The long awaited cash return on operating asset tweetstorm: $TSLA and $TSLAQ, anyone interested in investing and evaluating the FUNDAMENTAL RIGHT TO MAKE MONEY™ of a business should read this - our research on Tesla’s profitability is in the thread as well👇👇👇👇👇0 / 11

1 - What makes a right to make money™ ? Your ability to 1) invest some money into an operating asset 2) burn some cash to operate the asset and 3) generate cash from selling the resulting product or service, in excess of cash spent on running operations.

2 - A right to make money™ is more than a competitive advantage. It is a competitive advantage at producing something, which meets a need. which is valued at more than your cost of producing it. This is profound - as @elonmusk would say.

3 - The best way to measure a right to make money™? Cash return on operating asset (CRoOA), i.e. (3-2)/1. In other words: how many cents of cash per year can you generate, out of a dollar you invest in your operations? As simple as that.

4 - Let’s now apply this to $TSLA. See chart below. CRoOA broke-even at some point in 2018 with the ramp of model 3 then went straight up to 20% in 2020.Please note: this excludes credits, we don’t care about credits, and this is 100% cash metrics, no possible accounting cheats.

5 - Key question is - how does that evolve over time. Two ways to look at it: Full utilisation - What would Tesla generate with existing assets used at full capacity, and Incremental basis, i.e. additional returns generated on incremental capital deployed in the last year.

5.1 - Full asset utilisation view: Tesla has on the ground enough assets to produce 1.05m units. If we scale out to that number current economics, i.e. with today’s cash cost per car, and ramping working capital to that scale, Tesla would generate 37% CRoOA. Pretty good!

5.2 - Incremental return view - what incremental returns on incremental assets deployed in 2020? That is 90% - even better! As Tesla grows, returns will increase rapidly. Tesla is Filling in fabs faster than growing overall capacity.

7 - this is the basis for our profitability forecast. We assume cash profitability is stable (car selling price minus cash costs going into the car), as Tesla passes on into pricing all efficiency gains, but as assets get better utilised, profitability ands returns increase. 👇

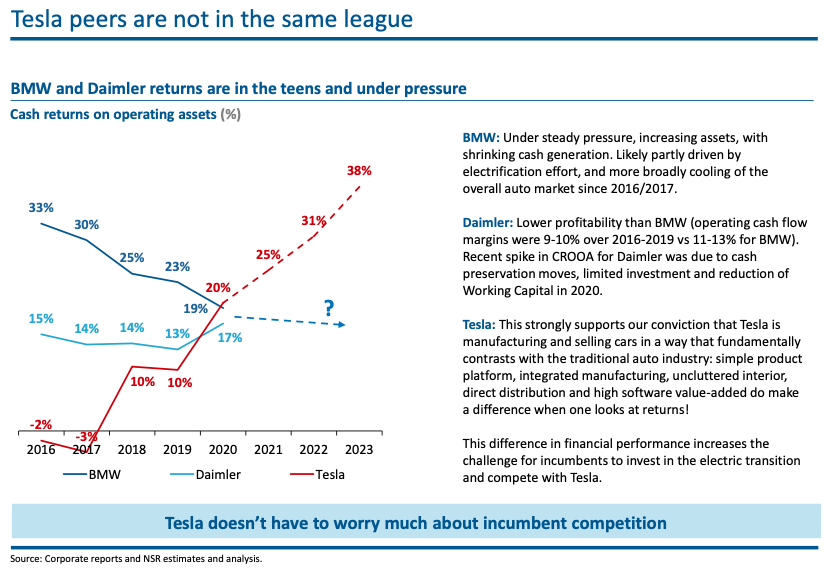

8 - How does this compare to peer premium car manufacturers? Tesla is definitely in another league. While BMW and Daimler struggle to produce cars that don’t differentiate and get less wanted, their returns are under pressure, in teens.

9 - This actually puts Tesla in the league of players with unique fabs, producing things nobody else can produce… like TSMC. Check it out by yourself 👇Our #1 conviction on TSMC is their ability to maintain a 40% CRoOA no matter what.

10 - One last perspective: Why is Tesla so much more profitable than a BMW or a Daimler? Every step of the operating model contributes. Check for yourself: 👇

11 - This concludes our thread. CRoOA is one of the pillar of the investment research we do. It is an excellent metric to understand how good fundamentals translate into strong financial performance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh