#RBIPolicy

RBI's monetary policy committee (MPC) outcome is to be announced today at 10 am.

We thought of writing an explainer thread🧵on key RBI Monetary policy tools & their implications. This should help you understand the policy better.

Please RT to educate more folks.

1/n

RBI's monetary policy committee (MPC) outcome is to be announced today at 10 am.

We thought of writing an explainer thread🧵on key RBI Monetary policy tools & their implications. This should help you understand the policy better.

Please RT to educate more folks.

1/n

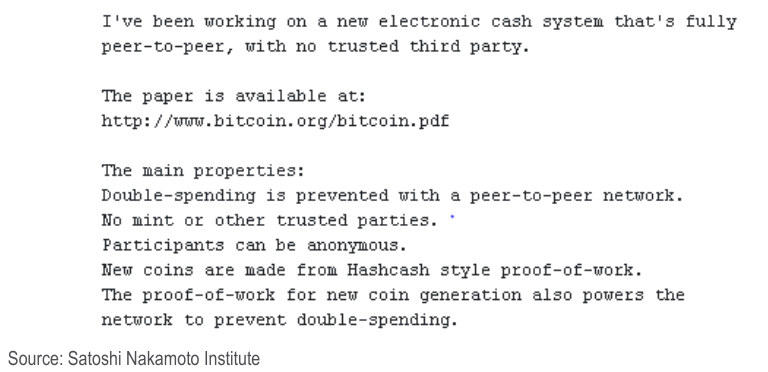

What is Monetary policy?

Monetary policy is the use of instruments under the control of the central bank to regulate:

✅Supply, cost and use of money & credit

With end objective of controlling:

✅Inflation, Liquidity, Balances, Exchange rate and overall financial stability

2/n

Monetary policy is the use of instruments under the control of the central bank to regulate:

✅Supply, cost and use of money & credit

With end objective of controlling:

✅Inflation, Liquidity, Balances, Exchange rate and overall financial stability

2/n

What are the tools used by RBI?

RBI (or any Central Bank) has various tools at its disposal to achieve its above-mentioned objectives. We have noted these tools in the left half of image below 👇

3/n

RBI (or any Central Bank) has various tools at its disposal to achieve its above-mentioned objectives. We have noted these tools in the left half of image below 👇

3/n

Let's understand how these tools work:

𝟏. 𝐑𝐞𝐩𝐨 𝐑𝐚𝐭𝐞: 𝟒.𝟎%

✅Repo or repurchase rate is the interest rate at which RBI lends money to Banks against govt. securities

✅Key tool used to control inflation – inverse relationship

We have explained the cycle below:

4/n

𝟏. 𝐑𝐞𝐩𝐨 𝐑𝐚𝐭𝐞: 𝟒.𝟎%

✅Repo or repurchase rate is the interest rate at which RBI lends money to Banks against govt. securities

✅Key tool used to control inflation – inverse relationship

We have explained the cycle below:

4/n

𝟐. 𝐑𝐞𝐯𝐞𝐫𝐬𝐞 𝐫𝐞𝐩𝐨 𝐫𝐚𝐭𝐞: 𝟑.𝟑𝟓%

✅Rate at which Banks park money with RBI or RBI borrows money from commercial banks

✅Used to control the money supply in the country – inverse relationship

RBI uses Repo & RR in conjunction.

We've explained the cycle below:

5/n

✅Rate at which Banks park money with RBI or RBI borrows money from commercial banks

✅Used to control the money supply in the country – inverse relationship

RBI uses Repo & RR in conjunction.

We've explained the cycle below:

5/n

𝟑. 𝐁𝐚𝐧𝐤 𝐫𝐚𝐭𝐞: 𝟒.𝟐𝟓%

✅Also known as discount rate, it is the rate at which RBI lends to banks or rediscounts their bills

✅If bank rate is increased, then banks also charge higher interest rate on loans given to public, so as to pass increased cost from RBI.

6/n

✅Also known as discount rate, it is the rate at which RBI lends to banks or rediscounts their bills

✅If bank rate is increased, then banks also charge higher interest rate on loans given to public, so as to pass increased cost from RBI.

6/n

𝟒. 𝐂𝐚𝐬𝐡 𝐑𝐞𝐬𝐞𝐫𝐯𝐞 𝐑𝐚𝐭𝐢𝐨 (𝐂𝐑𝐑): 𝟒.𝟎%

✅Share of bank deposits that are required to be maintained by Banks as cash reserves

✅Parked with RBI; Banks don’t earn any interest

✅To control liquidity & inflation

✅After🔽to 3% last year, RBI restored it to 4%

7/n

✅Share of bank deposits that are required to be maintained by Banks as cash reserves

✅Parked with RBI; Banks don’t earn any interest

✅To control liquidity & inflation

✅After🔽to 3% last year, RBI restored it to 4%

7/n

𝟓. 𝐒𝐭𝐚𝐭𝐮𝐭𝐨𝐫𝐲 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐑𝐚𝐭𝐢𝐨 (𝐒𝐋𝐑): 18.25%

✅Share of deposits to be kept as liquid assets, such as G-Sec, Treasury bills, etc notified by RBI

✅Kept with the banks themselves & earns G-Sec rate

✅To control the Bank’s leverage for credit expansion

8/n

✅Share of deposits to be kept as liquid assets, such as G-Sec, Treasury bills, etc notified by RBI

✅Kept with the banks themselves & earns G-Sec rate

✅To control the Bank’s leverage for credit expansion

8/n

𝟔. 𝐎𝐩𝐞𝐧 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬: Used as last resort

✅Under OMO, RBI conducts open market sale or purchase of G-Secs to control liquidity

✅When RBI buys G-Secs, it pays the buyer (banks/public), 🔼 liquidity and vice versa

Watch:

9/n

✅Under OMO, RBI conducts open market sale or purchase of G-Secs to control liquidity

✅When RBI buys G-Secs, it pays the buyer (banks/public), 🔼 liquidity and vice versa

Watch:

9/n

7. How do all these tools tie together?

RBI policy works as a virtuous continuous cycle as explained in the chart below

RT if this helps.

10/n

(To be continued..)

RBI policy works as a virtuous continuous cycle as explained in the chart below

RT if this helps.

10/n

(To be continued..)

5.1/n

Correction: Increase in reverse repo leads to decline in inflation and vice-versa. Ignore the error is previous image. Refer this:

Correction: Increase in reverse repo leads to decline in inflation and vice-versa. Ignore the error is previous image. Refer this:

Let see how these metrics stack up on RBI's Balance sheet at Mar-21 end?

Understand this via a simplified balance sheet of Indian Banking (image).

As we see Banks are continuing to park excess surplus of ₹8-10 lakh crores with RBI at low reverse repo, earning -ive carry.

11/n

Understand this via a simplified balance sheet of Indian Banking (image).

As we see Banks are continuing to park excess surplus of ₹8-10 lakh crores with RBI at low reverse repo, earning -ive carry.

11/n

In our view:

✅Stimulating Banking credit growth & controlling inflation risk are two key objectives of the RBI currently.

✅RBI is trying to suck excess liquidity out of Banking via tools such as OMO, etc.

Note: CARE doc for Banking credit details

careratings.com/uploads/newsfi…

12/n

✅Stimulating Banking credit growth & controlling inflation risk are two key objectives of the RBI currently.

✅RBI is trying to suck excess liquidity out of Banking via tools such as OMO, etc.

Note: CARE doc for Banking credit details

careratings.com/uploads/newsfi…

12/n

𝐔𝐩𝐝𝐚𝐭𝐞 𝐚𝐧𝐝 𝐯𝐢𝐞𝐰𝐬 𝐨𝐧 𝐭𝐨𝐝𝐚𝐲'𝐬 𝐌𝐏𝐂

✅RBI-MPC kept policy rates unchanged as expected and continued with its accommodative stance

✅Cuts FY22 GDP growth forecast to 9.5% from 10.5% earlier, assuming normal monsoon

✅CPI inflation target of 5.1% for FY22

13/n

✅RBI-MPC kept policy rates unchanged as expected and continued with its accommodative stance

✅Cuts FY22 GDP growth forecast to 9.5% from 10.5% earlier, assuming normal monsoon

✅CPI inflation target of 5.1% for FY22

13/n

✅RBI will be buying G-Sec worth 1.2 lakh crore under G-SAP program

✅10yr bond trading around 6% (marginally higher by 1-2 bps)

✅Interest rate swaps are still pricing in aggressive rate hikes in 2022-2023

✍️Overall most of the announcements were as expected

14/n

✅10yr bond trading around 6% (marginally higher by 1-2 bps)

✅Interest rate swaps are still pricing in aggressive rate hikes in 2022-2023

✍️Overall most of the announcements were as expected

14/n

𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐮𝐭𝐥𝐨𝐨𝐤 𝐚𝐧𝐝 𝐯𝐢𝐞𝐰𝐬:

✅Policy rates are expected to go upto 5.5% in 2023 from current 4%.

✅Contrary to RBI's stance, we @MultipieSocial believe CPI may surprise on higher side and we should see first rate hike by RBI in Q4 of 2021-22.

15/n

Fin.

✅Policy rates are expected to go upto 5.5% in 2023 from current 4%.

✅Contrary to RBI's stance, we @MultipieSocial believe CPI may surprise on higher side and we should see first rate hike by RBI in Q4 of 2021-22.

15/n

Fin.

*infuse excess liquidity

Hope this helped you understand RBI tools & policy better. However, the transmission of RBI policy by Banks has remained an "Expectations versus Reality" conundrum.

This old funny take on transmission issue by @ChandanCartoons remains relevant even today😇.

/End

This old funny take on transmission issue by @ChandanCartoons remains relevant even today😇.

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh