Britannia Industries undertakes an innovative corporate manoeuvre frequently – issuing bonus debentures. It securitizes part of its reserves as bonds, pays interest at 8% or so for a few years and then gives the securitized amount to shareholders as principal.

A thread 👇 (1/n)

A thread 👇 (1/n)

This is not an entirely new concept, in 2015, NTPC issued bonus debentures to all shareholders worth over INR 10,000 crore. These were issued at face value INR 12.50 and 8.49% interest (INR 1.06) per annum. (2/n)

What are bonus debentures, though? We have all heard of bonus shares. Companies often convert a part of their reserves into free shares for shareholders. This does nothing more than increase the float and a misplaced sense of increased wealth. (3/n)

Bonus debentures are another animal altogether. Their issuance creates a debt on the company to the creditors, who also happen to be shareholders. Cash outflow is created (interest) and there is an obligation to payout face value of the debenture at the end of defined term. (4/n)

Explained another way, the company creates a fixed deposit for shareholders from its equity reserves, pays interest on the fixed deposits, and after 3 years redeems the fixed deposits and gives the principal to the shareholders. All this, at no charge to your good self. (5/n)

So, unlike a bonus equity share that only holds the promise of capital appreciation (mostly), bonus debentures are real hard cash being paid out to shareholders over a defined period. Perhaps rightly, the Companies Act 2013 does not allow this kind of manoeuvre easily. (6/n)

Companies therefore initiate a Scheme of Arrangement - the shareholders agree to restructure the company by converting part of its reserves into debentures of defined face value, interest rate and tenure, which are issued to shareholders proportionally in the defined ratio. (7/n)

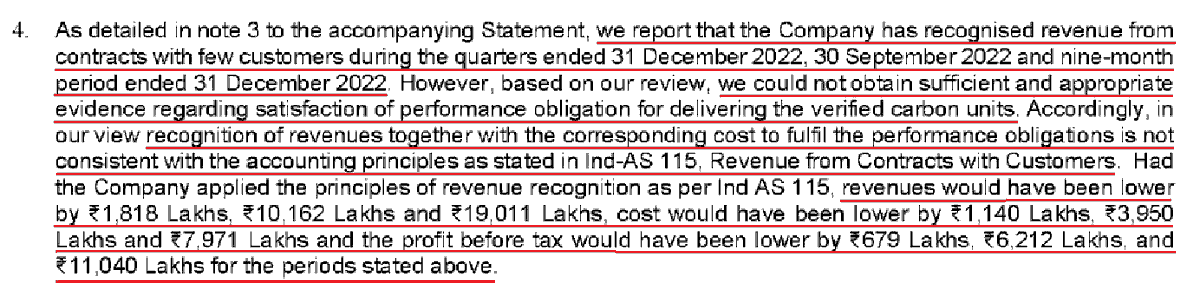

Schemes of arrangement require approval by National Company Law Tribunal and other stakeholders, which means at least 5-6 months to affect this kind of corporate action. Britannia’s bonus debenture issue was proposed in early October 2020. It has been approved in May 2021. (8/n)

Britannia has issued bonus debentures twice in the last 3 years, once in 2019 and once now in 2021. Both times it issued bonus debenture in 1:1 ratio, i.e. 1 free debenture for every equity share held. In 2019, the interest rate was 8%, it is yet to be determined for 2021. (9/n)

Britannia will return more than INR 1418 crore to shareholders over a 5-year period as principal. As interest, the 2019 debentures will pay INR 173 crore to shareholders over 3 years, whereas the 2021 ones will pay a similar amount. Close to INR 1750 crore in total. (10/n)

This is not a significantly large number; the company makes more profit after tax in a single year than this entire amount. Further, It has been issuing bonus debentures for over a decade and most of its interest payments over 10 years have been to shareholders. (111/n)

A benefit of issuing bonus debentures is that the interest payment is taxed only once with the recipient. If the same money were retained to be paid as dividend, it would incur corporate tax at the company level and then get taxed again in the hands of the recipient. (12/n)

This is great for the shareholders as it increases their post-tax returns, but how does it benefit the company? Interestingly, in both these bonus issues the company has allocated the debenture funds for capacity expansion, refinancing and other corporate purposes. (13/n)

By issuing free debentures against reserves, Britannia has turned its idle reserves into a temporary ‘bank’ from which it takes a loan and pay interest to the shareholders. After 3 years, the company pays out the ‘principal’ to the shareholders. (14/n)

Essentially, Britannia is recycling capital. If it chose to take external debt for the capacity expansion, it would be giving out cash to a third party. But with bonus debentures, it pays this interest to shareholders. And probably saves on other costs for debt financing. (15/n)

It is widely accepted that equity is more expensive than debt. By converting equity reserves into debt, the company can raise cheaper capital for its operations while at the same time committing to return accumulated earnings to shareholders. (16/n)

For the shareholders, tax efficiency is not the only benefit. From the perspective of an investor in a listed company, the combination of bonus debentures and equity dividend ensures the accumulated capital base remains small and the ROE remains high. (17/n)

A kicker in this entire equation is the fact that shareholders do not need to wait 3 years to monetize the debentures. Since these debentures will be listed, a shareholder can sell the debentures very soon after they are issued. (18/n)

Here is the BSE page of the 2019 bonus debentures issued by Britannia. Issued at a FV of INR 30, they now trade at INR 32. A holder needing liquidity now can realize a 7% capital gain too (though its better to hold till maturity). Sufficient quantities are traded daily. (19/n)

Here is the BSE page of bonus debentures issued by NTPC in 2015. Issued at a face value of INR 12.50 and currently trading at INR 13.10, current holders will also realize 9% capital appreciation if sold today. (20/n)

How much will the debentures be listed for? At 8% interest rate, the debentures will likely list and stay around the face value of INR 29. It will be price real-time like a bond and fluctuate accordingly as per debt market indicators. (21/n)

So, if you hold 100 shares in Britannia on the record date, you will receive 100 debentures that you can sell on the stock exchange immediately (figuratively speaking) for INR 2900. It is like, but not same as, being paid INR 29/share as dividend. (22/n)

In my tweet 8/n above, I mentioned that this structure works well if the company’s business model is conducive. What does this mean? Not any company can confidently commit to pay out a big chunk of its accumulated earnings every couple of years. (23/n)

Any company generating high asset turnover, return on capital employed and free cash flows can utilize this structure to recycle its accumulated capital with synergies both for itself and its shareholders. The markets love improved efficiencies in already good businesses. (24/n)

Converting equity reserves into debt may unfeasible for companies with existing debt burden. Bonus debentures disproportionately impact the debt-to-equity ratio as the numerator increases and denominator decreases. (25/n)

Thus, bonus debentures are likely unfeasible for most businesses needing to raise debt frequently. Lender covenants and rating agencies usually require maintaining a specified debt service coverage ratio and adequate reserves. (27/n)

NTPC is an outlier, it is capital-intensive but issued INR 10,000 crore bonus debentures probably by timing debt requirements with the debenture issuance. This recycling of capital too; it replaced external creditors with internal ones at similar interest rates - 8.49%. (26/n)

For companies like Britannia, and maybe other FMCG giants too, this is an attractive way to maximize shareholder returns while also signaling robust financial strength and significant free cash flows to carry out this financial manoeuvre. (27/n)

That's all for today, hope you learn something new. As always, this is not a recommendation to buy or sell anything discussed here and is purely for informational purposes only.

• • •

Missing some Tweet in this thread? You can try to

force a refresh