Corporate Debt: A Need-to-Know Guide for Equity Investors

1/ Get a cup of coffee.

In this thread, @10kdiver and I explain how & why you should add corporate debt analysis to your investment research.

👇

1/ Get a cup of coffee.

In this thread, @10kdiver and I explain how & why you should add corporate debt analysis to your investment research.

👇

2/ Why do corporations issue debt?

- to finance growth (new capital expenditure)

- to finance acquisitions

- to finance working capital needs (esp. for businesses with long cash conversion cycles)

- to not dilute existing shareholders

- to finance growth (new capital expenditure)

- to finance acquisitions

- to finance working capital needs (esp. for businesses with long cash conversion cycles)

- to not dilute existing shareholders

3/ Advantages of debt:

- Cheaper than equity, usually

(issuing equity isn’t “free” as ppl commonly think… debt is cheaper when interest rate is lower than expected rate of return on stock)

- Improves capital structure efficiency

- Interest tax shield

- Cheaper than equity, usually

(issuing equity isn’t “free” as ppl commonly think… debt is cheaper when interest rate is lower than expected rate of return on stock)

- Improves capital structure efficiency

- Interest tax shield

4/ Downsides of too much debt:

- Increases default risk

- Increases future borrowing cost, called "WACC" or "weighted average cost of capital" (we’ll explain the details of WACC and how to calculate it in a separate thread)

- Draconian debt covenants

- Increases default risk

- Increases future borrowing cost, called "WACC" or "weighted average cost of capital" (we’ll explain the details of WACC and how to calculate it in a separate thread)

- Draconian debt covenants

5/ Why should equity investors care about debt?

- paying interest reduces net profit & cash available for dividends

- debt affects valuation & WACC

- covenants may restrict capex & M&A activity

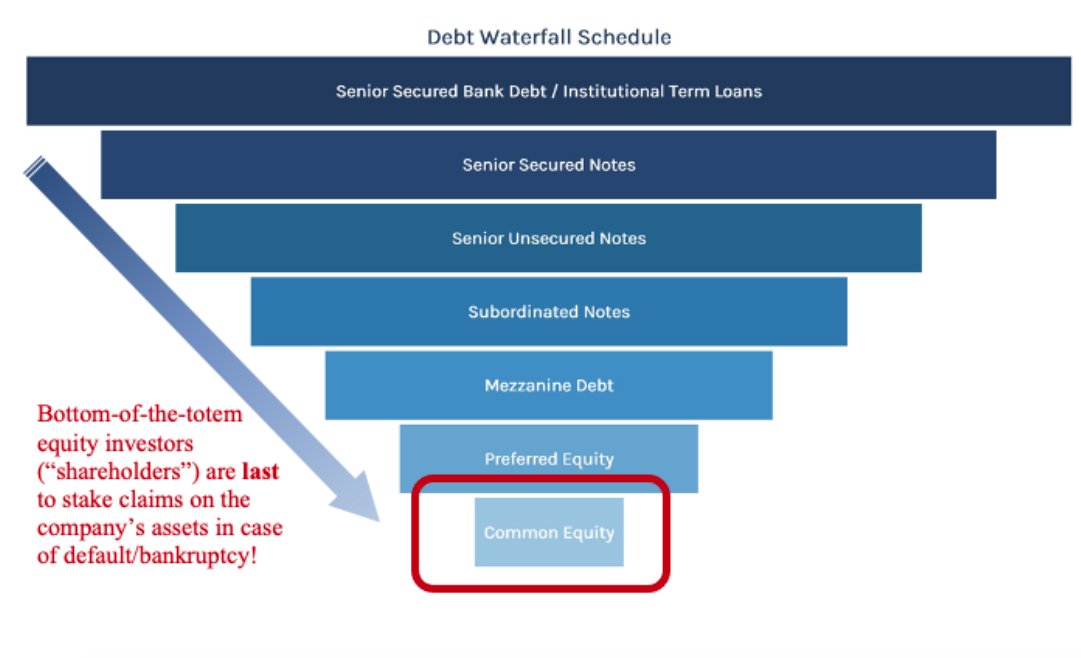

- in a distressed scenario, debt terms have huge influence on residual equity value

- paying interest reduces net profit & cash available for dividends

- debt affects valuation & WACC

- covenants may restrict capex & M&A activity

- in a distressed scenario, debt terms have huge influence on residual equity value

6/ *When* should they care about debt?

- when financing for a capital intensive project & covenants are too restrictive

- when macro conditions cause a cashflow squeeze (e.g. COVID)

- during financial distress (e.g. Ch11) where bondholder claims can 100% wipe out shareholders

- when financing for a capital intensive project & covenants are too restrictive

- when macro conditions cause a cashflow squeeze (e.g. COVID)

- during financial distress (e.g. Ch11) where bondholder claims can 100% wipe out shareholders

7/ Mechanics of debt:

ABC bank loans $10M to XYZ Corp to be repaid in 3Y in exchange for 8% fee paid quarterly. Here, 10M is the “principal,” 3Y is the “maturity” and 8% the “coupon”.

This is a standard bullet bond. Diagram below shows the exchange of cashflows btw ABC & XYZ.

ABC bank loans $10M to XYZ Corp to be repaid in 3Y in exchange for 8% fee paid quarterly. Here, 10M is the “principal,” 3Y is the “maturity” and 8% the “coupon”.

This is a standard bullet bond. Diagram below shows the exchange of cashflows btw ABC & XYZ.

8/ Variations in Debt Structure:

- Coupon can be floating or fixed

- Principal can be repaid periodically or all @ maturity

- Issuer can recall bond if rates drop

- Loan repayment can be secured (i.e. “collateralized”) w/ assets

- Bond can convert to equity in special situations

- Coupon can be floating or fixed

- Principal can be repaid periodically or all @ maturity

- Issuer can recall bond if rates drop

- Loan repayment can be secured (i.e. “collateralized”) w/ assets

- Bond can convert to equity in special situations

9/ Types of corporate debt

(sorted by seniority)

- Revolver: a line of credit from bank, usually w/ cap & secured by assets

- Term loan: fixed-maturity bank loan w/ amortization, also secured

- Senior note: sold on capital markets, unsecured

- Sub note: higher yield than senior

(sorted by seniority)

- Revolver: a line of credit from bank, usually w/ cap & secured by assets

- Term loan: fixed-maturity bank loan w/ amortization, also secured

- Senior note: sold on capital markets, unsecured

- Sub note: higher yield than senior

10/ How to analyze a company’s debt

Key Metrics

- Net Debt / EBITDA (measures ability to pay off principal, <4 is good)

- EBITDA / Interest (measures ability to pay interest, >2 is good)

- Debt / Assets (measures leverage, <0.4 is good)

Data Sources

- 10K

- Indenture Agreement

Key Metrics

- Net Debt / EBITDA (measures ability to pay off principal, <4 is good)

- EBITDA / Interest (measures ability to pay interest, >2 is good)

- Debt / Assets (measures leverage, <0.4 is good)

Data Sources

- 10K

- Indenture Agreement

Note: People usually use EBITDA in key ratios. But for companies needing lots of maintenance capex just to keep their assets in good shape and preserve (not grow) their earning power, it's more realistic to compare interest expenses to EBITDA + maintenance capex.

11/ Corporate Debt Analysis: 1st stop 👉10-K

Section 8 “Financial Statements”

Use the income statement, cash flow statement, and balance sheet to find inputs & calculate the key ratios discussed above.

Diagram below walks you through example calculations for Lockheed ($LMT).

Section 8 “Financial Statements”

Use the income statement, cash flow statement, and balance sheet to find inputs & calculate the key ratios discussed above.

Diagram below walks you through example calculations for Lockheed ($LMT).

2nd stop 👉 Notes to Consolidated Financial Statements

Here you’ll find the company’s full debt schedule with all repayment dates (maturities) and terms (coupon rates) laid out. This is a breakdown of the outstanding debt listed under “Long term debt, net” on the balance sheet.

Here you’ll find the company’s full debt schedule with all repayment dates (maturities) and terms (coupon rates) laid out. This is a breakdown of the outstanding debt listed under “Long term debt, net” on the balance sheet.

3rd stop 👉 Indenture Agreements

(under Sec. 4 "Covenants")

Here’s where the company lists all its covenant terms, i.e. stipulations on coverage or leverage ratios & restrictions on future debt financing

But where to find indenture documents?

Ctrl-F for “indenture” on the 10-K.

(under Sec. 4 "Covenants")

Here’s where the company lists all its covenant terms, i.e. stipulations on coverage or leverage ratios & restrictions on future debt financing

But where to find indenture documents?

Ctrl-F for “indenture” on the 10-K.

12/

If you're still with us, thank you very much!

Expect to see more from @10kdiver and @FabiusMercurius when we dive into corporate capital structure & efficient cost of capital next time!

Enjoy your weekend!

/End

If you're still with us, thank you very much!

Expect to see more from @10kdiver and @FabiusMercurius when we dive into corporate capital structure & efficient cost of capital next time!

Enjoy your weekend!

/End

Typo: last line should read "EBITDA - maintenance capex" (in other words, the EBITDA + "net depreciation", which is to say "earnings + interest + taxes + depreciation - compulsory additions to PP&E to preserve earning power")

• • •

Missing some Tweet in this thread? You can try to

force a refresh