Thinking of investing in YWBN Mutual Bank? [Thread]

WTF is a mutual bank?

You're probably thinking 'oh no VBS!'. Not all mutual banks are dysfunctional.

Mutual banks are institutions owned by depositors and are regulated. They also have lower capital requirements with the SARB.

They can accept deposits can issue loans.

You're probably thinking 'oh no VBS!'. Not all mutual banks are dysfunctional.

Mutual banks are institutions owned by depositors and are regulated. They also have lower capital requirements with the SARB.

They can accept deposits can issue loans.

The first red flag on YWBN is the 'membership fee' for 100 bucks. Having done a fair share of capital raising it's the first time I've seen a non-refundable membership fee to participate in an issuance. It's not common.

Is it easy to get involved?

Sure, if you have R1k lying around. After paying your 100 bucks club entrance fee - the minimum subscription is 100 shares at 10 bucks each (1k, quick maf)

Interesting to see a co-op bank set the minimum to R1k.

Sure, if you have R1k lying around. After paying your 100 bucks club entrance fee - the minimum subscription is 100 shares at 10 bucks each (1k, quick maf)

Interesting to see a co-op bank set the minimum to R1k.

Fun fact: YWBN owns 26% in Namlog (logistics, distribution & warehousing company). Ninathi Holdings owns a couple of car washes. Gives a bit of colour to the interesting bank management team.

Is this a car-tel?

(That was good. Honestly, I'd follow myself on this app if I could)

Is this a car-tel?

(That was good. Honestly, I'd follow myself on this app if I could)

The YWBN Mutual Bank investor materials say the right things - unemployment, diversity, financial exclusion, serving the underbanked.

Except it excludes all the hard detail you usually find in a prospectus - the stuff helping you decide if it's a great investment.

Except it excludes all the hard detail you usually find in a prospectus - the stuff helping you decide if it's a great investment.

How about the valuation?

R5bn

Take a second and let that sink in. 19% for 95m shares (each share is 10 bucks) implies a R5bn valuation.

If you think a R5bn valuation is absurd... wait until you see the numbers underpinning this.

R5bn

Take a second and let that sink in. 19% for 95m shares (each share is 10 bucks) implies a R5bn valuation.

If you think a R5bn valuation is absurd... wait until you see the numbers underpinning this.

They're currently making R2m a year attributing it to an increase in membership

Ideally, you would apply a price/book multiple to benchmark a FI. BV assets aren't provided.

In this instance, if revenues grow 100x - you're still looking at a 20x top line valuation. Steeeeeeep!

Ideally, you would apply a price/book multiple to benchmark a FI. BV assets aren't provided.

In this instance, if revenues grow 100x - you're still looking at a 20x top line valuation. Steeeeeeep!

Why would you put a bloated valuation in front of the public?

Simple. You become instantly rich since the value of equity stake skyrockets. How much is the founder's equity? 44%

This implies a founder valuation of R2.2bn on day 1

Simple. You become instantly rich since the value of equity stake skyrockets. How much is the founder's equity? 44%

This implies a founder valuation of R2.2bn on day 1

Apart from the sweat equity % being very steep at an eye-watering valuation there's zero mention of founder's hard capital commitment

A founder's co-investment is a key factor to watch in a capital raise. Are you putting your own money into this?

A founder's co-investment is a key factor to watch in a capital raise. Are you putting your own money into this?

So you invest into YWBN Mutual Bank, when can you realistically expect to start seeing returns?

6 years

No seriously

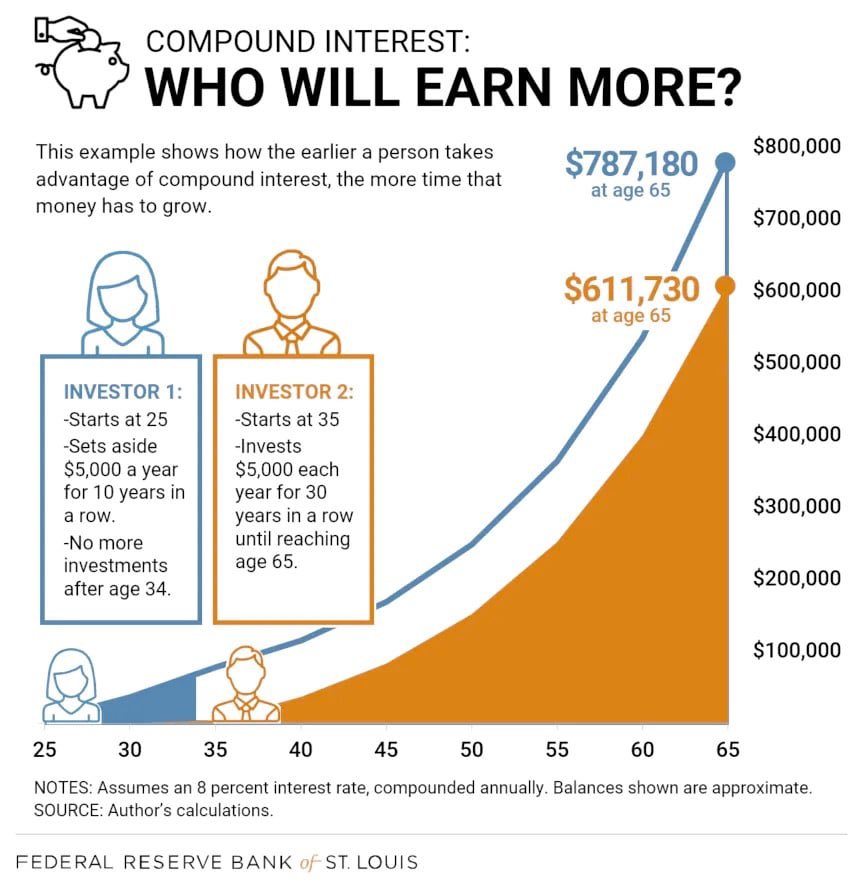

Don't expect to see any gains any time soon. Whenever I see the words "sustained investment", I'm tempted to take my investment capital and throw it into Betway

6 years

No seriously

Don't expect to see any gains any time soon. Whenever I see the words "sustained investment", I'm tempted to take my investment capital and throw it into Betway

So if you need cash quickly, can you sell?

lol no

This lock-in is longer than most of your relationships. There's literally no liquidity in the instruments you're buying.

Oh & after 6 years - you need board approval and need to apply to sell YOUR shares

lol no

This lock-in is longer than most of your relationships. There's literally no liquidity in the instruments you're buying.

Oh & after 6 years - you need board approval and need to apply to sell YOUR shares

But you will get a dividend right?

Uhm....

Look if there's "money left" - so no, don't pin your hopes on this being a juicy yielding investment ESPECIALLY across the first 6 years

Uhm....

Look if there's "money left" - so no, don't pin your hopes on this being a juicy yielding investment ESPECIALLY across the first 6 years

Let's be absolutely blunt here - what you're being sold is a share in a mutual bank, what you're actually getting is an instrument resembling long dated sub-ordinated paper (ranking below debt) with uncertain yield, lock-ins & low liquidity.

You're very cheap financing. End of.

You're very cheap financing. End of.

Where the fuck is all this money going?

A stake in Arsenal?

This money is going to buying assets, developing IP, and produce development. You're effectively a pre-seed capital funder. There are no products immediately scalable here.

This needs work. Lots & lots of work.

A stake in Arsenal?

This money is going to buying assets, developing IP, and produce development. You're effectively a pre-seed capital funder. There are no products immediately scalable here.

This needs work. Lots & lots of work.

If there's only tweet in this thread to stick with you - its this one. These forecasts are insane.

In a bank, loans are assets & deposits are liabilities. Pay VERY careful to the growth in the asset base relative to the liabilities. Massive mismatch here.

In a bank, loans are assets & deposits are liabilities. Pay VERY careful to the growth in the asset base relative to the liabilities. Massive mismatch here.

Remember growth in assets = growth in loan book

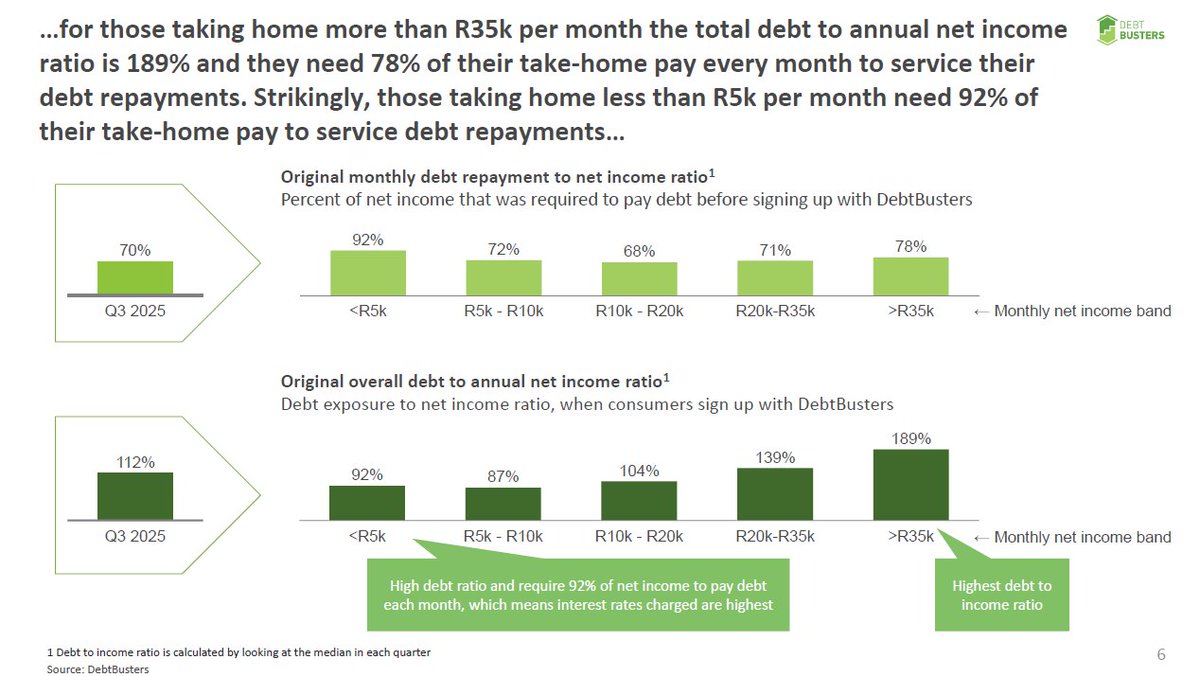

This is a high risk lending segment. You're growing deposits at a MUCH slower growth rate vs. extending your lending book. You lock in your equity participants. for the capital buffer.

Aggressive lending + high risk = .....

This is a high risk lending segment. You're growing deposits at a MUCH slower growth rate vs. extending your lending book. You lock in your equity participants. for the capital buffer.

Aggressive lending + high risk = .....

The easiest way to counter default risk is through higher yields on borrowings. If you're an investor I would strongly encourage you to find out what the typical borrowings yields are envisaged to be on YWBN mutual bank debt.

This will tell you everything about sustainability

This will tell you everything about sustainability

The leadership team does have experienced folks - no doubt. But then there's this homie who is in.... the car business!

What is it about this bank and its link to vehicle businesses? On the upside, Raymond went to hotel school & did a couple of courses.

What is it about this bank and its link to vehicle businesses? On the upside, Raymond went to hotel school & did a couple of courses.

Overall - looking at the eye watering valuation, massive owner sweat equity stake, stage of readiness, long lock-up period, insane forecasts, opaque detail on envisaged yields & overall risk you have to be one brave soul investing into this business.

• • •

Missing some Tweet in this thread? You can try to

force a refresh