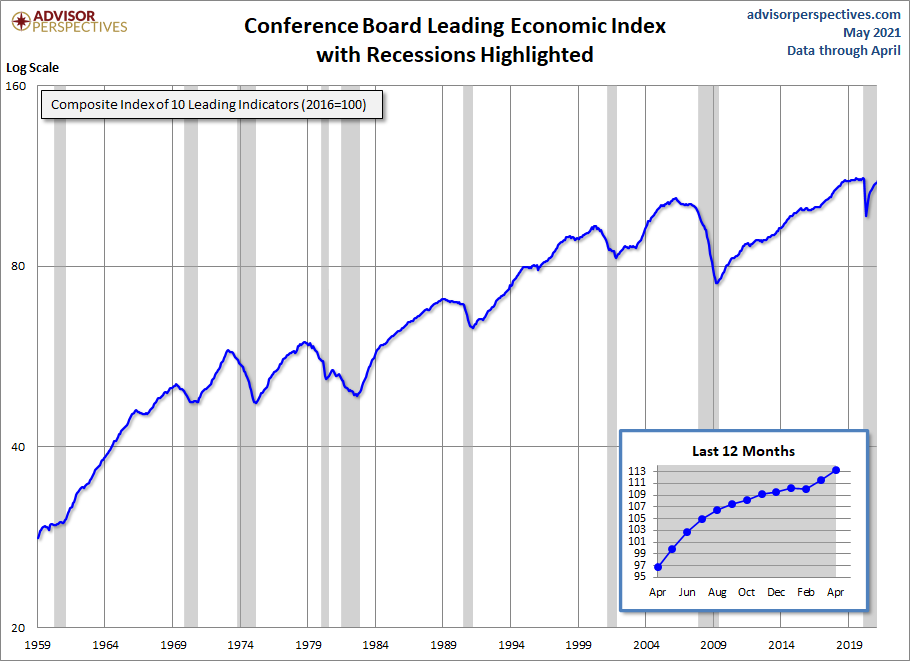

LEI lags, jobless claims, and stress index is better regarding the speed of recent Events. However, LEI is solid.

https://twitter.com/BullandBaird/status/1402649191076306946

Remember to know the components; once you got this, you will be ok. Don't just look at the chart without knowing.

The stress index is awesome. It would have saved the bears a lot of pain of being behind the curve. Hence why this was a big variable in AB economic recovery model, I wrote back on April 7th. Notice that was when LEI bottomed.

Bearish Twitter or ideological bearish Twitter can't acknowledge this because this in itself will make their trolling and crying seem kind of dumb. It is what it is. However, verse yourself on the components.

It would really cut out the need for yellow journalism or crazy extreme left or right-wing economic takes. If people just read data. 😉 Be the detective, not the troll.

• • •

Missing some Tweet in this thread? You can try to

force a refresh