Options Flow by https://t.co/CoBM8tcNWc (code snor14x 14% off)

Email support@unusualwhales for account help

Not financial advice / Flow is time sensitive

7 subscribers

How to get URL link on X (Twitter) App

My pinned tweet asks some questions that are relevant here. I won't hit on each one through this process but feel free to follow along. The UI will be slightly different but the concepts remain the same.

My pinned tweet asks some questions that are relevant here. I won't hit on each one through this process but feel free to follow along. The UI will be slightly different but the concepts remain the same.

https://twitter.com/snorlax_uw/status/1658152263125221378

https://twitter.com/snorlax_uw/status/1660699857340735488

Legit I don't give a shit I know it's going up vibes~~~

Legit I don't give a shit I know it's going up vibes~~~

https://twitter.com/snorlax_uw/status/1641587416598298625

https://twitter.com/akelling99/status/1644308998974480385

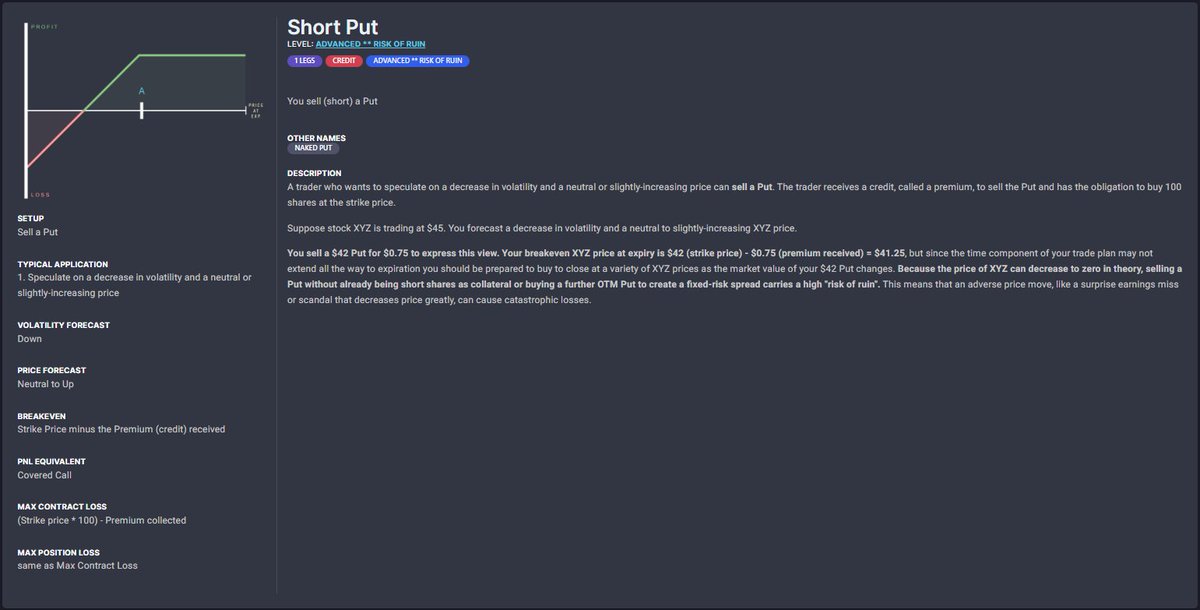

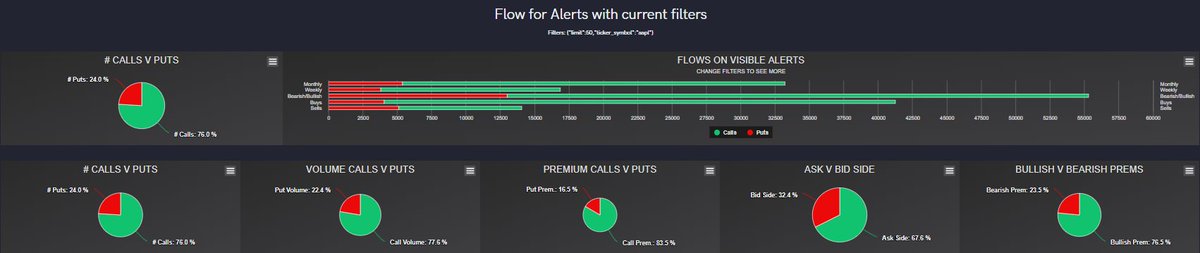

4 cont) If you see 1000 calls at the ask you'd think it was bullish. But if those 1000 calls are a part of a multileg trade you must take pause. Are they part of a call credit spread (🐻)? A debit spread (🐂)? Something else? Multil % isn't bad but a higher value requires more DD

4 cont) If you see 1000 calls at the ask you'd think it was bullish. But if those 1000 calls are a part of a multileg trade you must take pause. Are they part of a call credit spread (🐻)? A debit spread (🐂)? Something else? Multil % isn't bad but a higher value requires more DD

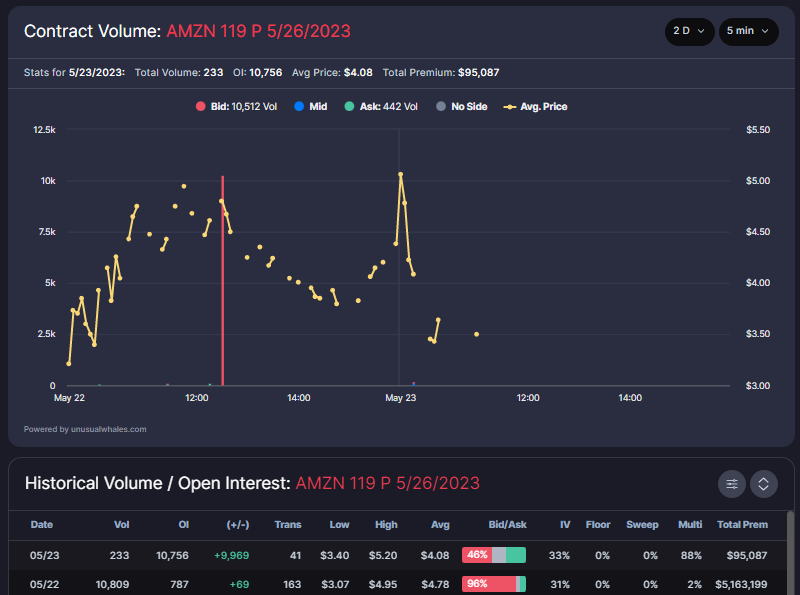

Any 2 or more of these strategies can be combined in order to create a more complex strategy. For example a long call and a short call be used in conjunction to create both a (1) bullish call debit spread or a (2) bearish call credit spread.

Any 2 or more of these strategies can be combined in order to create a more complex strategy. For example a long call and a short call be used in conjunction to create both a (1) bullish call debit spread or a (2) bearish call credit spread.

Flow:

Flow:

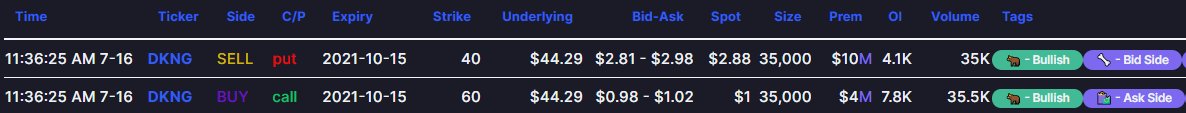

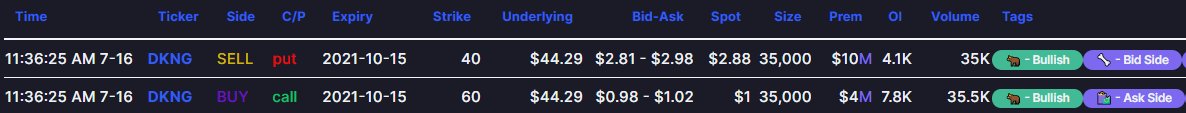

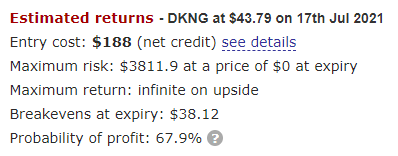

Selling the 10/15 40p nets this trader a premium of $288. With this $288 they buy the 10/15 60c for $100. This trader is pocketing $188 (288-100) & freerolling a 60c. The trade theoretically as unlimited upside & downside starts with $DKNG @ $38.12 (40p, minus the net 188 credit)

Selling the 10/15 40p nets this trader a premium of $288. With this $288 they buy the 10/15 60c for $100. This trader is pocketing $188 (288-100) & freerolling a 60c. The trade theoretically as unlimited upside & downside starts with $DKNG @ $38.12 (40p, minus the net 188 credit)

https://twitter.com/unusual_whales/status/1416068899729182723

correction, to sell 35000 contracts of 40p they'd need 35000 x 4000 = $140,000,000

correction, to sell 35000 contracts of 40p they'd need 35000 x 4000 = $140,000,000

Time and Ticker:

Time and Ticker:

https://twitter.com/ThetaWarrior/status/1403360123179782146Using the filters, you could enter in something similar (1). Feel free to add in a premium to expedite.

When you're on the flow and you click "Show Charts" you'll see 5 pie charts running across the bottom.

When you're on the flow and you click "Show Charts" you'll see 5 pie charts running across the bottom.

https://twitter.com/unusual_whales/status/1390368100911132683)

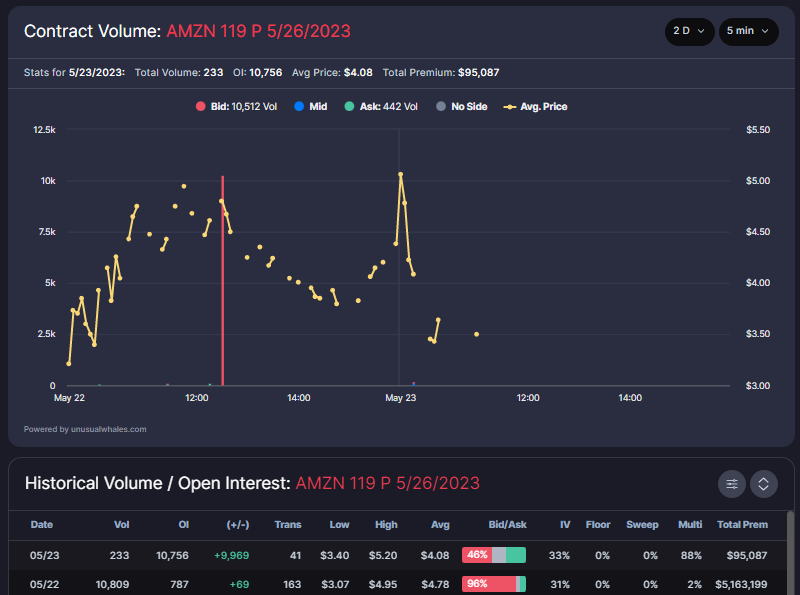

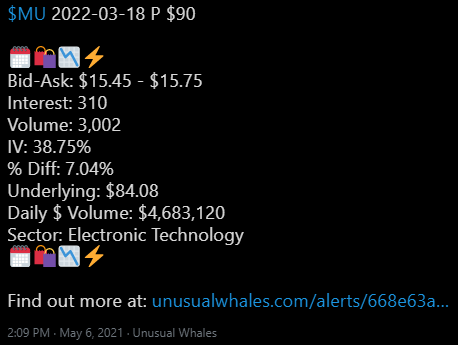

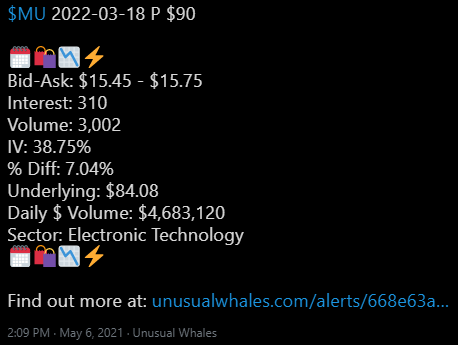

First we will need to visit the alert page. You can do so by clicking the hyperlink preceded by "Find out more at:". Alternatively, you can select the hyperlink in Discord, select the alert on the website, or on the app to view the alert page.

First we will need to visit the alert page. You can do so by clicking the hyperlink preceded by "Find out more at:". Alternatively, you can select the hyperlink in Discord, select the alert on the website, or on the app to view the alert page.