My presentation at the @NDTAHQ Surface Force Projection Conference questioned the need for national merchant marines by examining China and Russia's use of their own to exert hegemony from the past to the present.

The Maritime Silk Road of China's #BeltandRoad Initiative aims to defend their vital trade routes - particularly between Asia & Europe/Africa - and ensure an adequate supply of raw materials and imports to sustain their economy and country.

The historical antecedent may have been the voyages of Zheng He. When the Ming Dynasty assumed power they aimed to ensure the restoration of China as the Middle Kingdom. Their fleet demonstrated the power of China and then was scrapped as trade flowed.

The early 19th century witnessed China's attempt to control its trade & its defeat at the hands of the British and the East India Company. China was forced to concede a 99 year lease of Hong Kong - something that China is doing today along Maritime Silk Road.

Russia, a continental power, in the early 20th century confronted a new world power that was ridiculed as being inferior. When Russia was denied use of the Suez, its fleet sailed around Africa and was destroyed at Tsushima.

Did the closing of a chokepoint impact its fate?

Did the closing of a chokepoint impact its fate?

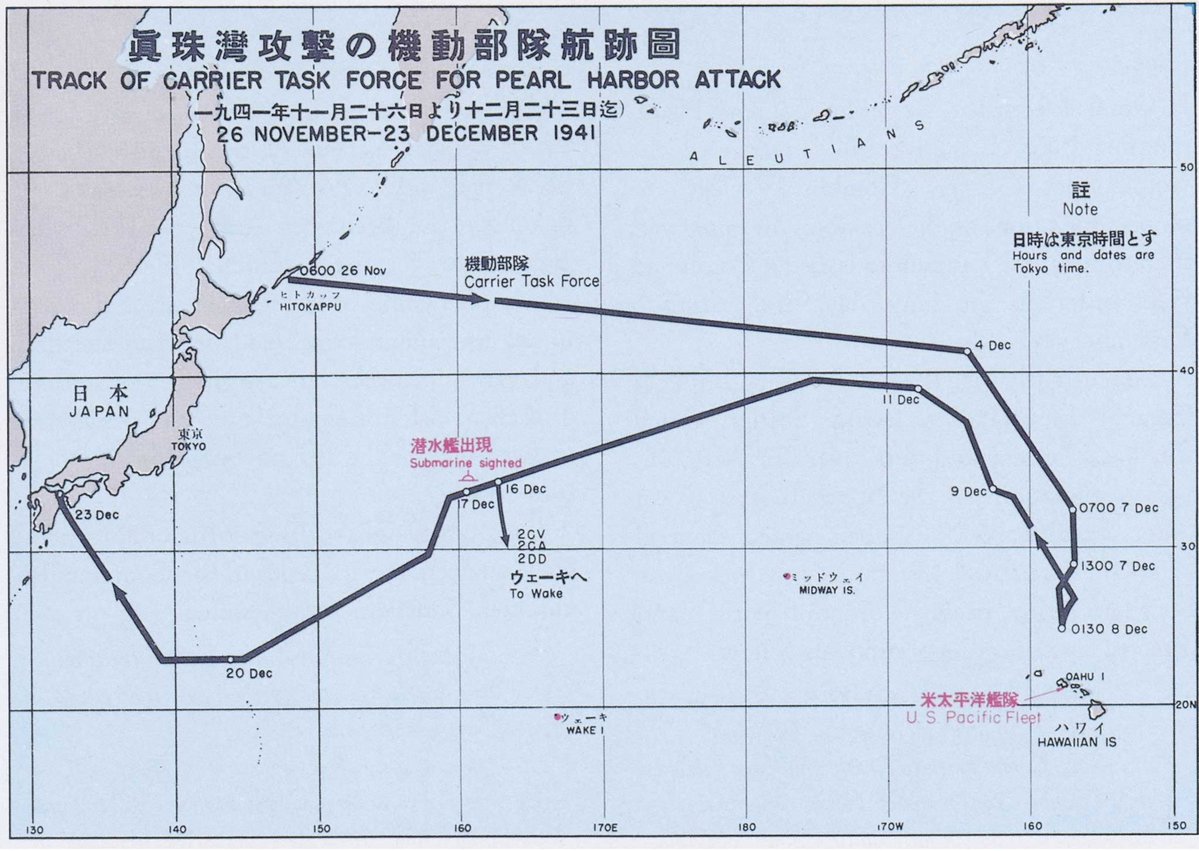

By the mid-20th century, the Sino-Japanese War saw China being systematically cut off from the outside world by Japan. The US embargo to Japan resulted in war, and this 1937 map discusses a blockade of Japan - a strategy that was emulated in Operation Strangulation.

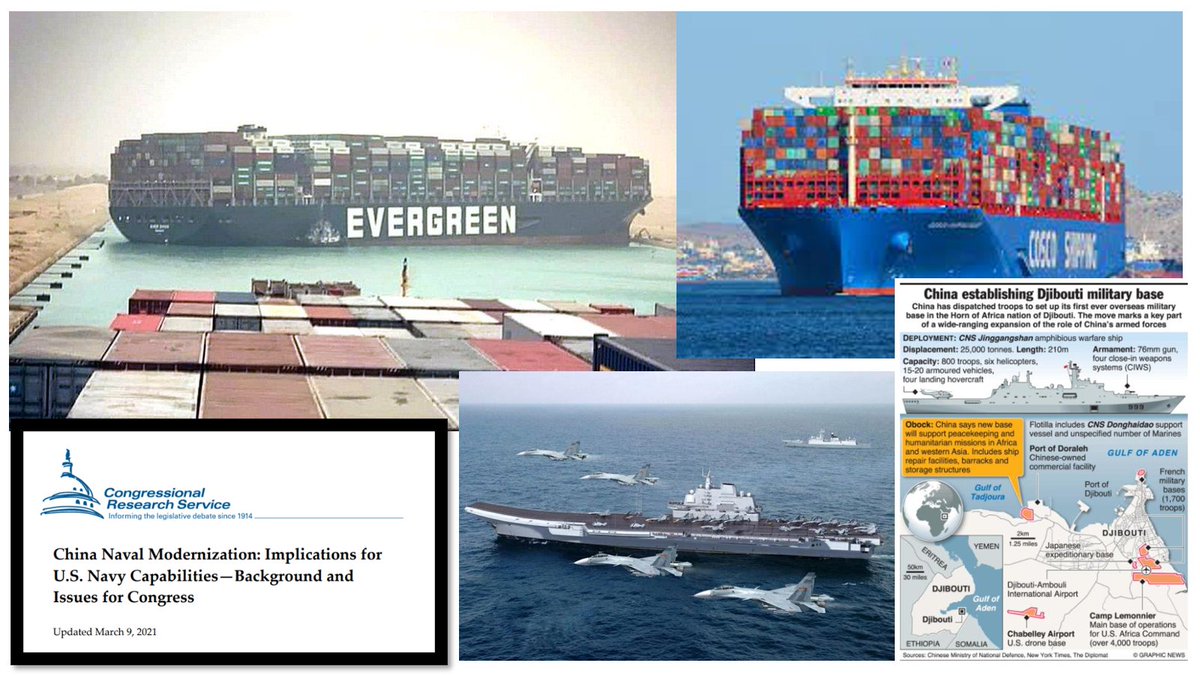

China's COSCO fleet is the largest shipping line in the world, with a well-balanced cargo carrying capacity. Their domestic shipbuilding infrastructure supports the PLAN.

Russia's SOVCOMFLOT is foreign built & specialized in energy from the Arctic, but Russia's navy is lacking.

Russia's SOVCOMFLOT is foreign built & specialized in energy from the Arctic, but Russia's navy is lacking.

What if instead of #EverGiven going ashore in Suez, it was COSCO Galaxy in front of her?

Would Egypt be holding her?

How would China react?

The base at Djibouti is strategically placed for such a response. Would this deter Egypt?

Is PLAN geared for peer-to-peer or trade defense?

Would Egypt be holding her?

How would China react?

The base at Djibouti is strategically placed for such a response. Would this deter Egypt?

Is PLAN geared for peer-to-peer or trade defense?

The Belt & Road has a maritime strategy associated with it. It is expanding into the South Pacific, Arctic, west Africa, and South America. Should one route close, there are alternatives.

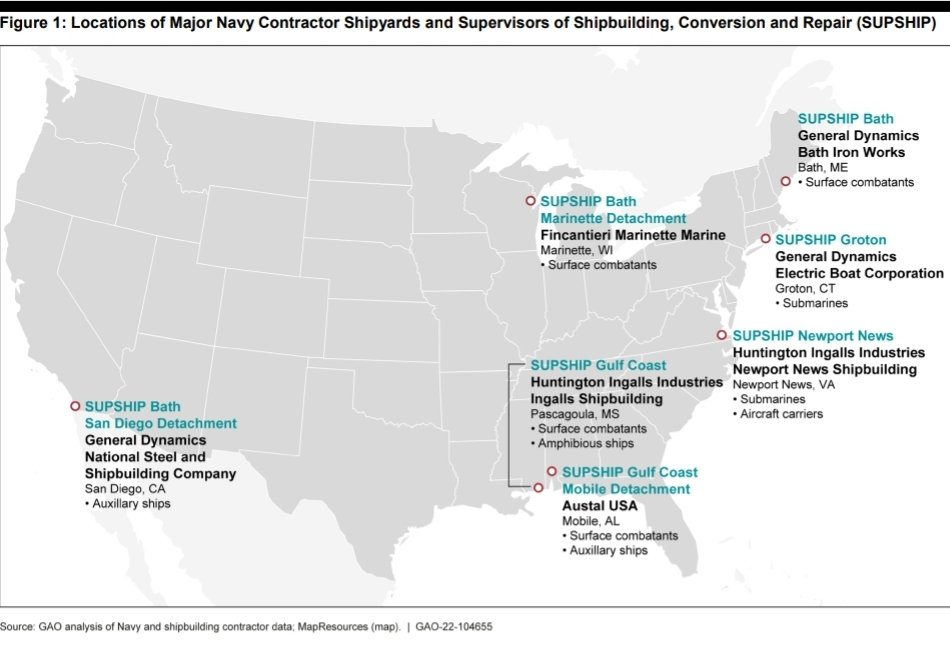

The US had a strategy in 1920, but it has waned.

Who is the better Sea Power today?

The US had a strategy in 1920, but it has waned.

Who is the better Sea Power today?

• • •

Missing some Tweet in this thread? You can try to

force a refresh