@yaxis_project brings DeFi yields to users within an easy interface that simplifies the complexities of yield farming.

Yield aggregation is a new area in DeFi with TVL 3x'ing this year to $6.1B including players

+ @iearnfinance

+ @VesperFi

+ @BadgerDAO

+ @harvest_finance

Yield aggregation is a new area in DeFi with TVL 3x'ing this year to $6.1B including players

+ @iearnfinance

+ @VesperFi

+ @BadgerDAO

+ @harvest_finance

Competition is fierce, but @yaxis_project has plans to take yield farming to the next level starting with their "Era 1" which includes

+ Strategy vaults (multi-strategy “Metavaults”)

+ Governance token, $YAXIS

+ Liquidity pools to allow for token purchases.

+ Strategy vaults (multi-strategy “Metavaults”)

+ Governance token, $YAXIS

+ Liquidity pools to allow for token purchases.

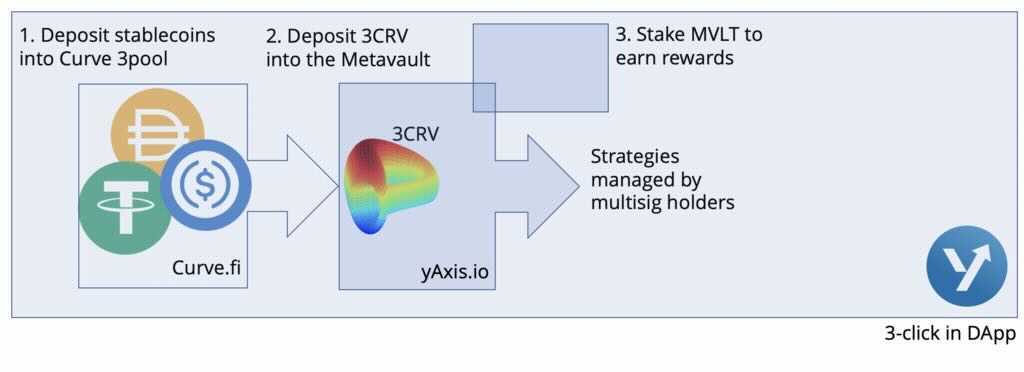

yAxis offers users 2-click access to its v2 MetaVault, where users deposit stablecoins such as $DAI, $USDC, $USDT – in exchange for $3CRV tokens, with are then deposited in return for a MetaVault Token (MVLT).

$MVLT tokens can be staked to earn $YAXIS rewards.

$MVLT tokens can be staked to earn $YAXIS rewards.

yAxis' token, $YAXIS, can be used to

+ Incentivize staking tokens for governance and strategy development

+ Incentivize liquidity providers on Uniswap

+ Boost APY to attract early users to the new protocol & grow TVL

+ Compensate strategists and community participants

+ Incentivize staking tokens for governance and strategy development

+ Incentivize liquidity providers on Uniswap

+ Boost APY to attract early users to the new protocol & grow TVL

+ Compensate strategists and community participants

@yaxis_project's roadmap is ambitious and, if successful, yAxis will be able to provide a valuable service to newly arriving DeFi users.

To learn more about yAxis and seamless yield farming, read @r_sale's latest article here

messari.io/article/yaxis-…

To learn more about yAxis and seamless yield farming, read @r_sale's latest article here

messari.io/article/yaxis-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh