It's a new week and a pleasant rainy morning here in Mumbai!

Grab some tea/ coffee as we share some snippets and readings from the week gone by that we found interesting.

#MultipieWeekly

1/n

Grab some tea/ coffee as we share some snippets and readings from the week gone by that we found interesting.

#MultipieWeekly

1/n

1. Interesting slide from CRISIL that depicts the trend of raw material cost inflation across industries and their ability to pass on the cost to end user (pricing power).

2/n

2/n

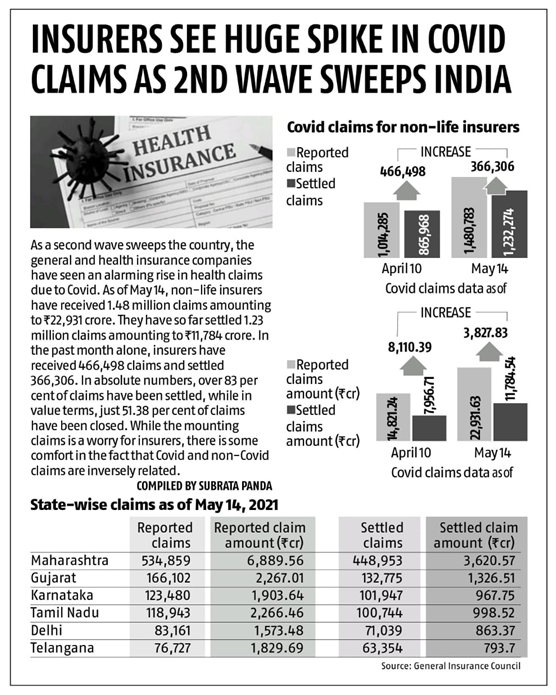

2. General and health insurance companies are seeing a major spike in Insurance claims as a result of larger than anticipated second wave.

Source: Business Standard

3/n

Source: Business Standard

3/n

3. Copper is being hailed as the new Oil as the world prepares to shift to a greener economy. We found this explainer helpful on this huge global trend.

Bonus: List of Top 18 copper companies in India (alphabetically) - not an investment advice.

4/n

Bonus: List of Top 18 copper companies in India (alphabetically) - not an investment advice.

4/n

4. Truck rentals have fallen another 5-7% in first half of May, indicating cues of a fresh slowdown to the ailing economy. However, not all is gloomy as power consumption grew 19% in the same period!

5/n

5/n

5. Interesting viewpoint on Cryptocurrency in a recent note by Sundaram MF. They seem less critical of Bitcoin's prospects as "Digital gold" compared to government machinery.

6/n

6/n

6. Latest data on brokerages by Spark Capital that captures market share trends (cumulative and incremental) across discount brokerages, bank based brokerages and traditional brokers.

7/n

7/n

7. AMC industry:

Favorable commentary on the outlook of Asset Management business by UTI AMC management at Centrum Capital's Small and Midcap conference.

8/n

Favorable commentary on the outlook of Asset Management business by UTI AMC management at Centrum Capital's Small and Midcap conference.

8/n

8. Company specific:

Optimistic outlook on #AegisLogistics by Edelweiss, expecting 32% PAT CAGR over next 3 years.

9/n

Optimistic outlook on #AegisLogistics by Edelweiss, expecting 32% PAT CAGR over next 3 years.

9/n

9. Select smallcap result highlights:

👗AYM Syntex

🐑DCM Nouvelle

🌱Jayant Agro-Organics

🕵️Quick Heal Technologies

Note: Not investment advice

10/n

👗AYM Syntex

🐑DCM Nouvelle

🌱Jayant Agro-Organics

🕵️Quick Heal Technologies

Note: Not investment advice

10/n

10. Some good reading/ talk links:

A. Q&A session from Stan Druckenmiller on current state of markets, finding more short opportunities, SPACs and what’s wrong with them, cryptocurrency, etc.

vimeo.com/548917378

A. Q&A session from Stan Druckenmiller on current state of markets, finding more short opportunities, SPACs and what’s wrong with them, cryptocurrency, etc.

vimeo.com/548917378

11. Conversation with Manish Chokhani (ENAM), moderated by Navneet Munot (HDFC AMC). This talk is strewn with learning nuggets. Recommended!

12/n

12/n

That's it for now folks.

If you are looking for more reading links, Please check #MultipieWeekly from last week:

If you are looking for more reading links, Please check #MultipieWeekly from last week:

https://twitter.com/MultipieSocial/status/1391592538205691910?s=20

@threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh