Co-Founder & Manager - Onami Press

Co-Founder & Manager - XAO DAO

VP R&D - Sindric Solutions

President - Block Digital

Nuclear Eng. /UWUA Local 590

5 subscribers

How to get URL link on X (Twitter) App

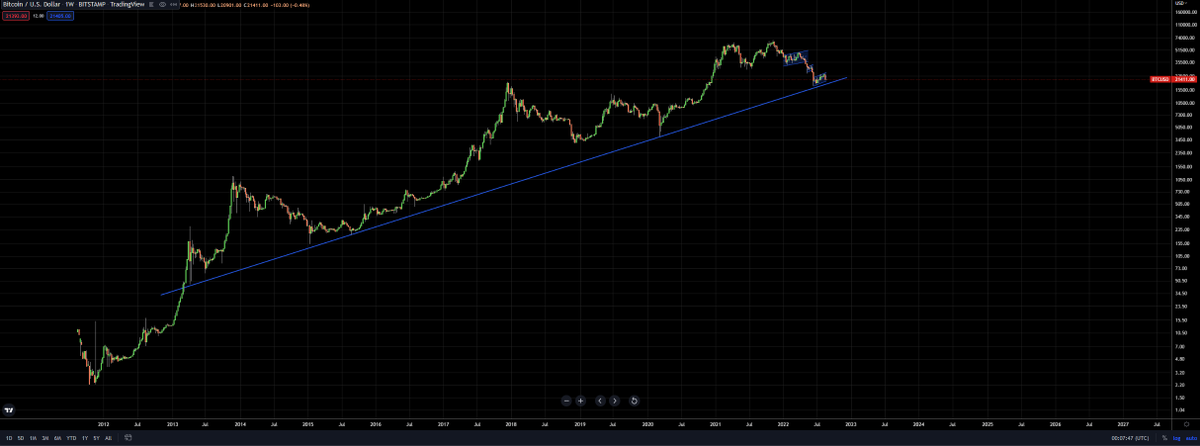

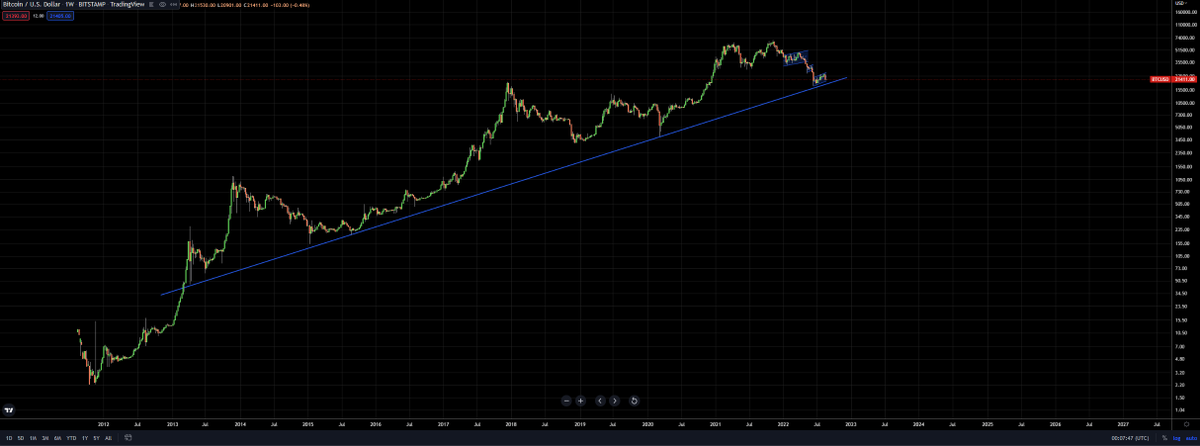

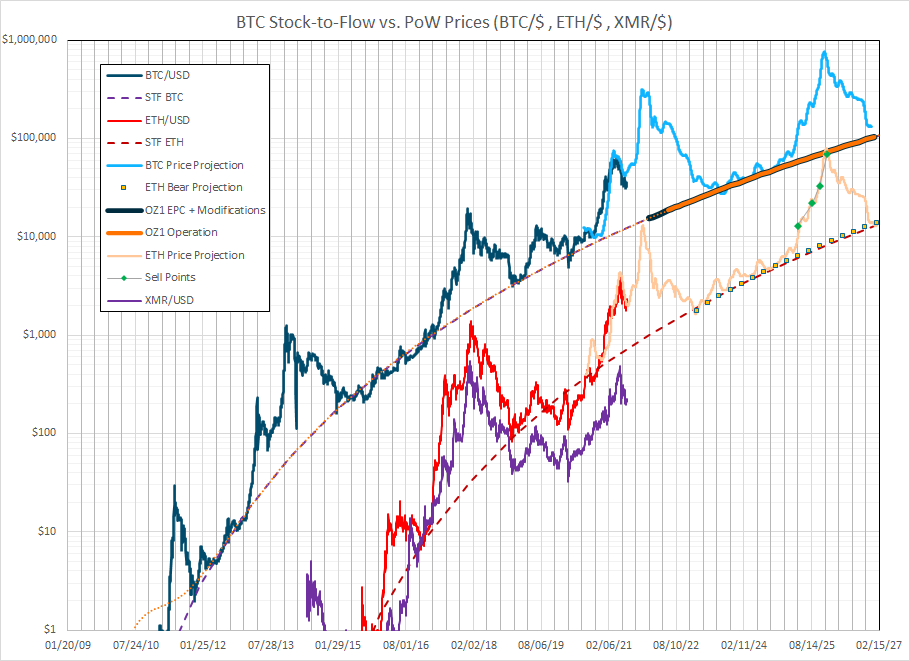

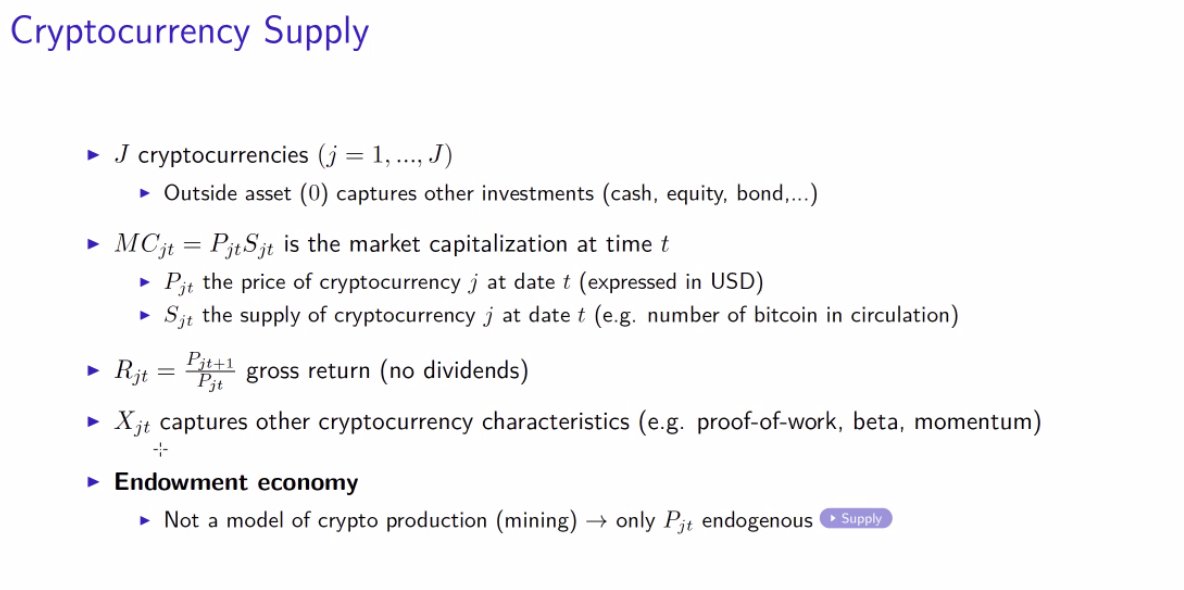

2/ What isn't discussed was that the monetary regime that established the growth of the network in the first place, as a value capacitor for excess liquidity, was always in relation to central bank policy. Value flowed into the network in search of yield (outperformance) vs. risk

2/ What isn't discussed was that the monetary regime that established the growth of the network in the first place, as a value capacitor for excess liquidity, was always in relation to central bank policy. Value flowed into the network in search of yield (outperformance) vs. risk

https://twitter.com/TCHtweets/status/1470821050447454215Oh, and FinTechs, you're on the hit list too!

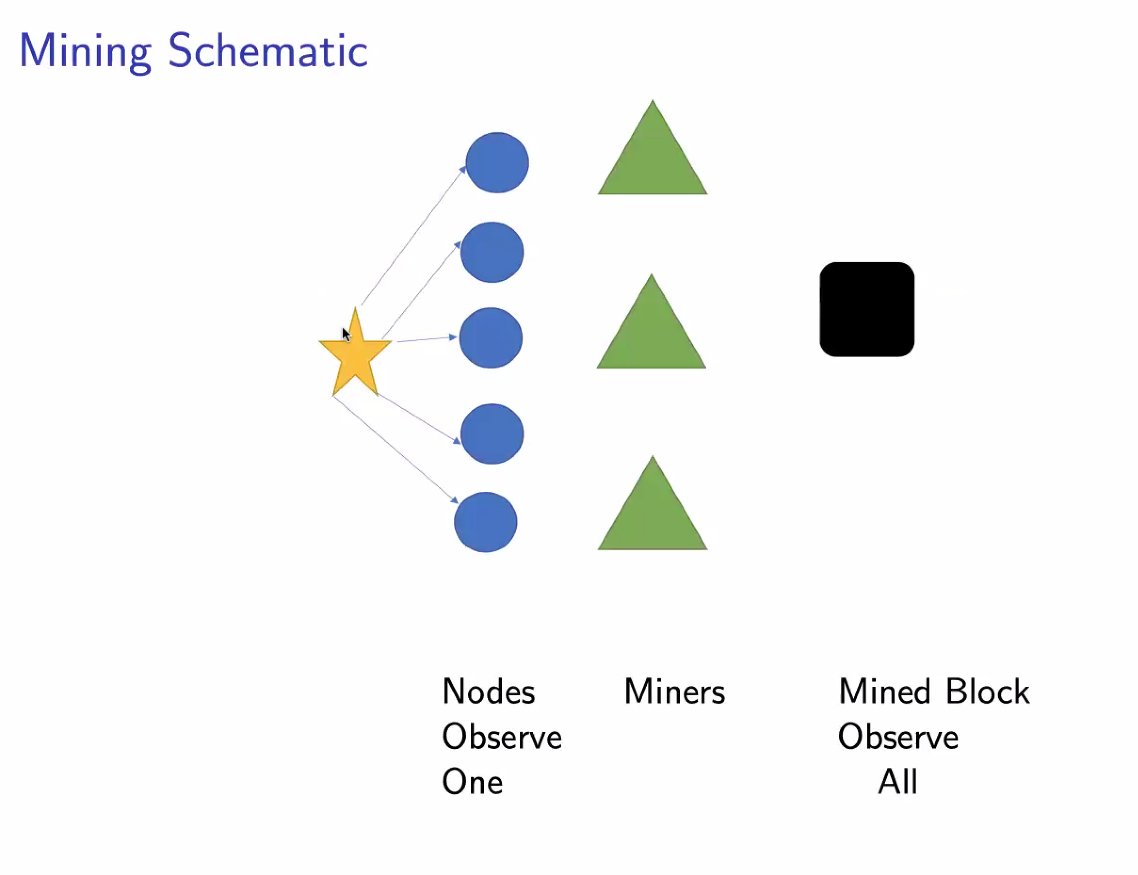

Strategic Capacity Management is the name of the game. Keep your resource at a premium at all times, even if means not delivering on the end user. Wow! Talk about being held hostage when blocks are left underutilized even during congested periods.

Strategic Capacity Management is the name of the game. Keep your resource at a premium at all times, even if means not delivering on the end user. Wow! Talk about being held hostage when blocks are left underutilized even during congested periods.

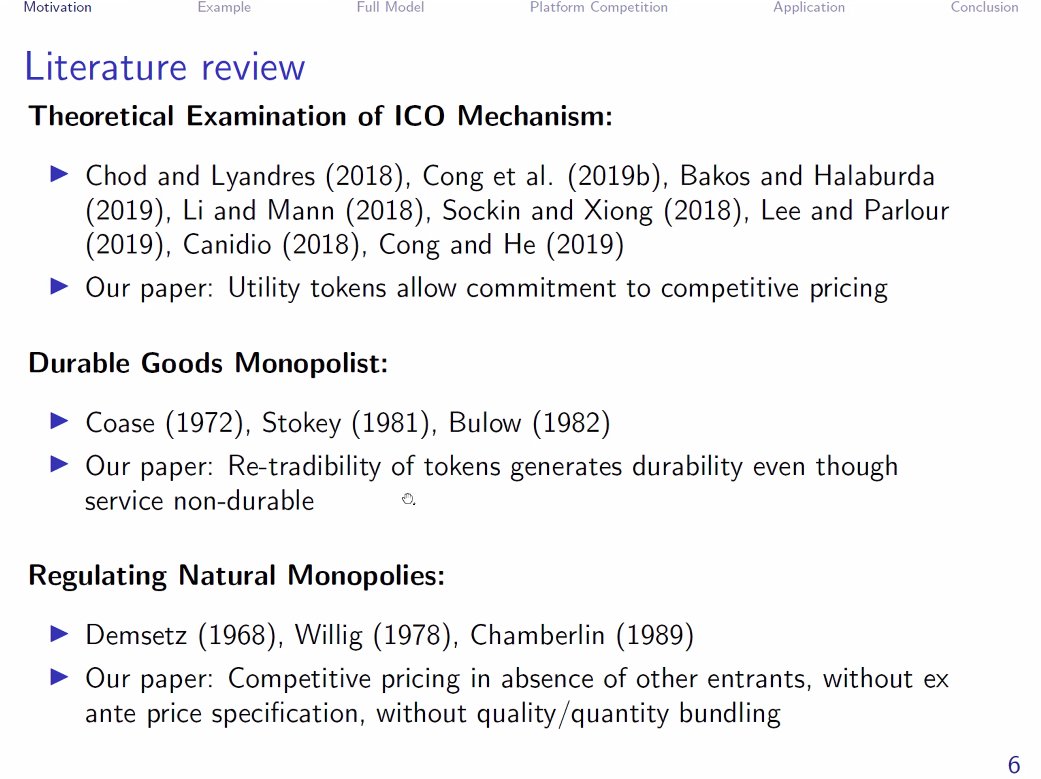

Entrepreneurs essentially become issuing mini-central banks in their micro-economy that represent the platform network but with predetermined issuance policy that participants can transparently view.

Entrepreneurs essentially become issuing mini-central banks in their micro-economy that represent the platform network but with predetermined issuance policy that participants can transparently view.

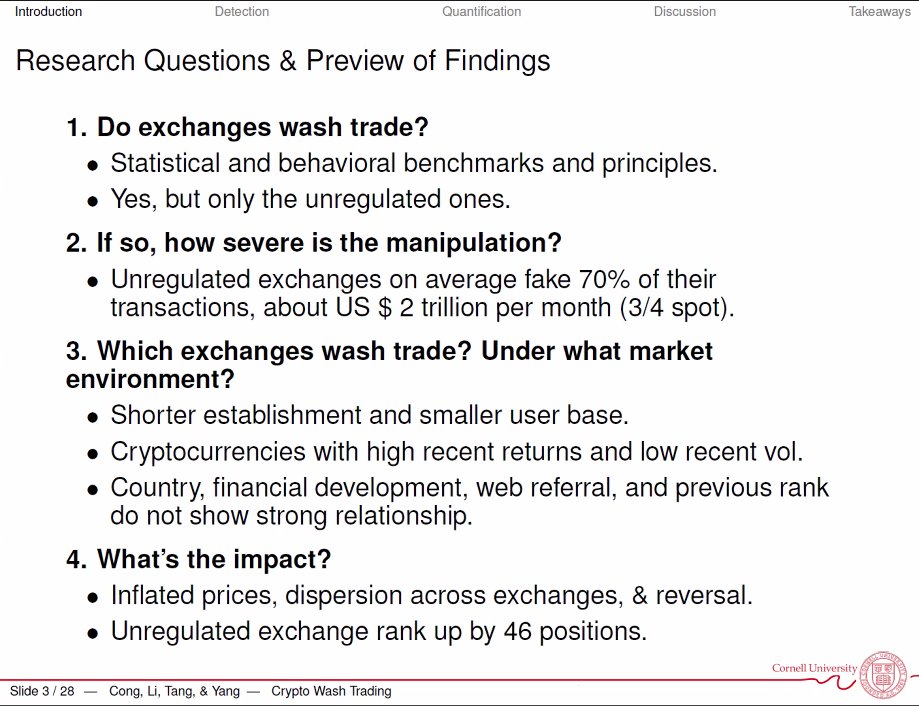

XRP is the favorite to spook wash trading, but the arbitrage bots collapse the effect in less than 1 week. Likely due to low final settlement chain fees & large investor base.

XRP is the favorite to spook wash trading, but the arbitrage bots collapse the effect in less than 1 week. Likely due to low final settlement chain fees & large investor base.

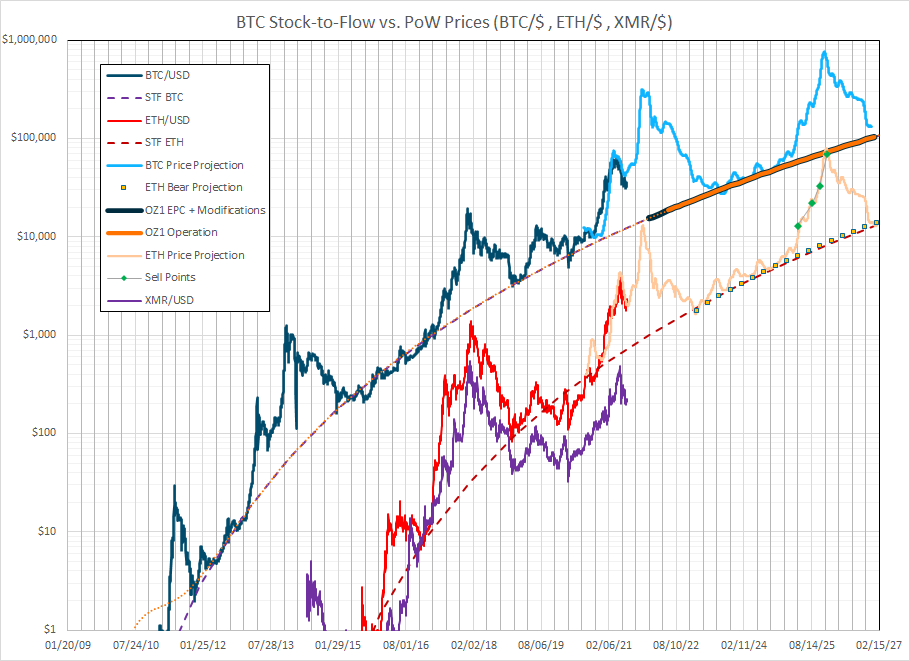

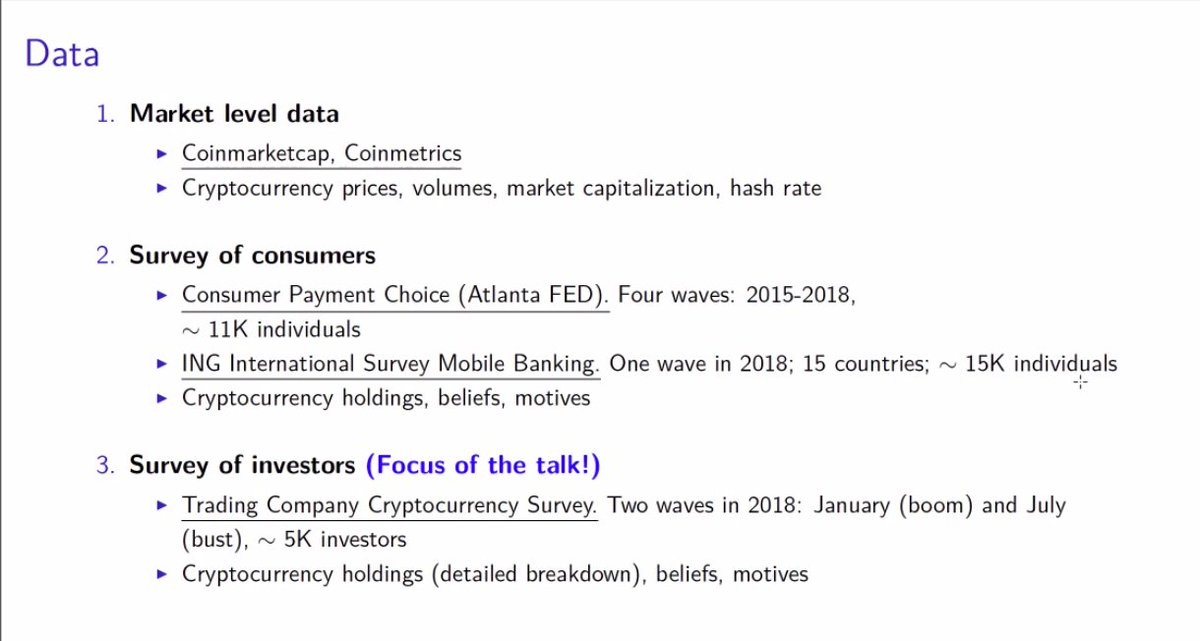

Creating the model and sorting out some relative effects on a the data set.

Creating the model and sorting out some relative effects on a the data set.

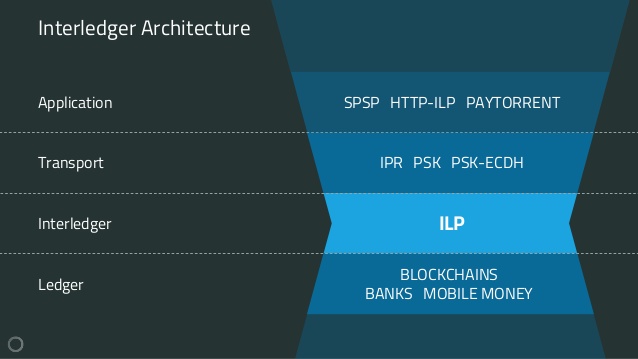

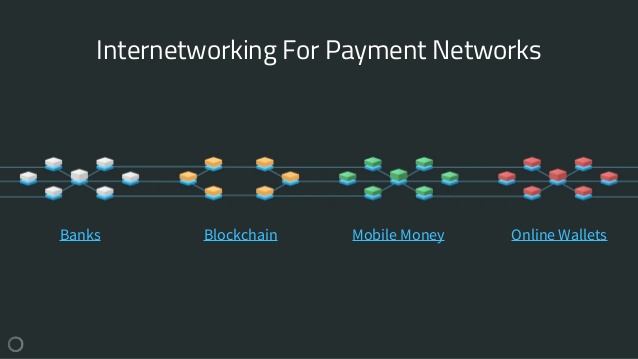

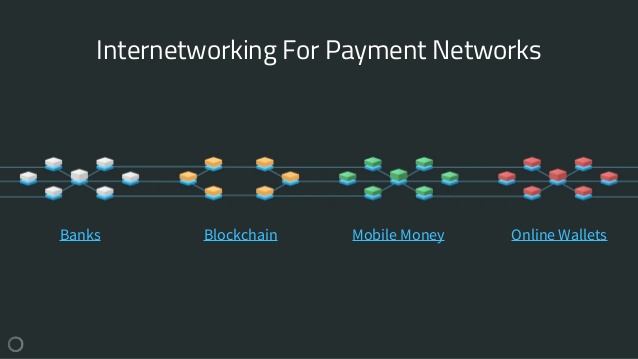

2/ The underlying architecture rests on top of accessible ledgers, like API enabled PayPal, or public permissionless blockchains like BTC. ILP enables the routing of value packets across these ledgers. ILP stacks become interoperable.

2/ The underlying architecture rests on top of accessible ledgers, like API enabled PayPal, or public permissionless blockchains like BTC. ILP enables the routing of value packets across these ledgers. ILP stacks become interoperable.