A thread on the claims made by GoI in its press conference yesterday (see pib.gov.in/PressReleasePa… and for the recording). Let me take, one by one, their so-called repudiation of "reports in a section of the media followed by some uninformed tweets"! 1/n

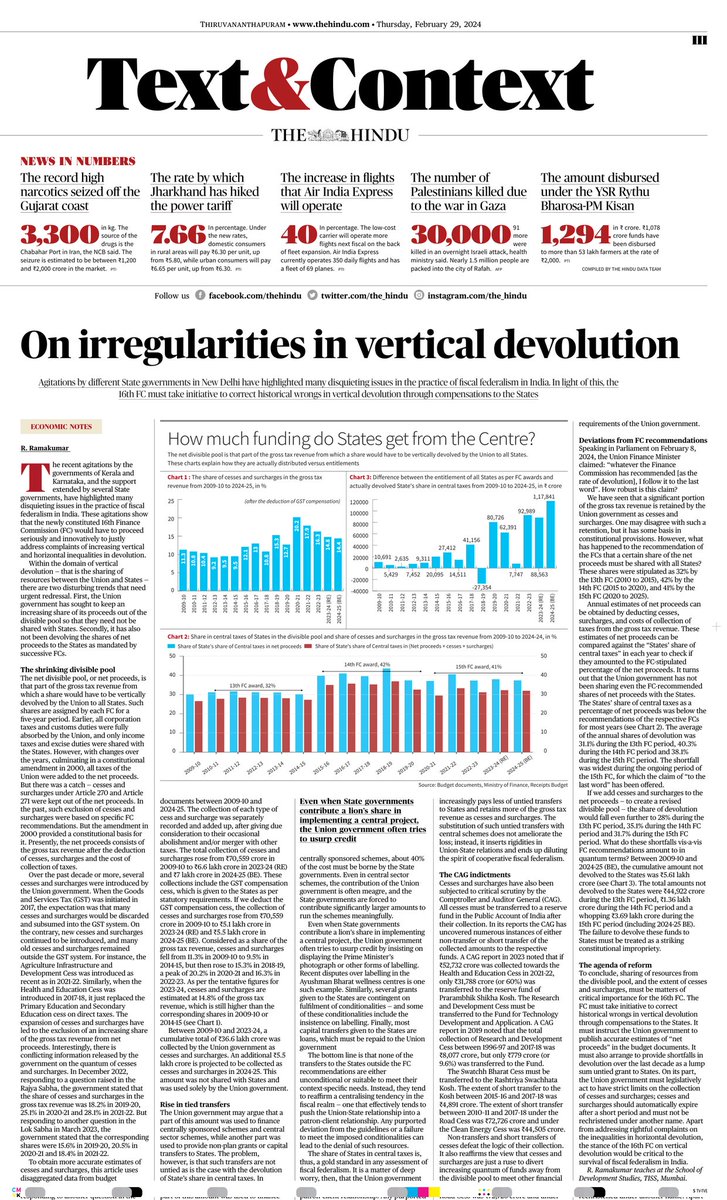

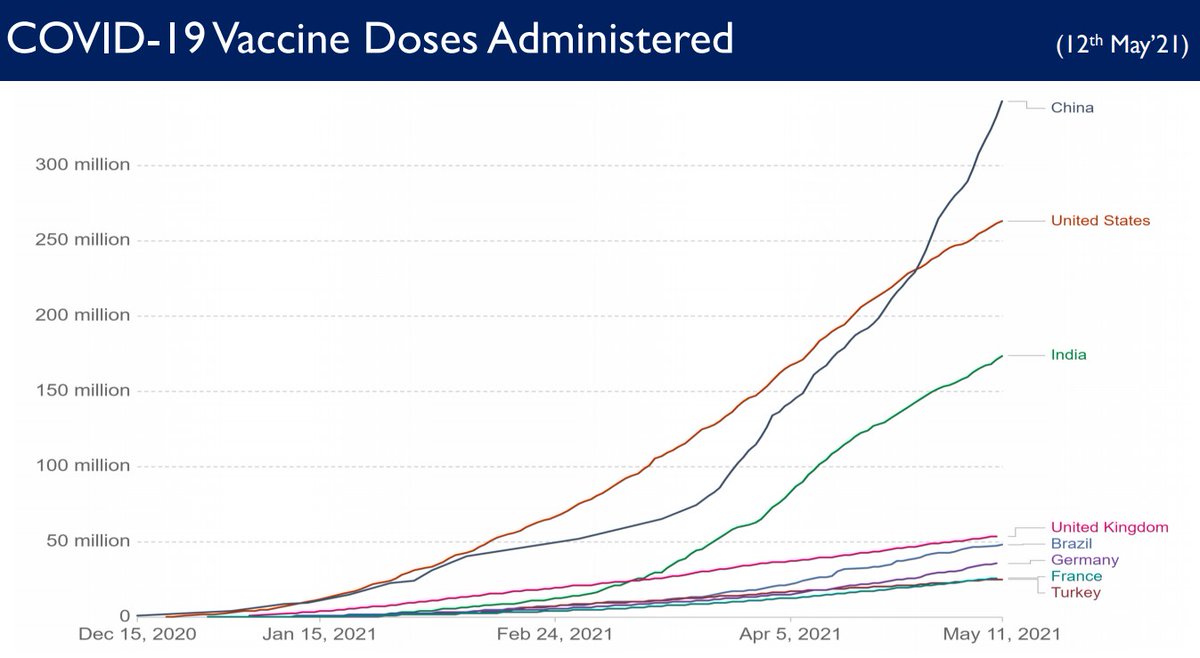

Their first graph was accompanied by a claim that of all vaccines given in the world, 13% are in India. First, this graph with absolute data shows that India's is NOT the world's "largest" vaccination programme, as claimed. China and US are ahead of us even in absolute terms. 2/n

Secondly, India's share in world population is 18%. But we have given only 13% of all vaccines. Details like this will never be admitted, as it will diminish the spirit of "positivity"! Also, the kind of graph as attached below will never be shown, as it spreads "negativity"! 3/n

Then comes this graph. What is not understood is that nations like USA, once they cross 50% coverage, naturally find it difficult to keep up pace. That India at 10% coverage is moving only as fast as USA at 50% coverage is actually a bad thing. But no, hey, don't be negative! 4/n

This slide. The claim: 35.6 crore doses received till now or in pipeline for GoI. States/private hospitals have ordered 16 crore doses b/w May-July. The problem with this was detailed by me in Scroll: bit.ly/3tMRMx0. See Table 1 in this article. What does Table1 say? 5/n

Table 1 says for May-July, GoI has ordered/grabbed 2.1 million doses/day. Our capacity is only 2.3 million/day (GoI's estimate). What is left for States? 16 crore doses/3 months is 1.7 million doses/day! For that, we should produce 3.8 million/day. But we don't produce that! 6/n

Then comes the king of all slides. This shows India will be flooded with vaccines BETWEEN August & December. We will have 216 crore doses over 5 months, or 1.4 crore doses/day! We now produce only 2.3 million/day. That is, there will be a 6-fold rise of availability. Wow! 7/n

GoI claims SII will make 95 crore doses in 5 months. That is, 6.4 million doses/day! This is a ~3-fold rise from ~2.2 million doses/day now. SII is already struggling to meet the promise of 3.3 million/day by July. They will make 6.4 million/day by December? Give us a break! 8/n

Take Covaxin. Capacity will be 3.7 million doses/day? Capacity of BB now is not >0.5 million doses/day. BB says it will be 1.9 million doses/day by Jan 2022. Haffkine won't start production before 8-12 months. So won't the other two PSUs. Where will the rest come from? 9/n

The affidavit of GoI to SCI says Covaxin capacity will rise from 0.3 million doses/day to 3.3 million "in the next 8-10 months". So, if at all possible, we may achieve the target of 3.3 million doses/day (3.7 million doses/day in GoI's slide) IN Dec21-Jan22, NOT BEFORE THAT! 10/n

Note also that GoI has set aside Rs 200 crore as grant-in-aid to the three PSUs to produce Covaxin. However, the GoI's affidavit noted that "grant-in-aid has been recommended; however, disbursements have yet to be made"! So no payments, yet. Is this spending on war-footing? 11/n

The same holds for the other vaccines too. Yes, some doses may trickle in by December, but the cited numbers here are absolutely unrealistic & wrong. To spread positivity doesn't mean to spread lies. Speak truth. People will be happy and positive if you just state the truth. 12/n

In sum, what's the vaccine story now? Doses administered/day in May is as poor as in April. Why don't we have one good explanation on why doses/day fell from 4.8 million doses/day to 2.3 million doses/day? Bombastic claims can give way to that one good and truthful reason. n/n

@threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh