1/ Tether isn't burning any of the USDT that its sending to the "burn address" on Tron.

TRC20 USDT smart contract = TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t

"Burn" address = T9yD14Nj9j7xAB4dbGeiX9h8unkKHxuWwb

Treasury = THPvaUhoh2Qn2y9THCZML3H815hhFhn5YC

TRC20 USDT smart contract = TR7NHqjeKQxGTCi8q8ZY4pL8otSzgjLj6t

"Burn" address = T9yD14Nj9j7xAB4dbGeiX9h8unkKHxuWwb

Treasury = THPvaUhoh2Qn2y9THCZML3H815hhFhn5YC

https://twitter.com/Tether_to/status/1399365962055434240

2/ We first became aware of the true identities of these addresses in a public way when Paolo "accidentally" minted 5B USDT to the Treasury address.

https://twitter.com/whale_alert/status/1150161710587764737?s=20

3/ From that point, @paoloardoino provided the transactions for the alleged burn -

https://twitter.com/paoloardoino/status/1150164876138037249?s=20

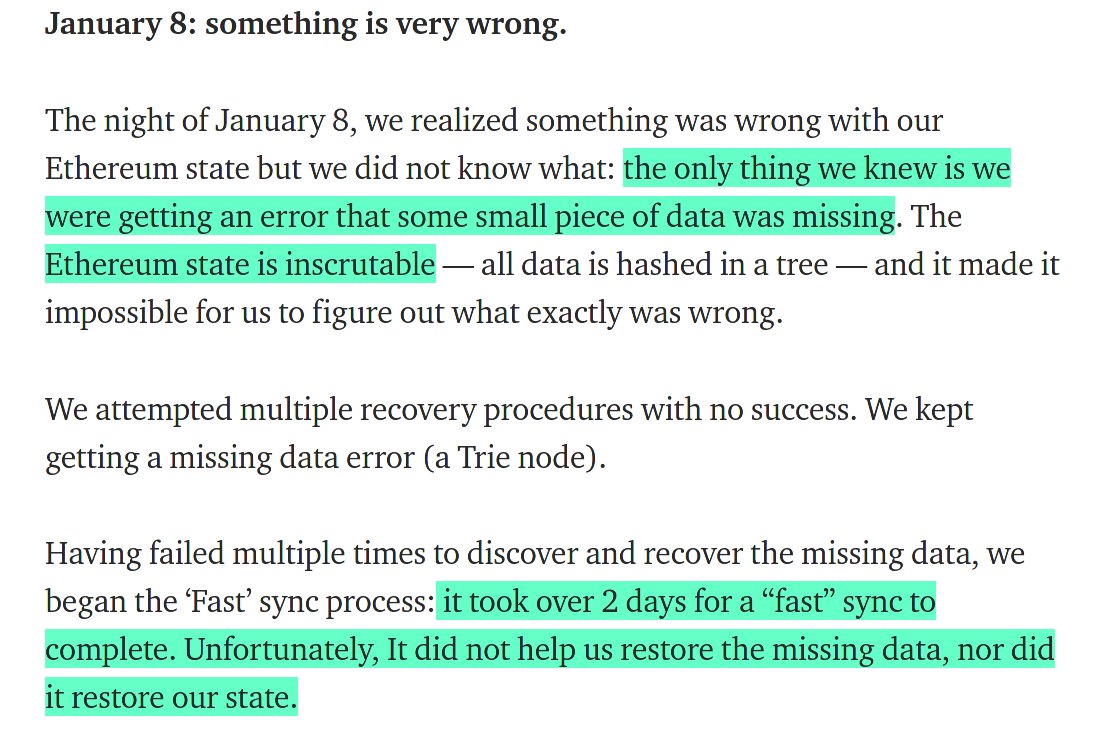

5/ Visiting the burn address though, we can see that billions of USDT have left the burn wallet and returned to the Tether Treasury over the past 160 days.

In total this wallet has sent out 21.50B USDT to the Treasury while only receiving 2B USDT (from the Treasury).

In total this wallet has sent out 21.50B USDT to the Treasury while only receiving 2B USDT (from the Treasury).

6/ Looking at this most recent burn, we can see that the 2 (1B) USDT transfers landed into the 'burn address' from a smart contract that Bitfinex has been indirectly making calls on (TBPxhVAsuzoFnKyXtc1o2UySEydPHgATto).

7/ It appears that the 2B USDT sent out for the burn initially came from address TKHuVq1oKVruCGLvqVexFs6dawKv6fQgFs (Tether Treasury #2 I suppose).

The 2B USDT that the Tether Treasury #2 received came from Binance...@paoloardoino yall do swaps for @binance now?

The 2B USDT that the Tether Treasury #2 received came from Binance...@paoloardoino yall do swaps for @binance now?

8/ Either way - even if it is from Binance, seems like no harm no foul right?

Wrong. Let's revisit that new smart contract they burned the USDT through for a sec.

We can see the burn addy drop funds into that smart contract, then smart cntrct dumps back to Tether treasury #2.

Wrong. Let's revisit that new smart contract they burned the USDT through for a sec.

We can see the burn addy drop funds into that smart contract, then smart cntrct dumps back to Tether treasury #2.

• • •

Missing some Tweet in this thread? You can try to

force a refresh