Family-run listed companies with diverse promoter businesses sometimes decide to take minority shareholders for a ride. Here's a live example.

A thread 👇 (1/n)

A thread 👇 (1/n)

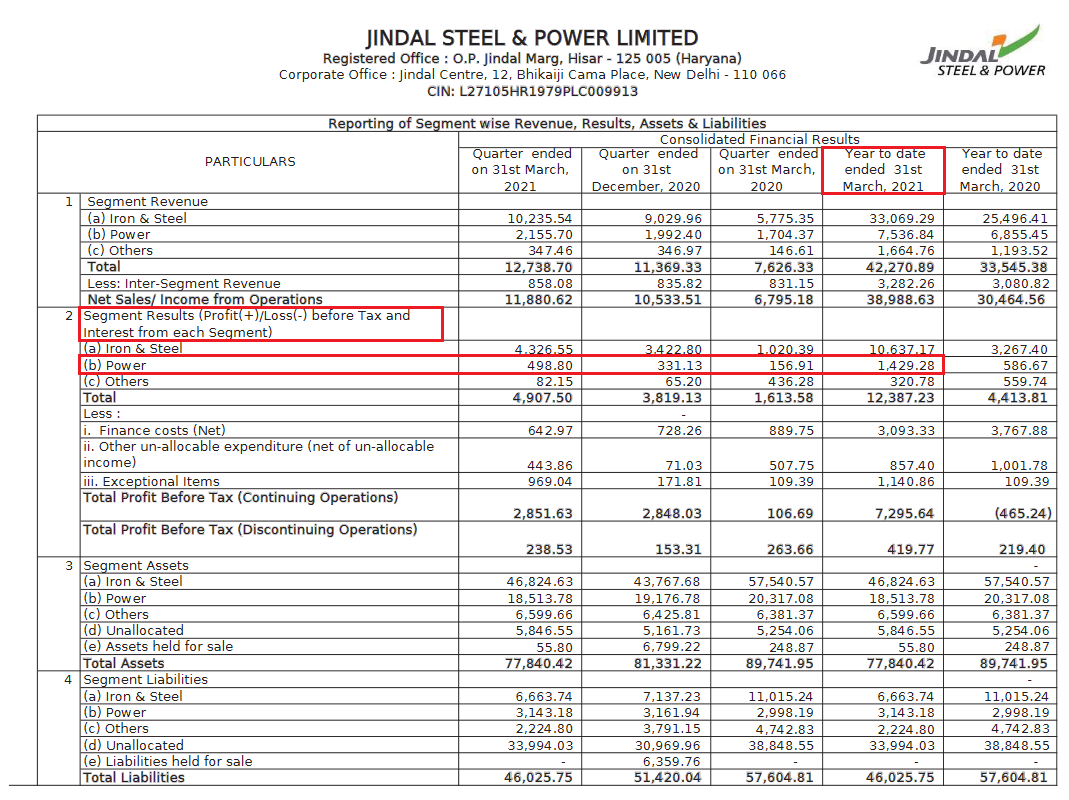

Jindal Steel and Power Limited (JSPL) has a subsidiary, Jindal Power Limited (JPL), with 3400 MW of power generation assets. These assets cost JSPL INR 4.4 crore per MW, totaling approximately INR 14,950 crore in capital expenditure. (2/n)

JPL generated INR 960 crore cash profit in FY19-20, and is on track to achieve approx. INR 2000 crore of profit before tax and interest on an annualized basis. By all means, this is a mature business generating excellent cash flows for JSPL. 96% of JPL is held by JSPL. (3/n)

JPL seems to have enough cash flow to be making substantial advances to JSPL, to the tune of almost INR 4500 crore. Further, JSPL seems to have also given loans to JPL of a similar amount. Whatever the reasons for the two-way flow, JPL clearly generates a lot of cash. (4/n)

JSPL management, as recently as March 2020, was confident of even better performance at JPL. Electricity demand has hit record levels in 2021, matched by a commensurate improvement in JPL financials as of March 2021. If electricity can be called a commodity, it is booming. (5/n)

Towards the end of April 2021, JSPL held a board meeting and decided to divest its entire 96.42% shareholding in JPL to its own promoter entity, Worldone, for cash consideration of INR 3015 crore. Further, 4400 crore advance by JPL to JSPL were to be turned into loans. (6/n)

The promoter entity was 'selected' in an 'elaborate' process and was the highest bidder at 'acceptable terms'. What bids were received? What was the process? What was the valuation metrics? Why was the INR 4400 crore advance not appropriated or returned prior to bidding? (7/n)

Coal power plants have a generally accepted valuation of INR 5-6 crore per MW. Even distress sales (which this is not) take place at INR 3-4 crore per MW. Recent deals in the public space clearly evidence this. What kind of benchmark was taken for this related party sale? (8/n)

For assets generating almost INR 2000 crore on annualized basis, how is a valuation of only INR 3015 crore justified? Further, JSPL is itself undergoing capacity expansion for which it will need to raise debt. The net debt reduction for JSPL would be only INR 2000 crore. (9/n)

JPL has debt of approx. INR 6500 crore, why can't JPL service these loans out of its annualized INR 2000 crore of profit before interest and tax? 6500 crore of debt would cost INR 780 crore in interest even at 12%. The entity is self sustaining, why lend INR 4400 crore? (10/n)

Why not square off the loans and advances b/w JSPL and JPL and value JPL cleanly? Currently, 15000 crore EV assets are being sold for 3000 crore cash and loans made out of money that belonged to JSPL shareholders in the first place (by virtue of 96% ownership) (11/n).

This move has definitely ruffled some feathers among possibly institutional investors in JSPL, because the EGM to be held on 24 May 2021 was hastily postponed on 20 May 2021. Behind the bravado and platitudes, clearly there is a lot of scrambling going on. (12/n)

Management owes a lot of explanation to minority shareholders, and should be engaging all shareholders instead of just "concerned parties". It needs approval of only the FII and DII shareholders (27.5% of share capital), but retail should also demand full information. (13/n)

Over and out. (14/n)

P.S. Not invested, this is just commentary and not a recommendation to buy, sell or take any action whatsoever. (15/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh