#RBIPolicy | @RBI’s Monetary Policy Committee decides to maintain ACCOMMODATIVE stance as long as necessary

#RBIPolicy | Reverse Repo Rate maintained at 3.35%, MSF rate at 4.25% & Bank Rate at 4.25%

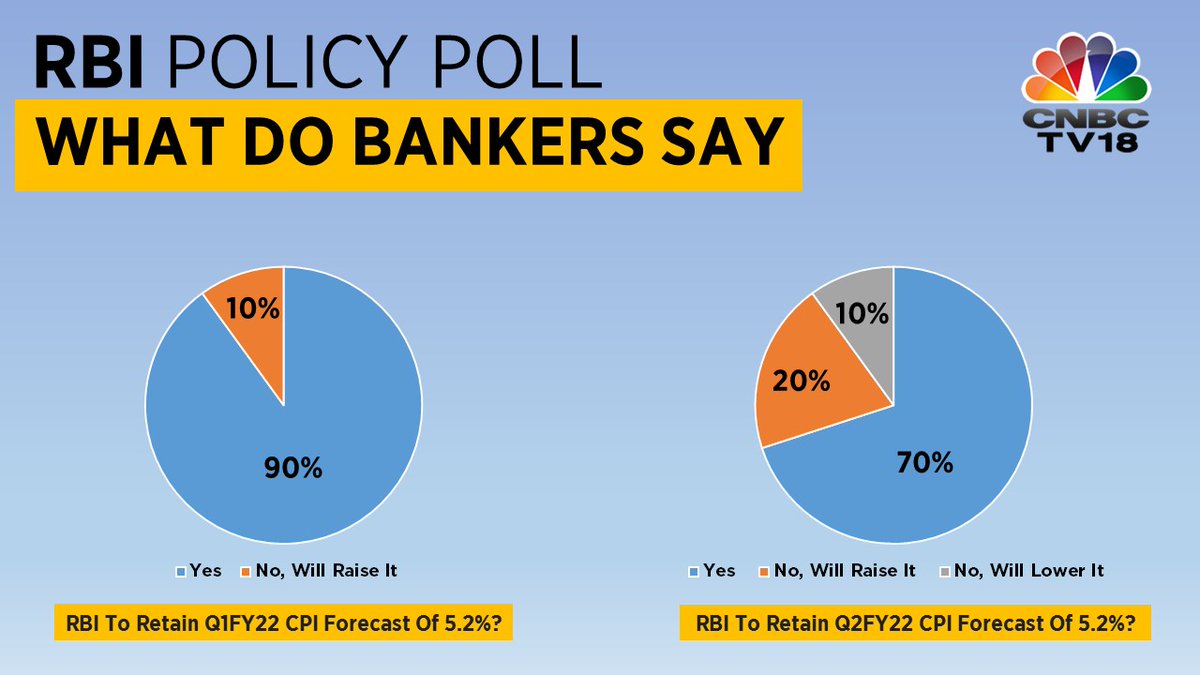

#RBIPolicy | @RBI sees CPI inflation at 5.1% in FY22 with Q1 at 5.2%, Q2 at 5.4%, Q3 at 4.7% & Q4 at 5.3%

#RBIPolicy | Forecast of normal monsoon and resilience of agriculture and farm economy will provide tailwinds to growth revival: @RBI Governor @DasShaktikanta

#RBIPolicy | On-tap liquidity window for contact-intensive sectors (Hotels, Restaurants, Tour Operators, Aviation Ancillary Services, Car Services, Parlours And Salons) of Rs 15,000 cr at repo rate

#RBIPolicy | Special liquidity facility of Rs 16,000 cr for MSMEs via SIDBI For 1-year at repo rate

#RBIPolicy | RRBs allowed to issue CDs with an option to buy back CDs. NAC has emerged as important DBT vehicle, it will be made available for all days of the week from August 1

• • •

Missing some Tweet in this thread? You can try to

force a refresh