Mercado Libre is an absurd company.

- $3.9 billion in 2020 net revenue

- $50 billion in payments processed

- Barely scratched the surface

Seriously, the more I looked at Meli, the more opportunities I found.

Here's what I mean👇

readthegeneralist.com/briefing/meli

- $3.9 billion in 2020 net revenue

- $50 billion in payments processed

- Barely scratched the surface

Seriously, the more I looked at Meli, the more opportunities I found.

Here's what I mean👇

readthegeneralist.com/briefing/meli

1/

In 1999, Meli was founded.

There's a fun story about the first money the company raised.

Marcos Galperin was a student at Stanford GSB at the time. One day, the famous investor John Muse came to give a lecture...

In 1999, Meli was founded.

There's a fun story about the first money the company raised.

Marcos Galperin was a student at Stanford GSB at the time. One day, the famous investor John Muse came to give a lecture...

2/

To make sure he had a chance to pitch him on his idea for an "eBay in Latin America" Galperin asked if he could drive him back to his private plane after the lecture.

Then he got lost on purpose.

To make sure he had a chance to pitch him on his idea for an "eBay in Latin America" Galperin asked if he could drive him back to his private plane after the lecture.

Then he got lost on purpose.

3/

During the ride, Galperin told Muse all about the opportunity. When they finally reached the airport he agreed to invest.

That's how Meli got its first cash.

During the ride, Galperin told Muse all about the opportunity. When they finally reached the airport he agreed to invest.

That's how Meli got its first cash.

4/

Later that year, Meli launched in Argentina.

Galperin would use that seed $$ to scale across Latam into Brazil, Uruguay, Mexico, and other geos.

Eventually Meli would grow to operate in 18 countries.

Later that year, Meli launched in Argentina.

Galperin would use that seed $$ to scale across Latam into Brazil, Uruguay, Mexico, and other geos.

Eventually Meli would grow to operate in 18 countries.

5/

Many entrepreneurs might have stopped at building an awesome e-commerce company.

But Galperin wasn't satisfied.

From the start, he knew he wanted to bring payments online.

Many entrepreneurs might have stopped at building an awesome e-commerce company.

But Galperin wasn't satisfied.

From the start, he knew he wanted to bring payments online.

6/

This was a huge challenge.

When Galperin launched "Pago" in 2003, most of the region's population was unbanked. Though some people bought and sold goods online, they often paid with cash or cheque.

This was a huge challenge.

When Galperin launched "Pago" in 2003, most of the region's population was unbanked. Though some people bought and sold goods online, they often paid with cash or cheque.

7/

Bit by bit, Pago became a market leader in payments.

More than one person I spoke to called it the "PayPal of Latam." Today, it includes a ton of financial services, including:

- Point of sale

- QR checkout

- Savings/investing

- Business credit

Bit by bit, Pago became a market leader in payments.

More than one person I spoke to called it the "PayPal of Latam." Today, it includes a ton of financial services, including:

- Point of sale

- QR checkout

- Savings/investing

- Business credit

8/

But Galperin *still* wasn't done.

So, he had the marketplace and the payments infrastructure.

What was missing?

Logistics.

"Mercado Envios" was born.

But Galperin *still* wasn't done.

So, he had the marketplace and the payments infrastructure.

What was missing?

Logistics.

"Mercado Envios" was born.

9/

Starting in 2013, Meli invested *heavily* in building out its own logistics network.

This was no small feat and was a big risk. It came at a time when the company was under financial pressure, but Galperin persevered.

Starting in 2013, Meli invested *heavily* in building out its own logistics network.

This was no small feat and was a big risk. It came at a time when the company was under financial pressure, but Galperin persevered.

10/

This has proven the right move.

Meli now has the best infrastructure in the region and can over fast, free delivery.

They're continuing to build out capabilities with fulfillment centers and even a fleet of planes.

This has proven the right move.

Meli now has the best infrastructure in the region and can over fast, free delivery.

They're continuing to build out capabilities with fulfillment centers and even a fleet of planes.

11/

When you look at Meli today, it's essentially 6 core businesses.

Each of them is meaningful.

- Libre (e-commerce)

- Shops (Shopify-style platform)

- Envios (logistics)

- Pago (payments)

- Credito (credit)

- Publicidad (ads)

When you look at Meli today, it's essentially 6 core businesses.

Each of them is meaningful.

- Libre (e-commerce)

- Shops (Shopify-style platform)

- Envios (logistics)

- Pago (payments)

- Credito (credit)

- Publicidad (ads)

12/

Even if they added no new products, Meli would be in a great spot.

Why?

Because Latam's internet economy is growing *so* fast.

Even if they added no new products, Meli would be in a great spot.

Why?

Because Latam's internet economy is growing *so* fast.

13/

It's not in Meli's DNA to sit still, though.

And when you look at the company's products, you can't help but think of all the directions they could go...

It's not in Meli's DNA to sit still, though.

And when you look at the company's products, you can't help but think of all the directions they could go...

14/

The Libre division could become the go-to for...

- Home rental/buying (Zillow)

- Car rental/buying (Carvana)

- SMB e-commerce infrastructure (Shopify)

- Grocery (Instacart)

- Pharmacy (Ro)

The Libre division could become the go-to for...

- Home rental/buying (Zillow)

- Car rental/buying (Carvana)

- SMB e-commerce infrastructure (Shopify)

- Grocery (Instacart)

- Pharmacy (Ro)

15/

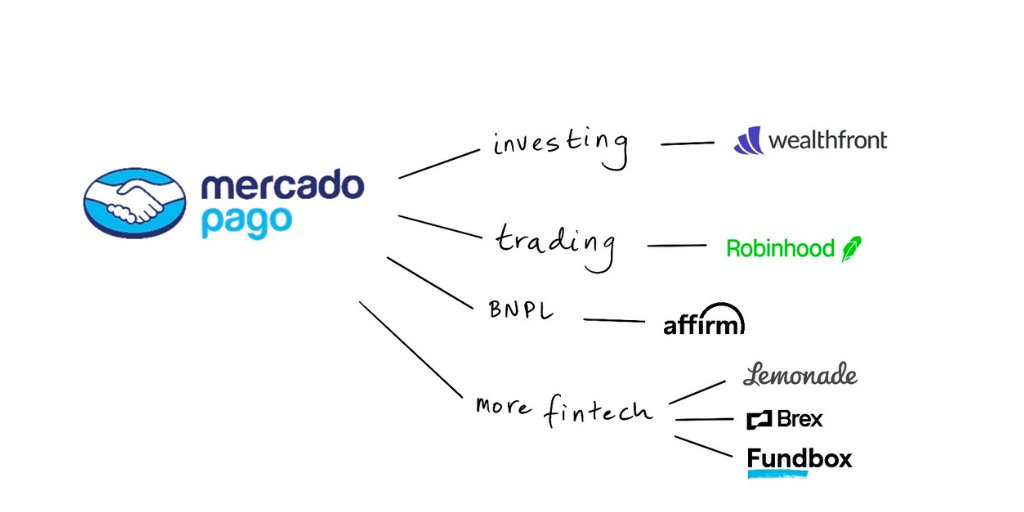

The Pago division could fork into...

- Investing (Wealthfront)

- Trading (Robinhood)

- BNPL (Affirm)

- Insurance (Lemonade)

- SMB banking (Brex)

- Invoice financing (Fundbox)

The Pago division could fork into...

- Investing (Wealthfront)

- Trading (Robinhood)

- BNPL (Affirm)

- Insurance (Lemonade)

- SMB banking (Brex)

- Invoice financing (Fundbox)

16/

What's so absurd about Meli is that you can play this game almost infinitely, taking one product and imagining how it (viably) could spin out into 10 others.

What's so absurd about Meli is that you can play this game almost infinitely, taking one product and imagining how it (viably) could spin out into 10 others.

17/

There's a ton more in the piece, particularly on Meli's amazing management, and competition from companies like Shopee.

Join +34,000 by signing up, and become a member for lots more like this!

readthegeneralist.com/briefing/meli

There's a ton more in the piece, particularly on Meli's amazing management, and competition from companies like Shopee.

Join +34,000 by signing up, and become a member for lots more like this!

readthegeneralist.com/briefing/meli

People on Twitter and beyond were so generous in providing advice and guidance on Meli.

Much gratitude to amazing people like @celocelo1, @Jeffreyw5000, @itsitz_, @iiiitsandrea, @WannaBeVix, and many others.

🙏

Much gratitude to amazing people like @celocelo1, @Jeffreyw5000, @itsitz_, @iiiitsandrea, @WannaBeVix, and many others.

🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh