Today we launch an exercise to find out how climate-related risks could affect large UK banks and insurers.

Our Climate Biennial Exploratory Scenario investigates the effects of taking climate action early, late or not at all. Find out more: b-o-e.uk/3w9p3EU

Our Climate Biennial Exploratory Scenario investigates the effects of taking climate action early, late or not at all. Find out more: b-o-e.uk/3w9p3EU

We’re asking large banks and insurers to use three scenarios to look at how climate-related risks could affect them.

Two of our scenarios focus on the move to a net-zero emissions economy. The third is concerned with the physical risks created by global warming.

Two of our scenarios focus on the move to a net-zero emissions economy. The third is concerned with the physical risks created by global warming.

In our climate scenarios, a large rise in fossil fuel prices for UK households and businesses is needed to reduce carbon emissions. We’re asking banks and insurers what this would mean for their businesses.

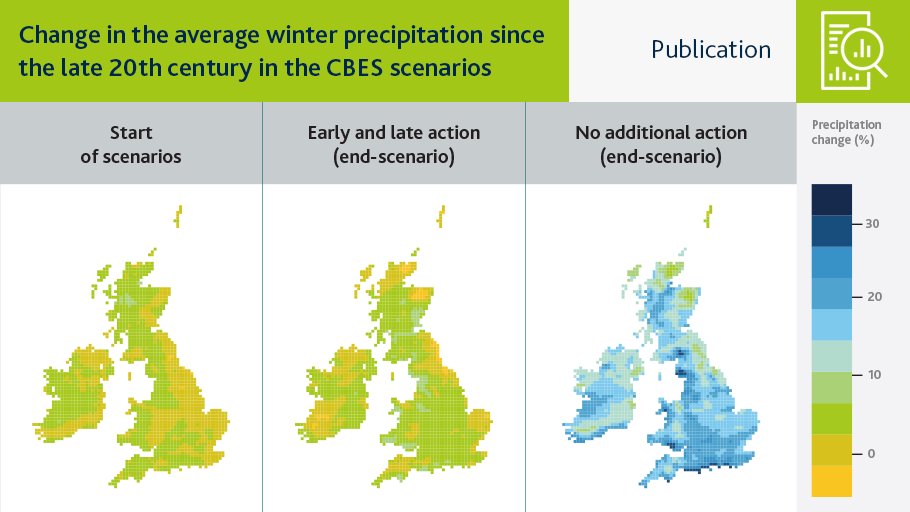

We look at how global warming could affect the weather in the UK.

Using @metoffice data we found it will get much wetter in winter if nothing is done to reduce global warming. This means a greater risk of flooding, which would affect banks and insurers’ customers.

Using @metoffice data we found it will get much wetter in winter if nothing is done to reduce global warming. This means a greater risk of flooding, which would affect banks and insurers’ customers.

Our climate scenarios help us to understand the risks UK banks and insurers may face from a hotter world.

In our scenario where no additional action is taken, global warming reaches 3.3 °C.

In our scenario where no additional action is taken, global warming reaches 3.3 °C.

These scenarios will help banks and insurers find out what impact climate change could have on each of their largest business customers. We also set out how it affects different industries and parts of the UK.

Read more about our work on climate risks: b-o-e.uk/3gmttl7

Read more about our work on climate risks: b-o-e.uk/3gmttl7

• • •

Missing some Tweet in this thread? You can try to

force a refresh