SWING THREAD

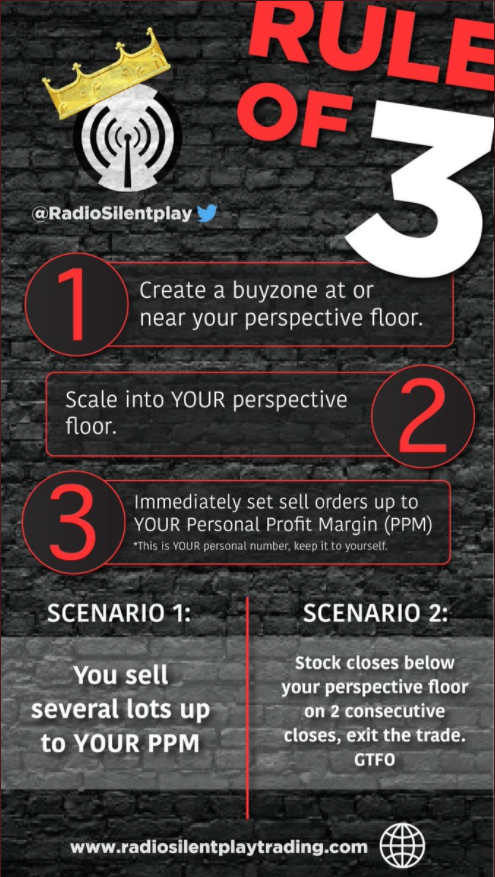

1)RULE OF 3-

a) At least 3 reasons to buy a stock always.

-Hot Sector

-Floor Buys

-Trend

-Catalyst

-Chart Patterns

-Share Structure

1)RULE OF 3-

a) At least 3 reasons to buy a stock always.

-Hot Sector

-Floor Buys

-Trend

-Catalyst

-Chart Patterns

-Share Structure

2)FLOOR RULE-

a) A place on the chart that is your dead bottom price.

b)Find YOUR floor using TA

-MAs

-Trend lines,

-Support Lines

-Fibs

c) Create a buy zone around your floor to scale into position(using 3 bullet system)

a) A place on the chart that is your dead bottom price.

b)Find YOUR floor using TA

-MAs

-Trend lines,

-Support Lines

-Fibs

c) Create a buy zone around your floor to scale into position(using 3 bullet system)

d) Depending on desired length of trade; Can use multiple time frames for this (D, W, M, 4HR, 1HR)

e) TWO CLOSES BELOW FLOOR EXIT- no question- no emotion, just exit and move on, can revisit if new floor found on stock (You are the calm monk by the lake)

e) TWO CLOSES BELOW FLOOR EXIT- no question- no emotion, just exit and move on, can revisit if new floor found on stock (You are the calm monk by the lake)

TWO SCENARIOS-

1) Stock hits PPM targets

2) Closes below floor 2 days in row =EXIT

3) THREE BULLET SYSTEM-

a) Use 3 bullets(buys) to scale into position in case of pull backs and too not overexpose early.

b) not in to heavy to early and could get a better average.

1) Stock hits PPM targets

2) Closes below floor 2 days in row =EXIT

3) THREE BULLET SYSTEM-

a) Use 3 bullets(buys) to scale into position in case of pull backs and too not overexpose early.

b) not in to heavy to early and could get a better average.

EX.

Floor 1.00

BZ =$1.00-$1.15

1st $1.15(starter), 2nd $1.05(pullback), 3rd $1.08(final) Average $1.09

(Could have went all in @ 1.15 and started the trade in the hole on higher average, Be patient with buys)

Floor 1.00

BZ =$1.00-$1.15

1st $1.15(starter), 2nd $1.05(pullback), 3rd $1.08(final) Average $1.09

(Could have went all in @ 1.15 and started the trade in the hole on higher average, Be patient with buys)

6)PPM

a)Personal Profit Margin A set % or price determined before taking the trade you will exit the trade.

b) PPM can change trade to trade but consistent PPM = consistent growth

(can leave just in case shares after PPM)

c) Can be set by

MAs

Previous run highs

Fibs

a)Personal Profit Margin A set % or price determined before taking the trade you will exit the trade.

b) PPM can change trade to trade but consistent PPM = consistent growth

(can leave just in case shares after PPM)

c) Can be set by

MAs

Previous run highs

Fibs

5) SCALING OUT-

a)Use same bullet system for exits setting sell orders on the way up (into strength/not weakness) to a set PPM(determined before taking the trade)

b) Set sell orders immediately after buys

a)Use same bullet system for exits setting sell orders on the way up (into strength/not weakness) to a set PPM(determined before taking the trade)

b) Set sell orders immediately after buys

c) Scale out to ride FREE (just in case) shares

d) LOCK PROFITS, pull backs happen, if on free shares and still like the chart you can readd those shares keeping profit for starters or cash

e) STICK TO PPM, Catch the meat of the play,

d) LOCK PROFITS, pull backs happen, if on free shares and still like the chart you can readd those shares keeping profit for starters or cash

e) STICK TO PPM, Catch the meat of the play,

EX 1:

Selling 3 lots of 25% of my position on the way up to my PPM

Takes out most or ALL risk while holding 25%(just in case share) with a stop loss for higher run

EX 2: from @BionicBulls (must follow)

Selling 3 lots of 25% of my position on the way up to my PPM

Takes out most or ALL risk while holding 25%(just in case share) with a stop loss for higher run

EX 2: from @BionicBulls (must follow)

6) A WATCHED POT NEVER BOILS-

a) Swings take time, stocks dont go straight up

-HAVE PATIENCE,

-STICK TO FLOOR RULE,

-STEP AWAY IF NEEDED

a) Swings take time, stocks dont go straight up

-HAVE PATIENCE,

-STICK TO FLOOR RULE,

-STEP AWAY IF NEEDED

7) COMFORT

a) Only hold as many stocks as you are comfortable with

b) You have to keep track of floors, closing prices, ect

a) Only hold as many stocks as you are comfortable with

b) You have to keep track of floors, closing prices, ect

8) EXPOSURE

If all 3 conditions are met HIGHLY advised to limit positions to 30% of total capital,

(Scalps and Day Trades Permitted)

1) Market Posting All Time Highs

2)Negative Divergence

3)Over-Bullish Sentiment

If all 3 conditions are met HIGHLY advised to limit positions to 30% of total capital,

(Scalps and Day Trades Permitted)

1) Market Posting All Time Highs

2)Negative Divergence

3)Over-Bullish Sentiment

All thanks to @RadioSilentplay @hustle2015 @ChartedInvests @dantheholy @SwingPony and many more. #RSP has been a game changer

With this system, keeping emotions in check anyone can be profitable.

We are all master traders. Some of you just dont know it yet

With this system, keeping emotions in check anyone can be profitable.

We are all master traders. Some of you just dont know it yet

• • •

Missing some Tweet in this thread? You can try to

force a refresh