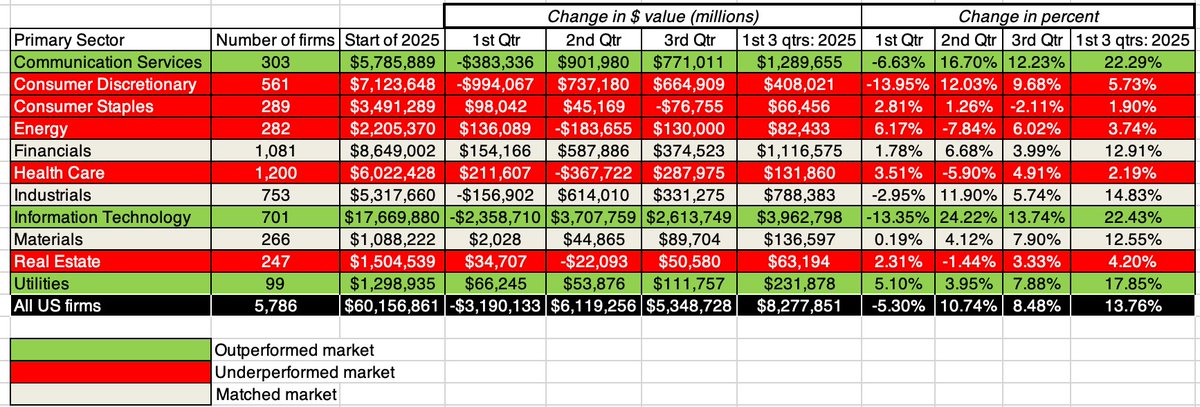

The second leg of the Biden tax plans targets the "rich", with a rollback in the 2017 rate cuts in the highest tax brackets and a doubling of tax rates on capital gains for the 0.3 percenters (making more than $ 1 million in investment income). bit.ly/3blbxp3

If historical stock returns in the US are adjusted for dividend and capital gain taxes, the tax impact wipes out almost 95% of the cumulative payoff. Paying a lower tax rate on dividends & trading less often reduces but does not eliminate the pain. bit.ly/3blbxp3

Prior to the tax rate change, investors are pricing stocks to earn an annual return of 5.73%, pre-taxes, and an after-tax return of 5.01%, with the current tax code. bit.ly/3blbxp3

If the proposed capital gain tax change goes through, even though it targets only a few, those few punch well above their weight, in terms of investment holdings, and the tax rate investors will need to make, in the aggregate, will go up materially. bit.ly/3blbxp3

Revaluing stocks, holding earnings and cash flows fixed, and using the higher pre-tax required return of 6.05% yield a 7.05% lower value for the S&P 500. bit.ly/3blbxp3

The bottom line. No tax hike ever hits just its intended target. The rich will feel the pain, but to assume that they will not share it with the rest of us is being in denial. Tax lawyers and accountants will clearly be beneficiaries. bit.ly/3blbxp3

• • •

Missing some Tweet in this thread? You can try to

force a refresh