DIY investor, lawyer - writing on corporate governance - and reading between the lines.

12 subscribers

How to get URL link on X (Twitter) App

If state wishes to promote domestic manufacturing, it can put tariff controls like it does for solar modules. If it wishes to promote better quality, it puts standards and BIS enforces them. BIS does not 'promote domestic manufacturing'; its function is quite different.

If state wishes to promote domestic manufacturing, it can put tariff controls like it does for solar modules. If it wishes to promote better quality, it puts standards and BIS enforces them. BIS does not 'promote domestic manufacturing'; its function is quite different.

https://twitter.com/jasonxparker/status/1841748306591903920Had one job, (a) don't leave a trail and (b) don't cheat your accomplices. Wasn't that difficult to get away with. Have to be operating with zero fear of consequences to be this careless. Darwin award candidate. Video of interactions with employee here: archive.org/details/553521

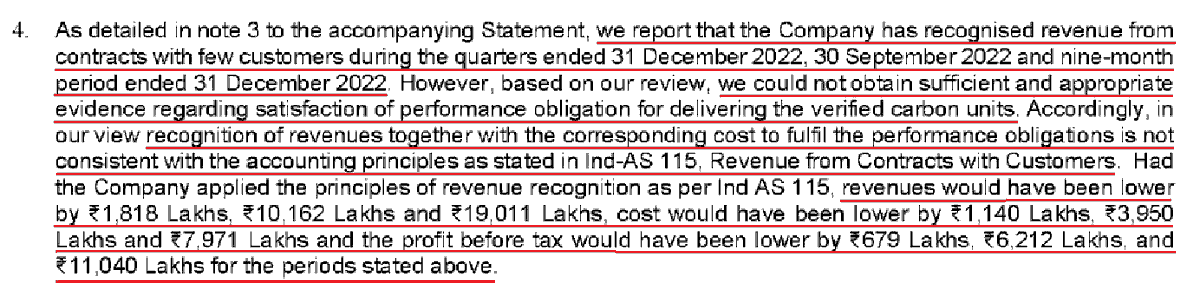

Management has recognised revenue, AGAINST opinion of auditor, in absence of fulfillment of contractual performance obligations!

Management has recognised revenue, AGAINST opinion of auditor, in absence of fulfillment of contractual performance obligations!

Promoters justify 12% stake sale in AGL for investment into a related entity Adicon Ceramica LLP, where they state they have no holding. Weak argument, because business is intertwined and a designated partner of the LLP is a director in all material subsidiaries of AGL. (2/7)

Promoters justify 12% stake sale in AGL for investment into a related entity Adicon Ceramica LLP, where they state they have no holding. Weak argument, because business is intertwined and a designated partner of the LLP is a director in all material subsidiaries of AGL. (2/7)

https://twitter.com/leading_nowhere/status/1428722374728306692?s=20(1/26) Why NCL with 100 Cr market cap? There are many small manufacturers like NCL. Without economies of scale, smaller players suffer from high fixed costs, obsolete machinery and lower operating efficiencies, which generally depresses margins and constrains future growth.(2/26)