ADAC BEV SUMMARY 20210521

Our BEV study using ADAC data for Germany has looked at a range of different vehicles with different levels of Power

And it has included some ICEV vehicles chosen by ADAC for comparison to the Tesla Model 3

Our BEV study using ADAC data for Germany has looked at a range of different vehicles with different levels of Power

And it has included some ICEV vehicles chosen by ADAC for comparison to the Tesla Model 3

It shows that BEVs are now available in Germany at lower price points than ICEVs with the same Power rating

Tesla Model 3 has the lowest Price at its respective Power points

The most popular BEVs are relatively low-powered compared to the Tesla Model 3 variants SR+, LR and P

Tesla Model 3 has the lowest Price at its respective Power points

The most popular BEVs are relatively low-powered compared to the Tesla Model 3 variants SR+, LR and P

And ADAC has typically estimated the 5-year Depreciation of the BEV study vehicles to be in the range of 50-60%

This is noticeably less Depreciation than ADAC estimates for the comparable ICEVs that we studied, which were typically expected to suffer around 70% Depreciation over a 5-year ownership period with 15,000 km per year

So ADAC expects BEVs to HOLD THEIR VALUE BETTER THAN ICEVs

So ADAC expects BEVs to HOLD THEIR VALUE BETTER THAN ICEVs

Fixed Costs are basically Insurance and Taxes

And these monthly costs tended to trend upwards with the higher-powered vehicles

- although there were curious anomalies

And these monthly costs tended to trend upwards with the higher-powered vehicles

- although there were curious anomalies

The Cost of Ownership per Kilometre does not increase dramatically with Motor Power

And as BEV manufacturers improve their drivetrains we may see customer demand for higher Power without significant increases in Price

BEVs clearly have the potential for higher Power than ICEVs

And as BEV manufacturers improve their drivetrains we may see customer demand for higher Power without significant increases in Price

BEVs clearly have the potential for higher Power than ICEVs

Power Consumption per 100 km relative to rated Motor Power varied widely

- with the Tesla Model 3 setting the efficient frontier across each of its variants

This suggest that Competitors still have some way to go in terms of drivetrain developement and efficient vehicle design

- with the Tesla Model 3 setting the efficient frontier across each of its variants

This suggest that Competitors still have some way to go in terms of drivetrain developement and efficient vehicle design

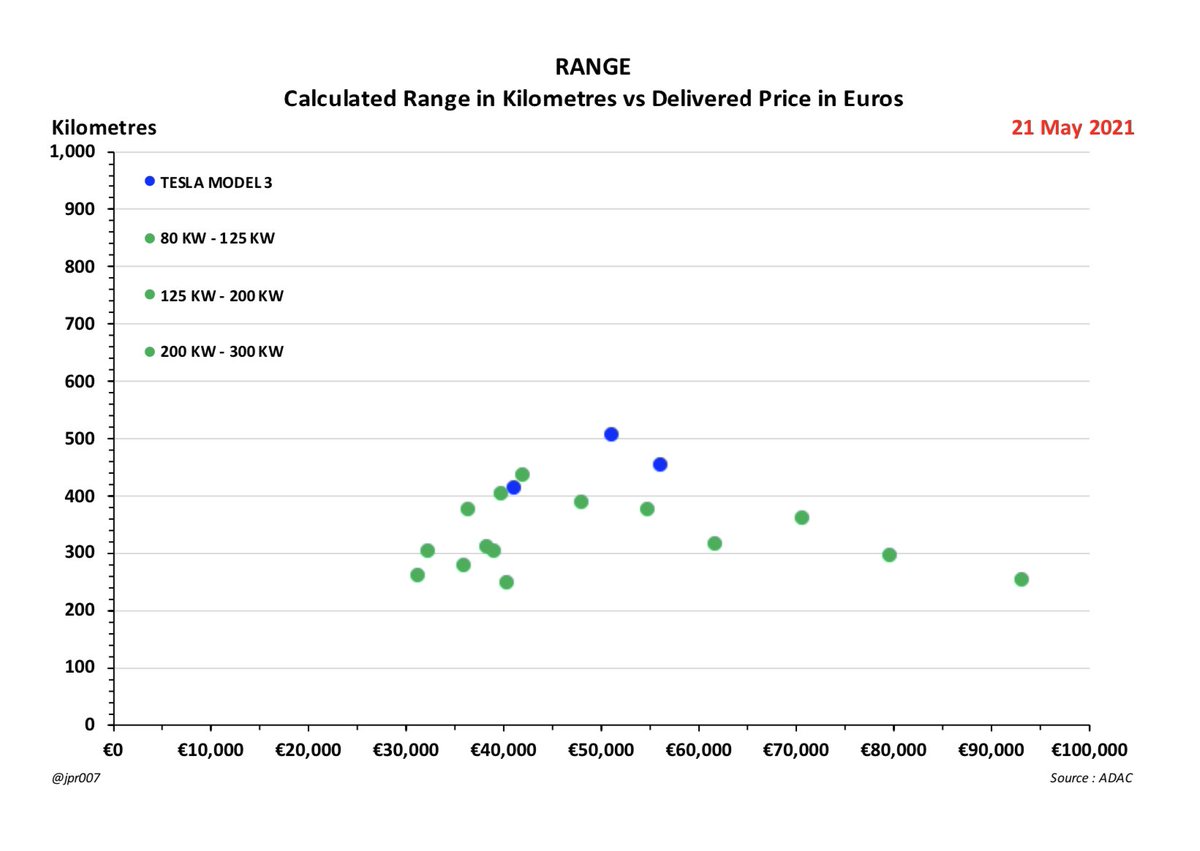

The biggest effect of this shows up in the kilometre Range of the sample vehicles

- which we show here calculated from the Battery Size divided by the reported Power Consumption

- which we show here calculated from the Battery Size divided by the reported Power Consumption

The Tesla Model 3 has the highest Acceleration at each of its Price points

- and spending more money on other BEVs does not get you more performance with the reference base models shown here

But BEVs are outperforming ICEVs at comparable price points

- and spending more money on other BEVs does not get you more performance with the reference base models shown here

But BEVs are outperforming ICEVs at comparable price points

For this last chart, we have used Price / Power to define the horizontal axis

And we are showing performance in the form of Acceleration as the vertical axis

We have also included the Tesla Model S, Model X and Model Y

The message is clear :

TESLA IS SELLING PERFORMANCE

And we are showing performance in the form of Acceleration as the vertical axis

We have also included the Tesla Model S, Model X and Model Y

The message is clear :

TESLA IS SELLING PERFORMANCE

• • •

Missing some Tweet in this thread? You can try to

force a refresh