🇺🇸💪🏽📈🔥🫡 Lead Analyst @HousingWire Financial Truth On Housing Economics. All American Bears have failed since 1790. Press inquiries: Press@HWMedia.com

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/Murph_eth/status/1963224060894298334Forecast

https://twitter.com/Solwoldjr74/status/1759225126397133176

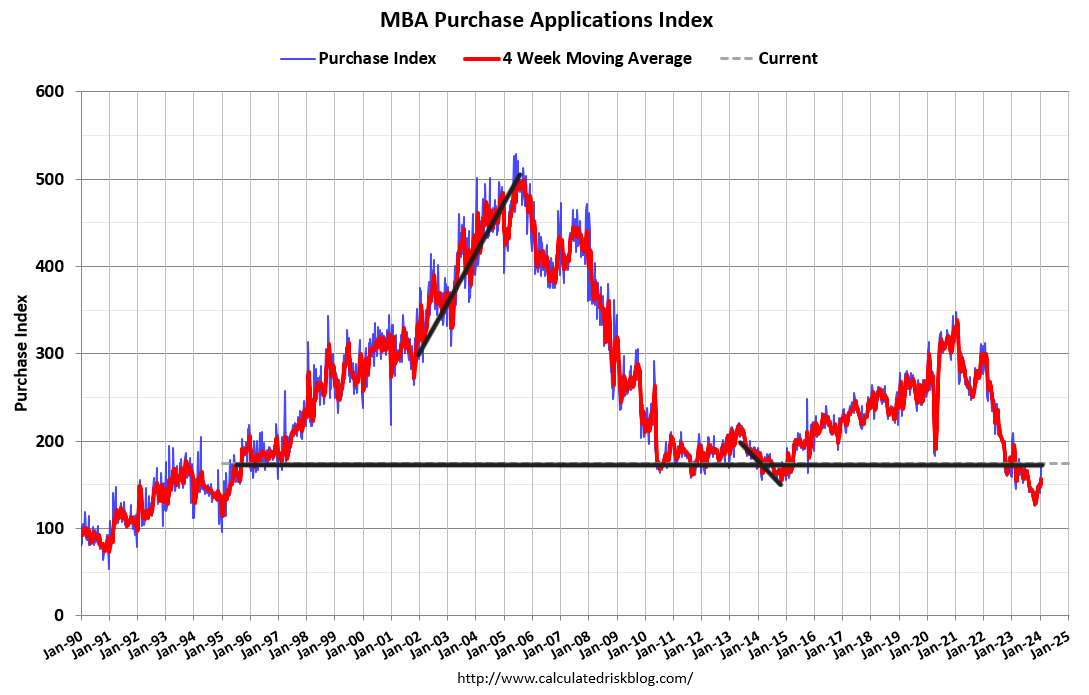

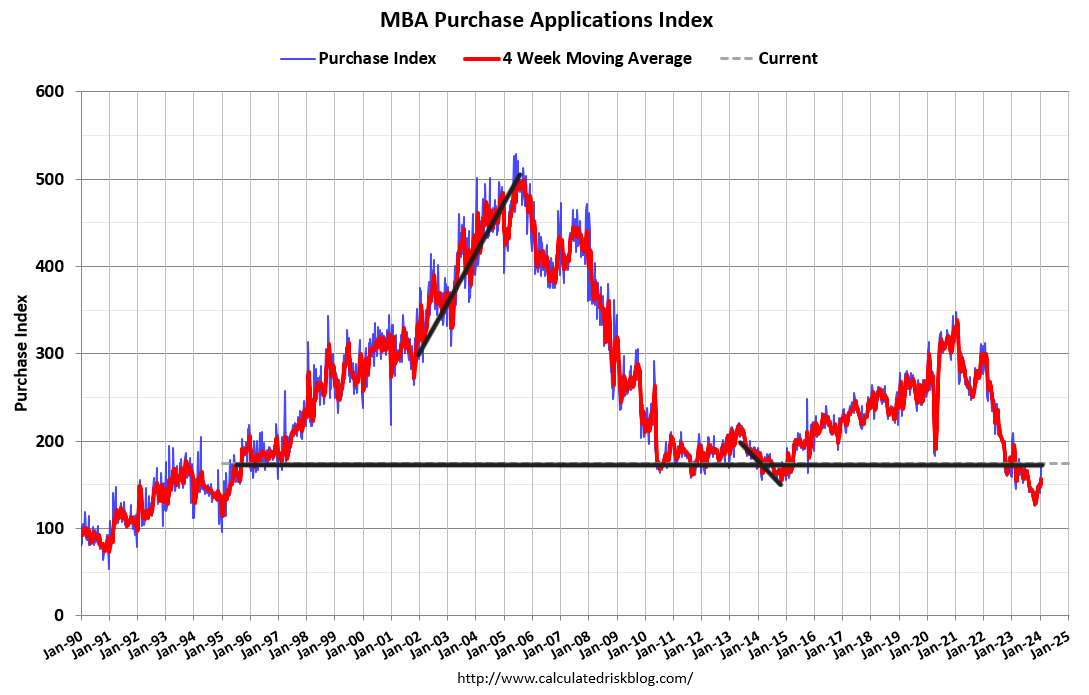

In general, housing mortgage demand was slow, but back then, the builders also had a lot of competition with an active inventory much higher than today

In general, housing mortgage demand was slow, but back then, the builders also had a lot of competition with an active inventory much higher than today

Since mortgage rates started to fall after making some Holiday adjustments, meaning I don't count the last few weeks of the year or the First week of January, we have had an 8-week positive trend; we get 12-14 weeks we have something material, as did late 2022 early 2023

Since mortgage rates started to fall after making some Holiday adjustments, meaning I don't count the last few weeks of the year or the First week of January, we have had an 8-week positive trend; we get 12-14 weeks we have something material, as did late 2022 early 2023

https://twitter.com/TheStalwart/status/1714973814675685761New listings data unfazed by 8% mortgage rates

First, we have separated the existing home sales market from the new home sales market. The new home sales market is still growing as they can live in a much lower mortgage rate market.

First, we have separated the existing home sales market from the new home sales market. The new home sales market is still growing as they can live in a much lower mortgage rate market.

Week-to-week data flat

Week-to-week data flat

https://twitter.com/HomesliceMike/status/1669450194189156352

Trust the data ☺️🙌🏽

Trust the data ☺️🙌🏽

https://twitter.com/CNBCTheExchange/status/1669409592927764498

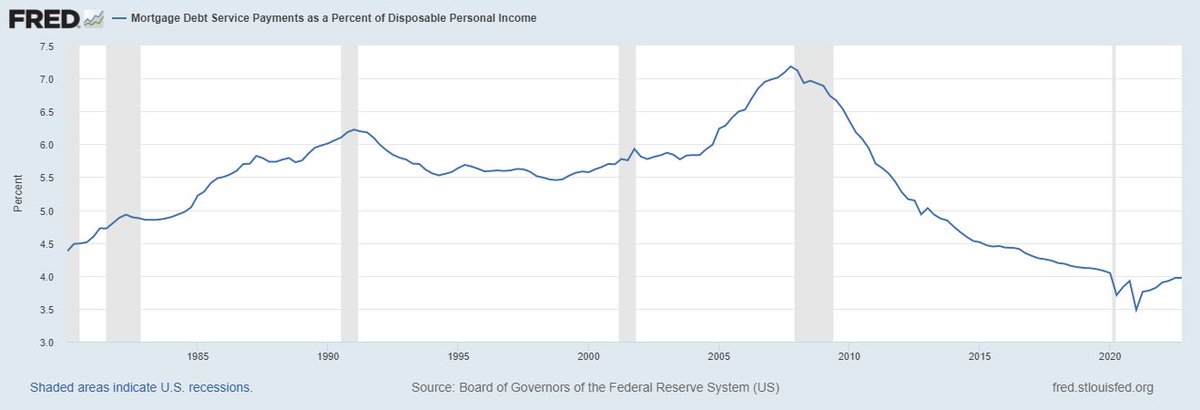

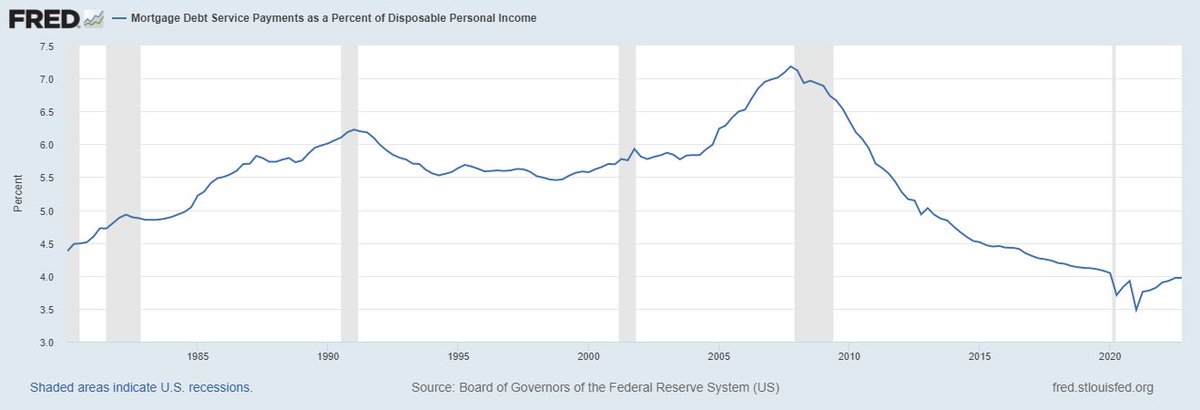

2. We had massive credit stress build-up in 2005, 2006, 2007, and 2008. All before the job loss recession in 2008

2. We had massive credit stress build-up in 2005, 2006, 2007, and 2008. All before the job loss recession in 2008

https://twitter.com/tracyalloway/status/1669305496220708865

When you have the best hedge on planet Earth on your books, you don't traditionally sell to be homeless when employed.

When you have the best hedge on planet Earth on your books, you don't traditionally sell to be homeless when employed.

https://twitter.com/conorsen/status/1669081640788795392

https://twitter.com/NewsLambert/status/1669059782089531394If you want a educational tutorial on how to properly track weekly forward-looking , this is what we do

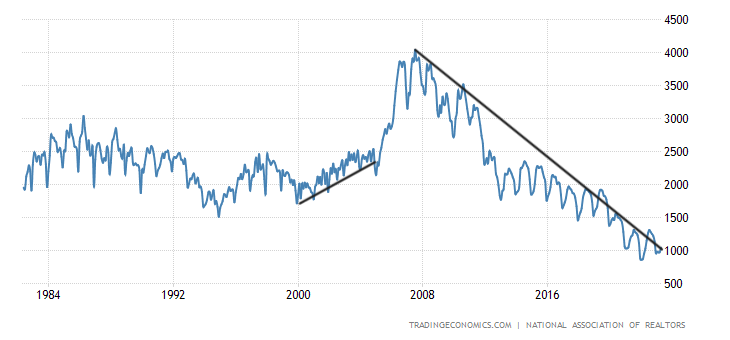

https://twitter.com/paymakr/status/1669003374170374147Chart 1

Year to date, 11 positives vs. 11 negative data

Year to date, 11 positives vs. 11 negative data

Even though purchase application data has had more positive purchase apps than negative YTD, not much is happening outside stabilization. Seasonality will be done with this data line by the end of this month.

Even though purchase application data has had more positive purchase apps than negative YTD, not much is happening outside stabilization. Seasonality will be done with this data line by the end of this month.