Excelentes resultados del grupo $TK. Tesis materializándose en línea con lo esperado. ¿Compartís mi feeling de que siempre que presenta bien TK la bolsa y el oil se hunden y nos termina arrastrando? 👇

$TGP. Resultados mejor de lo esperado. El anterior trimestre habían guiado -4M para Q12021 ($0.57eps) y han reportado +0.5M ($0.61eps). Fijado un barco a 1 año + ejercida opción por parte del cliente en otro + spot market-linked otro = 98% de la flota fija a 2021

La reducción de la deuda y la refinanciación a mejores tipos hace que el net income mejore la evolución del EBITDA. Aún así, la deuda total desciende únicamente 42M este trimestre. Esto es temporal y revertirá a lo largo del año: -39M "other operating assets and liabilities".

Buenos resultados, sector en crecimiento estructural que debería de cotizar a múltiplos más altos, excelente flota y backlog, desapalancamiento en línea, dividendo atractivo. Tesis clara, sin sorpresas con Dividend yield 7.8%. Es nuestra "liquidez"

$TNK. Resultados sorprendentemente buenos. Estimábamos una perdida de $0.90 y reportó sólo -$0.65eps. Reduciendo los costes financieros mediante recompra y refinanciación de leasings. Posición alta de liquidez $371M. Hay que esperar al inicio del super-ciclo.

A pesar de que aún quedan algunos meses flojos, los fundamentales para 4Q y adelante son cada vez más alentadores. Demanda de oil recuperando niveles pre-covid, inventarios en el mar normalizados. Sentarse y esperar!

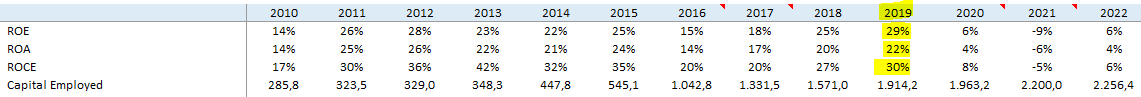

TK. Sin costes SG&A. Buena gestión en Banff que resta menos de lo esperado. Foinaven desaparecerá de balance pronto sin ningún coste por la decisión de BP (incluso espero un pequeño beneficio extraordinario). Hummingbird único activo y sigue generando un excelente cash flow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh