Sharing presentation and key highlights of @FLAMEUniversity webinar on Equity Markets and Real Economy: The current paradox. Link and key highlights from webinar are annexed.

flame.edu.in/pdfs/fil/prese…

flame.edu.in/pdfs/fil/prese…

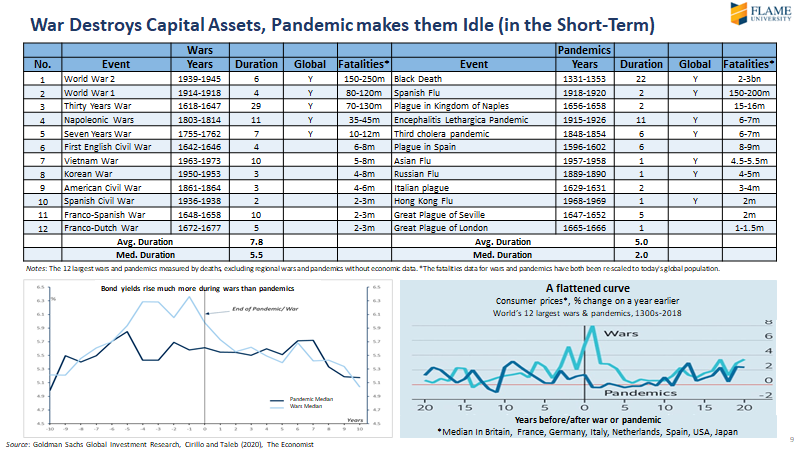

To sum it up, Corporate performance could be strong. Hence the disconnect between the economy and the markets. Not a still picture but a dynamic evolving story. Stay tuned.

• • •

Missing some Tweet in this thread? You can try to

force a refresh