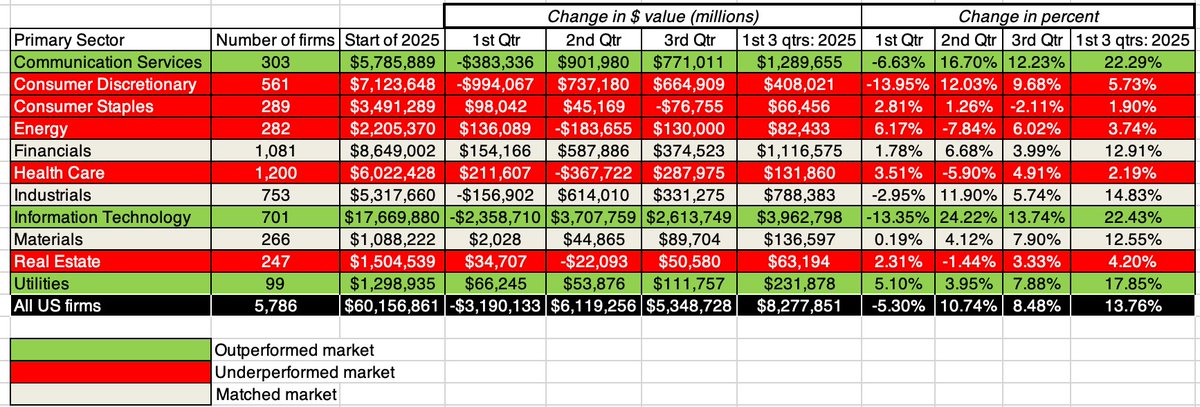

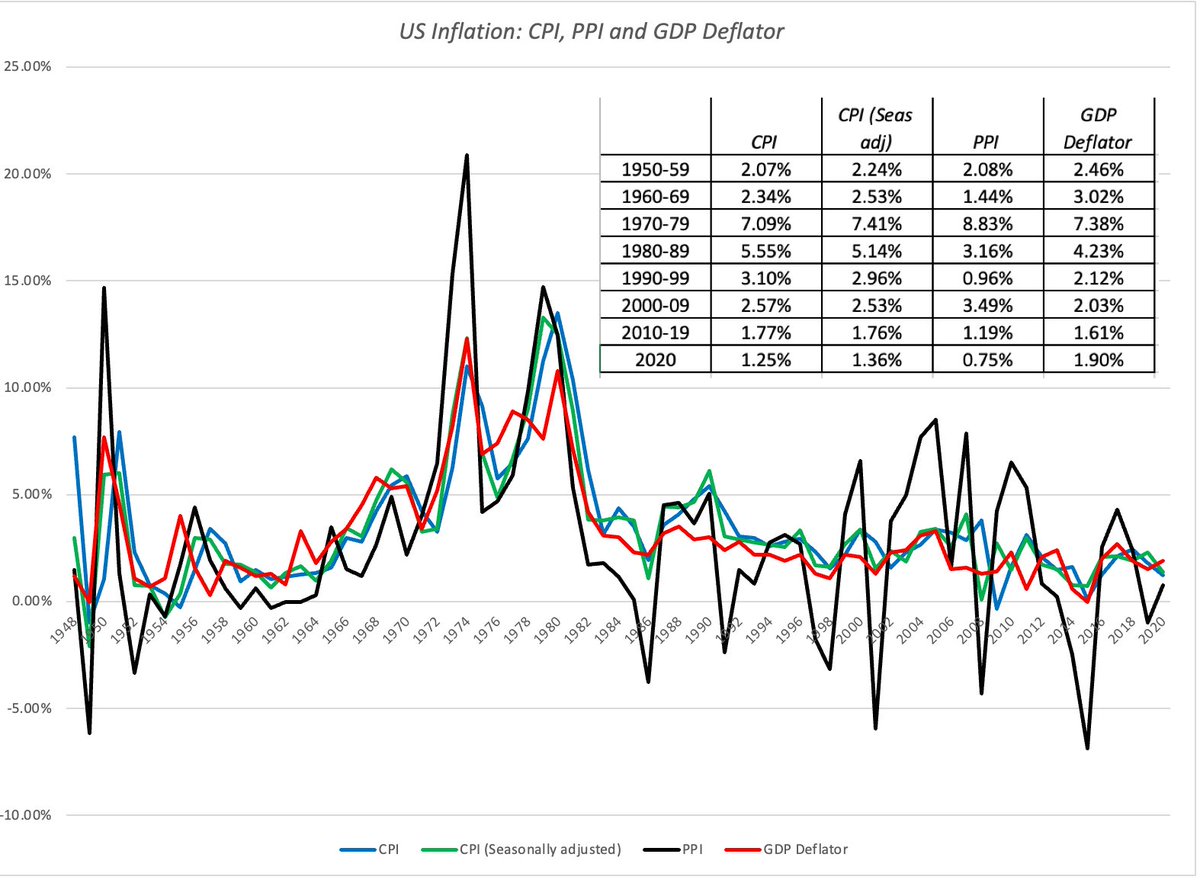

While US stocks have done well, so far, in 2021, the market is caught between two forces, a stronger than expected economy as a positive and worries about inflation as a negative. After a decade of benign inflation, are we ill-prepared for the latter? bit.ly/2RLARxQ

Expectations that inflation will rise are becoming more broad based, as can be seen in both a bond market based measure (T.Bond - TIPs) and consumer surveys. bit.ly/2RLARxQ

Inflation is currency specific, & differences explain why interest rates vary across currencies and exchange rates. Here are expected inflation rates for 2021-26, by country, from the IMF. Given the noise in measuring inflation, take with a grain of salt! bit.ly/2RLARxQ

Higher-than-expected inflation inflicts direct damage on bonds, as rates rise. Their effect of stocks is more complex, with discount rates and cash flows rising, but the net effect, at least in the aggregate, is more likely to be negative than positive. bit.ly/2RLARxQ

The effects of higher-than-expected inflation on nominal & real returns on stocks and bonds can be seen in historical returns over time. Take a look at annual returns in the 1970s (highest inflation) and 2010-19 (lowest inflation): bit.ly/2RLARxQ

Gold and real estate are posited to be inflation-protected, and the evidence is stronger for gold than for real estate, when you look at historical returns. As for cryptos, bitcoin is not behaving like millennial gold yet, but the jury is still out. bit.ly/2RLARxQ

For those who are nostalgic for an era when low PE and PBV stocks delivered superior returns, the silver lining in a high-inflation scenario may be a tilt back, albeit a small one, to old-time value stocks. bit.ly/2RLARxQ

Inflation is here & no one knows whether it is transitory or permanent. If permanent, we could be reverting to more normal inflation, but there is a non-trivial chance that it could be higher. The Fed's happy talk may get in the way of a robust response. bit.ly/2RLARxQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh