Laurus Labs : A Visual Story

I am a Data Science / Machine Learning developer by profession and data along with finance are my two areas of competence.

I realize how powerful combining both of them can be, so here is a visual analysis for Laurus Labs.

I am a Data Science / Machine Learning developer by profession and data along with finance are my two areas of competence.

I realize how powerful combining both of them can be, so here is a visual analysis for Laurus Labs.

Laurus Labs is a research driven diversified pharma company, based out of India, started in the year 2005.

The area that separates Laurus from its peers is its intense focus on R&D. The company started as a contract research organization and then forayed into manufacturing.

The founder highlights this in one of his interviews with Forbes early on.

The founder highlights this in one of his interviews with Forbes early on.

The founder of the business, Dr. Chava is also a very shrewd business man.

He started with R&D first as its the backbone of any pharma company and it is also a asset light business.

Profits from R&D business were then reinvested to build API manufacturing.

He started with R&D first as its the backbone of any pharma company and it is also a asset light business.

Profits from R&D business were then reinvested to build API manufacturing.

The relationships cultivated initially via contract research helped Laurus earn some credibility which later helped once it started its API Manufacturing business.

Dr. Chava also chose to foray into ARV API which comprises of 75% of final drug costs as opposed to generic APIs which only comprises of 25% of the final drug cost.

The company has a long history, which you can explore in the form of a timeline in the dashboard (link at the end of this thread)

The dashboard further tries to explore financials of the company and tries to build a story.

The story is evident in the strategy of Laurus

Niche High Margin Business -> Fast CAPEX -> Scale -> Operational Leverage -> Become top 3 player globally in various business segments

The story is evident in the strategy of Laurus

Niche High Margin Business -> Fast CAPEX -> Scale -> Operational Leverage -> Become top 3 player globally in various business segments

You may go through the dashboard at your own pace, I will keep updating this further as the story evolves.

Link: public.tableau.com/app/profile/vi…

Link: public.tableau.com/app/profile/vi…

Data Visualization is a powerful skill to have and can help you study a business beyond just the numbers in the excel.

If you want to learn the skill, I built this course to teach the same.

Sign up with the link below for a free 14 day access 👇🏼

skl.sh/2XNug6A

If you want to learn the skill, I built this course to teach the same.

Sign up with the link below for a free 14 day access 👇🏼

skl.sh/2XNug6A

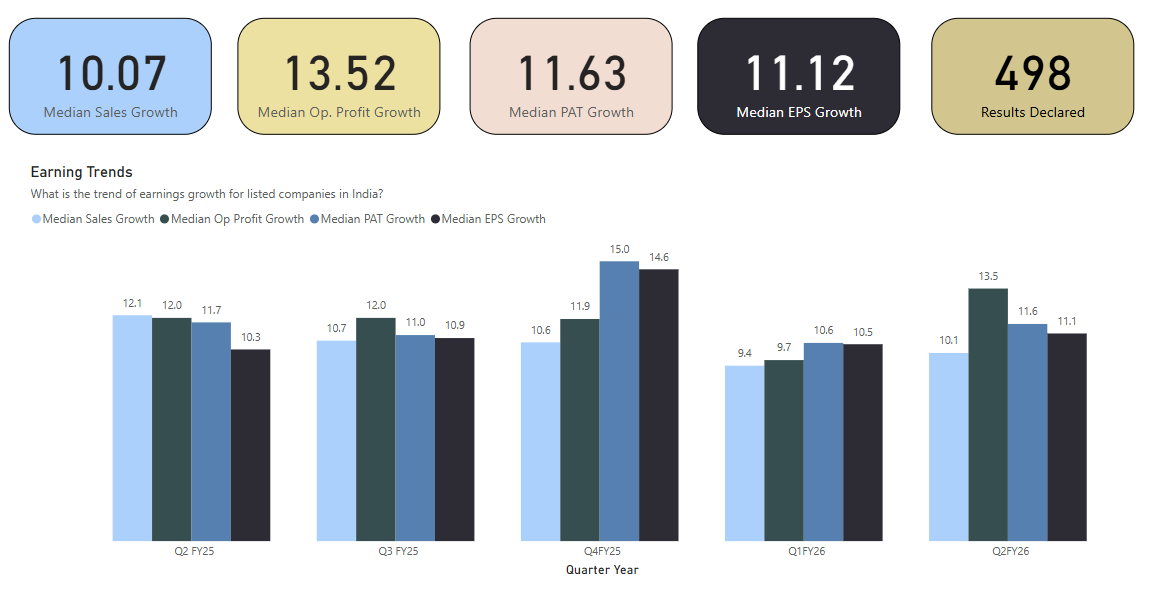

Laurus Sales are growing at rapid pace driven by its investments in new businesses.

From ARV API it went to ARV Formulations

And now doubling that Formulation Capacity in near term

From ARV API it went to ARV Formulations

And now doubling that Formulation Capacity in near term

When revenues rise faster than expenses, its called Operating Leverage

Laurus's main growth comes from its Operating Leverage

which again is derived from its good allocation of capital into high margin businesses

Laurus's main growth comes from its Operating Leverage

which again is derived from its good allocation of capital into high margin businesses

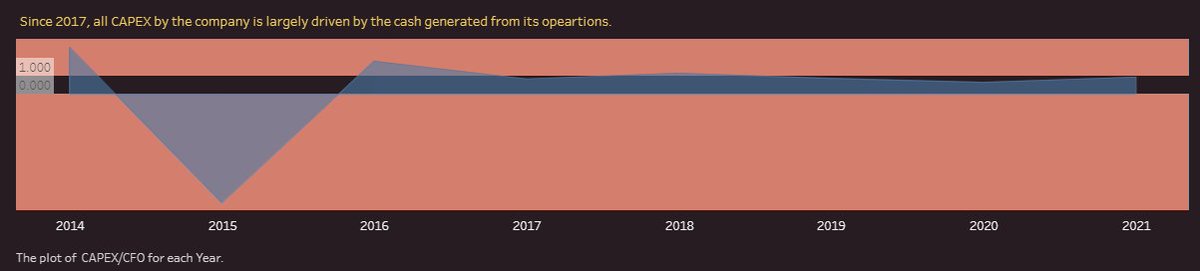

All CAPEX of the company is now driven by cash generated from its operations

Translation : It shows sustainable growth

Translation : It shows sustainable growth

Future Triggers for the company

Near Term: Doubling of Formulations Capacity

Medium Term: Synthesis and CDMO Projects

Long Term: Laurus Bio

Near Term: Doubling of Formulations Capacity

Medium Term: Synthesis and CDMO Projects

Long Term: Laurus Bio

Once Laurus Bio is of sufficient scale, no one will talk about ARV APIs or Formulations

Here is a short video of capabilities for Richore before it was acquired by Laurus Bio

Disclosure: Hold significant number of shares from lower levels, please do not take this as investment advice.

Full Dashboard available here

public.tableau.com/app/profile/vi…

Full Dashboard available here

public.tableau.com/app/profile/vi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh