Bitcoin has been consolidating around the $1 trillion market cap threshold for almost three months.

What’s happening behind the scenes, and how should investors be thinking about the recent price action of bitcoin?

[THREAD]

What’s happening behind the scenes, and how should investors be thinking about the recent price action of bitcoin?

[THREAD]

Long-term hodlers are accumulating.

Over the last 30 days HODLers have accumulated 93,638 BTC more than they have sold. The conviction of bitcoiners is not the least bit shaken, & they are viewing the period of price consolidation as a stacking opportunity.

Over the last 30 days HODLers have accumulated 93,638 BTC more than they have sold. The conviction of bitcoiners is not the least bit shaken, & they are viewing the period of price consolidation as a stacking opportunity.

Miners are accumulating.

Over the last 30-day period, miners have accumulated a net position of 5,459 BTC.

With hash rate lagging far behind price action over the past year, coupled with a global semiconductor shortage, expect miners to continue to be net accumulators of BTC.

Over the last 30-day period, miners have accumulated a net position of 5,459 BTC.

With hash rate lagging far behind price action over the past year, coupled with a global semiconductor shortage, expect miners to continue to be net accumulators of BTC.

Another metric to look at is the Puell Multiple.

Puell Multiple measures the dollar value of bitcoin issued to miners in relation to its 365 day MA.

Currently, the Puell Multiple is at 2.5. When compared to the previous cycle, the metric was around 2.5 at the $3-4k level.

Puell Multiple measures the dollar value of bitcoin issued to miners in relation to its 365 day MA.

Currently, the Puell Multiple is at 2.5. When compared to the previous cycle, the metric was around 2.5 at the $3-4k level.

Realized cap continues to surge.

Despite price consolidating over the past months, realized cap has increased by $250B since 11/20, to a total of $370B today (realized cap at the top of 2017 was just $90B).

An immense amount of capital is flowing onto the Network.

Despite price consolidating over the past months, realized cap has increased by $250B since 11/20, to a total of $370B today (realized cap at the top of 2017 was just $90B).

An immense amount of capital is flowing onto the Network.

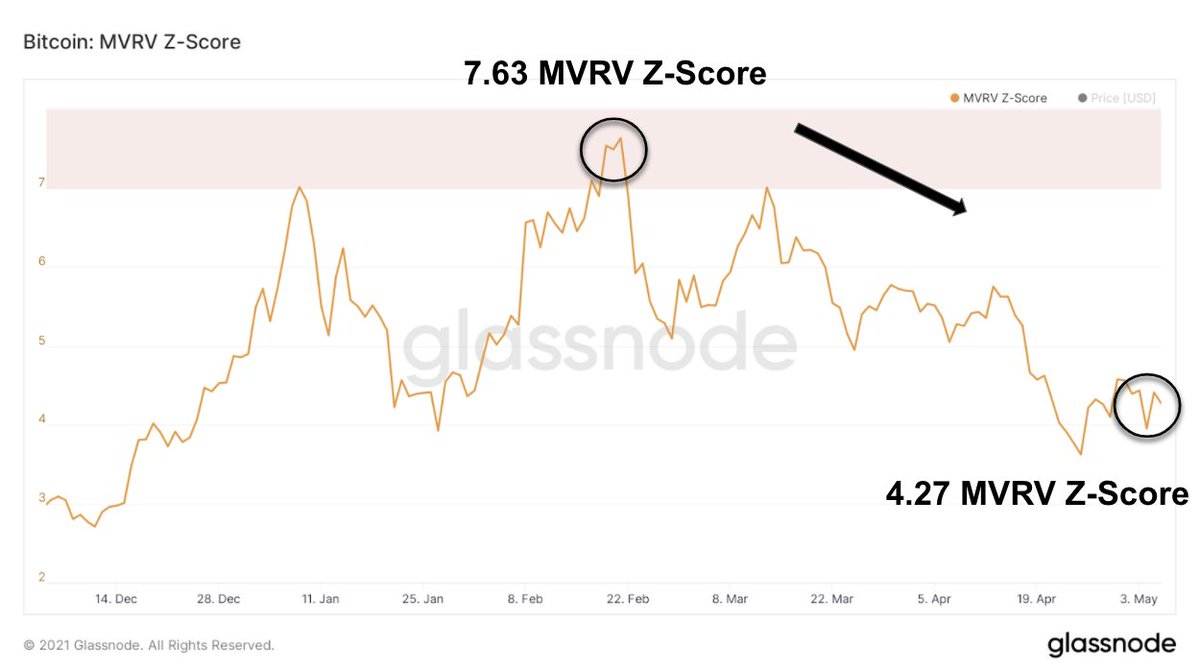

Because of the surge in realized cap, MVRV Z-Score has pulled back.

MVRV, a ratio between the market cap vs realized cap metrics, has pulled back from 7.63 in February to 4.27 today, a promising sign for a continuing bull market into 2021.

MVRV, a ratio between the market cap vs realized cap metrics, has pulled back from 7.63 in February to 4.27 today, a promising sign for a continuing bull market into 2021.

Macroeconomic backdrop remains the same.

The driving force behind much of the surge in Bitcoin adoption and interest over the past year remains unchanged.

Central banks continue to expand their balance sheets at exponential rates, showing no signs of letting up anytime soon.

The driving force behind much of the surge in Bitcoin adoption and interest over the past year remains unchanged.

Central banks continue to expand their balance sheets at exponential rates, showing no signs of letting up anytime soon.

Check out the full writeup by @BTCization on Bitcoin Magazine below !👇👇bitcoinmagazine.com/markets/market…

• • •

Missing some Tweet in this thread? You can try to

force a refresh