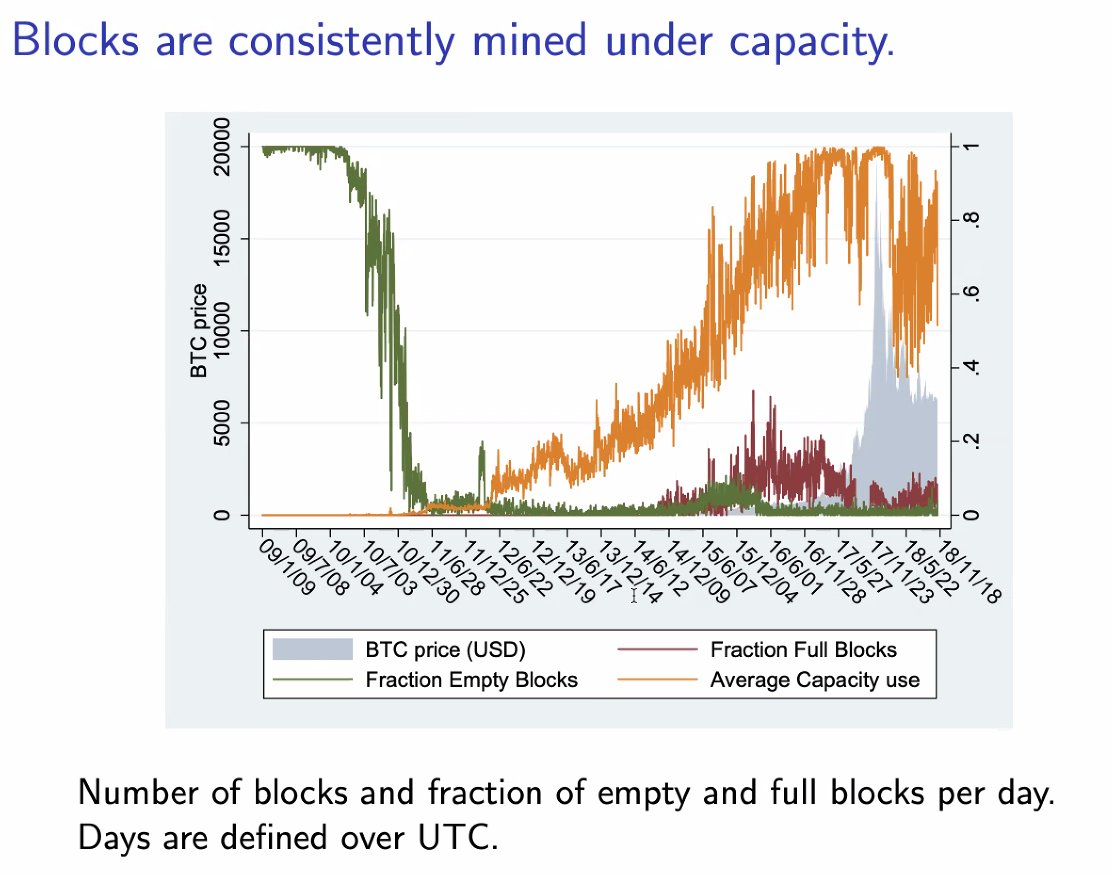

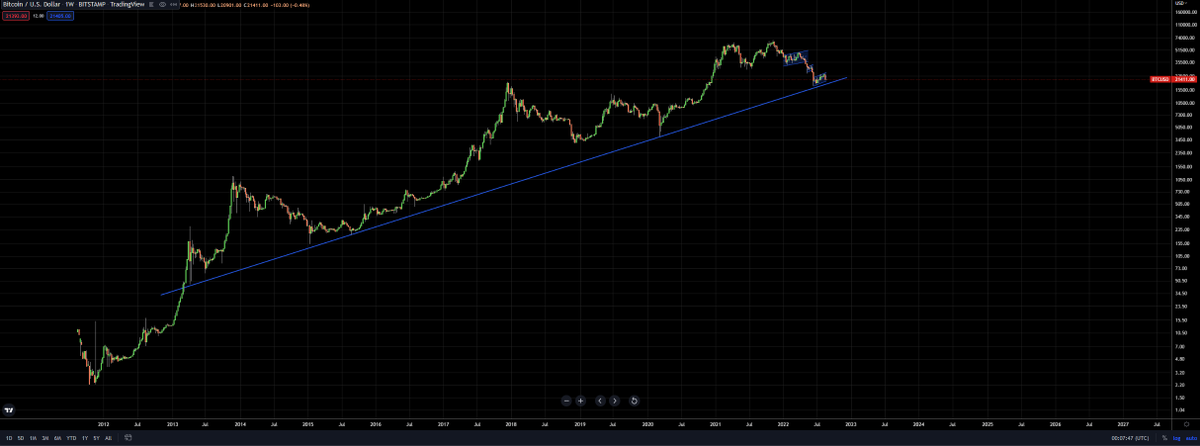

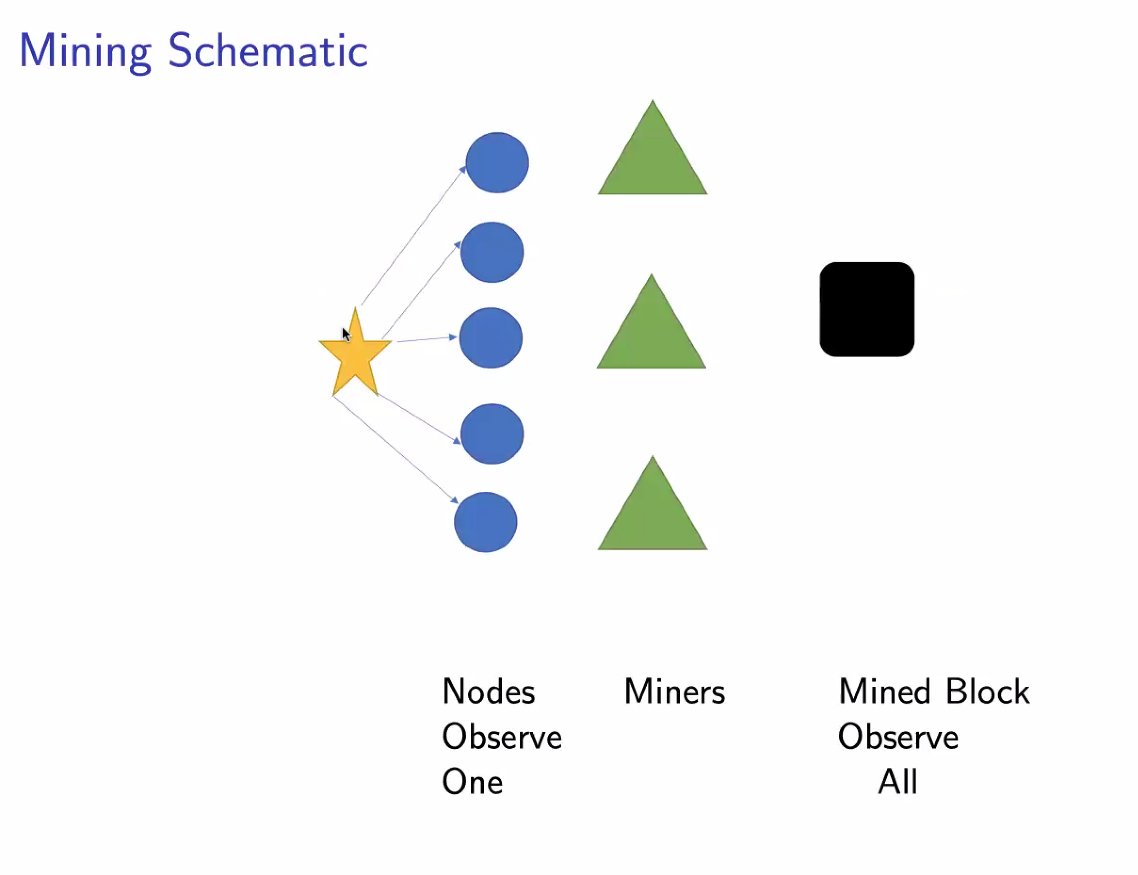

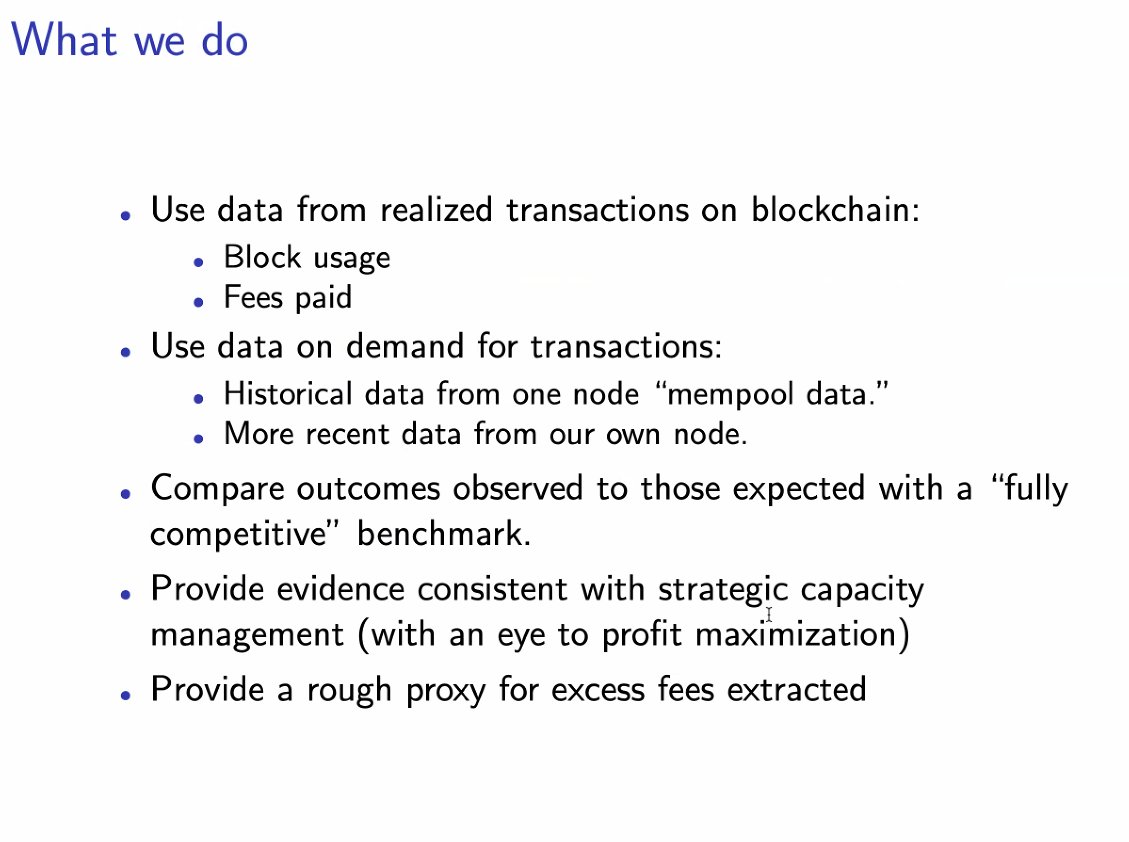

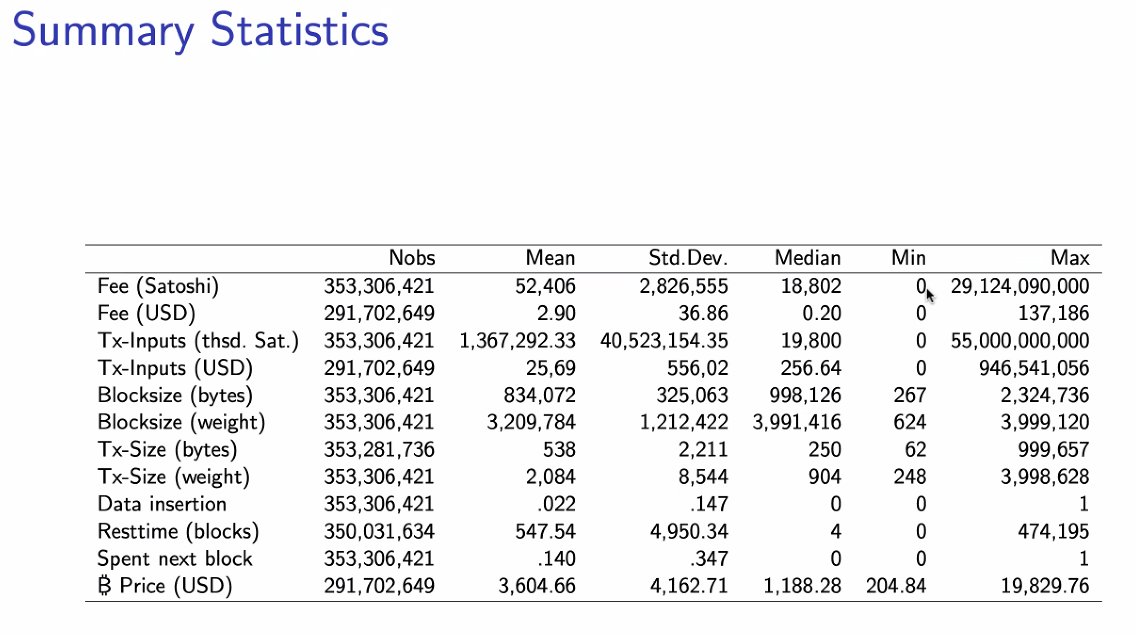

This should make you angry if you use PoW chains that utilize concentrated mining pools. Shows via data that there is likely collusion in processing mempool fees are processed & overall resources optimized for the miners. Why anyone would build a financial system on top of this?

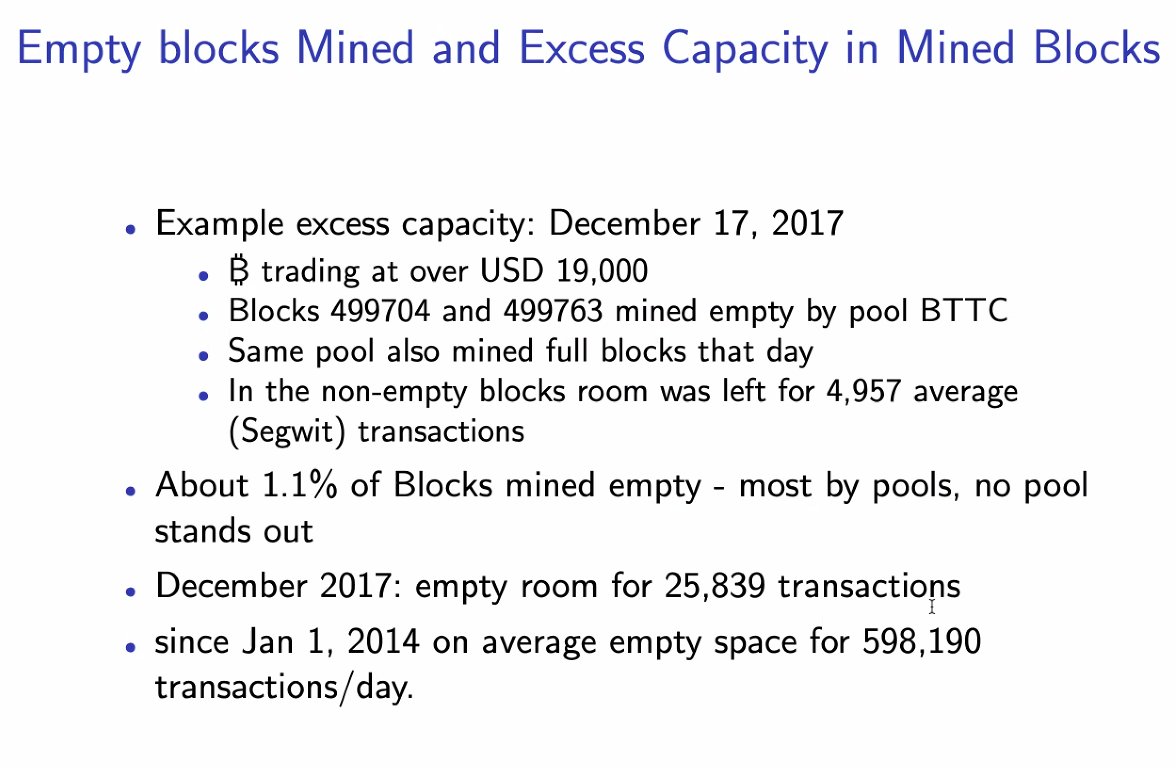

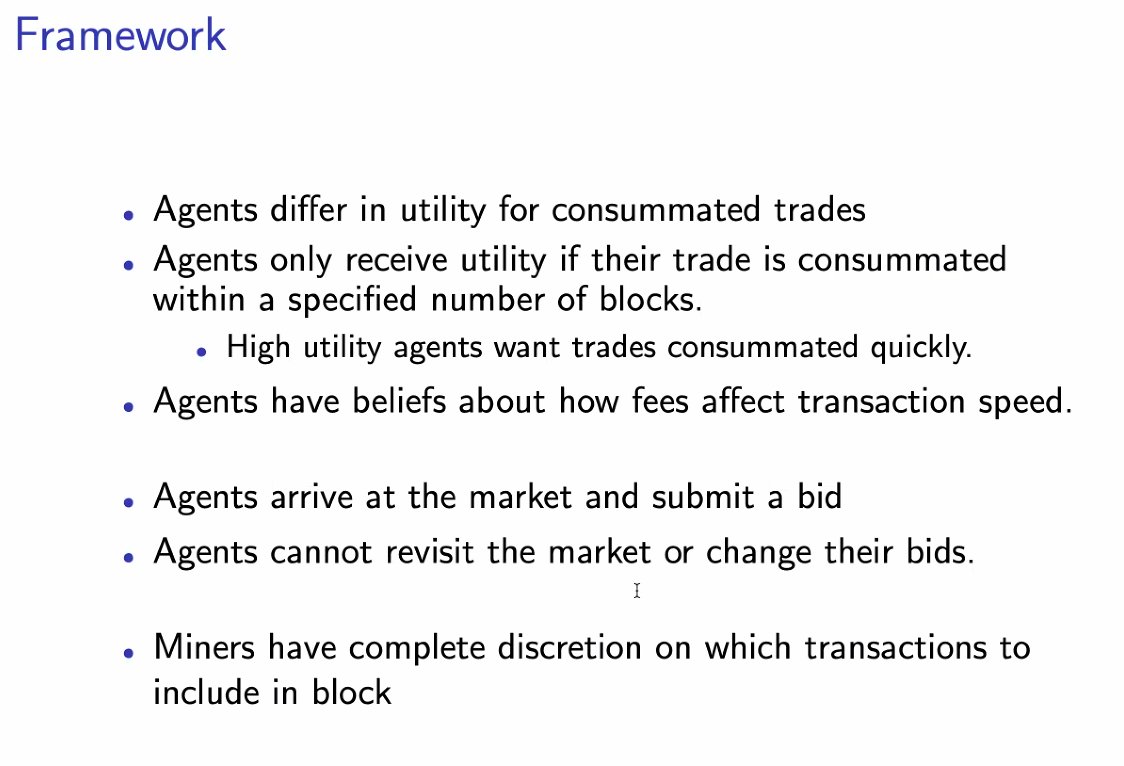

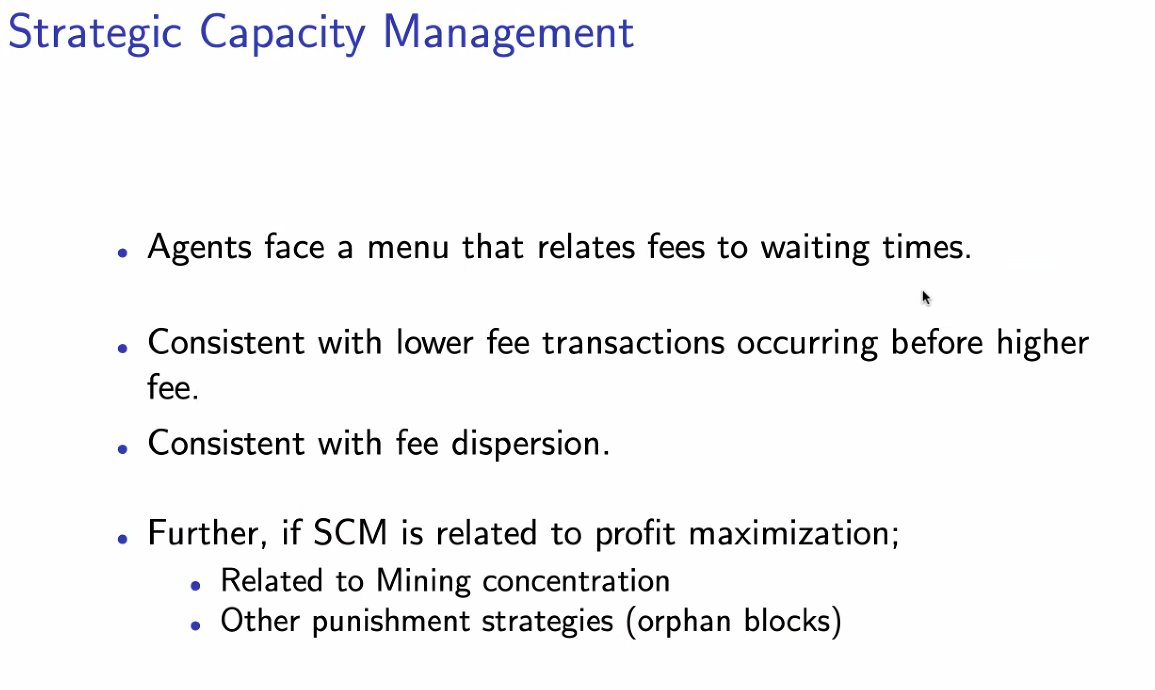

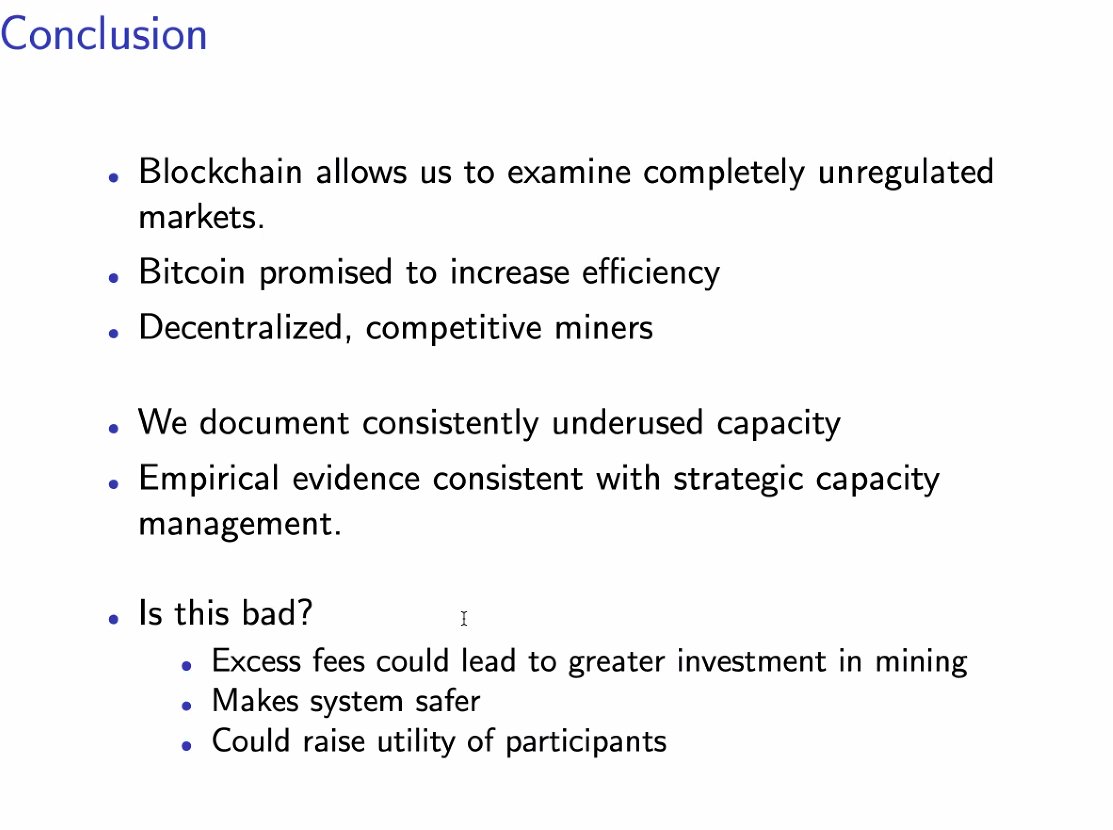

Strategic Capacity Management is the name of the game. Keep your resource at a premium at all times, even if means not delivering on the end user. Wow! Talk about being held hostage when blocks are left underutilized even during congested periods.

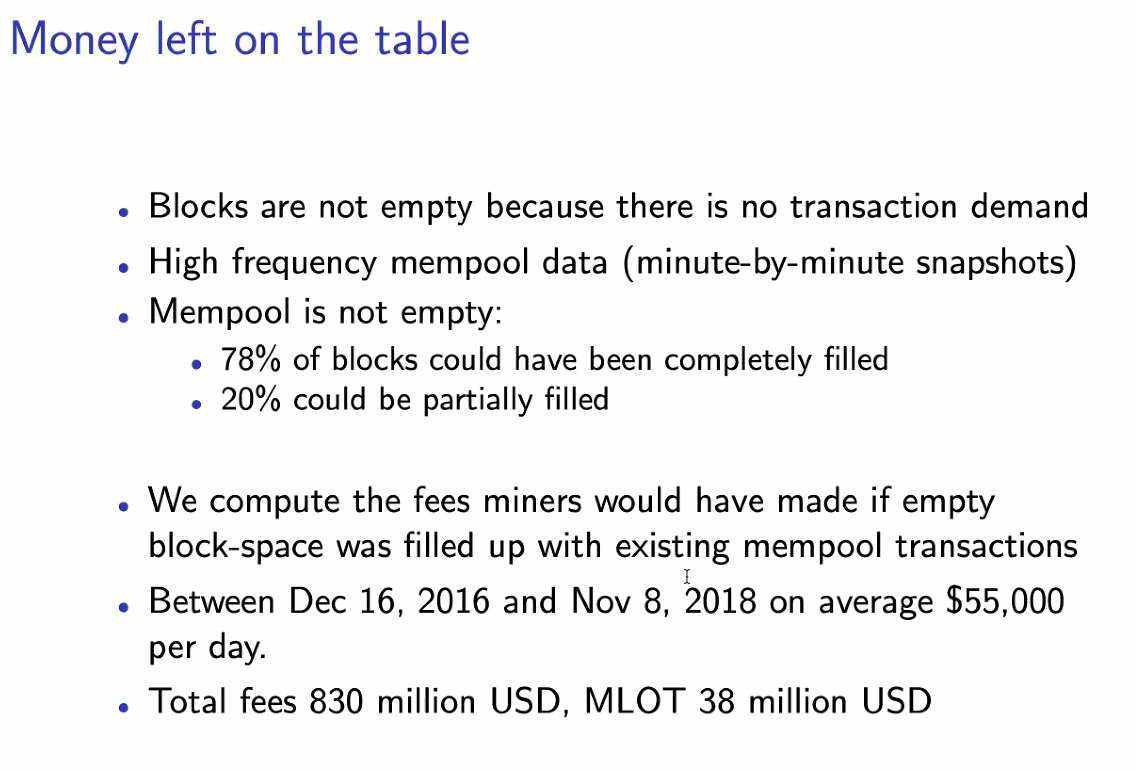

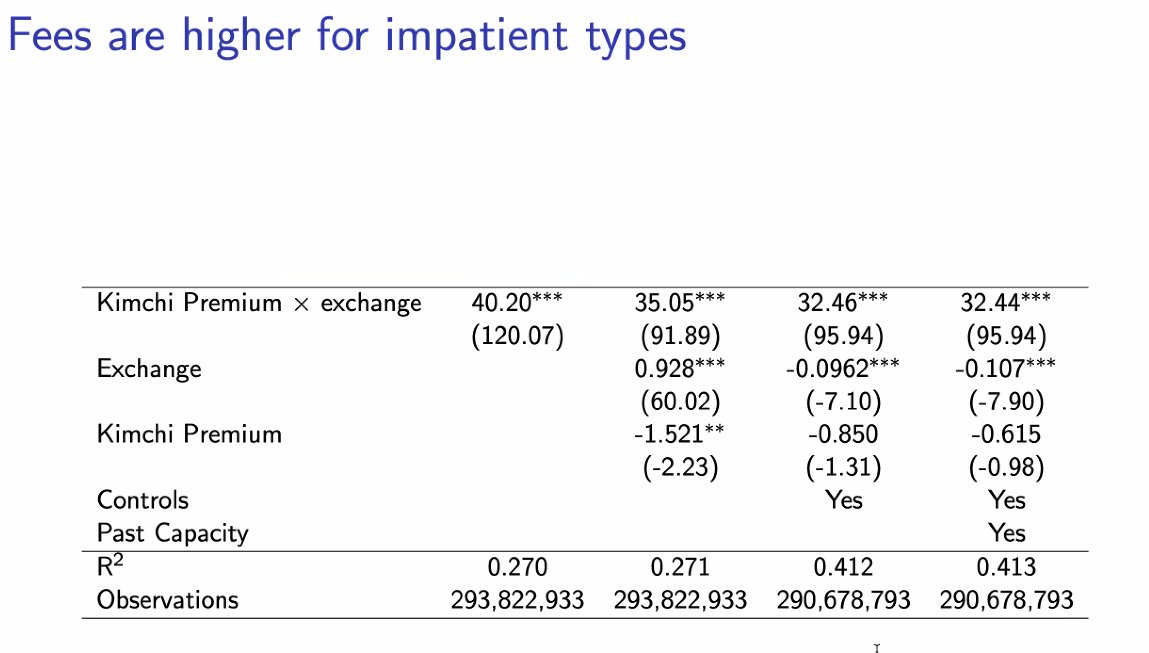

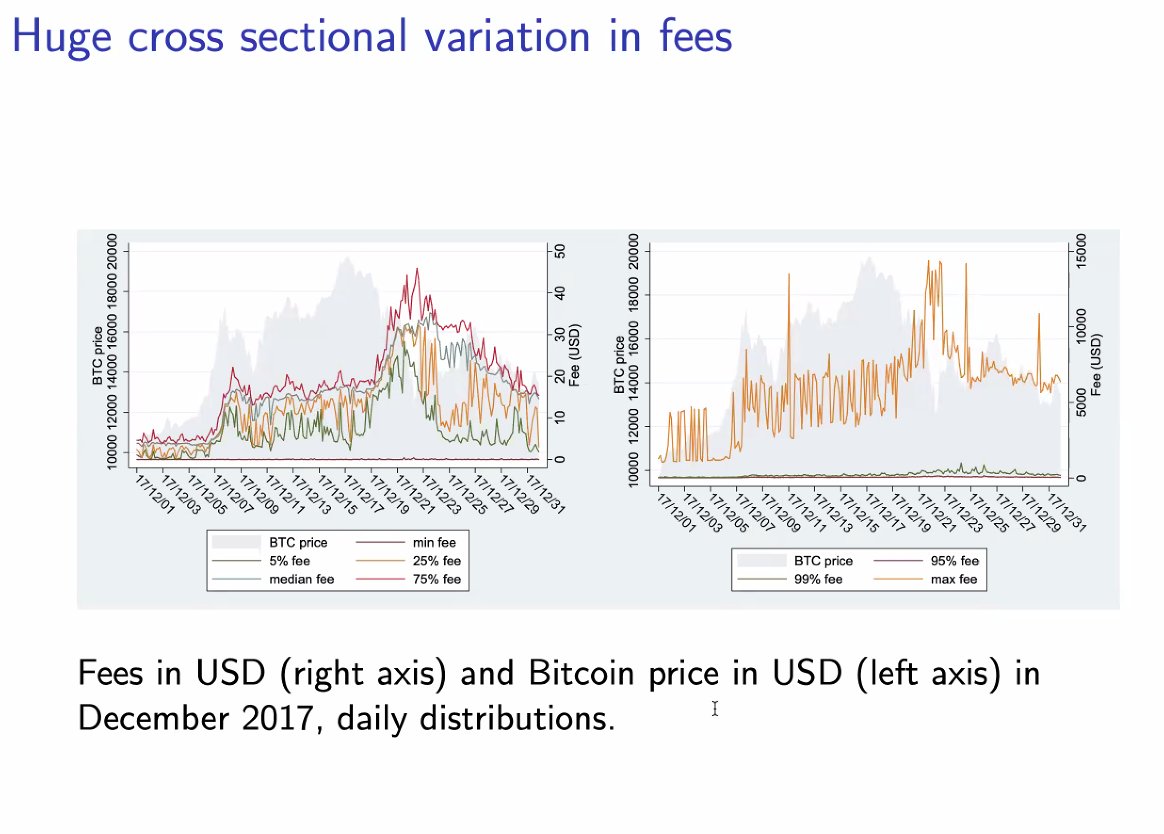

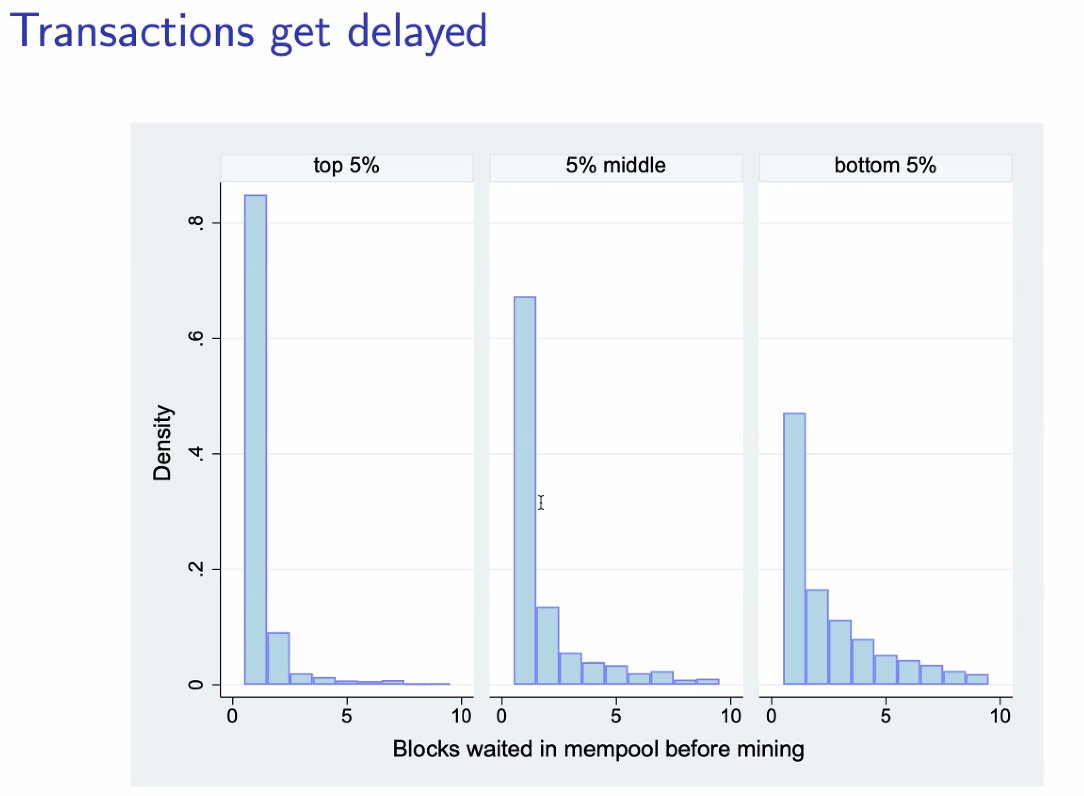

Do you think paying the higher fees means you'll get to the front of the line all the time? WRONG. Notice that when everyone heads for the exits is when you are held hostage most, the irony!

Proof that just because you receive a menu quote for your fee priority, it doesn't at all mean priority.

Mining pools punish each other for daring to keep the system running smoothly in the form of uncle rejects. I though we were trying to get rid of monopolist rent seekers. This is not the way.

Even at the most efficient utilization of block space for settlement does not guarantee that a competitive security framework will yield fair fees for the end user. This means only the rich will have the assurance of final settlement in due time. No thanks, issuance is not enough

• • •

Missing some Tweet in this thread? You can try to

force a refresh