Where are we in the #drybulk cycle?

Note: Baltic Dry Index reflects freight rates evolution in aggregate (routes and vessel types) for the Dry Bulk shipping sector. It’s expressed in points. A long-time perspective allows us to see the different cycles and how cyclical it is.

Note: Baltic Dry Index reflects freight rates evolution in aggregate (routes and vessel types) for the Dry Bulk shipping sector. It’s expressed in points. A long-time perspective allows us to see the different cycles and how cyclical it is.

In Feb 2016, BDI reached its lowest point ever, 291 points (huge imbalance between available vessels and cargo demand). Since that moment there has been a sustained recovery, temporarily interrupted by:

❌ 2019: iron ore supply shock (Brumadinho dam collapse).

❌ 2020: covid-19.

❌ 2019: iron ore supply shock (Brumadinho dam collapse).

❌ 2020: covid-19.

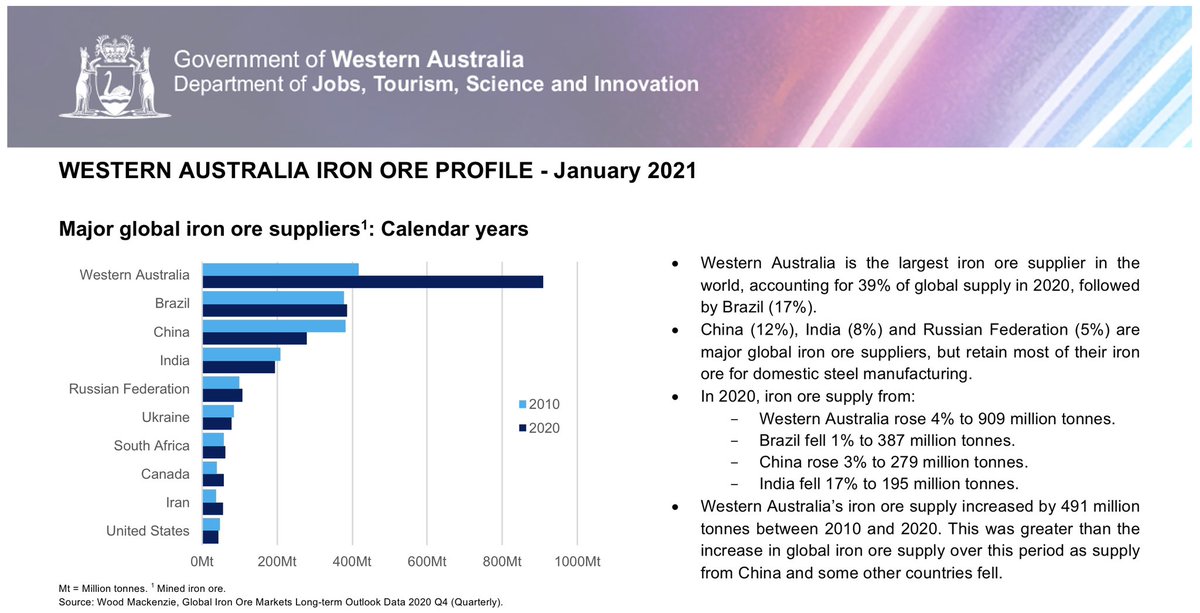

Iron ore is a critical commodity for the sector (#1 by volume and ton-miles), especially Brazilian iron ore (~17% of global exports), which is in high demand from China (huge distance).

Table source: Clarkson Research Services.

Table source: Clarkson Research Services.

Brazilian authorities discontinued operations in similar mines for several weeks to verify dams were in good condition. The accident coincided with the lowest seasonal point for demand in the year. Check how rates usually fall abruptly in Q1 every year. Peak is around Sep-Oct.

Covid was a demand shock. We all know what happened with the global economy being shut down for several months. Sector recovery was impressive though, and in 2021 Q1 we didn’t see the typical drop in rates.

It’s sure that economic stimulus packages have to do with the big rebound but it seems clear to me that there is also an underlying healthy equilibrium between demand and supply underpinned by the lowest newbuilding orderbook in several decades (less than 6% of the current fleet)

Conclusion: those two events, black swan category according to most people, have temporarily masqueraded the solid fundamentals of fhe #drybulk shipping sector. New vessels supply under control until 2024. I think we’re just at the beginning of a very profitable era.

$NMM $SBLK

$NMM $SBLK

By long-term perspective I meant this. China joining WTO in 2001 was a defining moment for the next 15 years. It not only produced a super bubble/cycle, but also an enormous vessel supply glut that the sector has been digesting for the most part of the last decade.

#drybulk history in one shot.

2011 and 2012 recorded the biggest deliveries ever. Shipyards normally need between 12-18 months to deliver a bulker, depending on vessel specifications and idle capacity (currently they are busy fulfilling mega large boxship 🚢 orders).

2011 and 2012 recorded the biggest deliveries ever. Shipyards normally need between 12-18 months to deliver a bulker, depending on vessel specifications and idle capacity (currently they are busy fulfilling mega large boxship 🚢 orders).

• • •

Missing some Tweet in this thread? You can try to

force a refresh