How to get URL link on X (Twitter) App

https://twitter.com/techlunatic/status/1406517273146191879

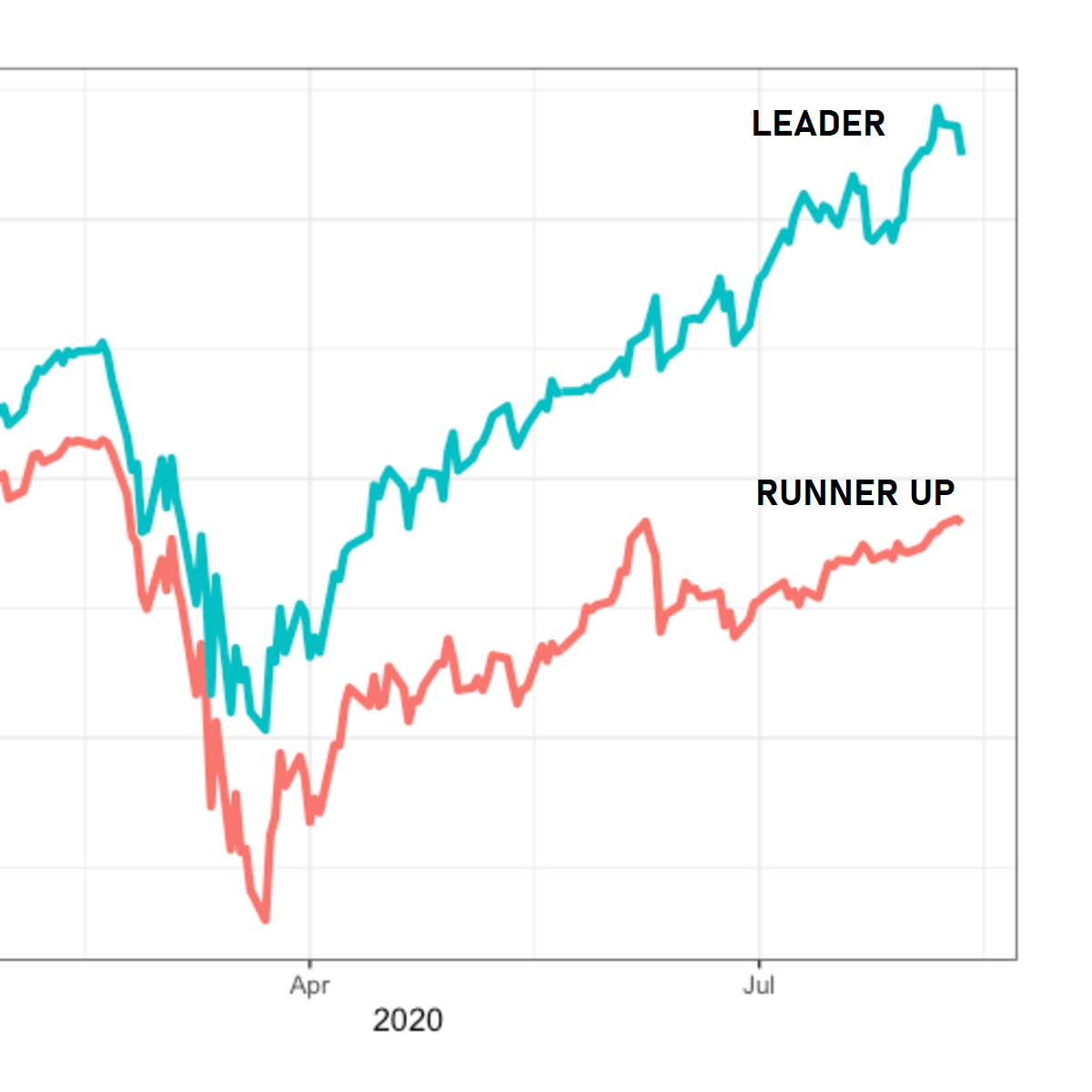

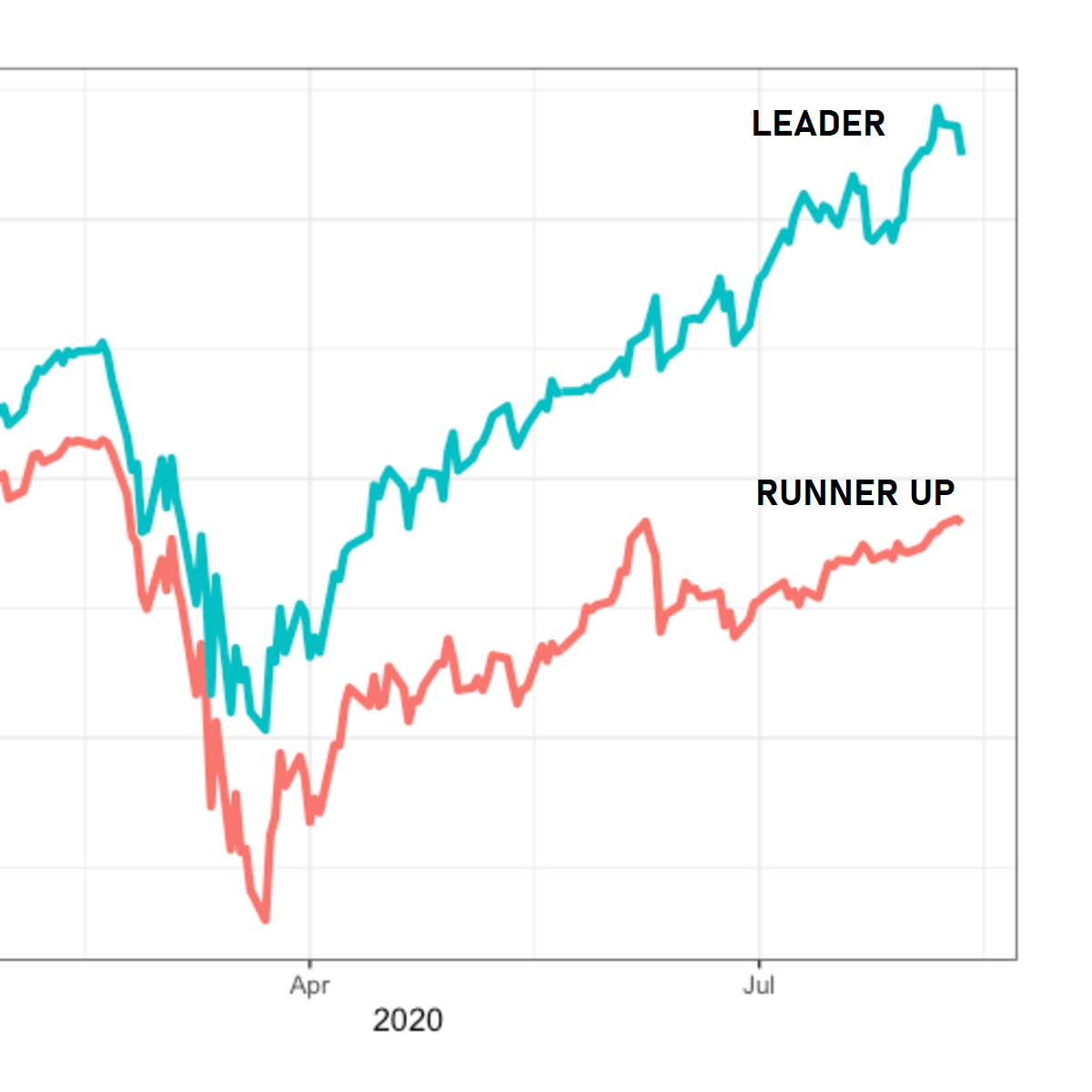

Should we only buy the leaders?

Should we only buy the leaders?

When they plotted out the damage these planes were incurring, it was spread out, but largely concentrated around the tail, body and wings. So the most natural impulse was to armor the parts with the most bullet holes.

When they plotted out the damage these planes were incurring, it was spread out, but largely concentrated around the tail, body and wings. So the most natural impulse was to armor the parts with the most bullet holes.

https://twitter.com/techlunatic/status/1421105492688916493

Earnings yields is mostly stable and smooth curve. It's the stock price that fluctuates due to sentiments, liquidity, news cycle, perception etc.

Earnings yields is mostly stable and smooth curve. It's the stock price that fluctuates due to sentiments, liquidity, news cycle, perception etc. https://twitter.com/techlunatic/status/1369651365912354823

https://twitter.com/vingystryker/status/1417760264028520449

https://twitter.com/techlunatic/status/1413748183402905601

#SupremeInd management has diligently worked to eliminate their debt from 2008 to being completely debt free now.

#SupremeInd management has diligently worked to eliminate their debt from 2008 to being completely debt free now.

https://twitter.com/techlunatic/status/1408336338294763523#2) Stocks and fundamentals both are bad : Market has bottomed, and people have stopped buying.

https://twitter.com/techlunatic/status/1355581588915032068

They have 2 major segments, pipes and adhesives. 77% revenue comes from Piping and the rest from Adhesives.

They have 2 major segments, pipes and adhesives. 77% revenue comes from Piping and the rest from Adhesives.

https://twitter.com/techlunatic/status/1370644064740077568

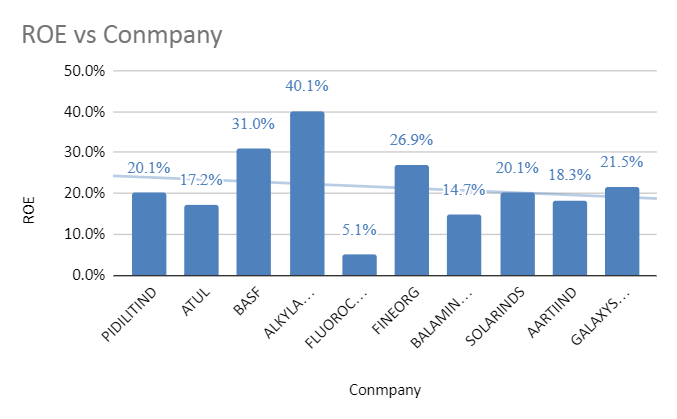

Pidilite, Atul, Alkyl amines, FinOrg have among the best ROE.

Pidilite, Atul, Alkyl amines, FinOrg have among the best ROE.

https://twitter.com/techlunatic/status/1343918252989186053

https://twitter.com/techlunatic/status/1347536660192391170

https://twitter.com/techlunatic/status/1392701125069967363

Presently all Insurance stocks are fully valued (i.e 4% margin priced in but 6% margin not priced in)

Presently all Insurance stocks are fully valued (i.e 4% margin priced in but 6% margin not priced in)

Whereas, if the correction is taking its own time & allowing (i.e inviting) people to buy, it is usually a distribution prior to multi-year stagnation

Whereas, if the correction is taking its own time & allowing (i.e inviting) people to buy, it is usually a distribution prior to multi-year stagnation

https://twitter.com/techlunatic/status/1357264708747866114

Tata Elxsi profit trend :

Tata Elxsi profit trend :

Sorted by sales figures, it's clear that the market is rewarding TataElxsi with some premium marketcap, because there are companies which make similar sales but don't enjoy the same valuation (and with good reason) :

Sorted by sales figures, it's clear that the market is rewarding TataElxsi with some premium marketcap, because there are companies which make similar sales but don't enjoy the same valuation (and with good reason) :

https://twitter.com/techlunatic/status/1356635288907505665

Relaxo sales history :

Relaxo sales history :