Its the weekend!

Grab a cup of coffee, in this thread I will explain

1. How to select a Mutual Fund?

2. Common and costly mistakes people make while choosing a Mutual Fund

3. Some tools and tips to help you while selecting a fund

Lets dive right in.

Grab a cup of coffee, in this thread I will explain

1. How to select a Mutual Fund?

2. Common and costly mistakes people make while choosing a Mutual Fund

3. Some tools and tips to help you while selecting a fund

Lets dive right in.

Everyone knows what a mutual fund is, so I wouldn't spend much time on that.

If you're new to the investing world or want to brush up on your knowledge of Mutual Funds, here is a great video explaining them in detail.

If you're new to the investing world or want to brush up on your knowledge of Mutual Funds, here is a great video explaining them in detail.

Now, that you have brushed up on your knowledge of mutual funds, lets look at the common mistakes to avoid while selecting a mutual fund.

1. Choosing a Regular Fund over a Direct Fund

This is one of the most common mistakes made by investors.

Every mutual fund is available in two types

1. Regular

2. Direct

Here is an example of SBI Small Cap available both in Reg (Regular) as well as Direct type.

This is one of the most common mistakes made by investors.

Every mutual fund is available in two types

1. Regular

2. Direct

Here is an example of SBI Small Cap available both in Reg (Regular) as well as Direct type.

As an investor, you should always be investing in a Direct Plan of any mutual fund you own.

Why you ask?

Cause there is a significant difference between the expense ratios of a Direct Plan vs a Regular Plan of the same fund.

Why you ask?

Cause there is a significant difference between the expense ratios of a Direct Plan vs a Regular Plan of the same fund.

*Expense Ratio - Percentage of AUM charged by the fund house to keeps the lights on and pay its expenses, fees, salaries to its employees etc.

*AUM - Assets under management, is the total value of all assets (stocks, bonds, cash) owned by the fund

*AUM - Assets under management, is the total value of all assets (stocks, bonds, cash) owned by the fund

Same fund house, same fund manager, same underlying holdings but just two different type of plans.

One is a Regular Fund with Expense Ratio of : 1.81%

Other is a Direct Fund with Expense Ratio of : 0.87%

Difference in Expense Ratios: 0.94%

One is a Regular Fund with Expense Ratio of : 1.81%

Other is a Direct Fund with Expense Ratio of : 0.87%

Difference in Expense Ratios: 0.94%

Now you will ask me two questions here:

1. Why does the Regular Fund have a higher expense ratio than the Direct Fund?

2. So the difference is just 0.94%, what's the big deal?

Let's answer both of them.

1. Why does the Regular Fund have a higher expense ratio than the Direct Fund?

2. So the difference is just 0.94%, what's the big deal?

Let's answer both of them.

Why does the Regular Fund have a higher expense ratio than the Direct Fund?

When you choose a Regular Fund, you are paying extra in expense ratio as commissions to a mutual fund distributor.

When you choose a Regular Fund, you are paying extra in expense ratio as commissions to a mutual fund distributor.

Most of these regular funds are sold by bank agents, when you start a SIP, you're basically paying that extra 0.94% as commission to the agent who sold you that Mutual Fund.

So on a Rs 1000 per month SIP, you're paying Rs 9.4 per month in commissions.

Why do that?

So on a Rs 1000 per month SIP, you're paying Rs 9.4 per month in commissions.

Why do that?

Coming to second question: The difference is just 0.94%, so what's the big deal.

Let me help answer this with the help of data.

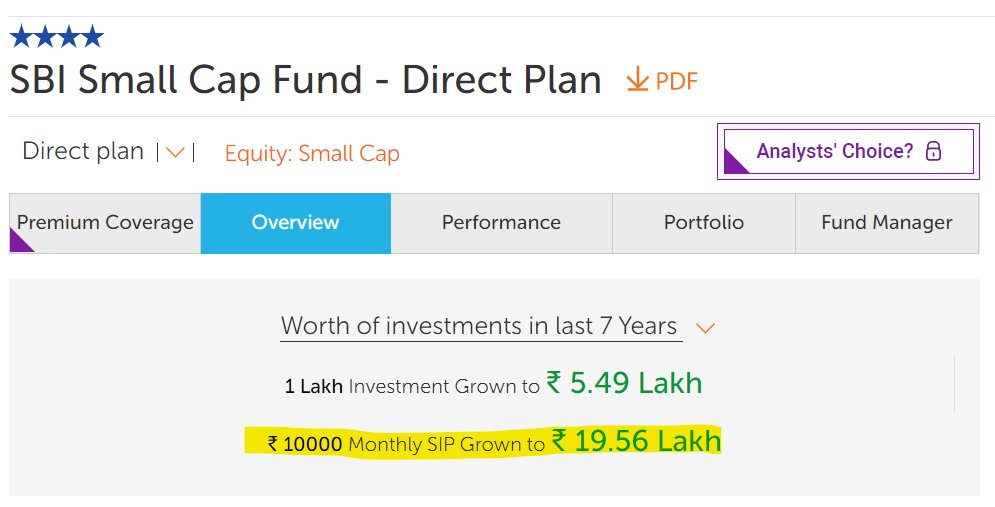

We will take the same fund: SBI Small Cap

and start an SIP into both of them of Rs 10,000 per month for 7 years

Let's see what is the return in each

Let me help answer this with the help of data.

We will take the same fund: SBI Small Cap

and start an SIP into both of them of Rs 10,000 per month for 7 years

Let's see what is the return in each

A SIP of Rs 10,000 per month

in SBI Small Cap Fund : Regular Plan

for 7 years

would have become Rs 18.62 Lakhs

in SBI Small Cap Fund : Regular Plan

for 7 years

would have become Rs 18.62 Lakhs

A SIP of Rs 10,000 per month

in SBI Small Cap Fund : Direct Plan

for 7 years

would have become Rs 19.56 Lakhs

in SBI Small Cap Fund : Direct Plan

for 7 years

would have become Rs 19.56 Lakhs

That's a difference of Rs 94,000

which you paid in commissions to the agent from your SIPs.

Why pay to agents when you can simply invest in a Direct plan and earn more?

which you paid in commissions to the agent from your SIPs.

Why pay to agents when you can simply invest in a Direct plan and earn more?

In today's age when you can buy mutual funds with a few clicks, you shouldn't be relying on agents to sell you a mutual fund.

Your entire SIP should be invested and working for you to generate returns and not going into the pocket of some agent as commissions.

Your entire SIP should be invested and working for you to generate returns and not going into the pocket of some agent as commissions.

The good news is, you do not have to sell your Mutual Funds to convert them from Regular to Direct.

The good folks @_groww can help you move all your Regular Funds to Direct Funds easily via their app.

The good folks @_groww can help you move all your Regular Funds to Direct Funds easily via their app.

I personally use @_groww to

1. Invest into Direct Mutual Funds

2. Invest in US Markets

You can sign up using this link to open an account and get Rs 100 as joining bonus.

groww.app.link/refe/tariq1050…

1. Invest into Direct Mutual Funds

2. Invest in US Markets

You can sign up using this link to open an account and get Rs 100 as joining bonus.

groww.app.link/refe/tariq1050…

Mutual Fund in itself is a diversified investment.

Every fund you invest in, holds at least 20+ stocks, debt and some cash.

You do not need to own more than 2 to 3 mutual funds to get benefits of diversification.

Every fund you invest in, holds at least 20+ stocks, debt and some cash.

You do not need to own more than 2 to 3 mutual funds to get benefits of diversification.

When you start investing into too many mutual funds, you are spreading yourself too thin and there are high chances that your funds are investing into the same stocks. Most investors do not bother checking what the holdings of a mutual fund are how they overlap with their funds.

Here is an example of two different Funds sold by the same fund house with different names but have 57% overlap in underlying holdings.

Doing SIP into both these fund, will give you worse returns than doing SIP into a single fund.

Reason: You're investing in 57% of the same stocks but paying expense ratio twice!

Reason: You're investing in 57% of the same stocks but paying expense ratio twice!

Here is free tool for you to help check the overlap in all your mutual funds.

If any of your funds have more than 50% overlap, you may want to sell them and consolidate your investments for better returns.

thefundoo.com/Tools/Portfoli…

If any of your funds have more than 50% overlap, you may want to sell them and consolidate your investments for better returns.

thefundoo.com/Tools/Portfoli…

Common Mistake # 3

Not Looking at Expense Ratio

As explained earlier in this thread

*Expense Ratio - is the percentage charged by the fund house on your investment to help them pay all their expenses.

Higher Expense Ratio = Lower Returns

Lower Expense Ratio = Higher Returns

Not Looking at Expense Ratio

As explained earlier in this thread

*Expense Ratio - is the percentage charged by the fund house on your investment to help them pay all their expenses.

Higher Expense Ratio = Lower Returns

Lower Expense Ratio = Higher Returns

Always look at expense ratio charged by the fund house, compare it with expense ratios of other fund houses before selecting a mutual fund to invest in.

It may be possible that you're able to find a fund that has 80% overlap in holdings but half the expense ratio charged.

It may be possible that you're able to find a fund that has 80% overlap in holdings but half the expense ratio charged.

Common Mistake # 4

Investing in funds with too little AUM or too large AUM

AUM stands for Assets Under Management- This is the total value of all the holdings held by the mutual fund

Too Large AUM = More money for fund to invest in

Too Little AUM = Not enough money to invest in

Investing in funds with too little AUM or too large AUM

AUM stands for Assets Under Management- This is the total value of all the holdings held by the mutual fund

Too Large AUM = More money for fund to invest in

Too Little AUM = Not enough money to invest in

If you invest in a fund that has a giant AUM with tens of thousands of crores, then it may be a problem as the fund is getting huge inflows of cash every month as SIP and has to keep investing that into the market even when the markets are overvalued.

If you invest in a fund that has small AUM of just < 100 crores then it may also be a problem as sudden big redemptions will mean that fund doesn't have enough cash to redeem all units at once and may be forced to sell their holdings and incur tax just to meet all redemptions.

Common Mistake # 5

Not Looking at Fund Manager Churn

If a fund keep changing the fund manager then chances are that with each new manager, a new investment strategy is adopted which means selling old positions and buying new ones

Each sell means incurring tax and other expense

Not Looking at Fund Manager Churn

If a fund keep changing the fund manager then chances are that with each new manager, a new investment strategy is adopted which means selling old positions and buying new ones

Each sell means incurring tax and other expense

Common Mistake # 6

Only looking at Returns for Last Year

Always look at 5 year, 3 year and 1 year returns for a fund before you select them. Performance of a fund should be measured across time periods and not in isolation of a single year.

Only looking at Returns for Last Year

Always look at 5 year, 3 year and 1 year returns for a fund before you select them. Performance of a fund should be measured across time periods and not in isolation of a single year.

Common Mistake # 7

Not rebalancing your fund every year

As an investor, you should review your funds every year at least once and evaluate their performance vs the benchmark and peers.

If they have underperformed by a wide margin, it maybe time to switch to another fund.

Not rebalancing your fund every year

As an investor, you should review your funds every year at least once and evaluate their performance vs the benchmark and peers.

If they have underperformed by a wide margin, it maybe time to switch to another fund.

Common Mistake # 8

Investing for short periods and not based on Goals

Every investment you make, should be goal based. Without goals you're investing without a target.

Also, any investment you make should be for a minimum of 7 years for it to generate any meaningful return.

Investing for short periods and not based on Goals

Every investment you make, should be goal based. Without goals you're investing without a target.

Also, any investment you make should be for a minimum of 7 years for it to generate any meaningful return.

Common Mistake # 9

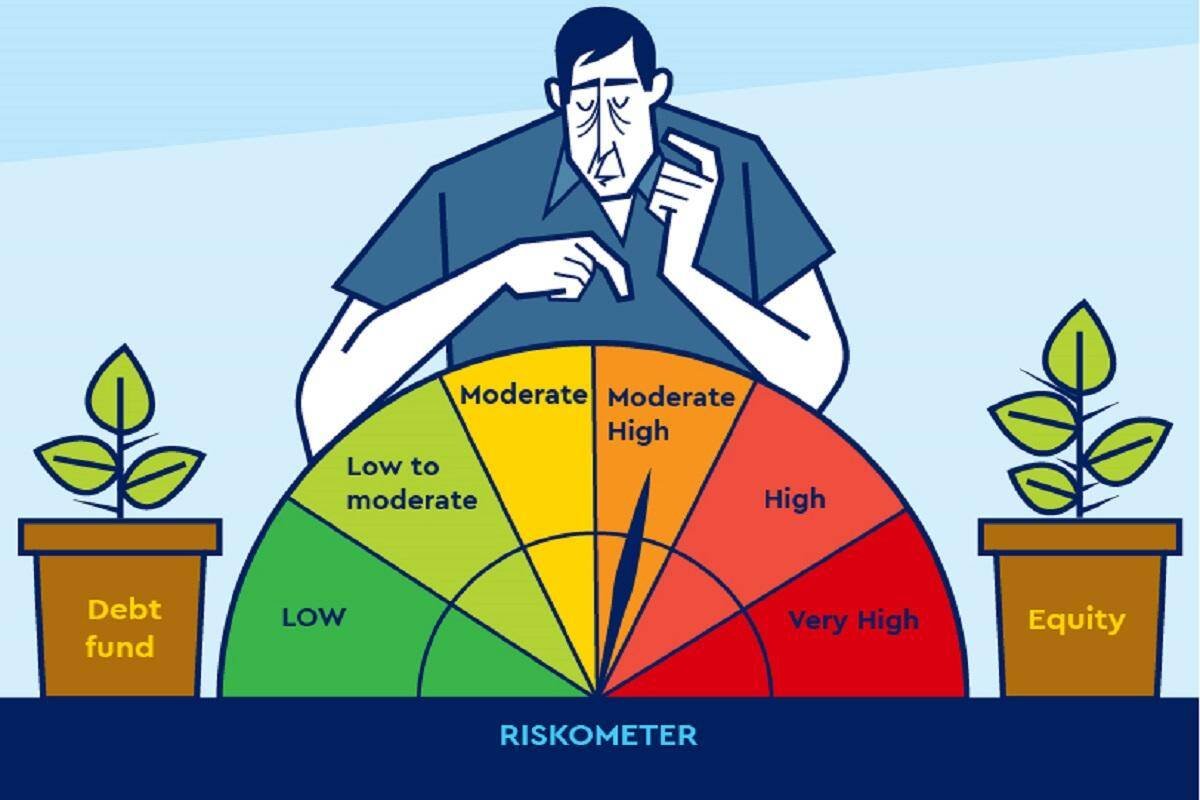

Not knowing your Risk Profile

Understand your risk profile before you can start investing

If you're young and do not need money from your investments = Equity Growth Mutual Funds

If you're old and need regular income = Debt and Dividend Funds are for you

Not knowing your Risk Profile

Understand your risk profile before you can start investing

If you're young and do not need money from your investments = Equity Growth Mutual Funds

If you're old and need regular income = Debt and Dividend Funds are for you

Common Mistake # 10

Unaware of Tax Implications and Exit Loads

Exit Load = Any money you have to pay in order to exit from the fund

This may include taxes, fees or a percentage of returns.

For most good funds, this is Nil

But for some close ended funds this can be very high.

Unaware of Tax Implications and Exit Loads

Exit Load = Any money you have to pay in order to exit from the fund

This may include taxes, fees or a percentage of returns.

For most good funds, this is Nil

But for some close ended funds this can be very high.

If you're still reading this, then thank you.

Please retweet for maximum reach and to help others.

I do these threads related to personal finance and investing every Saturday, follow me if you find this interesting.

Please retweet for maximum reach and to help others.

I do these threads related to personal finance and investing every Saturday, follow me if you find this interesting.

Occasionally also write long form investing articles at the link below.

investkaroindia.substack.com/p/coming-soon

investkaroindia.substack.com/p/coming-soon

There will also be a Twitter Spaces meet tomorrow (Sunday, 30th May at 7:30 pm) where I will try and answer your questions related to Mutual Funds.

Link below

twitter.com/i/spaces/1OdKr…

Link below

twitter.com/i/spaces/1OdKr…

• • •

Missing some Tweet in this thread? You can try to

force a refresh