I am hearing a lot of doubts whether EU and the West have any economic pressure over Belarus.

Here are some quick & obvious targets for trade sanctions. (thread)

Here are some quick & obvious targets for trade sanctions. (thread)

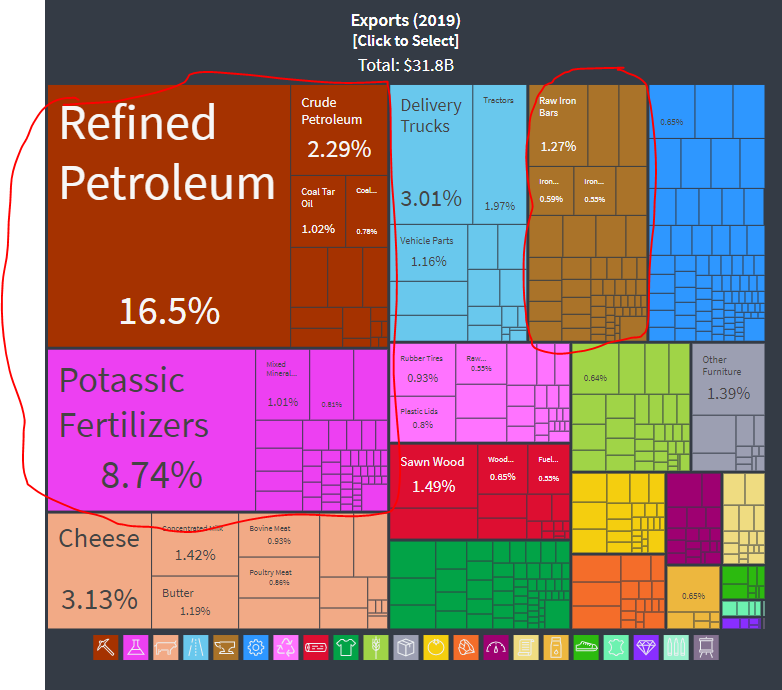

By hitting:

(1) oil & fuels

(2) iron, steel, metallurgy

(3) chemicals & fertilizers

the West would be hitting about a third of BLR trade. /2

(1) oil & fuels

(2) iron, steel, metallurgy

(3) chemicals & fertilizers

the West would be hitting about a third of BLR trade. /2

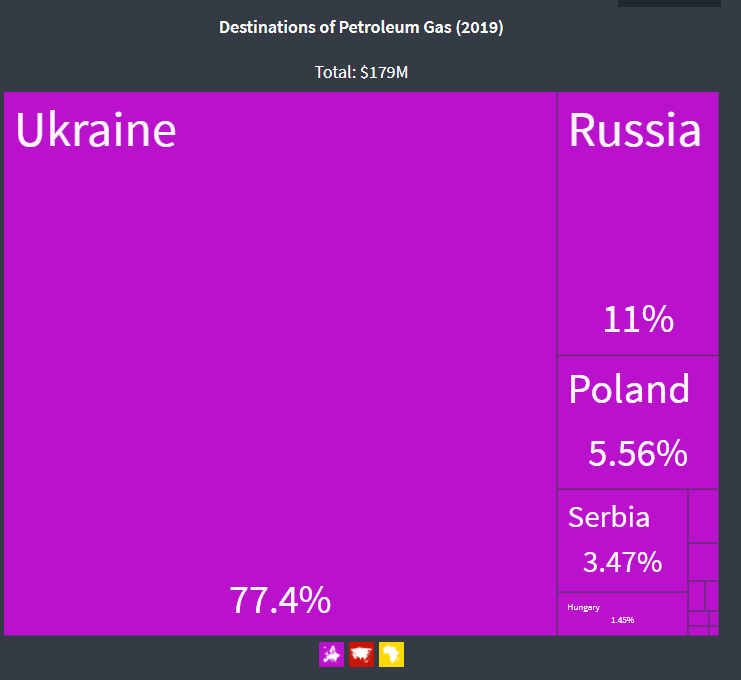

First, fuel, oil & minerals. Almost 7 bln USD in exports look sanctionable. Key player is Ukraine, which may not be able to join due to Kyiv's reliance on some energy-related imports from BLR. But below some examples. /3

Refined petroluem - Belarus' NUMBER 1 EXPORTS. Goes almost exlusively to the West _ Ukraine. Over 5 bln USD in exports. Even if Ukraine doesn't join, very painful to BLR. /4

Crude petroleum - over 700 mln USD in exports. All of them to Germany. /5

Second, big group - chemicals. Over 4 bln USD in potentially sanctionable exports. /9

Potassic fertilizers - BLR second biggest export - almost 3 bln USD in global exports, of which abt 20% goes to the West. /10

Compound fertilizers - almost all of the 320 mln USD in exports go to the West + Ukraine. Incidentally, Ukrainian producers would be happy to get rid of these imports as they just had a trade defence case against them. /11

Fertilizers are important, because none of them are going to Russia, which is a big competitor of the Belarus industry. So without Western markets, Belarusian exports have nowhere to go. /13

Finally, the third group: the steel & metals sector. Mostly state-owned. Some examples of top BLR global steel exports below, with West's share of imports marked. Over 1 bln USD is in sanctionable product groups (i.e., where West's share is significant). /15

Of course, this is rudimentary data. No ambition to be complete. In energy & fuel, Ukraine may not join for some categories. There may be other reasons why other groups are difficult. But overall, its clear the West has ability to deliver massive pain to BLR economy. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh