Astral Pipes fundamentals :

https://twitter.com/techlunatic/status/1355581588915032068

They have 2 major segments, pipes and adhesives. 77% revenue comes from Piping and the rest from Adhesives.

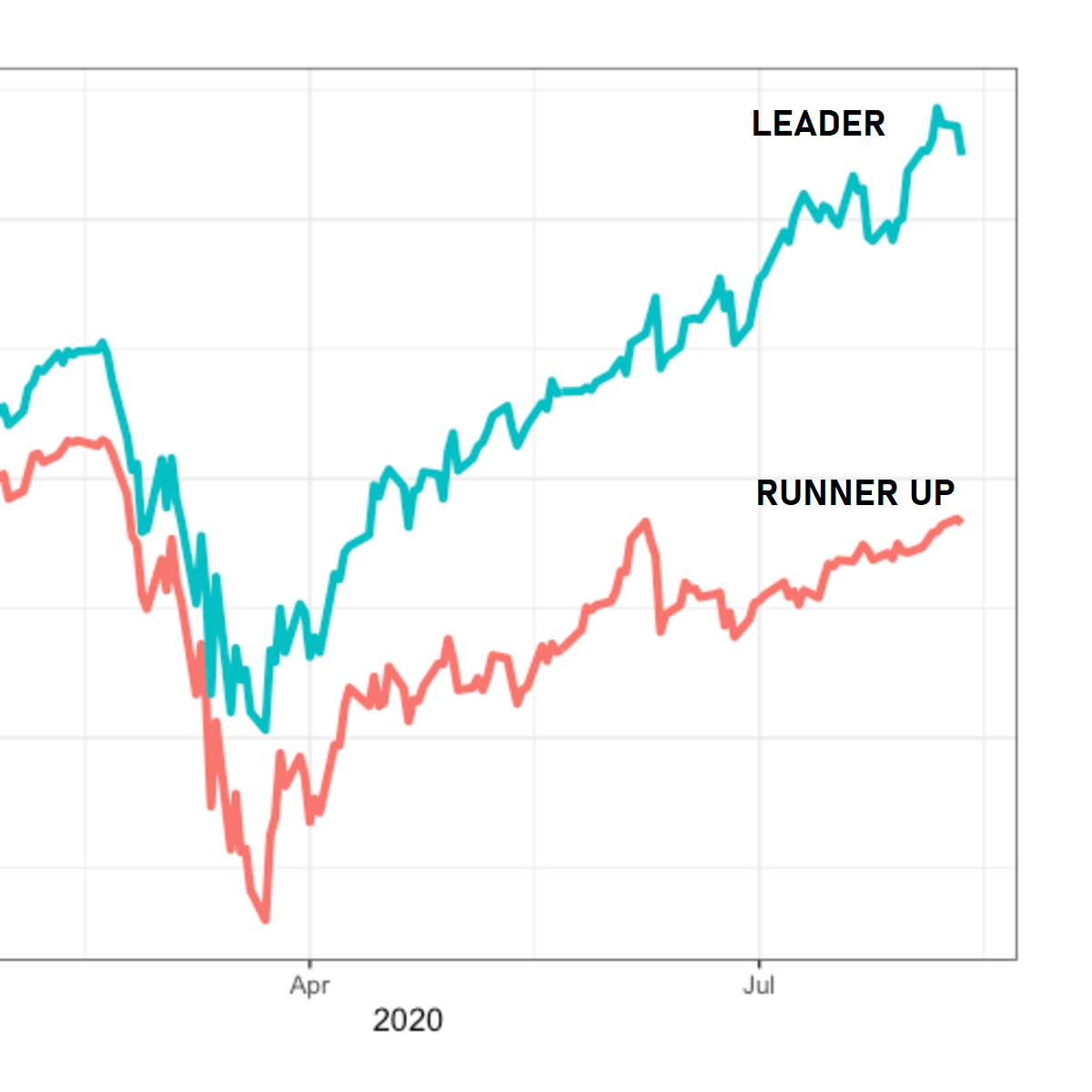

Astral is already a CPVC leader (77% revenue share) and has diversified into Pidilite's monopoly in the high-margin adhesives segment (23% revenue share) and held up pretty well.

Recent acquisitions show the management's ambition to use inorganic means to make a dent into the high margin segment that Pidilite currently has a dominating market share in (M Seal, Dr fixit)

Comparison with Supreme Industries would be a bit unfair since Supreme does a lot more than just pipes. They make furniture and packaging foam etc. Detailed comparison of Supreme Inds here :

https://twitter.com/techlunatic/status/1355582674715488259

• • •

Missing some Tweet in this thread? You can try to

force a refresh