How to get URL link on X (Twitter) App

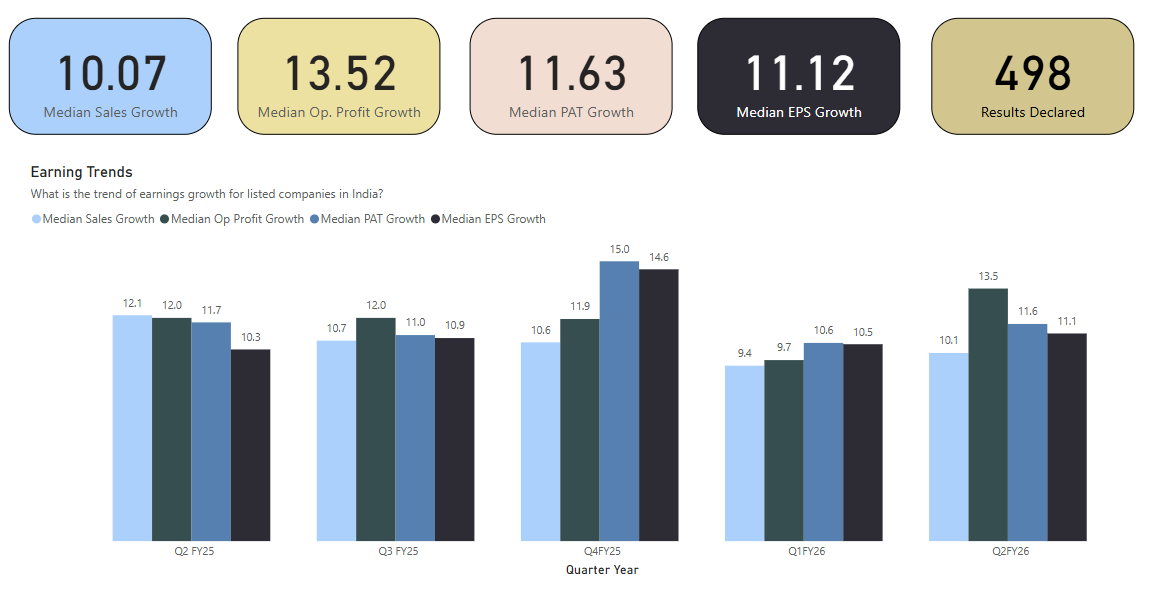

Nifty 500 earnings fare better than Q1FY26, but still are growing in low teens

Nifty 500 earnings fare better than Q1FY26, but still are growing in low teens

Highest Buying (absolute amount) is seen in Jindal Steel and Power

Highest Buying (absolute amount) is seen in Jindal Steel and Power

Lets talk about 'One Time Settlements' (OTS) first

Lets talk about 'One Time Settlements' (OTS) first

2/ Behavioral finance is a field that studies how psychological, human biases and emotions influence financial and investment decision-making.

2/ Behavioral finance is a field that studies how psychological, human biases and emotions influence financial and investment decision-making.

2/ Before we start to explore cost of capital, we first need to understand what is meant by capital structure of a company.

2/ Before we start to explore cost of capital, we first need to understand what is meant by capital structure of a company.

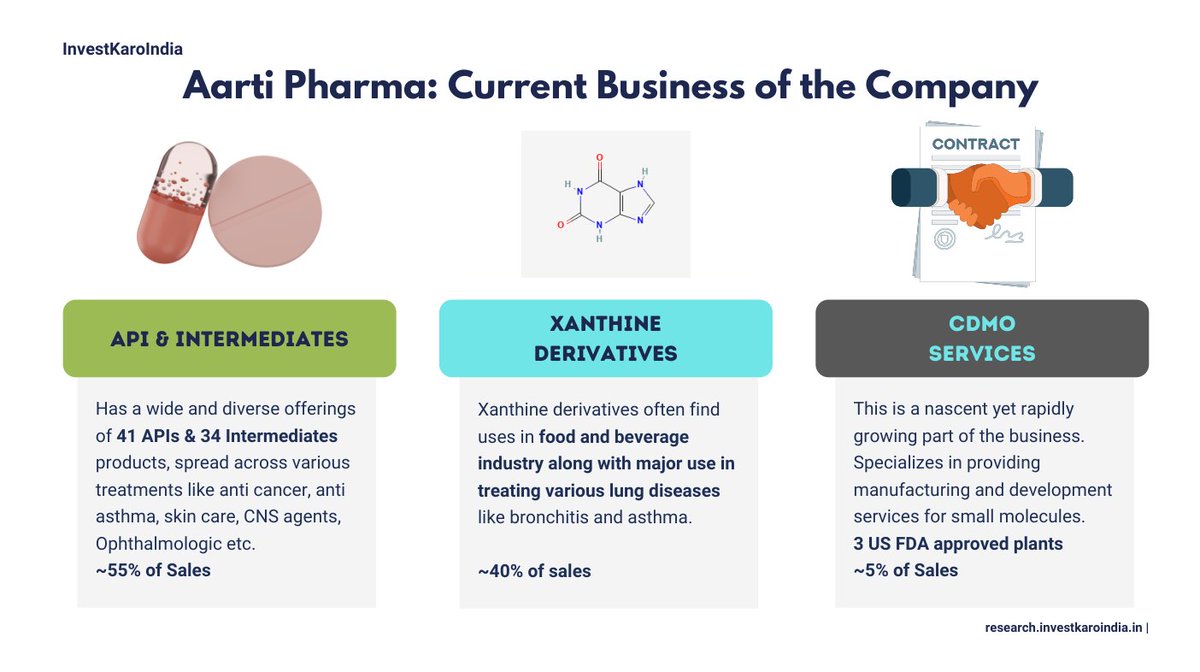

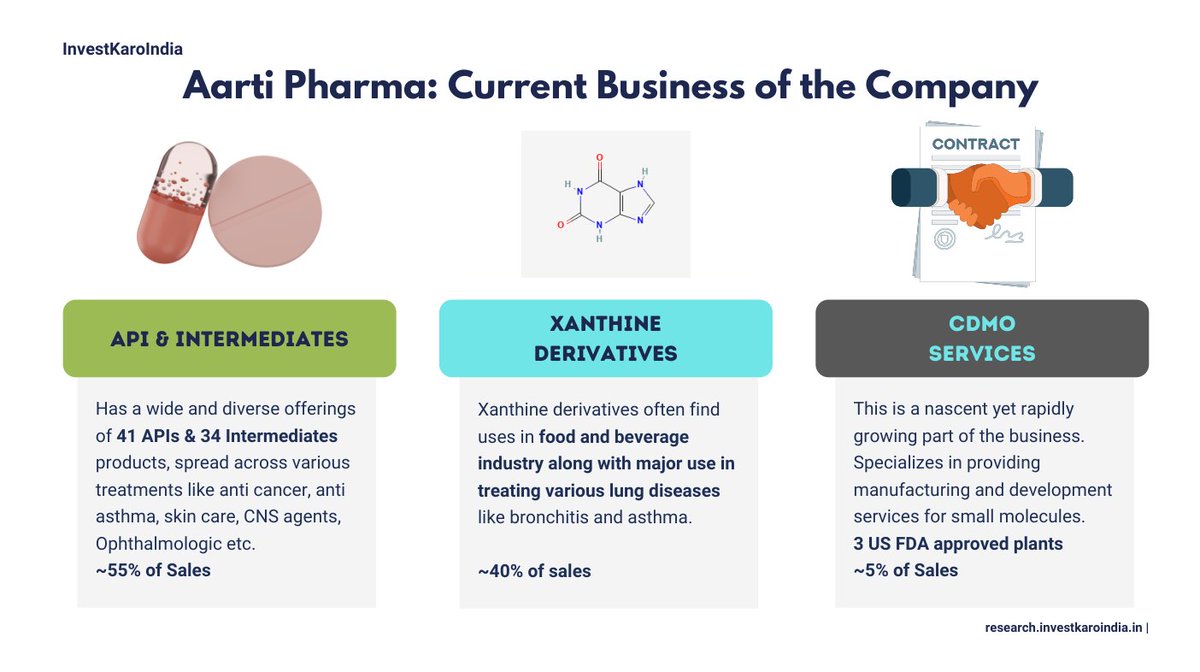

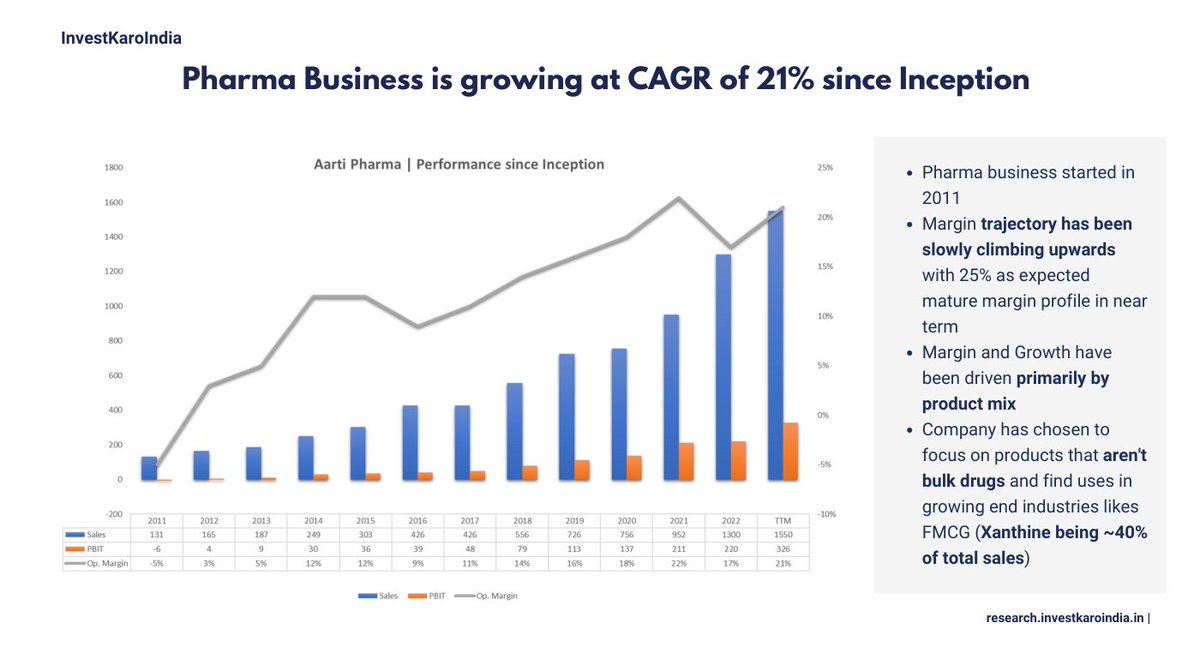

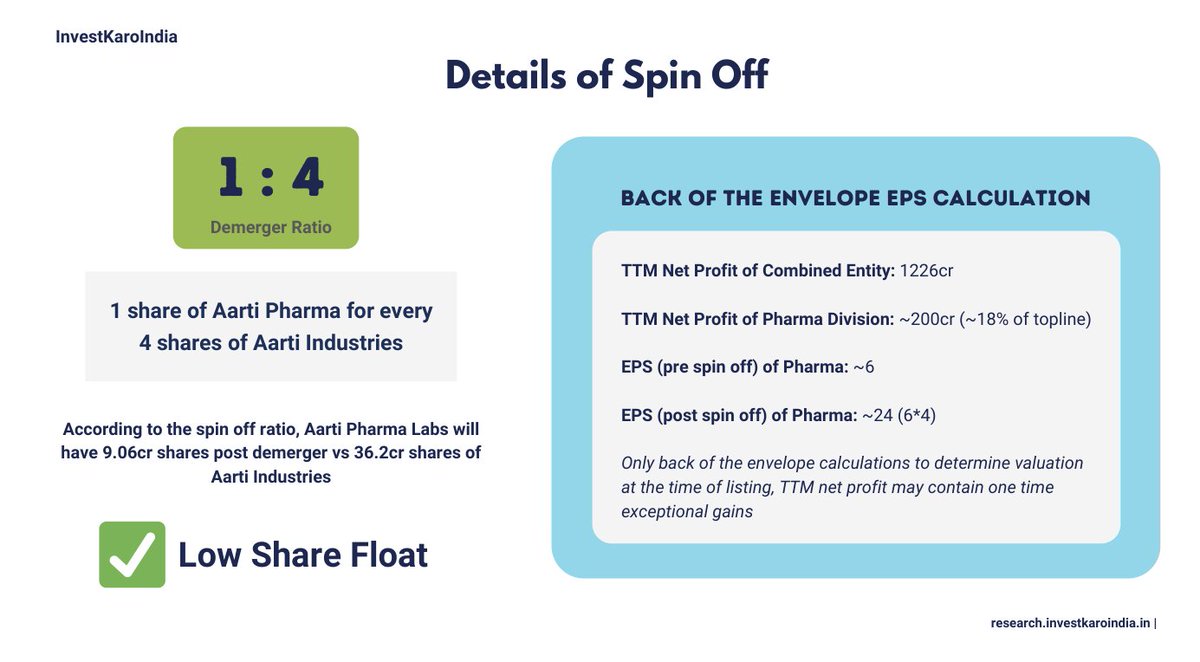

@ias_summit At 315/share, the market is implying a market cap of ~2850.75cr to the company or a PE multiple of ~18x TTM earnings

@ias_summit At 315/share, the market is implying a market cap of ~2850.75cr to the company or a PE multiple of ~18x TTM earnings

Only ~28% of IT stocks and ~45% of Pharma stocks are above their 40W EMA

Only ~28% of IT stocks and ~45% of Pharma stocks are above their 40W EMA

https://twitter.com/sama/status/1598038815599661056

https://twitter.com/macostaeth/status/1598099294728630272?s=20&t=pk794l9KLDl1fbWka7m5Uw

ETFs stand for Exchange Traded Funds

ETFs stand for Exchange Traded Funds

Service # 1

Service # 1

Before we understand a Yield Curve, lets get some of the basic terminology out of the way

Before we understand a Yield Curve, lets get some of the basic terminology out of the way

Rakesh Jhunjhunwala's Akasa Air takes its first flight in June 2022

Rakesh Jhunjhunwala's Akasa Air takes its first flight in June 2022

This thread is divided into the following parts

This thread is divided into the following parts

Before we proceed, a disclaimer, that I am invested and biased

Before we proceed, a disclaimer, that I am invested and biased