🧐How to Read 10Ks Like a Hedge Fund🧐

“Fundamentals don’t matter anymore!” I’ve heard this a lot lately on Fintwit.🙄

But, for those who’ve diversify beyond $GME and $DOGE, here’s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

👇

“Fundamentals don’t matter anymore!” I’ve heard this a lot lately on Fintwit.🙄

But, for those who’ve diversify beyond $GME and $DOGE, here’s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

👇

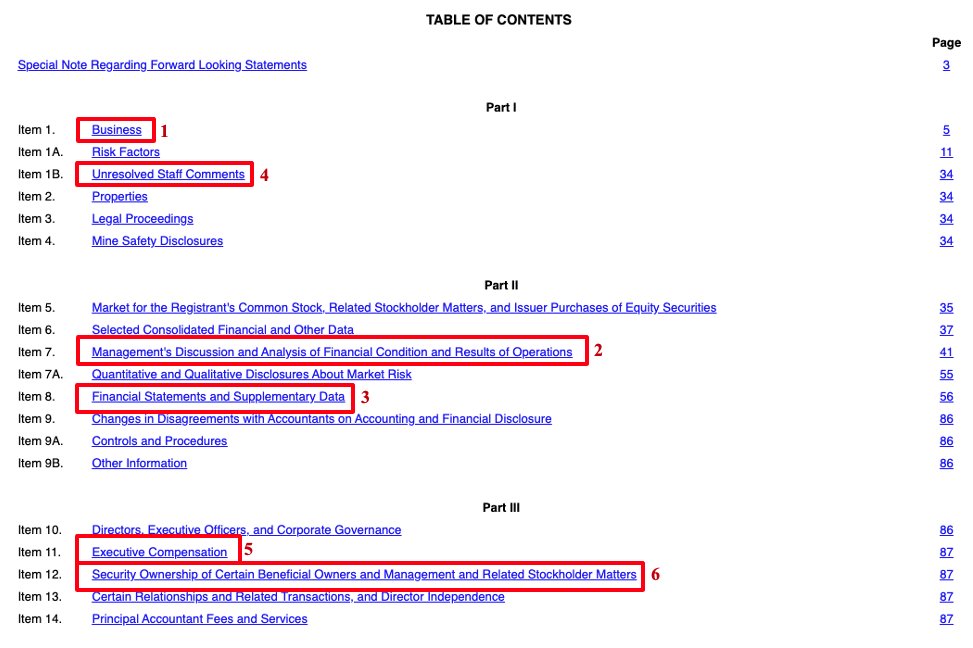

1/ Start @ business overview.

Look for these critical pts:

- market ecosystem (Who are the suppliers, distributors, partners? How is each $1 split btw the diff. players?)

- revenue model (How do they get paid? Subscription? Ads? Transaction fees?)

- product line/s (pure play?)

Look for these critical pts:

- market ecosystem (Who are the suppliers, distributors, partners? How is each $1 split btw the diff. players?)

- revenue model (How do they get paid? Subscription? Ads? Transaction fees?)

- product line/s (pure play?)

🚩 Reg flags if changes in:

- risk factors

- regulation

Why?

"If there’s a change here, it's b/c lawyers said so."

- if "cyber hack" gets added, there was probably a recent breach

- if "asbestos liability" gets added, expect workers comp to balloon

- risk factors

- regulation

Why?

"If there’s a change here, it's b/c lawyers said so."

- if "cyber hack" gets added, there was probably a recent breach

- if "asbestos liability" gets added, expect workers comp to balloon

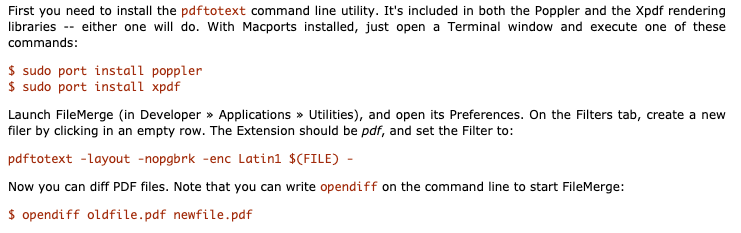

Useful tip:

If this is your 1st time ramping up on the company, read the business overview section whole.

If not, use a tool like FileMerge/opendiff to quickly find what’s changed since last year (hopefully, not much).

If you can't bash but got $20K to drop, get a Bloomberg.

If this is your 1st time ramping up on the company, read the business overview section whole.

If not, use a tool like FileMerge/opendiff to quickly find what’s changed since last year (hopefully, not much).

If you can't bash but got $20K to drop, get a Bloomberg.

2/ MD&A

Look for mgmt’s explanations on:

- revenue growth trends (if decelerating, why?)

- near-term expansion focus (selling up-market? geographical exp? partnerships? new product?)

- metrics that beat/missed

- competitive moat

- biggest risks

- governance changes

- guidance

Look for mgmt’s explanations on:

- revenue growth trends (if decelerating, why?)

- near-term expansion focus (selling up-market? geographical exp? partnerships? new product?)

- metrics that beat/missed

- competitive moat

- biggest risks

- governance changes

- guidance

3/ Financial Statements

aka the crux

Juiciest parts are in the FOOTNOTES (where truths like off-balance-sheet assets, operating leases, depreciation, etc. get uncovered).

But first let's start with the three statements (income statement, cash flow statement, & balance sheet).

aka the crux

Juiciest parts are in the FOOTNOTES (where truths like off-balance-sheet assets, operating leases, depreciation, etc. get uncovered).

But first let's start with the three statements (income statement, cash flow statement, & balance sheet).

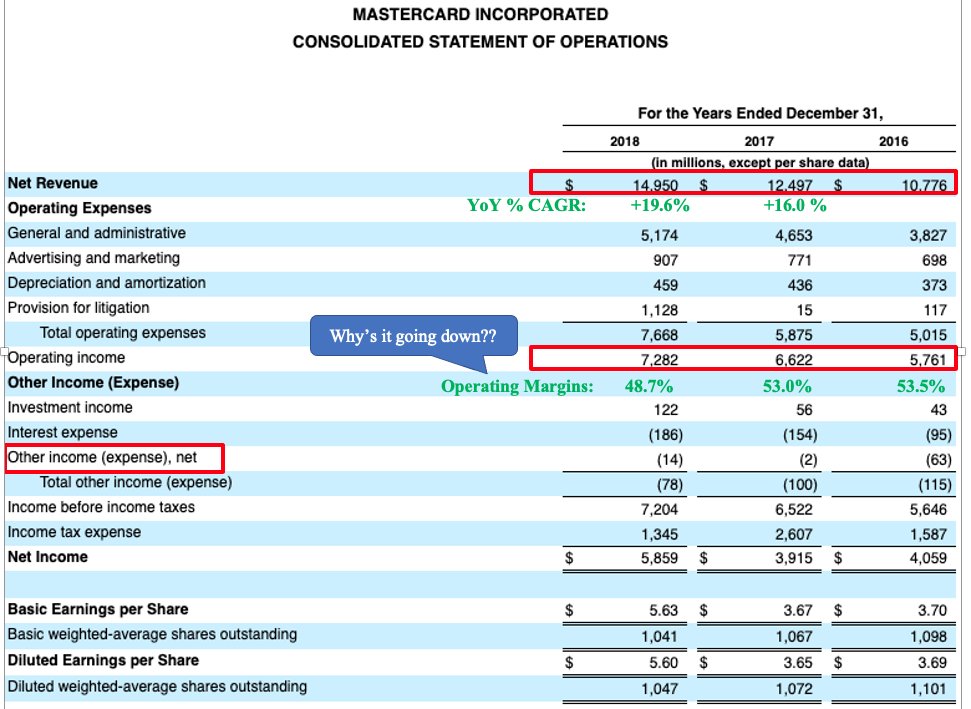

3a/ Income Statement

Look for:

- revenue %YoY growth (lots of co's, esp. tech, trade on revenue multiples... gotta keep 'em high to maintain those valuations)

- margins (economies of scale says margins should improve)

- one-time expenses/ writeoffs

- discontinued ops

Look for:

- revenue %YoY growth (lots of co's, esp. tech, trade on revenue multiples... gotta keep 'em high to maintain those valuations)

- margins (economies of scale says margins should improve)

- one-time expenses/ writeoffs

- discontinued ops

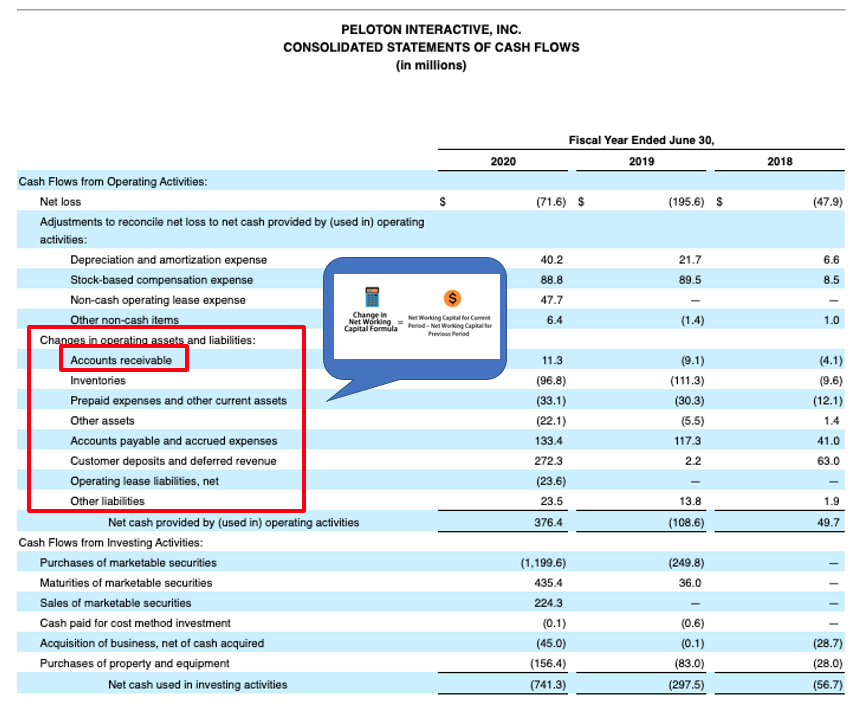

3b/ Cash Flows

Look for:

- changes in working capital or DSO (days sales outstanding) -- why? these 2 metrics indicate ST solvency

-🚩rising accts receivable -- why? this is a sign of capital inefficiency & maybe deteriorating customer quality

-🚩negative CFFO (from operations)

Look for:

- changes in working capital or DSO (days sales outstanding) -- why? these 2 metrics indicate ST solvency

-🚩rising accts receivable -- why? this is a sign of capital inefficiency & maybe deteriorating customer quality

-🚩negative CFFO (from operations)

- 🚩CFFO < net income, consistently (sign of some earnings shenanigans... see bit.ly/3tuTBys)

- 🚩 CFFI >> CFFO, consistently (can't mooch off investors forever!)

- 🚩 using one-time sales to pay down debt

- 🚩 capex < depreciation (mgmt is not investing back into biz)

- 🚩 CFFI >> CFFO, consistently (can't mooch off investors forever!)

- 🚩 using one-time sales to pay down debt

- 🚩 capex < depreciation (mgmt is not investing back into biz)

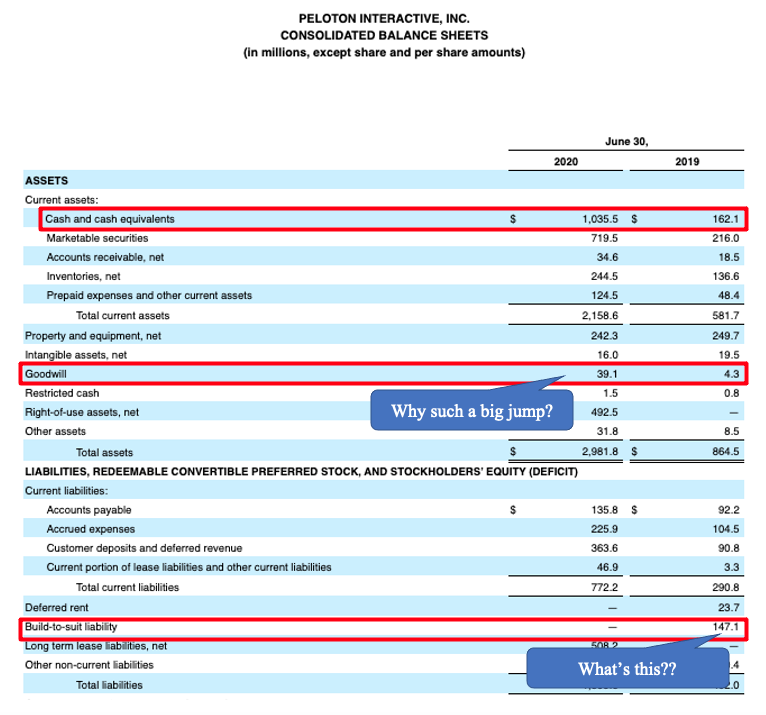

3c/ Balance Sheet

Look for:

- 🚩Rising debt/equity (if >200%, usually sign of impending liquidity crunch)

- 🚩Falling interest coverage (if <5, usually sign that operating income can't cover ST interest)

- Big change in cash w/out corporate action

- High goodwill (aka bad will)

Look for:

- 🚩Rising debt/equity (if >200%, usually sign of impending liquidity crunch)

- 🚩Falling interest coverage (if <5, usually sign that operating income can't cover ST interest)

- Big change in cash w/out corporate action

- High goodwill (aka bad will)

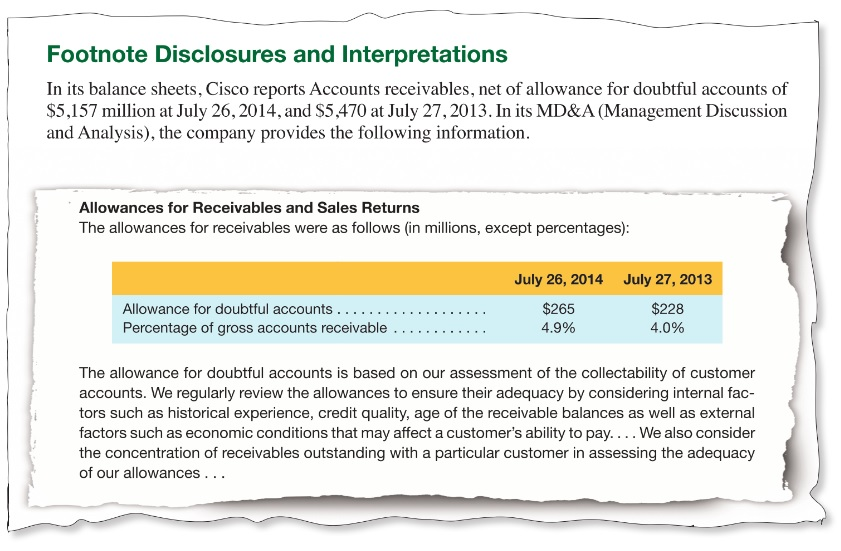

3d/ Footnotes: aka the fine print

DO NOT SKIP

Look for:

- revenue recognition explained

- GAAP vs non-GAAP (i.e. what did mgmt add/remove in Adjusted EBITDA?)

- off-balance sheet / VIEs

- operating leases

- legal actions

- LT debt maturities

- errors in previous filings

DO NOT SKIP

Look for:

- revenue recognition explained

- GAAP vs non-GAAP (i.e. what did mgmt add/remove in Adjusted EBITDA?)

- off-balance sheet / VIEs

- operating leases

- legal actions

- LT debt maturities

- errors in previous filings

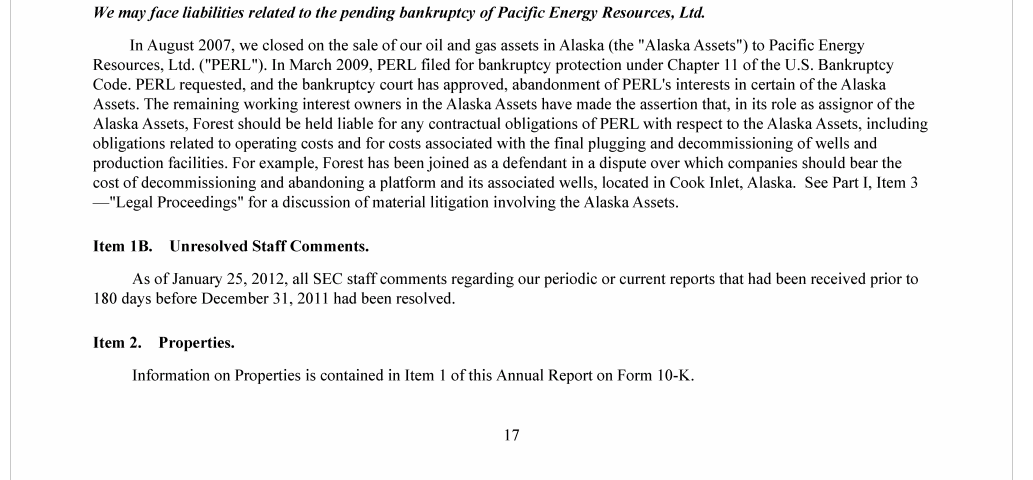

4/ Unresolved Staff Comments

Good case: this section is empty (about 99% of the time)

Trouble case: this is where mgmt addresses comments it received from the SEC on previously filed reports (had to dig a LONG AF time to find an example, Forrest Oil Corp -- now defunct)

Good case: this section is empty (about 99% of the time)

Trouble case: this is where mgmt addresses comments it received from the SEC on previously filed reports (had to dig a LONG AF time to find an example, Forrest Oil Corp -- now defunct)

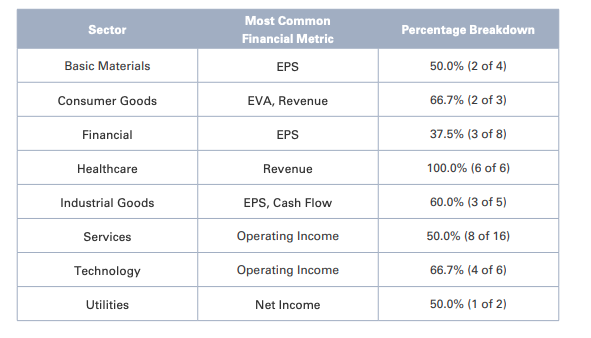

5/ Executive Comp

Why should u care how the CEO gets paid?

- CEO's goal is to maximize his bonus, so make sure the executive incentive plan is aligned w/ long-term value

What metrics are execs most often comped on?

- #1 revenue (20.2% of the time)

- #2 EPS

- #3 operating income

Why should u care how the CEO gets paid?

- CEO's goal is to maximize his bonus, so make sure the executive incentive plan is aligned w/ long-term value

What metrics are execs most often comped on?

- #1 revenue (20.2% of the time)

- #2 EPS

- #3 operating income

2nd reason to look @ proxy statements: signs of corporate governance issues

e.g. Michael Eisner's reign @ $Disney

- Board was stacked w/ insiders (so nobody challenged Eisner, no checks & balances)

- Hired & fired Michael Ovitz after 14 mo. w/ $130M golden parachute

e.g. Michael Eisner's reign @ $Disney

- Board was stacked w/ insiders (so nobody challenged Eisner, no checks & balances)

- Hired & fired Michael Ovitz after 14 mo. w/ $130M golden parachute

6/ Beneficial Ownership

Look for:

- high % ownership by insiders (C-suite, board): sign that mgmt is aligned w/ shareholders

- insider buying (Peter Lynch: "insiders might sell for a number of reasons, but they buy for only one: they think price will rise."

- 🚩🚩insider sales

Look for:

- high % ownership by insiders (C-suite, board): sign that mgmt is aligned w/ shareholders

- insider buying (Peter Lynch: "insiders might sell for a number of reasons, but they buy for only one: they think price will rise."

- 🚩🚩insider sales

- 🚩🚩if you see the CEO purge stock like a hot potato post-IPO, that's a clear-as-day sign that it's all over

e.g. #1 real news -- Tom Siebel @ $AI

e.g. #2 fake news -- @brian_armstrong sold 750K shares & apes thought he sold 75% of his stake... 😂🤯

Now this thread is over.

e.g. #1 real news -- Tom Siebel @ $AI

e.g. #2 fake news -- @brian_armstrong sold 750K shares & apes thought he sold 75% of his stake... 😂🤯

Now this thread is over.

• • •

Missing some Tweet in this thread? You can try to

force a refresh