Today, much of the focus is on US compounded stocks, cryptocurrencies and COVID-19.

Let's get some perspective (1/x)

Let's get some perspective (1/x)

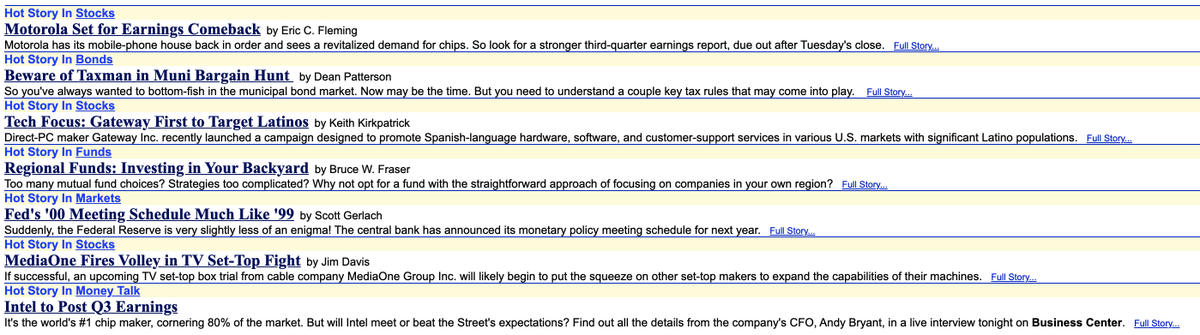

Key headlines in 1999:

• Motorola earnings

• Gateway Spanish speaking product

• Mutual funds

• Intel earnings

• Motorola earnings

• Gateway Spanish speaking product

• Mutual funds

• Intel earnings

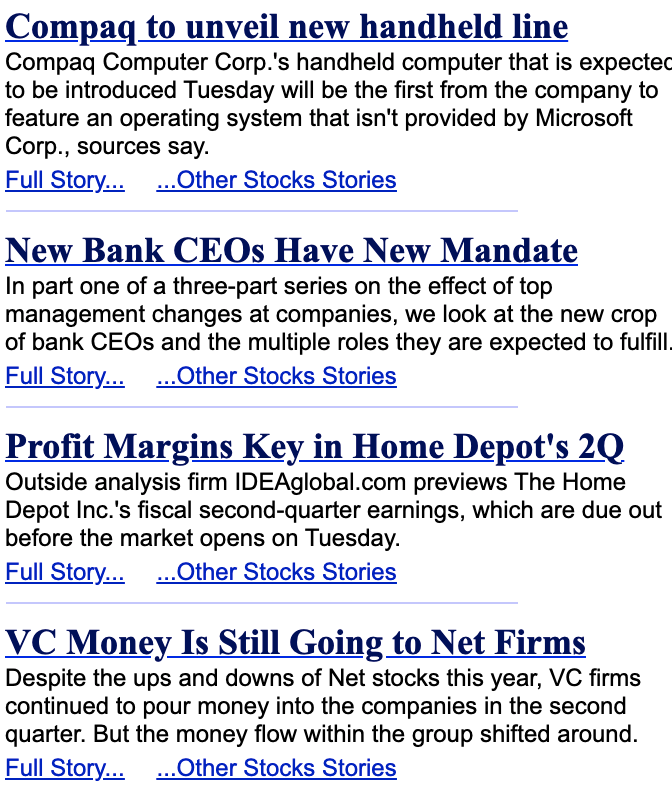

Key headlines in 2000:

• Compaq introduces hand-held line

• Looking forward to Home Depot earnings

• Bank CEO regulation

• Venture Capital flows still strong, despite crash

• Compaq introduces hand-held line

• Looking forward to Home Depot earnings

• Bank CEO regulation

• Venture Capital flows still strong, despite crash

Key headlines in 2001:

• NASDAQ ends three-day losing streak

• What's next for Microsoft?

• Commentator: Ignore gold stocks

• Jobless claims continue to rise

• NASDAQ ends three-day losing streak

• What's next for Microsoft?

• Commentator: Ignore gold stocks

• Jobless claims continue to rise

Key headlines in 2002:

• Defense stocks are a great offense

• Stocks seen as lagging over 20 years

• Legal challenges for Hershey

• OPEC hesitates amid oil price spike

• Defense stocks are a great offense

• Stocks seen as lagging over 20 years

• Legal challenges for Hershey

• OPEC hesitates amid oil price spike

Key headlines in 2003:

• Stock pick: Washington Mutual for a 30% return

• Traders slam IBM

• Dollar boosts Asian exporting stocks

• Nikkei turns positive on SoftBank

• Stock pick: Washington Mutual for a 30% return

• Traders slam IBM

• Dollar boosts Asian exporting stocks

• Nikkei turns positive on SoftBank

Key headlines in 2004:

• Diebold's a winner

• Safe stocks hiding under the radar

• Japanese stocks open lower

• Fleckenstein: Insurance mess may ignite greater problems

• Diebold's a winner

• Safe stocks hiding under the radar

• Japanese stocks open lower

• Fleckenstein: Insurance mess may ignite greater problems

Key headlines in 2005:

• A fund that beats Buffett

• Investors fear stock slip as oil surges

• Is China exporting good deflation?

• Dell's slowing may signal market weakness

• A fund that beats Buffett

• Investors fear stock slip as oil surges

• Is China exporting good deflation?

• Dell's slowing may signal market weakness

Key headlines in 2006:

• Iran keeps crude oil above $70

• More turbulence ahead for Boeing

• Goldman, Lehman had worst Q3 banking drops

• Clorox names Coca-Cola executive as CEO

• Iran keeps crude oil above $70

• More turbulence ahead for Boeing

• Goldman, Lehman had worst Q3 banking drops

• Clorox names Coca-Cola executive as CEO

Key headlines in 2007:

• How far will the credit crunch spread?

• ABN, RBS consortium say to continue takeover talks

• Bear chief moves to assuage investor fears

• Profit from the Blockbuster-Netflix war

• How far will the credit crunch spread?

• ABN, RBS consortium say to continue takeover talks

• Bear chief moves to assuage investor fears

• Profit from the Blockbuster-Netflix war

Key headlines in 2008:

• Wall St. soars on banks' best day in 16 years

• Inflation soars; home builder sentiment crumbles

• Merrill to sell Bloomberg stake for $4.5bln

• Computer shipment growth said slowing

• Wall St. soars on banks' best day in 16 years

• Inflation soars; home builder sentiment crumbles

• Merrill to sell Bloomberg stake for $4.5bln

• Computer shipment growth said slowing

Key headlines in 2009:

• Why a meltdown could happen again

• The bold new face of GM

• Why it's time to invest in real estate

• 4 problems that could sink America

• Why a meltdown could happen again

• The bold new face of GM

• Why it's time to invest in real estate

• 4 problems that could sink America

Key headlines in 2010:

• Will Apple offer free iPhone fix?

• Should you buy gold?

• A meltdown survival plan

• Dow streak still alive, barely

• Will Apple offer free iPhone fix?

• Should you buy gold?

• A meltdown survival plan

• Dow streak still alive, barely

Key headlines in 2011:

• Russia sells oil via pipeline to China

• Hangover or afterparty for stocks?

• Why Japanese stocks look tempting

• UK business leader sees rough start for economy

• Russia sells oil via pipeline to China

• Hangover or afterparty for stocks?

• Why Japanese stocks look tempting

• UK business leader sees rough start for economy

Key headlines in 2012:

• Better jobs, but worse jobs

• Sealed Air looks tasty

• Icahn goes activist on Motorola

• Transocean's surprising turnaround

• Better jobs, but worse jobs

• Sealed Air looks tasty

• Icahn goes activist on Motorola

• Transocean's surprising turnaround

Key headlines in 2013:

• How Twitter's pop stacks up

• Tesla and the competition

• Groupon is no bargain

• Macy's ready for happy holidays

• How Twitter's pop stacks up

• Tesla and the competition

• Groupon is no bargain

• Macy's ready for happy holidays

Key headlines in 2014:

• The next Chipotle?

• Sunny outlook for solar?

• Home Depot hacking report worries Wall Street

• Why you shouldn't put your money in index funds

• The next Chipotle?

• Sunny outlook for solar?

• Home Depot hacking report worries Wall Street

• Why you shouldn't put your money in index funds

Key headlines in 2015:

• US gasoline prices at lowest level since 2008 recession

• A worst-case scenario for stocks? It's ugly

• How low can oil go? Goldman says $20 a barrel is a possibility

• Surging US debt should have you prepping for fiscal crisis

• US gasoline prices at lowest level since 2008 recession

• A worst-case scenario for stocks? It's ugly

• How low can oil go? Goldman says $20 a barrel is a possibility

• Surging US debt should have you prepping for fiscal crisis

Key headlines in 2016:

• Trump shifts from Wall St. villain to savior

• The oil market could get a lot messier

• Silver prices have slumped into a bear market

• What Fidel Castro’s death means for investors

• Trump shifts from Wall St. villain to savior

• The oil market could get a lot messier

• Silver prices have slumped into a bear market

• What Fidel Castro’s death means for investors

Key headlines in 2017:

• Here's why oil might crash to $10 a barrel

• Are Analysts Secretly Calling Gilead a Screaming Buy?

• Amazon said to make sportswear push in industry

• Bitcoin prices hit all-time high

• Here's why oil might crash to $10 a barrel

• Are Analysts Secretly Calling Gilead a Screaming Buy?

• Amazon said to make sportswear push in industry

• Bitcoin prices hit all-time high

Key headlines in 2018:

• Cryptocurrency ether hits lowest point of the year

• China puts off licenses for US companies amid tariff battle

• China trade war could cause bear market

• US 'likely' has taken over as the world's top oil producer

• Cryptocurrency ether hits lowest point of the year

• China puts off licenses for US companies amid tariff battle

• China trade war could cause bear market

• US 'likely' has taken over as the world's top oil producer

Key headlines in 2019:

• 80% of the stock market is now on autopilot

• Tesla analyst cuts price target

• Trump says no reduction in tariffs

• Stocks rise to close out Dow’s biggest June gain since 1938

• 80% of the stock market is now on autopilot

• Tesla analyst cuts price target

• Trump says no reduction in tariffs

• Stocks rise to close out Dow’s biggest June gain since 1938

Key headlines in 2020:

• Big tech lobbying

• Virus epicenter stocks

• Elon says China rocks

• Coronavirus live updates

• Big tech lobbying

• Virus epicenter stocks

• Elon says China rocks

• Coronavirus live updates

Today's headlines:

• $100 million market cap deli

• Dogecoin rallies on Elon Musk tweet

• Facebook data could be halted

• Greece emerging from coronavirus lockdowns

• $100 million market cap deli

• Dogecoin rallies on Elon Musk tweet

• Facebook data could be halted

• Greece emerging from coronavirus lockdowns

Conclusions?

• News = noise

• All news are backwards-looking

• New, emerging trends are not obvious from today's news headlines

• Your focus has to be driven by something other than news reports: e.g. insider buying trends, buybacks, capital cycles, valuations, etc.

• News = noise

• All news are backwards-looking

• New, emerging trends are not obvious from today's news headlines

• Your focus has to be driven by something other than news reports: e.g. insider buying trends, buybacks, capital cycles, valuations, etc.

• • •

Missing some Tweet in this thread? You can try to

force a refresh