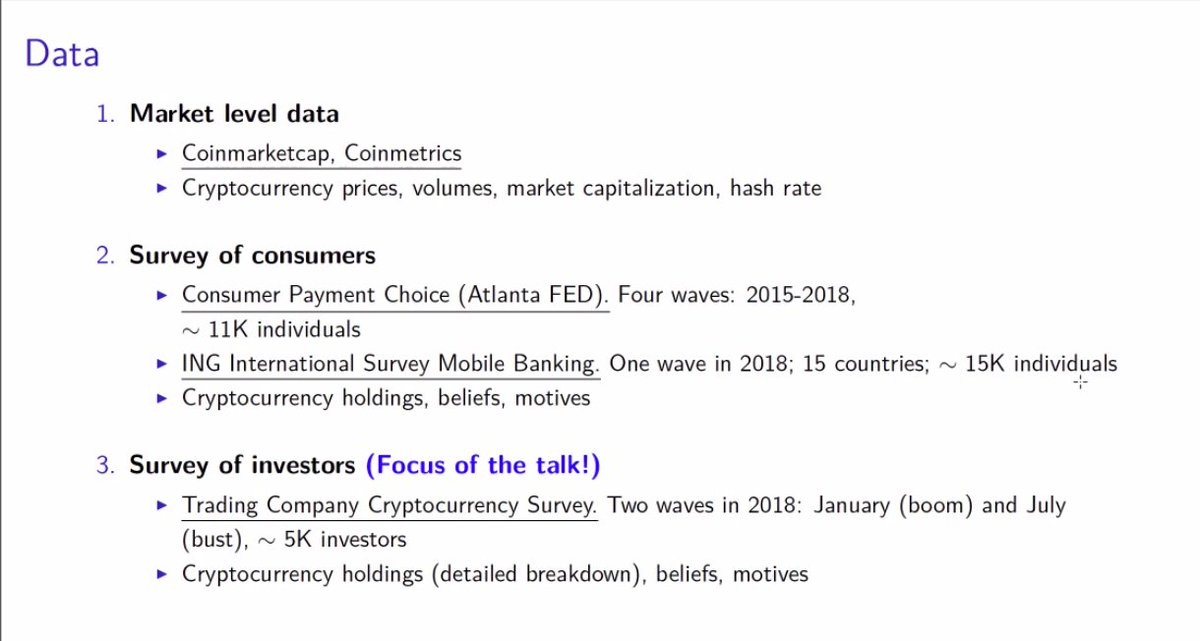

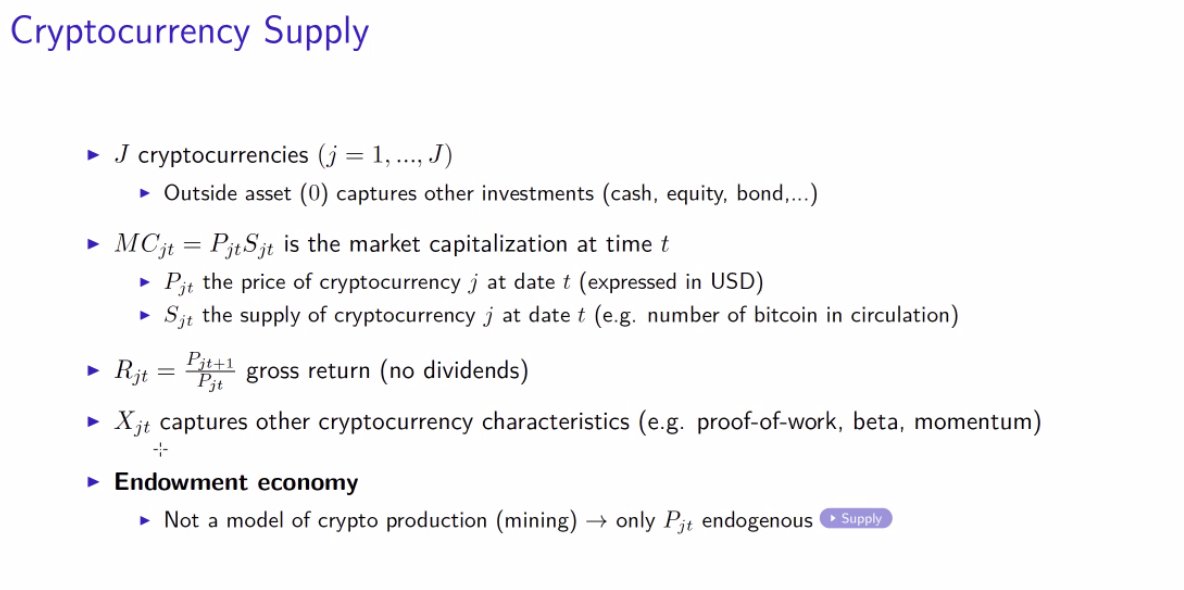

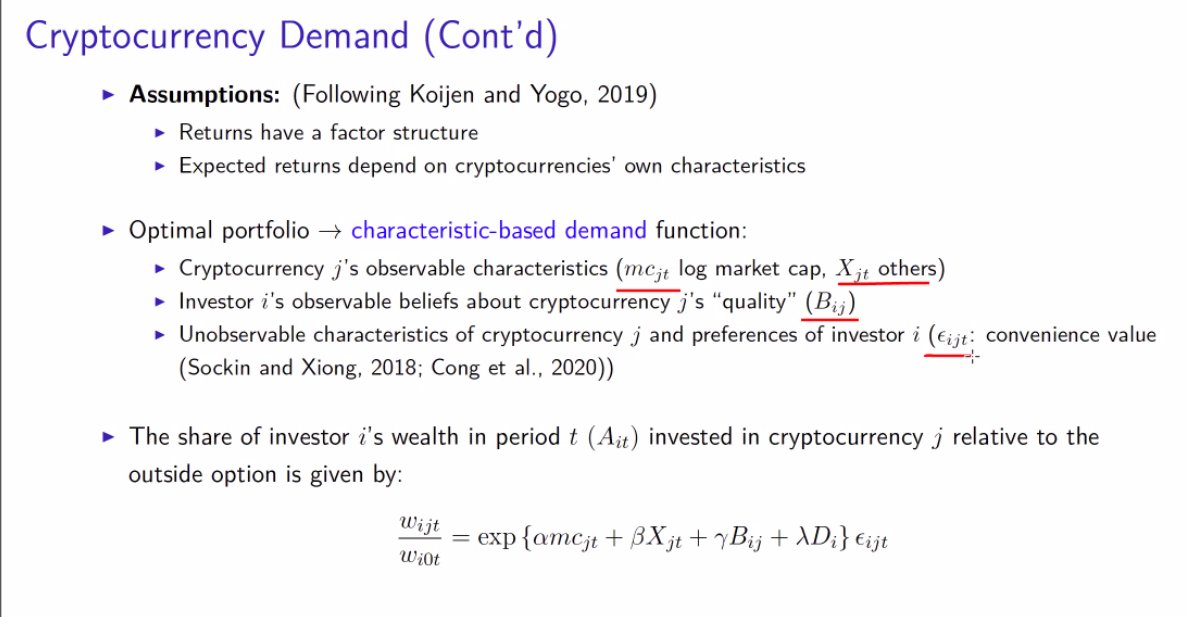

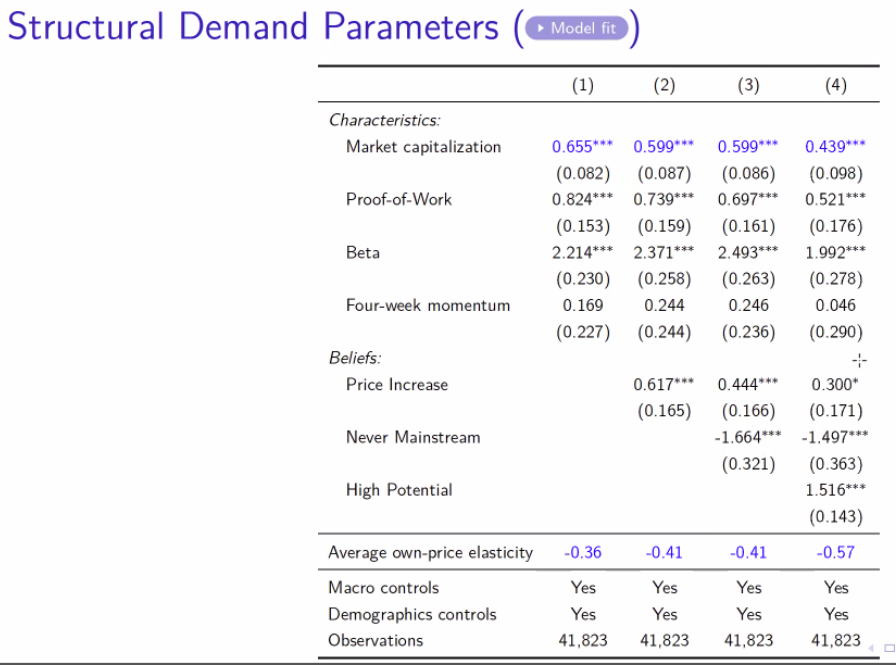

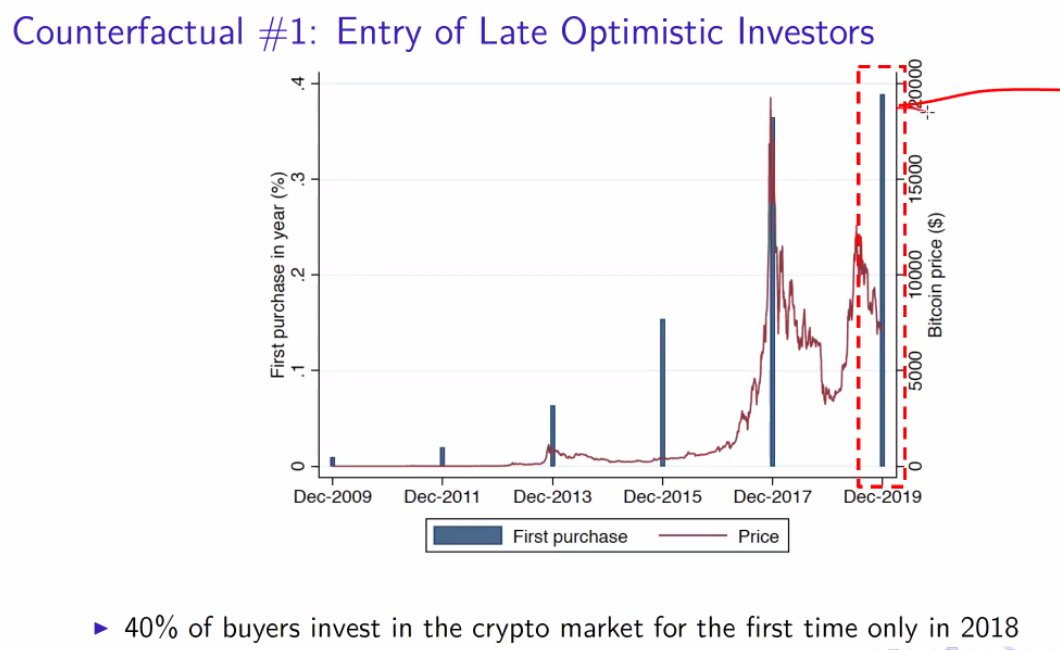

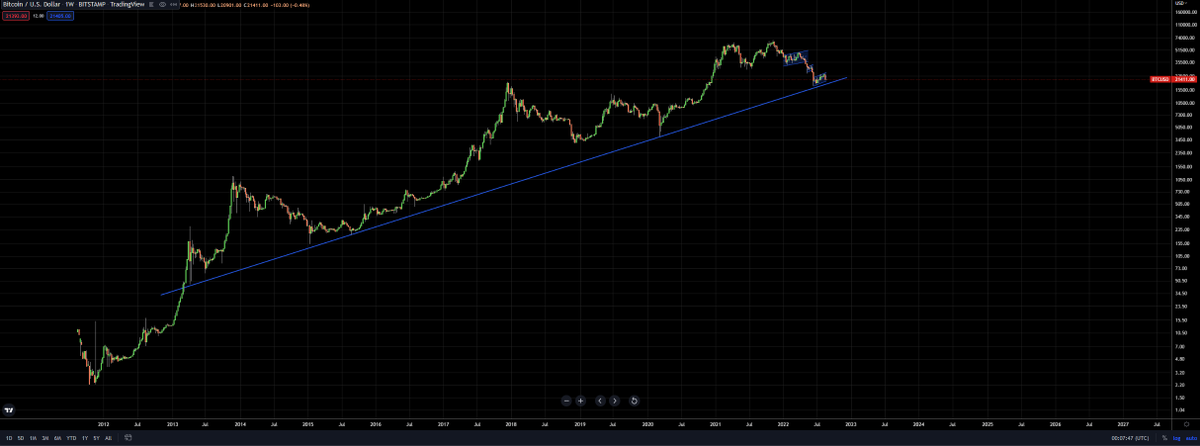

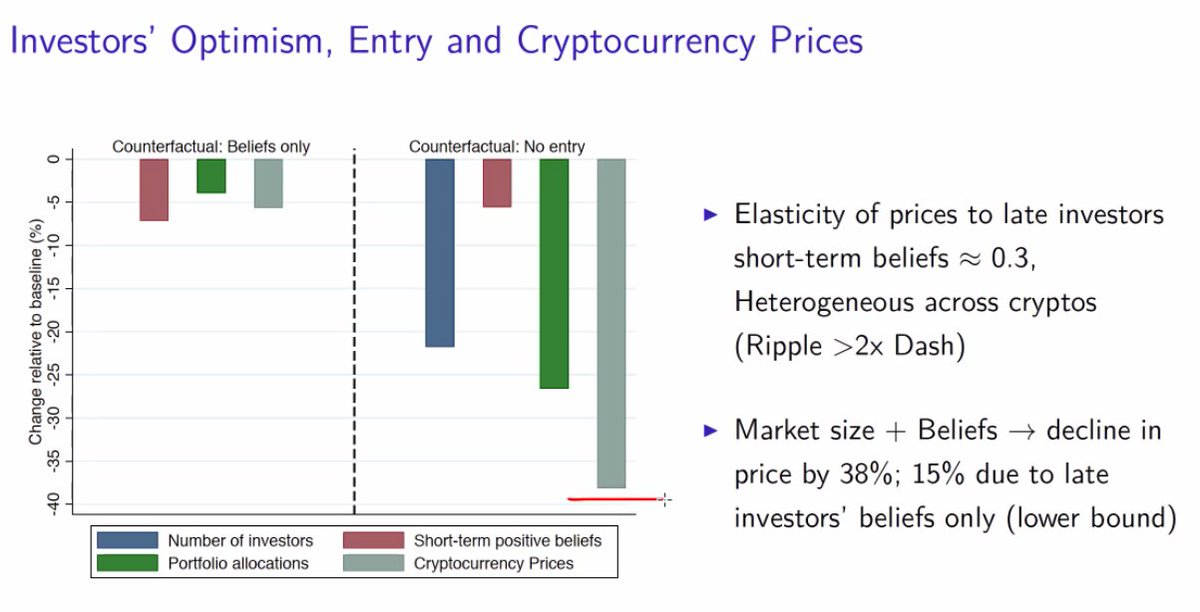

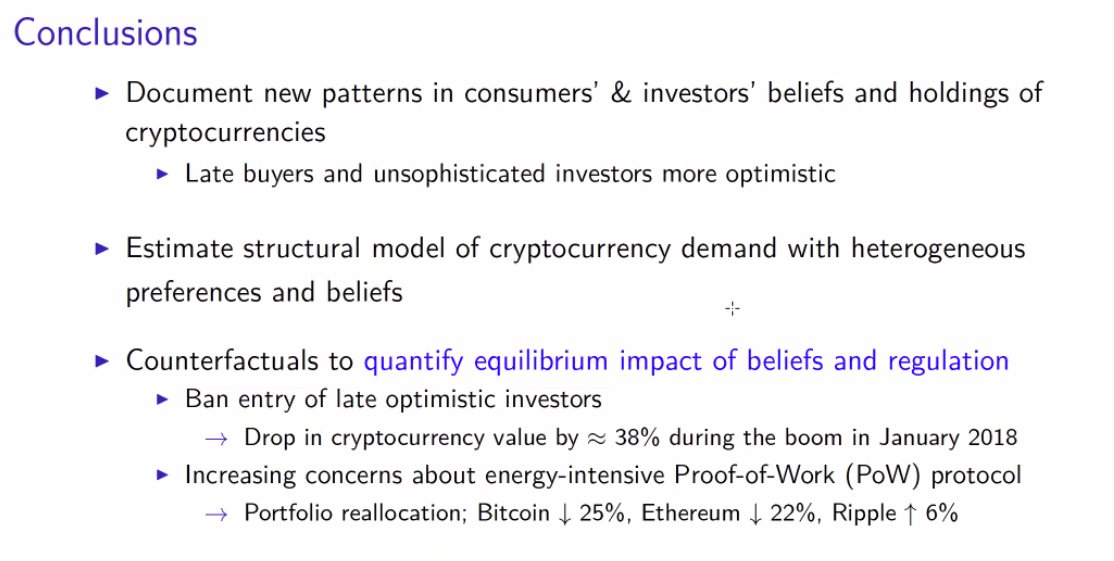

Excellent paper by Giovanni Compiani & Matteo Benetoon of UC Berkley on the role of belief in the price action of digital assets over demographics (early vs. late buyers & age).

cowles.yale.edu/3a/bcwp-invest…

cowles.yale.edu/3a/bcwp-invest…

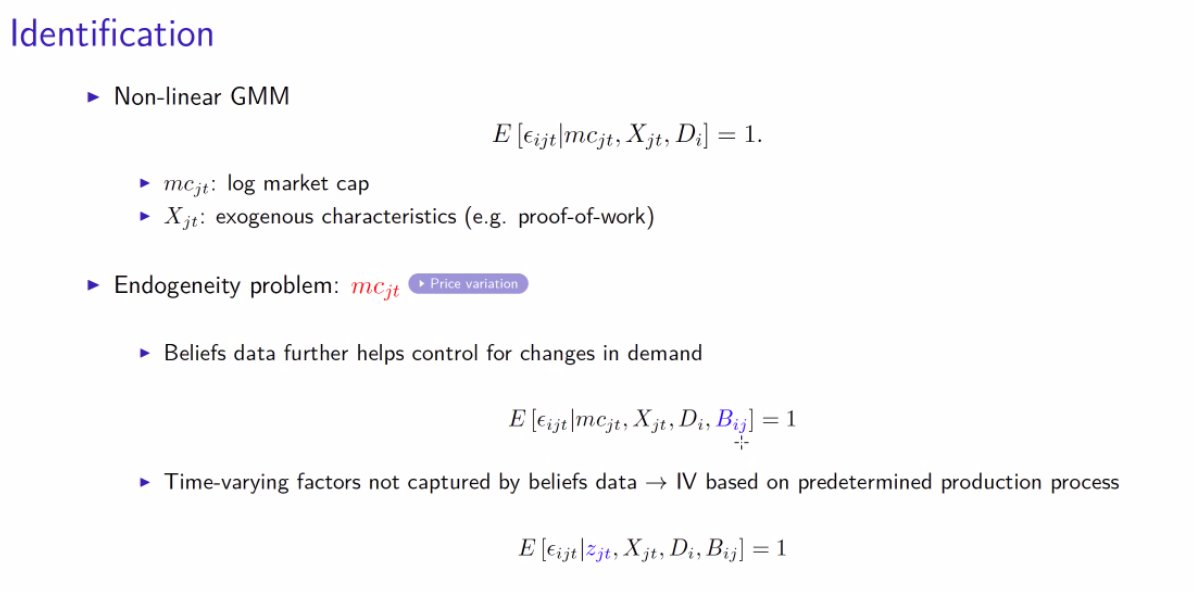

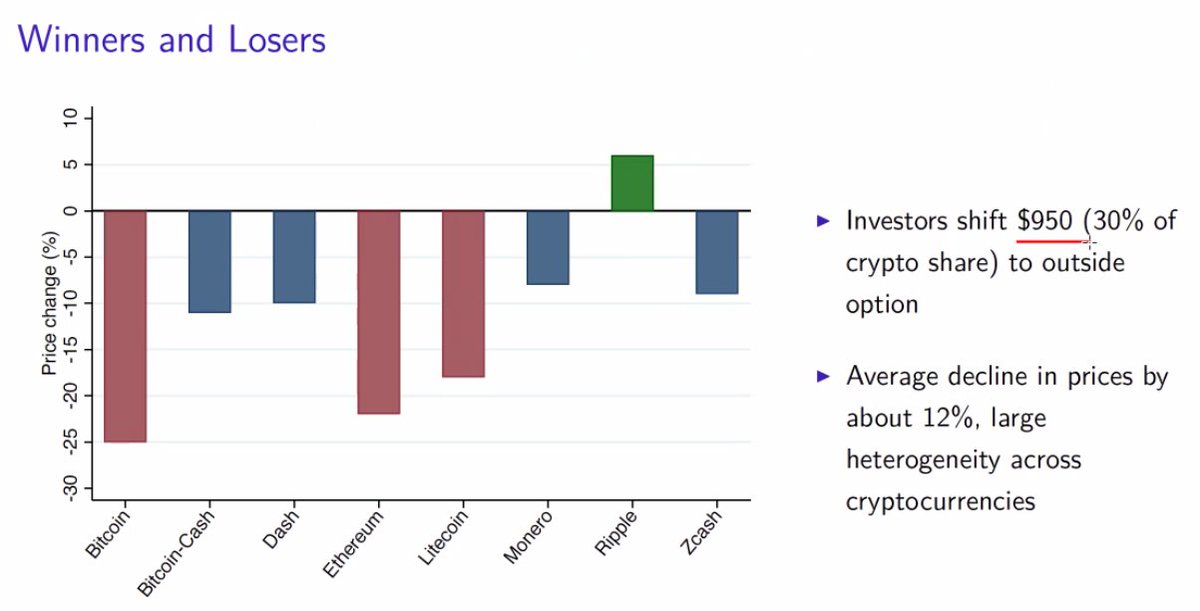

Narrative on the environmental impacts of PoW on prices leads to a perceived winner (reallocation) to non-PoW digital assets. This is expected.

• • •

Missing some Tweet in this thread? You can try to

force a refresh