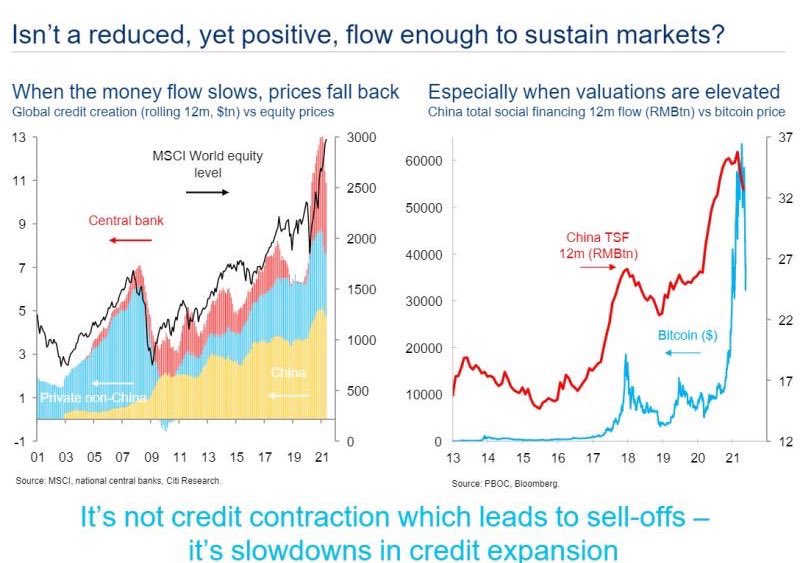

*It appears that global liquidity peaked 2mo back & is now evaporating

For instance:

1. China’s credit impulse turned neg.

2. Both G4 public liquidity + M2 supply are decelerating

3. Global $-supply down significantly

IMO crowd grossly discounting deflation + volatility risks

For instance:

1. China’s credit impulse turned neg.

2. Both G4 public liquidity + M2 supply are decelerating

3. Global $-supply down significantly

IMO crowd grossly discounting deflation + volatility risks

*Attn: for more info on today’s ‘inflation fade’ ~ here’s an article I wrote 3 weeks ago highlighting that the inflation trade was grossly overcrowded, leading to diminished upside (remember it’s about magnitude of correctness > frequency of correctness)

speculatorsanonymous.com/articles/the-i…

speculatorsanonymous.com/articles/the-i…

**PS - as credit expansion + liquidity begin slowing (as shown above), prices begin decelerating - esp. when they’re so juiced up on easy-money (meaning: slight declines in new credit growth greatly increases fragility)

Credit follows the law of diminishing returns

Credit follows the law of diminishing returns

• • •

Missing some Tweet in this thread? You can try to

force a refresh