New #Blog «#FiscalPolicy to drive the recovery in #LatinAmerica: the “when” and “how” are key» @voxlacea @OECD_Centre

For fiscal policy to be effective it needs a well-defined sequencing of actions and to be backed by consensus

➡️ vox.lacea.org/?q=blog/fiscal…

Here the thread 🧵:

For fiscal policy to be effective it needs a well-defined sequencing of actions and to be backed by consensus

➡️ vox.lacea.org/?q=blog/fiscal…

Here the thread 🧵:

The political economy of fiscal policy is more important than ever and country-specific characteristics calls for a tailored approach. However, some overarching considerations can help countries in #LAC get their “policy menu” between public spending, tax policy and public debt.

- Moving towards the expansion of well-targeted social exp. with long-term economic effects

- More and better capital exp. to close the infra. needs incl. digital+green

- Innovative fiscal frameworks incl. fiscal rules to ensure fiscal sustainability with adequate escape clauses

- More and better capital exp. to close the infra. needs incl. digital+green

- Innovative fiscal frameworks incl. fiscal rules to ensure fiscal sustainability with adequate escape clauses

- Taxes⬇️ 11.2% in 2020 vs.2019

- The sequencing + national consensus on tax policies are key

- A set of actions could⬆️ income without affecting recovery: e.g.,⬇️evasion/avoidance, tax expenditure, ⬆️tax compliance, strengthen tax admin., prog. PIT, 🌎measures on multinat. firms

- The sequencing + national consensus on tax policies are key

- A set of actions could⬆️ income without affecting recovery: e.g.,⬇️evasion/avoidance, tax expenditure, ⬆️tax compliance, strengthen tax admin., prog. PIT, 🌎measures on multinat. firms

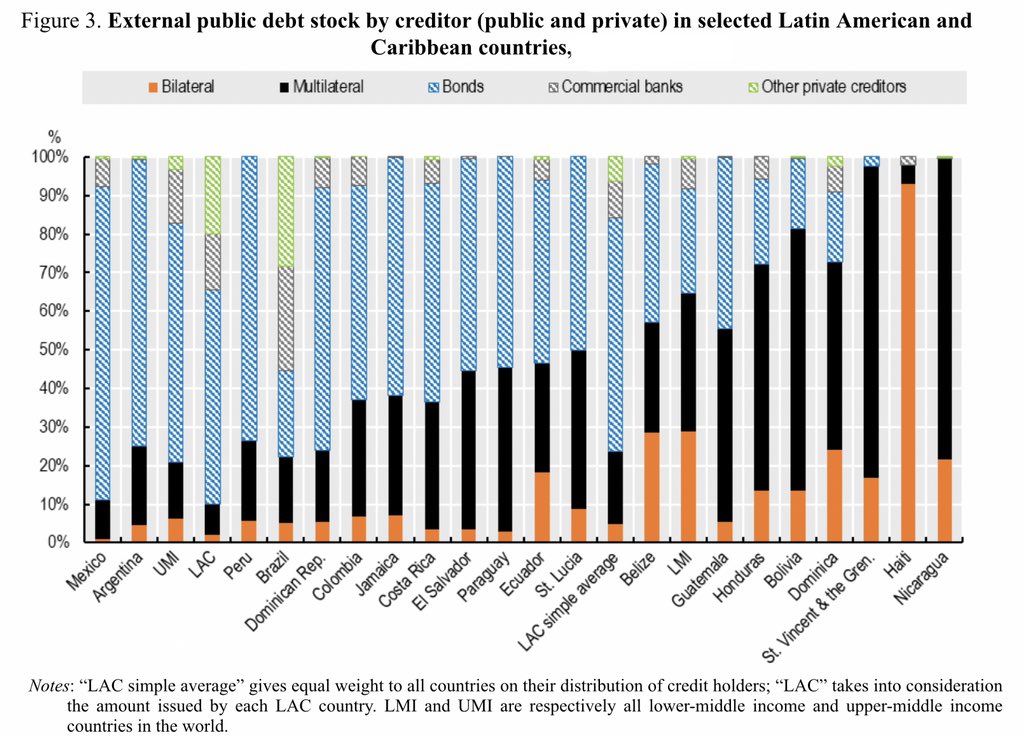

- There is no single solution to public debt management in the region

- National responses are not enough, the nature of this crisis and the interlinkages across countries require further coordination and co-operation at the international level, including public debt management

- National responses are not enough, the nature of this crisis and the interlinkages across countries require further coordination and co-operation at the international level, including public debt management

• • •

Missing some Tweet in this thread? You can try to

force a refresh