@solana is becoming the AWS of crypto

A recent tweet by @garrytan about his frustration using Binance to buy Solana piqued my interest in it

I read and condensed the white paper, so you don't have to

here's an overview on Solana for the avg non technical reader

a 🧵

A recent tweet by @garrytan about his frustration using Binance to buy Solana piqued my interest in it

I read and condensed the white paper, so you don't have to

here's an overview on Solana for the avg non technical reader

a 🧵

Solana was started over 3.5 years ago

by ex-Qualcomm and Dropbox engineer Anatoly Yakovenko

Solana is trying to build the infrastructure to power the next generation of crypto and DeFi apps

by ex-Qualcomm and Dropbox engineer Anatoly Yakovenko

Solana is trying to build the infrastructure to power the next generation of crypto and DeFi apps

Why it's needed:

Blockchains today don't have the scale to power applications of every type

for comparison

AWS can handle 250,000 requests/sec

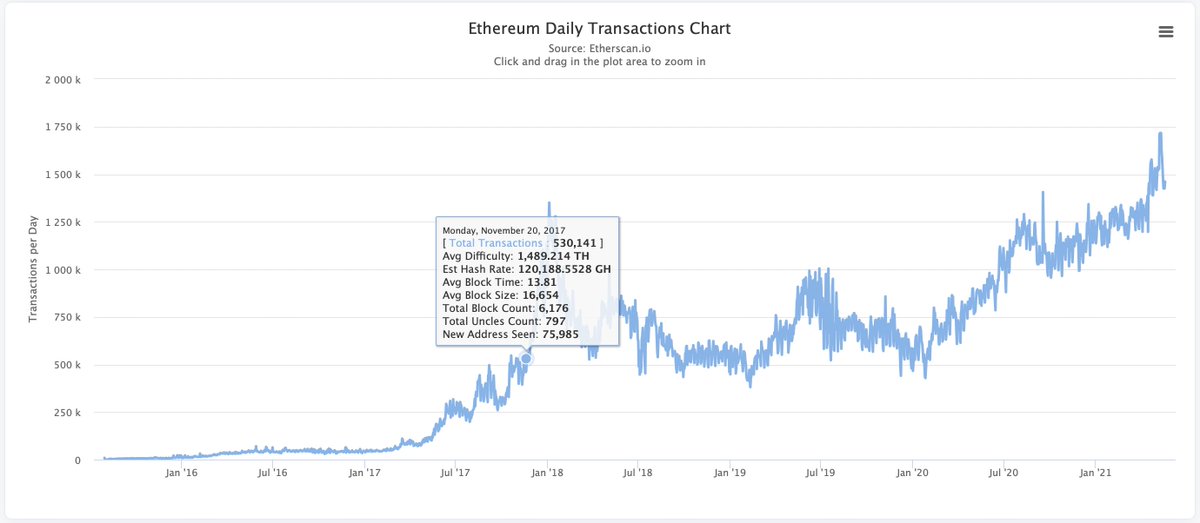

ETH today can do 30/second

(2.0 goes up to 10k/sec)

As on date Solana can do 50k/second and will increase with time

Blockchains today don't have the scale to power applications of every type

for comparison

AWS can handle 250,000 requests/sec

ETH today can do 30/second

(2.0 goes up to 10k/sec)

As on date Solana can do 50k/second and will increase with time

1. No mempool:

Unlike most blockchains, Solana doesn't have a mempool

a mempool is like a waiting room for pending transactions

Thats how fast they claim their system is

Unlike most blockchains, Solana doesn't have a mempool

a mempool is like a waiting room for pending transactions

Thats how fast they claim their system is

2. Proof of History:

Solana combines consensus algos(PoS) with time data.

Nodes on a blockchains today don't record time.

This causes issues when nodes far from each other have conflicting transactions

Currently the node with the most computing power wins

PoH changes this

Solana combines consensus algos(PoS) with time data.

Nodes on a blockchains today don't record time.

This causes issues when nodes far from each other have conflicting transactions

Currently the node with the most computing power wins

PoH changes this

Consequence:

- PoH allows for faster transactions, as the PoS is optimised for faster consensus based on the PoH timestamps

- Adds an extra layer of security(uses Sha 256)

- Very low overhead(160kb of data)

- Many more that may be too technical for this thread

- PoH allows for faster transactions, as the PoS is optimised for faster consensus based on the PoH timestamps

- Adds an extra layer of security(uses Sha 256)

- Very low overhead(160kb of data)

- Many more that may be too technical for this thread

3. Horizontal scaling w/o Sharding

Unlike traditional DBs Solana uses a proprietary DB for files that solve the specific bottlenecks caused by blockchain data

This allows faster transaction with nodes on consumer hardware

TLDR : better optimised files for faster transactions

Unlike traditional DBs Solana uses a proprietary DB for files that solve the specific bottlenecks caused by blockchain data

This allows faster transaction with nodes on consumer hardware

TLDR : better optimised files for faster transactions

Consequence:

Parallel smart contract processing

Unlike the eth block which processes smart contract 1 at a time

Solana uses a combination of their file storage tech and ability to group overlapping actions(debit, credit)

This means Solana can process smart contracts parallely

Parallel smart contract processing

Unlike the eth block which processes smart contract 1 at a time

Solana uses a combination of their file storage tech and ability to group overlapping actions(debit, credit)

This means Solana can process smart contracts parallely

4. Fees remain low as you scale

As the ETH network has scaled, GAS fees have increased rapidly

Solana uses Moore's law to ensure that GAS fees remain low as you scale

But as true with any Moore's law related hypothesis, only time will tell

As the ETH network has scaled, GAS fees have increased rapidly

Solana uses Moore's law to ensure that GAS fees remain low as you scale

But as true with any Moore's law related hypothesis, only time will tell

5. Proof of replication

Solana uses an adaptation of PoR

Participants have to prove to the network that they have a unique copy of the blockchain data

This adds an extra layer of security

Solana uses an adaptation of PoR

Participants have to prove to the network that they have a unique copy of the blockchain data

This adds an extra layer of security

6. Write code on rust/c/c++

Unlike ETH, where users need to learn solidity to write smart contracts

Solana allows users to write code in their preferred language and gives Solana specific commands

This makes it easier to build on top of Solana

Unlike ETH, where users need to learn solidity to write smart contracts

Solana allows users to write code in their preferred language and gives Solana specific commands

This makes it easier to build on top of Solana

As a combination of these, @Solana has the potential to be the AWS or digital ocean of the next wave of crypto apps

Disclaimer: I'm not affiliated with them in any way, I am simply an enthusiast

Disclaimer: I'm not affiliated with them in any way, I am simply an enthusiast

If you liked this thread, follow me @srinathariharan on more such crypto breakdowns and much more!

• • •

Missing some Tweet in this thread? You can try to

force a refresh