Markets reward businesses that display the ability to diversify into adjacencies while at the same time maintaining their return ratios.Signals expanding size of opportunity and managements ability to identify more profit pools

Time for a thread with examples 🧵

Time for a thread with examples 🧵

Astralpoly🚰 isn't just a pipes company anymore. It is a water solutions provider dealing in Adhesives, Tanks, Valves, and Pipes. Homework for everyone: check the CFO compounding of the last decade

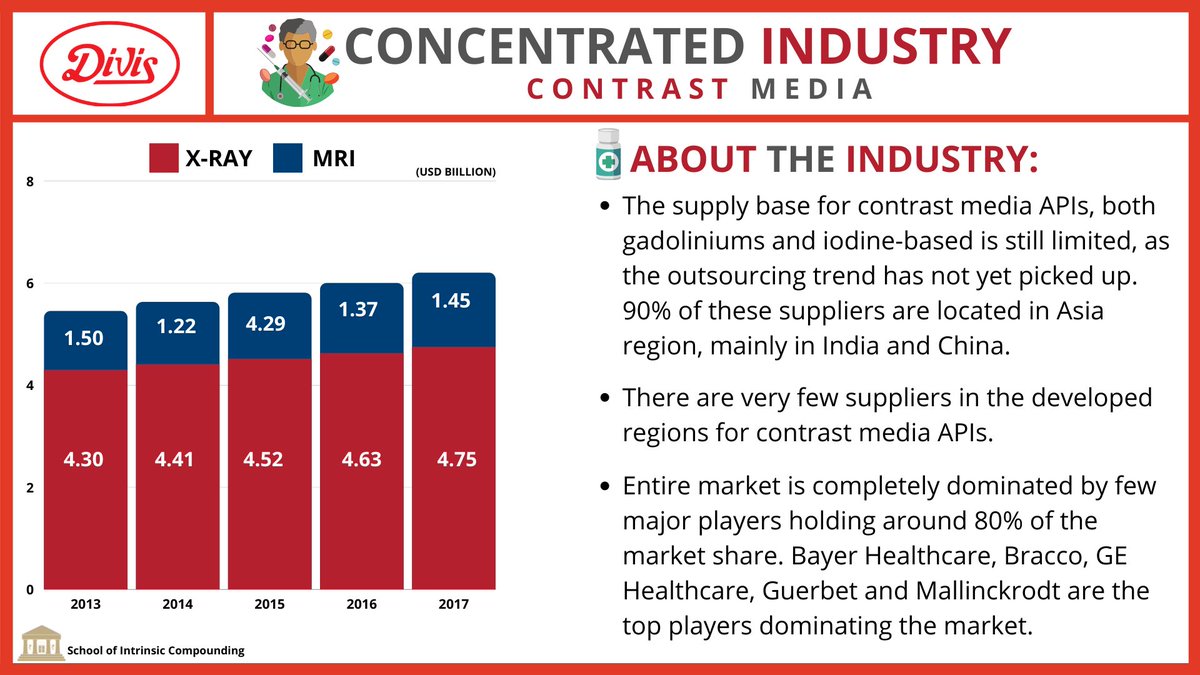

Divis Labs💊-again another API Champion which is entering Contrast Media API's which a very concentrated segment. They believe they have the process chemistry advantage over here as well!

Another successful story has been Navin Fluorine⚗️,which has taken the cashflows from commodity chemical business and successfully diversified into CRAMS, HPP&Speciality Chemicals

Laurus Labs🧬 is another candidate which is still not truly appreciated by the markets. Given majority of the returns have come from Earnings growth and not re-rating

Truly Antifragile managements have the ability to spot opportunities without diluting their incremental returns. This is when management recognizes the importance of intrinsic compounding🤝🤝

Disclosure: not SEBI Registered. Been through the journey with Navin&Laurus.

Disclosure: not SEBI Registered. Been through the journey with Navin&Laurus.

Remain invested and not a buy/sell. Only time will tell if this story plays out in Pi Industries successfully or not 🤞

• • •

Missing some Tweet in this thread? You can try to

force a refresh