time... for 2006!

This ends that stupidity. But we're not done with catch-up contributions (or, unfortunately, stupidity) yet.

Which brings us to Section 107...

...not the IRA catch-up contribution limit. It has to be increased by legislation, and that's only happened one time... for 2006!

This ends that stupidity. But we're not done with catch-up contributions (or, unfortunately, stupidity) yet.

Which brings us to Section 107...

13/

...Section 107 creates new plan catch-up contribution limits in years a participant turns 62, 63 + 64.

Such (62-64) participants would have following catch-up contribution limits beginning in 2023:

- 401(k)s and similar plans: $10k ($6.5k today)

- SIMPLE: $5k ($3k today)

...Section 107 creates new plan catch-up contribution limits in years a participant turns 62, 63 + 64.

Such (62-64) participants would have following catch-up contribution limits beginning in 2023:

- 401(k)s and similar plans: $10k ($6.5k today)

- SIMPLE: $5k ($3k today)

14/

On the surface this is cool, but for the life of me, I can't understand why Congress is so interested in helping 62-64 year-olds save for retirement, but then wants to give 65-year-olds the🖕.

I mean, they go out of their way to ensure you that at 65, you can take a hike🤷♂️

On the surface this is cool, but for the life of me, I can't understand why Congress is so interested in helping 62-64 year-olds save for retirement, but then wants to give 65-year-olds the🖕.

I mean, they go out of their way to ensure you that at 65, you can take a hike🤷♂️

15/

Thought we were done talking about catch-up contributions, huh?

Well, guess what? Fooled you!

(OK, it's not Star Wars, but it's close enough)

Anyway... Section 603 would require ALL CATCH-UP CONTRIBUTIONS TO BE MADE TO ROTH ACCOUNTS!!!!

I have a lot to say about this...

Thought we were done talking about catch-up contributions, huh?

Well, guess what? Fooled you!

(OK, it's not Star Wars, but it's close enough)

Anyway... Section 603 would require ALL CATCH-UP CONTRIBUTIONS TO BE MADE TO ROTH ACCOUNTS!!!!

I have a lot to say about this...

16/

First... not all plans have Roth options yet. What happens to those participants?

Notably, this would take effect next year! That's not all that much time with everything else businesses have going on these days.

Second, for those who continue to question whether...

First... not all plans have Roth options yet. What happens to those participants?

Notably, this would take effect next year! That's not all that much time with everything else businesses have going on these days.

Second, for those who continue to question whether...

17/

Uncle Sam will keep the Roth IRA around or whether it will be eliminated b/c it's "too good"...

Let this be the latest evidence of what I've been saying for years...

Uncle Sam LOVES the Roth.

It brings in $ today, and people like it. Name me ANYTHING else that does that.

Uncle Sam will keep the Roth IRA around or whether it will be eliminated b/c it's "too good"...

Let this be the latest evidence of what I've been saying for years...

Uncle Sam LOVES the Roth.

It brings in $ today, and people like it. Name me ANYTHING else that does that.

18/

OK, now we can FINALLY move on to something else besides catch-up contributions. But let's stick with the Roth now that I've brought it up...

In another "pay-for" provision, Section 601 of SECURE Act 2.0 would create SEP and SIMPLE Roth accounts, and Section 604 would...

OK, now we can FINALLY move on to something else besides catch-up contributions. But let's stick with the Roth now that I've brought it up...

In another "pay-for" provision, Section 601 of SECURE Act 2.0 would create SEP and SIMPLE Roth accounts, and Section 604 would...

19/

allow individuals to designate employer matching contributions to the Roth side.

Best I can tell, Roth SIMPLE IRA salary deferrals would work similarly to Roth 401k contributions.

As for SEP or matching contributions, I think they would just get added to the W-2 somehow.

allow individuals to designate employer matching contributions to the Roth side.

Best I can tell, Roth SIMPLE IRA salary deferrals would work similarly to Roth 401k contributions.

As for SEP or matching contributions, I think they would just get added to the W-2 somehow.

20/

On to the portion of this bill that was likely written by the Life Insurance lobbyists... ... don't kid yourself, they are a very powerful group.

Section 202 would amend the QLAC rules to eliminate the 25% limit (of acct balance) on purchases. It appears to keep the...

On to the portion of this bill that was likely written by the Life Insurance lobbyists... ... don't kid yourself, they are a very powerful group.

Section 202 would amend the QLAC rules to eliminate the 25% limit (of acct balance) on purchases. It appears to keep the...

21/

current overall limit of $135k (indexed) in place. So, essentially, someone would be able to use all retirement acct dollars, up to $135k, to purchase a QLAC.

It also would clarify the treatment of contracts in the event of a divorce👇, and allow up to a 90-day free-look...

current overall limit of $135k (indexed) in place. So, essentially, someone would be able to use all retirement acct dollars, up to $135k, to purchase a QLAC.

It also would clarify the treatment of contracts in the event of a divorce👇, and allow up to a 90-day free-look...

22/

Section 203 would expand investment options for insurance contracts. Specifically (but still subject to some limitations), insurance contracts would be able to incorporate ETFs into their offering.

So in the near future, we might see VUL and/or VA policies w/ ETF options...

Section 203 would expand investment options for insurance contracts. Specifically (but still subject to some limitations), insurance contracts would be able to incorporate ETFs into their offering.

So in the near future, we might see VUL and/or VA policies w/ ETF options...

23/

Coupled with potential changes to the capital gains rules (e.g., the top rate and changes to the step-up), low-cost ETFs inside a low-cost VA wrapper could become a particularly attractive option for some high-income taxpayers.

Will be interesting to see where this goes...

Coupled with potential changes to the capital gains rules (e.g., the top rate and changes to the step-up), low-cost ETFs inside a low-cost VA wrapper could become a particularly attractive option for some high-income taxpayers.

Will be interesting to see where this goes...

24/

Lastly on the insurance front, more flexibility would be given to income annuities in retirement accounts.

Such contracts could have:

🔹Up to a 5% annual COLA on payments

🔹Lump-sum payments that reduce or eliminate future payments

🔹Dividends (based on experience)...

Lastly on the insurance front, more flexibility would be given to income annuities in retirement accounts.

Such contracts could have:

🔹Up to a 5% annual COLA on payments

🔹Lump-sum payments that reduce or eliminate future payments

🔹Dividends (based on experience)...

25/

🔹ROP less premium death benefits

🔹Payments up to 12 months in the future paid now

Previously, these benefits often would have caused the annuity to run afoul of various actuarial requirements.

Now I want to move on to talk about something I think is really cool...

🔹ROP less premium death benefits

🔹Payments up to 12 months in the future paid now

Previously, these benefits often would have caused the annuity to run afoul of various actuarial requirements.

Now I want to move on to talk about something I think is really cool...

26/

Section 111 seeks to provide some well-deserved help for military spouses.

🗝issue = Military spouses often move around a lot, and so they are less likely to accumulate enough time w/ an employer to participate in and/or receive employer contributions under their plan so...

Section 111 seeks to provide some well-deserved help for military spouses.

🗝issue = Military spouses often move around a lot, and so they are less likely to accumulate enough time w/ an employer to participate in and/or receive employer contributions under their plan so...

27/

...SECURE Act 2.0 creates incentives for employers to create special provisions for certain "Military Spouses" (e.g., doesn't apply to highly-comped military spouses).

If employers allow military spouses to participate w/in 2 months of starting work and treat them as...

...SECURE Act 2.0 creates incentives for employers to create special provisions for certain "Military Spouses" (e.g., doesn't apply to highly-comped military spouses).

If employers allow military spouses to participate w/in 2 months of starting work and treat them as...

28/

...though they had 2 years of service ((e.g., for purposes of ER contributions), AND they fully vest them immediately (I like anything that's fully vested😜), then the employer will be eligible for up to a $500 credit per military spouse for up to 3 years each.

Woohoo!

...though they had 2 years of service ((e.g., for purposes of ER contributions), AND they fully vest them immediately (I like anything that's fully vested😜), then the employer will be eligible for up to a $500 credit per military spouse for up to 3 years each.

Woohoo!

29/

OK,🧠needs a break, so let's talk about some sillier parts of the bill.

Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".

So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.

OK,🧠needs a break, so let's talk about some sillier parts of the bill.

Sec 112 would update plan + prohibited transaction rules to allow "de minimis financial incentives".

So "enroll in your 401(k) and get a $25 @Starbucks gift card" is a real possibility in the future.

30/

And Section 305 allows plans to stop sending a whole bunch of crap to employees who are eligible to participate in the plan, but dont.

Let's be real, even those who DO participate don't read most💩they get from plans, so sending stuff to non-participants? Waste of ⏳+💰

And Section 305 allows plans to stop sending a whole bunch of crap to employees who are eligible to participate in the plan, but dont.

Let's be real, even those who DO participate don't read most💩they get from plans, so sending stuff to non-participants? Waste of ⏳+💰

31/

OK... back to important stuff. Significant changes to QCD rules could be on the way!

Section 309 would:

🔹Index the $100k limit for inflation🤑

🔹Allow a one-time, up to $50k QCD to a split-interest entity (e.g., CRAT, CRUT, charitable gift annuity) SOLELY funded via QCD...

OK... back to important stuff. Significant changes to QCD rules could be on the way!

Section 309 would:

🔹Index the $100k limit for inflation🤑

🔹Allow a one-time, up to $50k QCD to a split-interest entity (e.g., CRAT, CRUT, charitable gift annuity) SOLELY funded via QCD...

32/

Last part kills it, at least for CRUTs and CRATs. The $ to establish (e.g. drafting) and maintain (e.g., annual tax returns) a CRUT/CRAT is likely not worth it if you can only fund it with $50k (or maybe $100k for couples).

Plus, ALL distributions will be ordinary income👎

Last part kills it, at least for CRUTs and CRATs. The $ to establish (e.g. drafting) and maintain (e.g., annual tax returns) a CRUT/CRAT is likely not worth it if you can only fund it with $50k (or maybe $100k for couples).

Plus, ALL distributions will be ordinary income👎

33/

The 50% penalty for missing an RMD would be reduced to 25% under Section 302 of the bill.

The 25% amount would be further reduced to 10% for errors timely and appropriately corrected w/in the "Correction Window", which could be as long as 3 years👇

Sounds great, but...

The 50% penalty for missing an RMD would be reduced to 25% under Section 302 of the bill.

The 25% amount would be further reduced to 10% for errors timely and appropriately corrected w/in the "Correction Window", which could be as long as 3 years👇

Sounds great, but...

34/

Right now, if you realize you missed an RMD but take corrective action + properly request relief (see my article ➡kitces.com/blog/fix-rmd-m…) you'll likely get a waiver of the 50% penalty.

But I wonder if the IRS will become more stingy w/ "only" a 10% penalty.

Dare I say...

Right now, if you realize you missed an RMD but take corrective action + properly request relief (see my article ➡kitces.com/blog/fix-rmd-m…) you'll likely get a waiver of the 50% penalty.

But I wonder if the IRS will become more stingy w/ "only" a 10% penalty.

Dare I say...

35/

Sticking with the theme of making IRA mistakes less painful...

Section 321 would amend the IRA Prohibited Transactions (PT) rules (a.k.a. "things you can't do w/ your IRA"), curtailing what is, today, one of the most punitive penalties around.

Presently...

Sticking with the theme of making IRA mistakes less painful...

Section 321 would amend the IRA Prohibited Transactions (PT) rules (a.k.a. "things you can't do w/ your IRA"), curtailing what is, today, one of the most punitive penalties around.

Presently...

36/

...committing a PT w/ just $1 of IRA funds results in the deemed distribution of the entire IRA account in which the PT occurs.

So, for ex, a PT w/ $100 in a $500k IRA and your $500k is deemed distributed.

Immediate taxation, plus the 10% penalty for those under 59 1/2...

...committing a PT w/ just $1 of IRA funds results in the deemed distribution of the entire IRA account in which the PT occurs.

So, for ex, a PT w/ $100 in a $500k IRA and your $500k is deemed distributed.

Immediate taxation, plus the 10% penalty for those under 59 1/2...

37/

Under SECURE Act 2.0, the penalty would change so that ONLY THE AMOUNT INVOLVED in the PT would be deemed distributed.

That seems like a punishment more in line with the 'crime' (and is already how prohibited INVESTMENTS are dealt with)...

Under SECURE Act 2.0, the penalty would change so that ONLY THE AMOUNT INVOLVED in the PT would be deemed distributed.

That seems like a punishment more in line with the 'crime' (and is already how prohibited INVESTMENTS are dealt with)...

38/

Section 109 would codify what we've seen in recent Private Letter Rulings.

Employers would be able to make "matching contributions" to a 401(k), 403(b), or SIMPLE IRA to the extent the participant made what would technically be known as a "Qualified Student Loan Payment"

Section 109 would codify what we've seen in recent Private Letter Rulings.

Employers would be able to make "matching contributions" to a 401(k), 403(b), or SIMPLE IRA to the extent the participant made what would technically be known as a "Qualified Student Loan Payment"

39/

Believe it or not, there's still a lot of stuff left in this bill to discuss, but it's about 1:30AM, and I've been under the weather all week, so time to speed this up a bit and knock out a few provisions quickly...

Believe it or not, there's still a lot of stuff left in this bill to discuss, but it's about 1:30AM, and I've been under the weather all week, so time to speed this up a bit and knock out a few provisions quickly...

40/

🔹Sec 320 would allow sole props (only) to make retroactive 1ST YEAR (only) deferrals up to filing deadline (no extension)

🔹Sec 315 answers a Q we've had since the OG SECURE Act was passed. Qualified Birth and Adoption (QBAD) distribution can be repaid for up to 3 years...

🔹Sec 320 would allow sole props (only) to make retroactive 1ST YEAR (only) deferrals up to filing deadline (no extension)

🔹Sec 315 answers a Q we've had since the OG SECURE Act was passed. Qualified Birth and Adoption (QBAD) distribution can be repaid for up to 3 years...

🔹Sec 316 would allow more hardship distributions based on employee self-certification (this is how it worked for Coronavirus-Related Distributions, and that seemed to work fairly well).

🔹Sec 317 would create a new 10% penalty exception for victims of domestic abuse😞It...

🔹Sec 317 would create a new 10% penalty exception for victims of domestic abuse😞It...

...would allow impacted individuals (defined extremely - and painfully - broad👇) to take up to the LESSER of 1) 50% of their account balance or 2) $10,000 w/out the 10% penalty.

Such individuals would also be able to pay back (rollover) the distribution for up to 3 years.

Such individuals would also be able to pay back (rollover) the distribution for up to 3 years.

43/

Forgot to number last 2 tweets🤦♂️

Think my brain was stuck on how sad it is that domestic abuse is so widespread we need a 10% penalty exception to help deal w/ it.

For reference, according to CDC, ~25% of women + ~15% of men will be victims of physical domestic violence...

Forgot to number last 2 tweets🤦♂️

Think my brain was stuck on how sad it is that domestic abuse is so widespread we need a 10% penalty exception to help deal w/ it.

For reference, according to CDC, ~25% of women + ~15% of men will be victims of physical domestic violence...

44/

On to happier things...

🔹In a "Good Stuff for Good People" provision...

Currently, PUBLIC safety employees can access plan 💰w/out a 10% penalty if they separate in the year they turn 50 or later.

Section 310 would expand this relief to private-sector firefighters🚒👊

On to happier things...

🔹In a "Good Stuff for Good People" provision...

Currently, PUBLIC safety employees can access plan 💰w/out a 10% penalty if they separate in the year they turn 50 or later.

Section 310 would expand this relief to private-sector firefighters🚒👊

45/

🔹SECURE Act (OG) made part-time employees mandatorily eligible for 401(k) participation once they had 3 or more consecutive years of 500+ hours (counting years in 2021+).

Sec 114 reduces it to 'just' 2 years.

So, more part-time workers will have plan access sooner!

🔹SECURE Act (OG) made part-time employees mandatorily eligible for 401(k) participation once they had 3 or more consecutive years of 500+ hours (counting years in 2021+).

Sec 114 reduces it to 'just' 2 years.

So, more part-time workers will have plan access sooner!

46/

Section 104 would expand 403(b) investment options to include certain Collective Investment Trusts (CITs).

A step in the right direction, but why not just combine 401(k) plans and 403(b) plans? Or at least give them the same basic rules?

Why keep things so complicated?

Section 104 would expand 403(b) investment options to include certain Collective Investment Trusts (CITs).

A step in the right direction, but why not just combine 401(k) plans and 403(b) plans? Or at least give them the same basic rules?

Why keep things so complicated?

47/

One more significant provision to cover.

It's one that should be even MORE significant, but they basically created a rule to try and significantly increase auto-enrollment contributions, but then they exempt just about every plan under the sun from the requirement, so🤷♂️

One more significant provision to cover.

It's one that should be even MORE significant, but they basically created a rule to try and significantly increase auto-enrollment contributions, but then they exempt just about every plan under the sun from the requirement, so🤷♂️

48/

Sec 101 says to be considered a 401(k) / 403(b), unless a participant opts out, the plan MUST auto-enroll them for first-year contributions of between 3% and 10% of comp, AND

That % MUST increase by 1% annually it gets to between 10% and 15% (w/ some exceptions until 2025).

Sec 101 says to be considered a 401(k) / 403(b), unless a participant opts out, the plan MUST auto-enroll them for first-year contributions of between 3% and 10% of comp, AND

That % MUST increase by 1% annually it gets to between 10% and 15% (w/ some exceptions until 2025).

49/

Auto-enrollment has a HUGE impact on retirement savings. So making it mandatory for plans makes sense.

But here's a list of plans exempt from the requirement:

🔹SIMPLE plans

🔹Any existing 401(k) / 403(b)

🔹Biz <3 years old

🔹Bis <10 EEs

So, MAYBE this was a good try, but

Auto-enrollment has a HUGE impact on retirement savings. So making it mandatory for plans makes sense.

But here's a list of plans exempt from the requirement:

🔹SIMPLE plans

🔹Any existing 401(k) / 403(b)

🔹Biz <3 years old

🔹Bis <10 EEs

So, MAYBE this was a good try, but

50/

Before I leave you, a few more of the wonkier parts of the bill...

🔹Sec 306 creates the "Retirement Savings Lost and Found" to help participants track down lost retirement money, and the Office of the Retirement Savings Lost and Found" (seriously!) to manage it...

Before I leave you, a few more of the wonkier parts of the bill...

🔹Sec 306 creates the "Retirement Savings Lost and Found" to help participants track down lost retirement money, and the Office of the Retirement Savings Lost and Found" (seriously!) to manage it...

51/

the Section goes on to say that if the Office determins that a private company can handle the responsibilities it is charged with managing more efficiently, it can hire a private company to do it.

So, someone will be in line for a F-A-T gov't contract.

And Section 103...

the Section goes on to say that if the Office determins that a private company can handle the responsibilities it is charged with managing more efficiently, it can hire a private company to do it.

So, someone will be in line for a F-A-T gov't contract.

And Section 103...

52/

...turns the IRS into a PR Agency (I💩you not. See👇) for the Retirement Saver's Credit.

I get that Congress want to make sure the public is aware of the credit, but is the IRS in the best position to do it?

Maybe if the credit was 'better' more people would know about it!

...turns the IRS into a PR Agency (I💩you not. See👇) for the Retirement Saver's Credit.

I get that Congress want to make sure the public is aware of the credit, but is the IRS in the best position to do it?

Maybe if the credit was 'better' more people would know about it!

53/

And Section 115 is just a bizarre, seemingly self-congratulatory 'story' about Congress creating S Corp ESOPs nearly 25 years ago.

I'm sure it's happened before, but I can't recall ever seeing anything like this (then again, it's 3AM, so maybe I can't recall anything!)...

And Section 115 is just a bizarre, seemingly self-congratulatory 'story' about Congress creating S Corp ESOPs nearly 25 years ago.

I'm sure it's happened before, but I can't recall ever seeing anything like this (then again, it's 3AM, so maybe I can't recall anything!)...

54/

There's actually more in the bill, but that's pretty much all the big stuff, and then some.

Will it pass?

If so, when will it pass?

How much will change between now and then?

Well...

There's actually more in the bill, but that's pretty much all the big stuff, and then some.

Will it pass?

If so, when will it pass?

How much will change between now and then?

Well...

55/

But chances are it will pass. And when it does, it's probably going to look a lot like this.

And w/ all the other changes we're likely to need to learn about and plan for this year, getting a head start on this now can only help you help others...

But chances are it will pass. And when it does, it's probably going to look a lot like this.

And w/ all the other changes we're likely to need to learn about and plan for this year, getting a head start on this now can only help you help others...

56/

...Good luck on your quest to rid the Galaxy of unnecessary taxes and failed retirements.

And w/ that, I bid you Good Night.

May the Force be with you.

'Hammer Out! 🔨👊

...Good luck on your quest to rid the Galaxy of unnecessary taxes and failed retirements.

And w/ that, I bid you Good Night.

May the Force be with you.

'Hammer Out! 🔨👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh