Do you call yourself an investor?

Then you need to understand the different metrics and formulas used in investment decision making.

For our case study we will be using Sibanye Stillwater’s 2020 financials.

Let’s learn.

(Thread) 👇🏽

Then you need to understand the different metrics and formulas used in investment decision making.

For our case study we will be using Sibanye Stillwater’s 2020 financials.

Let’s learn.

(Thread) 👇🏽

•Gross income

is all the income(revenue)that a company earned in the last 12 months.

Sibanye Stillwater’s Total Revenue = R127 392 400 000 That’s R127billion, friends.

73% increase in revenue from 2019.

is all the income(revenue)that a company earned in the last 12 months.

Sibanye Stillwater’s Total Revenue = R127 392 400 000 That’s R127billion, friends.

73% increase in revenue from 2019.

•Net Income

is the money that is left after expenses.

Sibanye Stillwater’s net income: R29 311 900 000( R29billion)

is the money that is left after expenses.

Sibanye Stillwater’s net income: R29 311 900 000( R29billion)

•Gross Margin

is the difference between the total revenue and costs of goods sold. (expressed as a %)

#SSW

GPM = (R42 065 200 000) ÷ revenue (R127billion)

= 33%

Net profit margin = 23% (excellent)

Is shows us how much money is retained from the sale of products/service

is the difference between the total revenue and costs of goods sold. (expressed as a %)

#SSW

GPM = (R42 065 200 000) ÷ revenue (R127billion)

= 33%

Net profit margin = 23% (excellent)

Is shows us how much money is retained from the sale of products/service

•Operating Margin

measures how much profit a company makes after paying for variable costs of production, such as wages or materials.

calculated by dividing a company's operating income by its sales (revenue)

#SSW

OP ÷ Revenue

R39billion ÷R127billion

=30%

measures how much profit a company makes after paying for variable costs of production, such as wages or materials.

calculated by dividing a company's operating income by its sales (revenue)

#SSW

OP ÷ Revenue

R39billion ÷R127billion

=30%

•Current Ratio

Important one

A company’s ability to pay short term liabilities with its cash on hand.

•Current assets is the cash that a company has on hand for the upcoming year.

•Current liabilities are amounts of money due to be paid to creditors within the next year

Important one

A company’s ability to pay short term liabilities with its cash on hand.

•Current assets is the cash that a company has on hand for the upcoming year.

•Current liabilities are amounts of money due to be paid to creditors within the next year

Sibanye Stillwater’s current Ratio is at:

R 52 242 600 000 ÷ R17 487 100 00 =

2.98 (extremely excellent)

#SSW has enough liquidity to cover short term obligations, in fact, more than enough- almost 3 times over.

R 52 242 600 000 ÷ R17 487 100 00 =

2.98 (extremely excellent)

#SSW has enough liquidity to cover short term obligations, in fact, more than enough- almost 3 times over.

•Shareholders’ Equity

If the company went bust today, it’s how much equity would be left after the deal. (Net Worth)

You find this information on a balance sheet, and it shows you how investable a company is. It will show you what price you are paying for the company.

If the company went bust today, it’s how much equity would be left after the deal. (Net Worth)

You find this information on a balance sheet, and it shows you how investable a company is. It will show you what price you are paying for the company.

$SSW shareholder’s equity is:

Total assets = R134 103 100 000

Total liabilities = R 63 387 100 000

*Minus minority interest. (Subsidiaries) - (watch video at the end to understand this).

Equity = R 68 billion 480 million.

Total assets = R134 103 100 000

Total liabilities = R 63 387 100 000

*Minus minority interest. (Subsidiaries) - (watch video at the end to understand this).

Equity = R 68 billion 480 million.

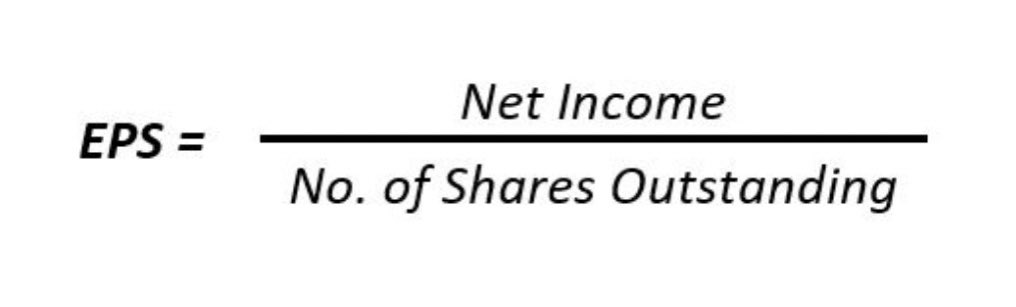

•Earnings Per Share

shows us what portion of a company’s profit is allocated to each outstanding share.

Companies profit ÷ outstanding shares.

$SSW EPS =

R29billion ÷ 2 923 571 000

= 10

So for every share, $SSW Earns R10 in profits.

Negative earnings is a NO NO

shows us what portion of a company’s profit is allocated to each outstanding share.

Companies profit ÷ outstanding shares.

$SSW EPS =

R29billion ÷ 2 923 571 000

= 10

So for every share, $SSW Earns R10 in profits.

Negative earnings is a NO NO

•P/E ratio

To work out the P/E ratio you need to know the EPS.

The higher the P/E ratio, supposedly the more overvalued it is.

The lower the P/E , supposedly the more neglected it is.

Higher P/E’s demand higher earnings.

$SSW P/E ratio =

R65.70 ÷ 10

= 6.57

To work out the P/E ratio you need to know the EPS.

The higher the P/E ratio, supposedly the more overvalued it is.

The lower the P/E , supposedly the more neglected it is.

Higher P/E’s demand higher earnings.

$SSW P/E ratio =

R65.70 ÷ 10

= 6.57

•Return on Equity (ROE)

ROE measures the profitability in relation to equity.

Basically, a return on assets (minus) all liabilities.

You want to see between 15%- 20% for it to be considered decent.

R29billion ÷R68billion 480 million

=42% (extremely attractive)

ROE measures the profitability in relation to equity.

Basically, a return on assets (minus) all liabilities.

You want to see between 15%- 20% for it to be considered decent.

R29billion ÷R68billion 480 million

=42% (extremely attractive)

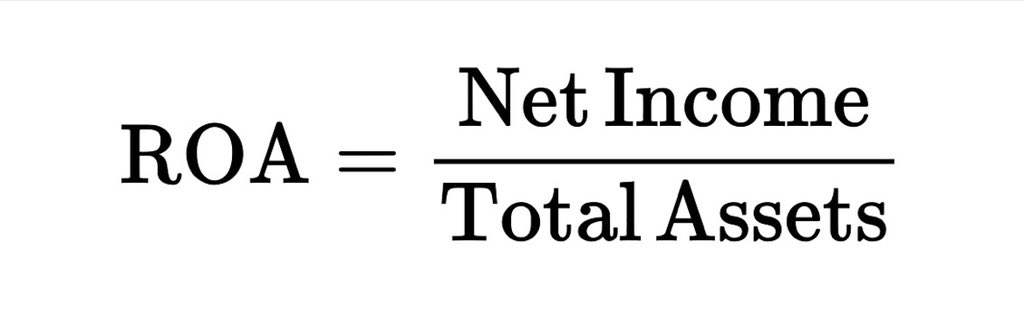

•Return on Assets (ROA)

ROA indicates how profitable a company is relative to its total assets.

Shows us how efficient management is at using a it’s assets to generate earnings.

$SSW ROA =

R29 311 900 000 ÷ R134 103 100 000 =

21.85%

ROA indicates how profitable a company is relative to its total assets.

Shows us how efficient management is at using a it’s assets to generate earnings.

$SSW ROA =

R29 311 900 000 ÷ R134 103 100 000 =

21.85%

Alright, I’ve done my homework on #SSW and I want in. Numbers look attractive,

• Pay dividends

• Growing revenue

• High in Liquidity

In my eyes, it’s time to buy- undervalued.

Those interested in $SSW 👇🏽

reports.sibanyestillwater.com/2020/#home

• Pay dividends

• Growing revenue

• High in Liquidity

In my eyes, it’s time to buy- undervalued.

Those interested in $SSW 👇🏽

reports.sibanyestillwater.com/2020/#home

YouTube

Learn about the income statement and balance sheet here 👇🏽

Forgive me for sound quality. Mic broke, will get a new one. 😊

Learn about the income statement and balance sheet here 👇🏽

Forgive me for sound quality. Mic broke, will get a new one. 😊

Think this information was valuable?

Consider thanking me by buying me a coffee

buymeacoffee.com/davidketh

Consider thanking me by buying me a coffee

buymeacoffee.com/davidketh

Seminar

Interested in a FREE financial seminar, please fill out the form below.

Spots are limited, so let me know when you are free👇🏽

forms.gle/AQqWE8v5ToYPp8…

Interested in a FREE financial seminar, please fill out the form below.

Spots are limited, so let me know when you are free👇🏽

forms.gle/AQqWE8v5ToYPp8…

Disclaimer:

This is not financial advice, it’s for educational purposes. Please always do your own due diligence before making any investment decisions.

This is not financial advice, it’s for educational purposes. Please always do your own due diligence before making any investment decisions.

• • •

Missing some Tweet in this thread? You can try to

force a refresh