Fascinated by finance & markets and like writing about them, but teaching is my passion.

23 subscribers

How to get URL link on X (Twitter) App

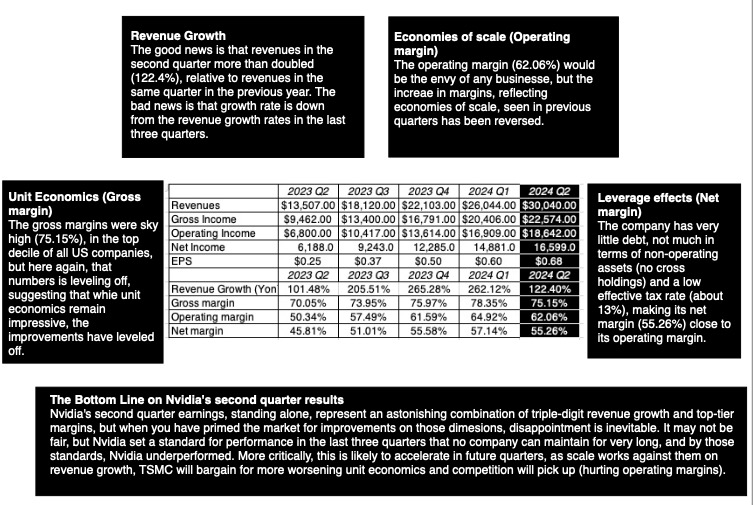

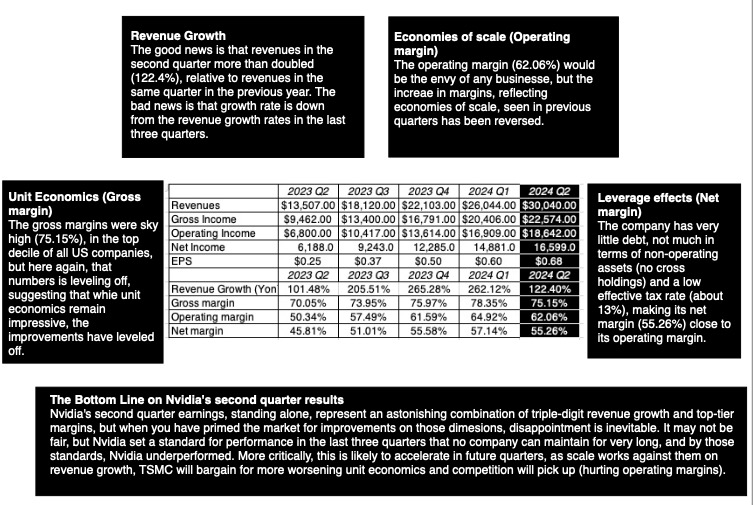

Debates about over pricing quickly devolve into shouting matches between one side that argues that a trillion dollars is too high a price for any company and the other pointing to a changed world order for business. bit.ly/3Ycei3W

Debates about over pricing quickly devolve into shouting matches between one side that argues that a trillion dollars is too high a price for any company and the other pointing to a changed world order for business. bit.ly/3Ycei3W

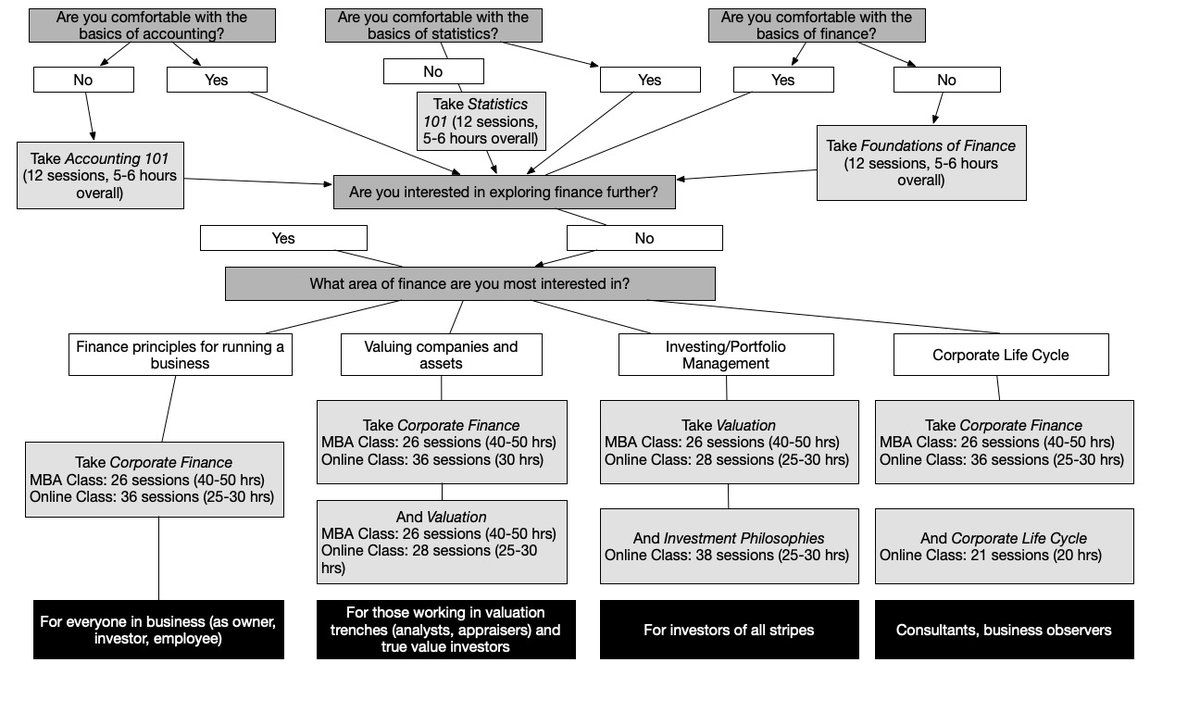

I start by describing why I leave material on open access (not altruism, but selfishness) and how you can find any content I have created (written, spoken) online on one of four platforms. bit.ly/4mtKKcg

I start by describing why I leave material on open access (not altruism, but selfishness) and how you can find any content I have created (written, spoken) online on one of four platforms. bit.ly/4mtKKcg

The reasons for holding cash vary depending on where a company is in the life cycle from survival for young growth firms to youth serum for mature firms to liquidation manager for declining firms. bit.ly/40TEjXG

The reasons for holding cash vary depending on where a company is in the life cycle from survival for young growth firms to youth serum for mature firms to liquidation manager for declining firms. bit.ly/40TEjXG

These ignored investments are what comprise the alternative investing universe, and in the last two decades, they have been sold relentlessly to portfolio managers, on the promise that they will yield better risk/return trade offs. bit.ly/4l6DOSp

These ignored investments are what comprise the alternative investing universe, and in the last two decades, they have been sold relentlessly to portfolio managers, on the promise that they will yield better risk/return trade offs. bit.ly/4l6DOSp

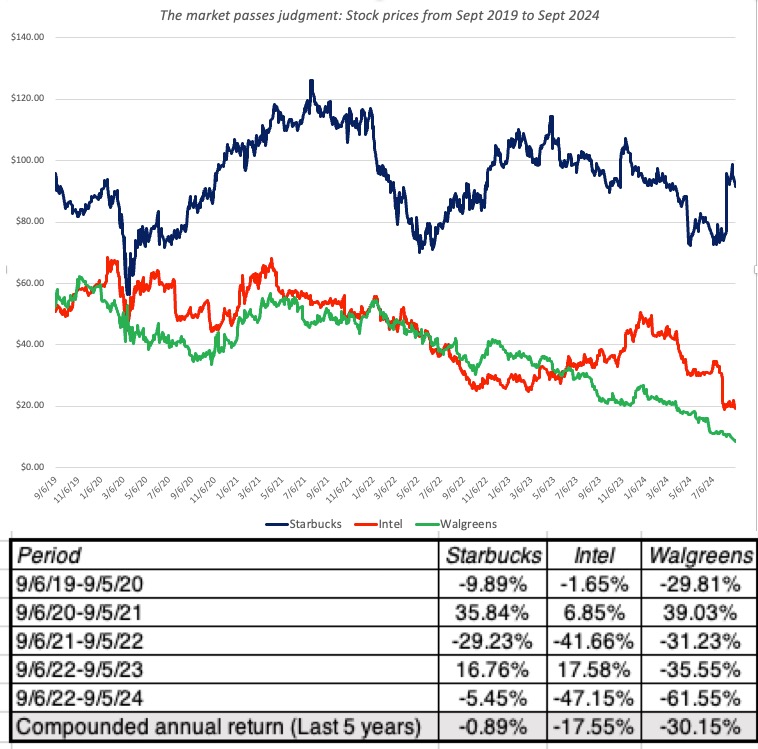

The market has turned sour on all three companies, as they have all delivered sub-par returns over the last 5 years. Hiring a new CEO seems to have brought some euphoria back at Starbucks, but is it overdone?

The market has turned sour on all three companies, as they have all delivered sub-par returns over the last 5 years. Hiring a new CEO seems to have brought some euphoria back at Starbucks, but is it overdone?