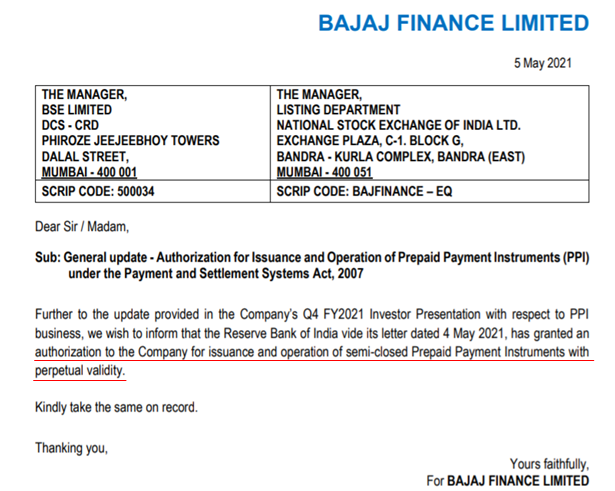

One interesting development during the week was that Bajaj Finance got RBI approval to issue and operate SEMI-CLOSED Prepaid Payment Instruments (PPI) with PERPETUAL validity.

Here is an explainer thread 🧵 on what this means for Bajaj Finance and potential implications.

1/9

Here is an explainer thread 🧵 on what this means for Bajaj Finance and potential implications.

1/9

What are PPIs?

PPIs are instruments that facilitate purchase of goods & services or interpersonal money remittances, etc, against the value stored on such instruments.

While PPIs aren't entirely new (remember Sodexo coupons, Edenred cards), it was formalized by RBI in 2017.

2/9

PPIs are instruments that facilitate purchase of goods & services or interpersonal money remittances, etc, against the value stored on such instruments.

While PPIs aren't entirely new (remember Sodexo coupons, Edenred cards), it was formalized by RBI in 2017.

2/9

How is it different from Credit Cards?

Prepaid payment instruments come with a pre-loaded value and in some cases a pre-defined purpose of payment (more on this later).

PPIs makes it more convenient to get credit at the retail store, or to get an EMI without a physical CC.

3/9

Prepaid payment instruments come with a pre-loaded value and in some cases a pre-defined purpose of payment (more on this later).

PPIs makes it more convenient to get credit at the retail store, or to get an EMI without a physical CC.

3/9

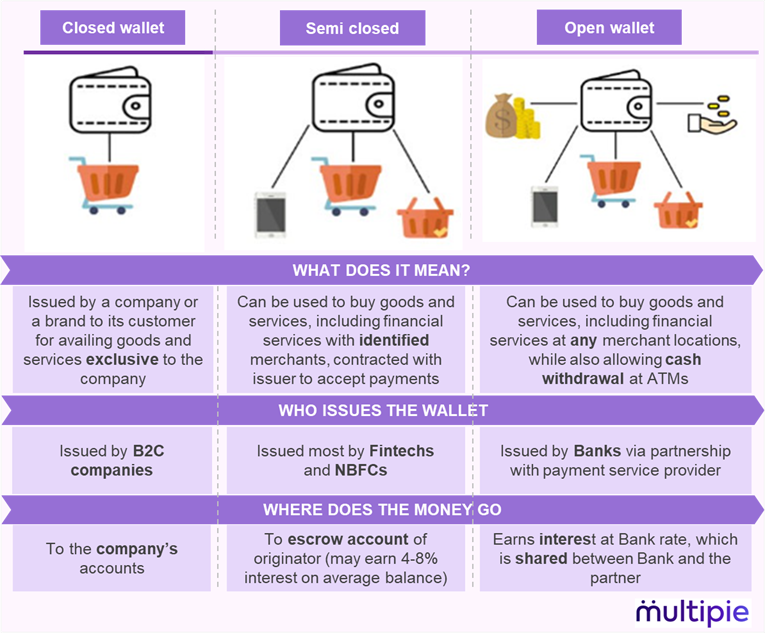

RBI categorizes 3 types of PPI wallets - Closed, Semi-closed and Open.

✅Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.

✅Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.

✅Open: Issued by Banks (eg: Travel cards).

4/9

✅Closed: Brand-specific gift card, wallets etc (Sodexo, Ola Money, etc). More prominent in 2000s.

✅Semi-closed: Mostly e-wallets issued by Fintechs and NBFCs.

✅Open: Issued by Banks (eg: Travel cards).

4/9

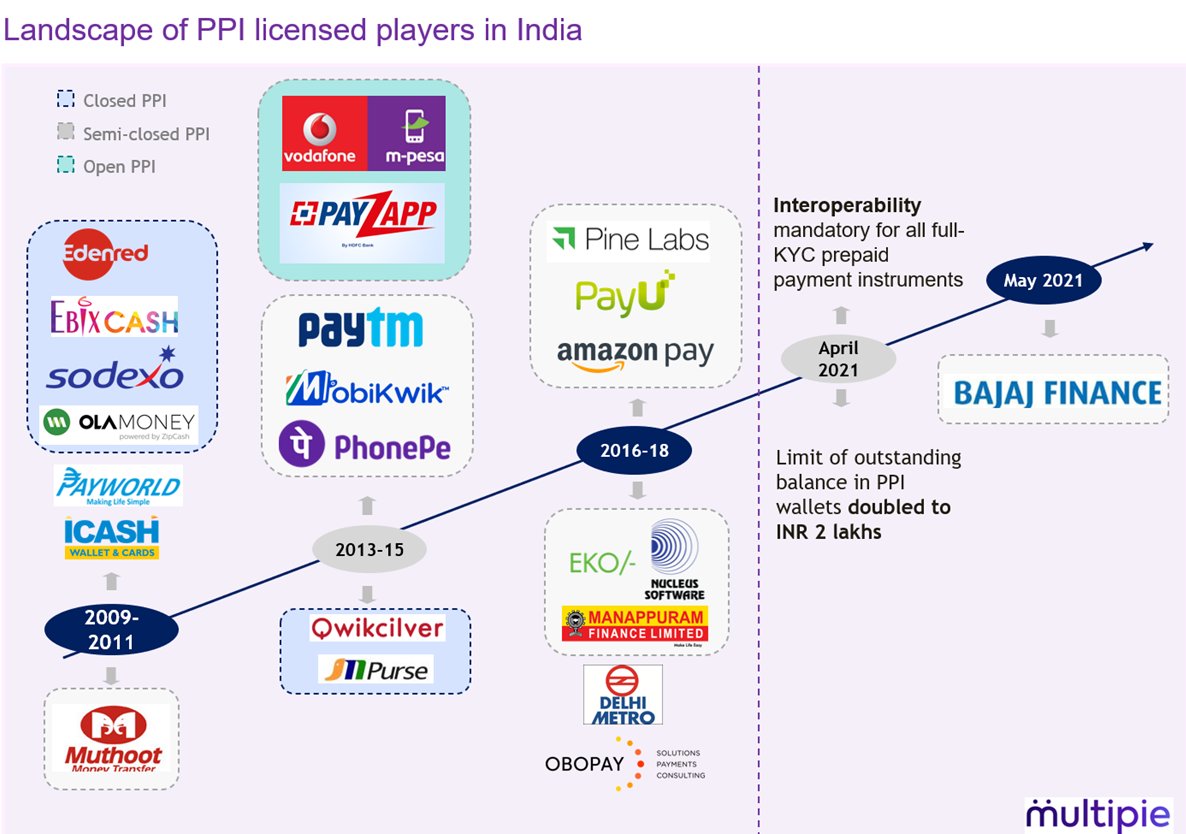

Let's understand the landscape of PPI players in India. As we can see, single use closed wallets were prominent earlier and have since given way to mostly semi-closed PPIs/ e-wallets.

Open wallets such M-pesa (ICICI Bank) and Payzapp (HDFC Bank) have seen limited success.

5/9

Open wallets such M-pesa (ICICI Bank) and Payzapp (HDFC Bank) have seen limited success.

5/9

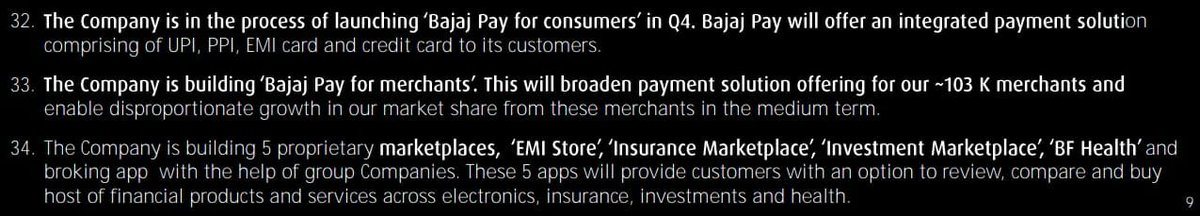

This brings us back to Bajaj Finance (BF). What does the PPI license mean for them?

BF had indicated its' Vision 2.0 via "Bajaj Pay" in their Q3 earnings call - an integrated payments solution of UPI, PPI & EMI Store (zero EMI). As per analysts, this should help cross-sell.

6/9

BF had indicated its' Vision 2.0 via "Bajaj Pay" in their Q3 earnings call - an integrated payments solution of UPI, PPI & EMI Store (zero EMI). As per analysts, this should help cross-sell.

6/9

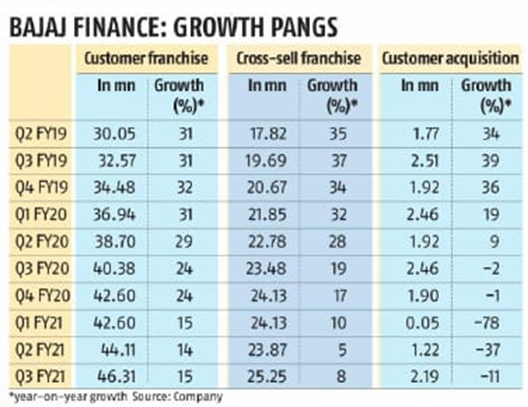

Over time, Bajaj has built a network of over 1 lakh merchants and ~5 crore customers. The two together create a base for a strong marketplace model, wherein payment capabilities was a missing link.

BF needs new legs to maintain growth, a key reason for its valuation premium.

7/9

BF needs new legs to maintain growth, a key reason for its valuation premium.

7/9

How big can this be for BF?

There have been two recent regulatory changes on PPI:

1. Mandatory interoperability for full KYC PPIs

2. Increased limit from ₹1 Lakh to ₹ 2 lakhs.

With these, some believe e-wallets may soon function as a Bank account.

8/9

livemint.com/news/india/rbi…

There have been two recent regulatory changes on PPI:

1. Mandatory interoperability for full KYC PPIs

2. Increased limit from ₹1 Lakh to ₹ 2 lakhs.

With these, some believe e-wallets may soon function as a Bank account.

8/9

livemint.com/news/india/rbi…

Conclusion:

While market reaction to this has been neutral, credit card expert @sandeepssrin had an optimistic take on this: "NBFC O/D line + prepaid + 2lakh limit + cash withdrawal + mandatory UPI linkage could be killer!"

Note: This is not an investment advice on BF.

9/9

While market reaction to this has been neutral, credit card expert @sandeepssrin had an optimistic take on this: "NBFC O/D line + prepaid + 2lakh limit + cash withdrawal + mandatory UPI linkage could be killer!"

Note: This is not an investment advice on BF.

9/9

What do you think of this development?

Let us know and we would love to discuss.

Please follow our page and subscribe to our blog (blog.multipie.co). We are just getting started.

Also do checkout our last podcast with @WeekendInvestng here:

podcast.multipie.co/alok-jain-foun…

Let us know and we would love to discuss.

Please follow our page and subscribe to our blog (blog.multipie.co). We are just getting started.

Also do checkout our last podcast with @WeekendInvestng here:

podcast.multipie.co/alok-jain-foun…

@threadreaderapp unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh