Someone asked how they could use Flow to look into this tweet (1035 AM est).

https://twitter.com/ThetaWarrior/status/1403360123179782146

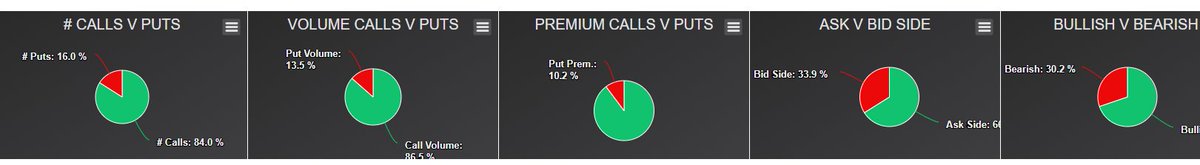

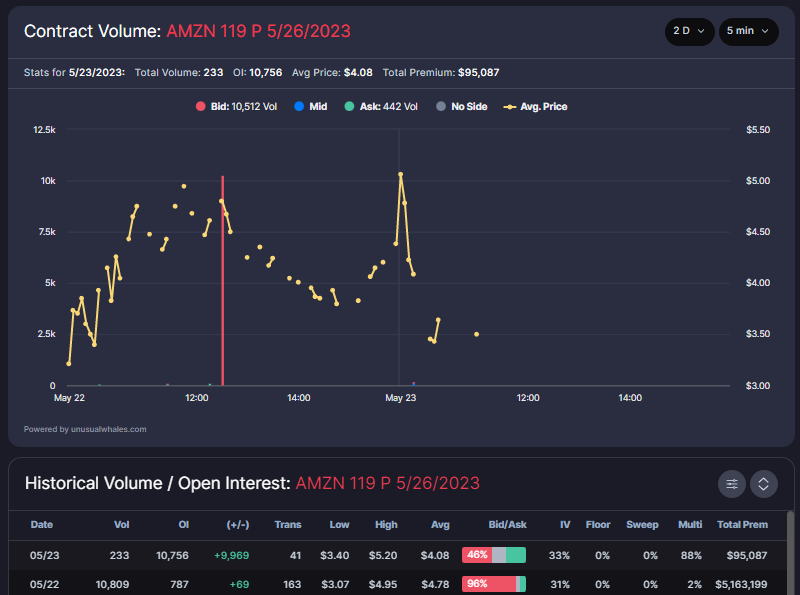

Using the filters, you could enter in something similar (1). Feel free to add in a premium to expedite.

So, there's something there. Now let's zoom out some.

I'm going to zero out my filters except for the ticker ($NIO), the minimum premium ($5k), and i'm still only using information that was available to me prior to 1035 (1).

I'm going to zero out my filters except for the ticker ($NIO), the minimum premium ($5k), and i'm still only using information that was available to me prior to 1035 (1).

Now, we'll use @ThetaWarrior cause his charts are 🔥 but we can see potentially retesting of the breakout level (1). Now consider your risk tolerance and whether or not you have enough conviction to take a position. Hope this helps.

• • •

Missing some Tweet in this thread? You can try to

force a refresh