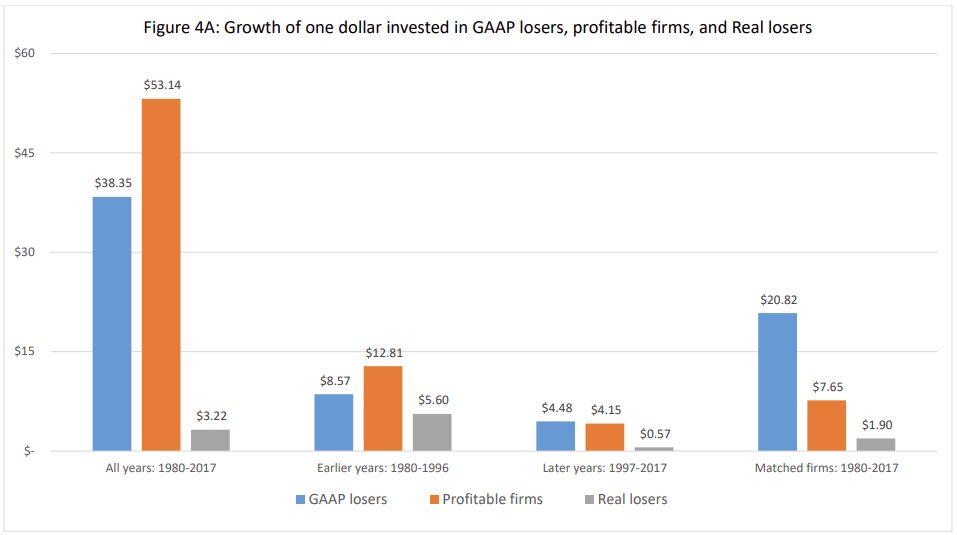

1/"All Losses Are Not Alike: Real versus Accounting-Driven Reported Losses" by Feng Gu, @lev_baruch and Chenqi Zhu. Dwells on the important distinction between losing money because of accounting method and losing money because of a poor business:

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

2/"the results of this study demonstrate the fundamental differences between losses driven by the immediate expensing of internally-generated intangible investments and losses reflecting genuine business performance shortfalls."

3/"Standard accounting reports, however, do not properly reflect these differences and their implications."

• • •

Missing some Tweet in this thread? You can try to

force a refresh