Uh, DM me if you happen to want the whatsapp link. Hopefully sharing it won't prevent me from getting reincarnated

"My goodness, it's a loss. I can only use the reincarnation method to recover my funds." This is giving me poorly-written-videogame-NPC-speech vibes

I'm now trying to figure out whether I'm the only human in here. I asked "what is reincarnation" as a bait and got totally ignored

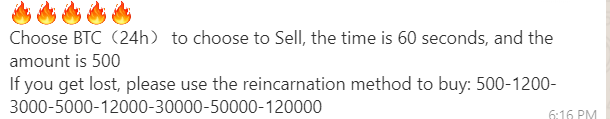

(I just copypasted a pic from their chat group)

This is a hilariously elaborate scam though, all this fake activity/impression of people making tons of money. how do you even generate this many fake phone numbers and bot speech at scale

I think I figured it out. The big group chat stopped having any activity after a flurry of messages. It's just one guy with a manual bot and a script. Then they hook you in the private messages

(in case not entirely obvious I am trolling throughout this thread, do not actually join these groups, etc)

• • •

Missing some Tweet in this thread? You can try to

force a refresh