📝How to Make Sense of Earnings Calls📝

You hear about the hottest earnings this week: $UPST, $ABNB, $PLTR, $DIS ... & excitedly tune in to your 1st call.

2min later. "What r they talkin' abt? How does this help me trade??"

So many metrics, which are important?

Here's a guide👇

You hear about the hottest earnings this week: $UPST, $ABNB, $PLTR, $DIS ... & excitedly tune in to your 1st call.

2min later. "What r they talkin' abt? How does this help me trade??"

So many metrics, which are important?

Here's a guide👇

1/ Pre-call diligence

To know what's going on, u should collect the following info ahead of call:

a. Street estimates on revenue, EBIT, & EPS

b. Latest guidance #'s from mgmt

c. Last 4 quarters' revenue/EPS beats/misses & how the stock reacted

d. Last 4 quarters' QoQ growth #'s

To know what's going on, u should collect the following info ahead of call:

a. Street estimates on revenue, EBIT, & EPS

b. Latest guidance #'s from mgmt

c. Last 4 quarters' revenue/EPS beats/misses & how the stock reacted

d. Last 4 quarters' QoQ growth #'s

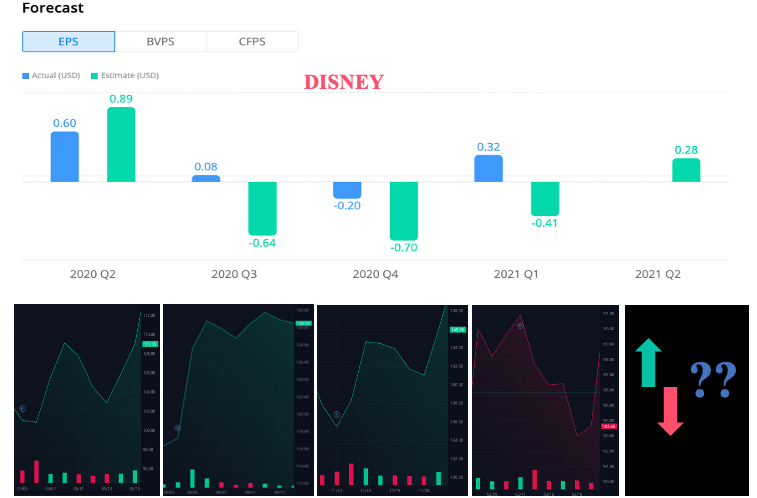

Example:

$DIS reports Q2 '21 results on 5/13

I've pulled actual v. estimated EPS from the last 4 quarters & corresponding stock performance.

Things to note:

- actual EPS consistently beats estimates (which means $DIS mgmt team is conservative about providing forward guidance)

$DIS reports Q2 '21 results on 5/13

I've pulled actual v. estimated EPS from the last 4 quarters & corresponding stock performance.

Things to note:

- actual EPS consistently beats estimates (which means $DIS mgmt team is conservative about providing forward guidance)

- most executives err on conservative b/c earnings misses can be devastating

- EPS doesn't look like a strong driver for $DIS stock performance (though Q1 '21 results significantly beat expectations the stock still plummeted)

- is revenue better? How about Pixar-specific revenue?

- EPS doesn't look like a strong driver for $DIS stock performance (though Q1 '21 results significantly beat expectations the stock still plummeted)

- is revenue better? How about Pixar-specific revenue?

2/ Structure of an earnings call

Who's present?

- CEO, CFO, IR, operator, sell-side analysts & rarely buy-side

Format: 3 parts (~45min)

- CEO's prepared remarks

- CFO's prepared remarks

- Analyst Q&A (~15-30min)

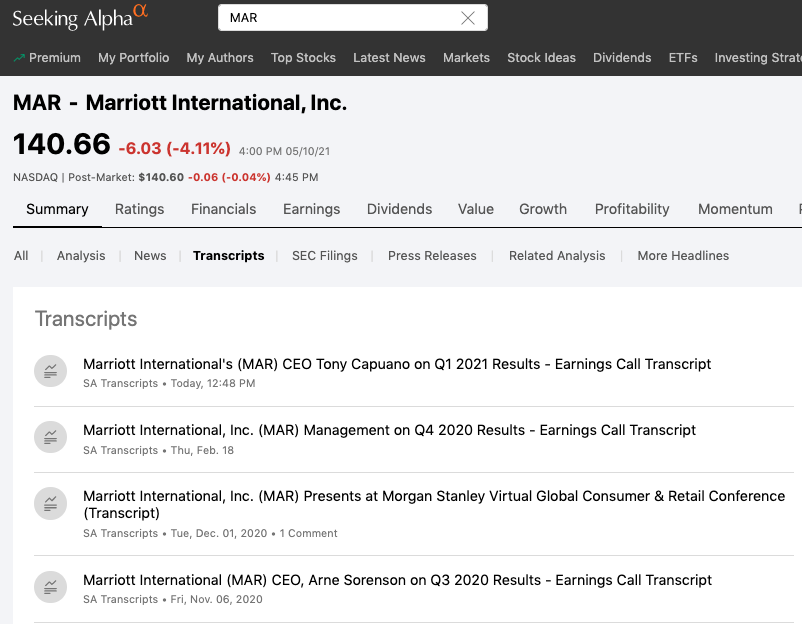

Where are historic transcripts?

- Company IR pages

- SeekingAlpha

Who's present?

- CEO, CFO, IR, operator, sell-side analysts & rarely buy-side

Format: 3 parts (~45min)

- CEO's prepared remarks

- CFO's prepared remarks

- Analyst Q&A (~15-30min)

Where are historic transcripts?

- Company IR pages

- SeekingAlpha

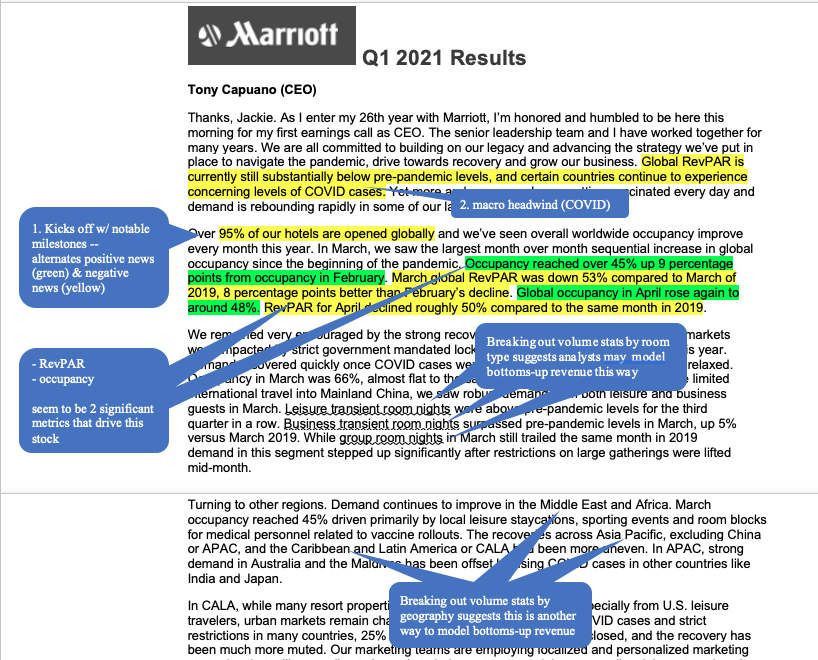

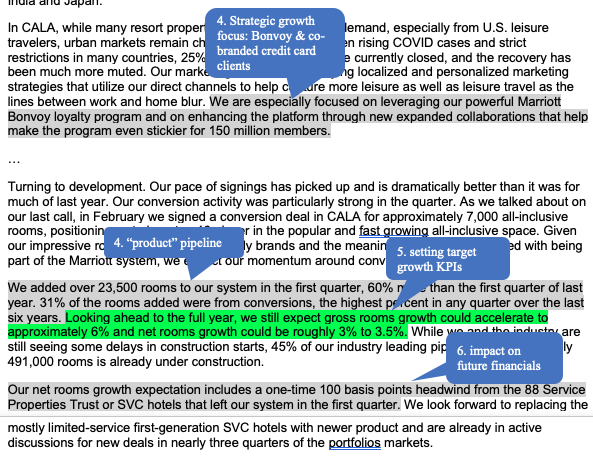

2a/ Prepared remarks - CEO

Typical flow:

1. notable milestones this quarter

2. macro tailwinds

3. major corporate actions (M&As, restructuring)

4. growth & expansion strategy (new partnerships, campaigns, product pipeline)

5. upcoming goals/KPIs

6. impact on future financials

Typical flow:

1. notable milestones this quarter

2. macro tailwinds

3. major corporate actions (M&As, restructuring)

4. growth & expansion strategy (new partnerships, campaigns, product pipeline)

5. upcoming goals/KPIs

6. impact on future financials

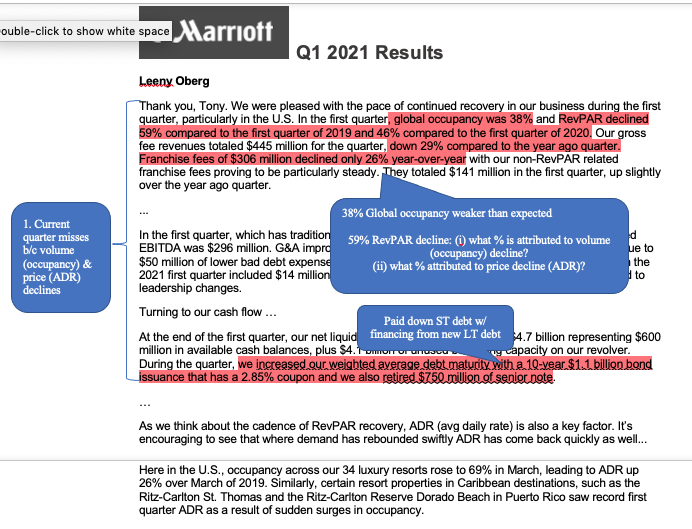

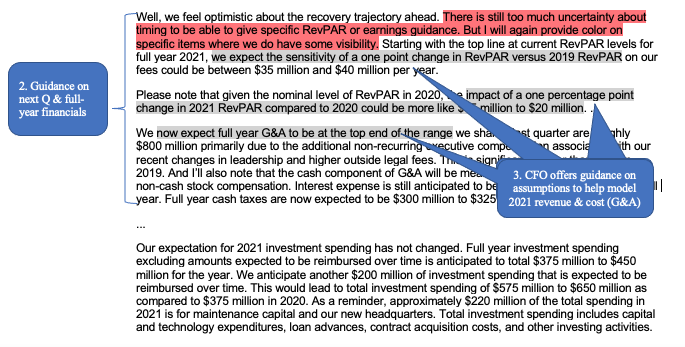

2b/ Prepared remarks - CFO

While CEO focuses on high-level strategy, CFO focuses on low-level financial metrics.

Typical flow:

1. Current quarter beats, misses, & why?

2. Guidance for next Q & fiscal year

3. Assumptions for modeling revenue & profit

(Marriot Q1 example cont'd)

While CEO focuses on high-level strategy, CFO focuses on low-level financial metrics.

Typical flow:

1. Current quarter beats, misses, & why?

2. Guidance for next Q & fiscal year

3. Assumptions for modeling revenue & profit

(Marriot Q1 example cont'd)

Key questions to ponder during CEO/CFO prepared remarks:

- What metrics does the CEO focus on (vs. CFO who spews out all metrics whether useful or not)

- What clues does the CFO give about how to model revenues & costs? (e.g. by product line? by geography? by customer size/type?)

- What metrics does the CEO focus on (vs. CFO who spews out all metrics whether useful or not)

- What clues does the CFO give about how to model revenues & costs? (e.g. by product line? by geography? by customer size/type?)

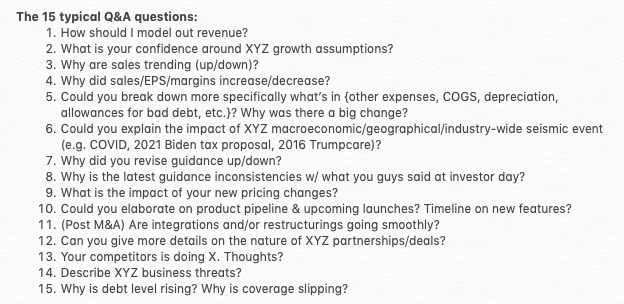

3/ Q&A

This is the most important part IMHO. Why? Because it's not prepared. That said, most questions that analysts ask are very predictable.

There's 15 main question "flavors."

#1-10 focus on improving financial modeling accuracy

#11-12 are long term

#13-15 are about threats

This is the most important part IMHO. Why? Because it's not prepared. That said, most questions that analysts ask are very predictable.

There's 15 main question "flavors."

#1-10 focus on improving financial modeling accuracy

#11-12 are long term

#13-15 are about threats

Pay special attention to:

- bearish questions

- questions that mgmt doesn't know the answer to

- questions that mgmt refuses to answer

- metrics/KPIs that sell-side analysts repeatedly ask for more clarification on (b/c this tells u exactly how they're modeling revenue)

- bearish questions

- questions that mgmt doesn't know the answer to

- questions that mgmt refuses to answer

- metrics/KPIs that sell-side analysts repeatedly ask for more clarification on (b/c this tells u exactly how they're modeling revenue)

Why DOESN'T buy-side ask questions?

From 57,784 sample transcripts, buy-side repr. <5% of all questioners.

Why?

1. Don't want to reveal positions

2. Can ask IR later in private 1-1 meetings

3. IR may purposely put funds @ back of the queue to avoiding challenging questions

From 57,784 sample transcripts, buy-side repr. <5% of all questioners.

Why?

1. Don't want to reveal positions

2. Can ask IR later in private 1-1 meetings

3. IR may purposely put funds @ back of the queue to avoiding challenging questions

Why/When DOES buy-side ask questions?

1. Your name is @davidein & you want to move markets (bit.ly/2R2vNoK)

2. Your name is not Einhorn but you still want to move markets in your favor

3. Your name is Bruce Wayne (bit.ly/3exfWY6)

1. Your name is @davidein & you want to move markets (bit.ly/2R2vNoK)

2. Your name is not Einhorn but you still want to move markets in your favor

3. Your name is Bruce Wayne (bit.ly/3exfWY6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh